Content

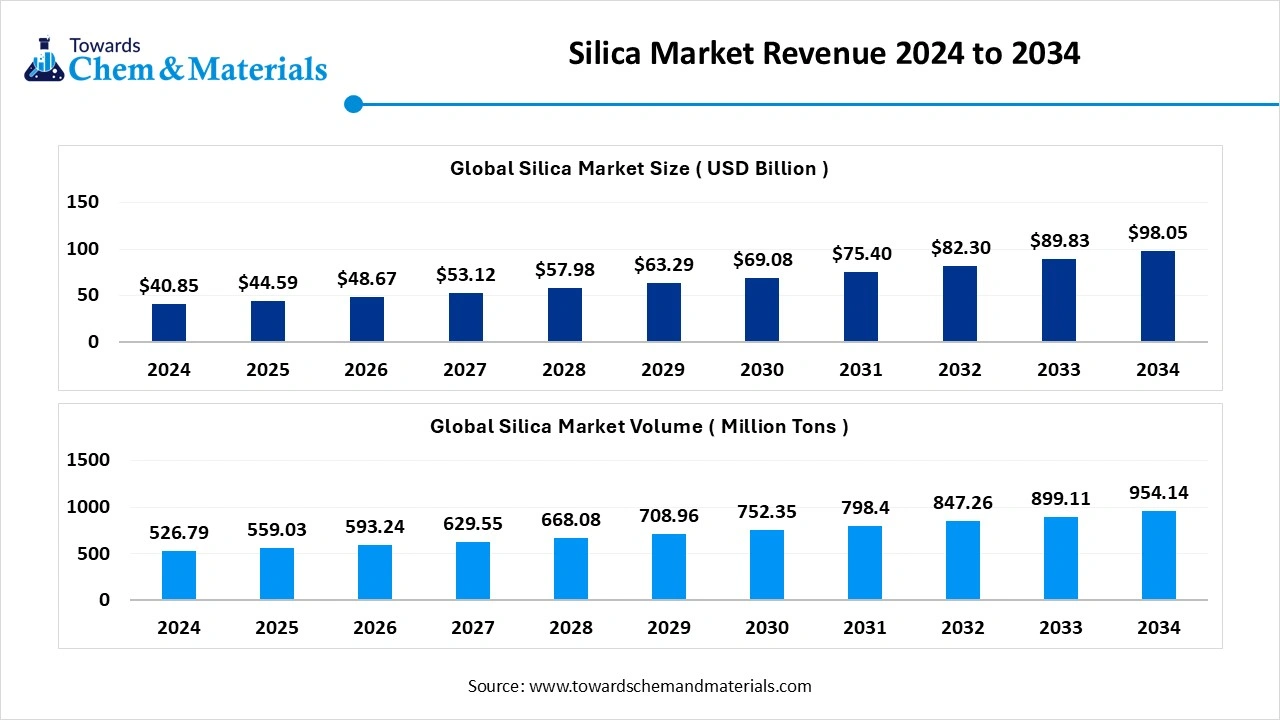

Silica Market Volume to Reach 954.14 Million Tons by 2034

The global silica market volume is estimated at 559.03 million tons in 2025, and is expected to reach 954.14 million tons by 2034, at a CAGR of 6.12% during the forecast period 2025-2034.

The global silica market size was reached at USD 40.85 billion in 2024 and is expected to be worth around USD 98.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.15% over the forecast period 2025 to 2034. Growing silica demand from the tire industry to improve vehicle performance is the key factor driving market growth. Also, an increasing trend towards utilizing silica in green construction practices, coupled with the rapid industrialization across the globe, can fuel market growth further.

Key Takeaways

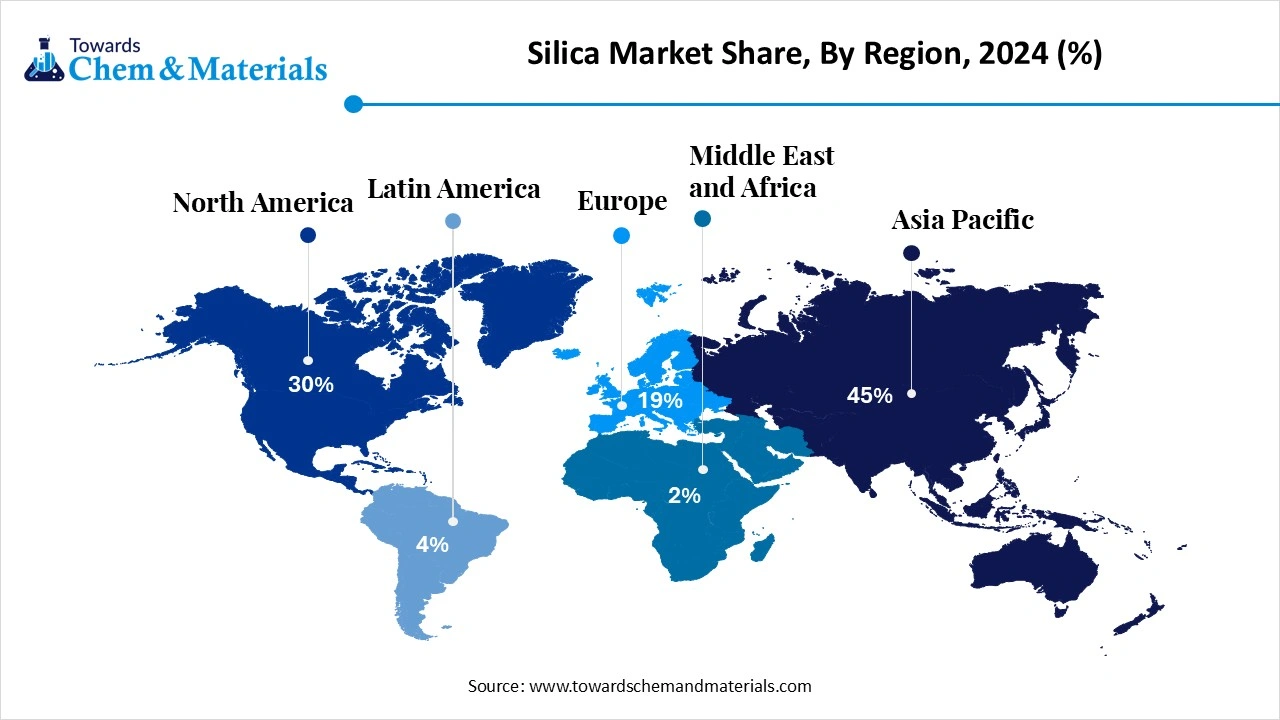

- By region, Asia Pacific dominated the market by holding approximately 45% share in 2024. The dominance of the region can be attributed to the extensive product demand from the construction and automotive sectors.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to its strong focus on green technologies, coupled with the rapid investments in new production facilities.

- By type, the crystalline silica segment dominated the market with approximately 45% share in 2024. The dominance of the segment can be attributed to the growing product demand from the electronics sector.

- By type, the nano-silica segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing environmental concerns and ongoing innovations in electronics and healthcare applications.

- By application, the glass manufacturing segment held approximately 35% market share in 2024. The dominance of the segment can be linked to the ongoing advancements in glass manufacturing.

- By application, the electronics & semiconductors segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing demand for high-grade silica to design innovative components.

- By end-use industry, the building & construction segment led the market by holding approximately 40% share in 2024. The dominance of the segment is owed to the rapid infrastructure development in developing regions such as the Asia-Pacific.

- By end-use industry, the renewable energy segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for high-grade silica sand to produce solar cells and panels.

Technological Advancements are Expanding Market Growth

The global silica market refers to the production and utilization of silica (SiO₂), a naturally occurring mineral found in quartz, sand, and other materials. It is used across industries, including glass manufacturing, foundry, construction, paints & coatings, rubber, electronics, and chemicals. Silica is available in crystalline, amorphous, and fused forms.

Demand is driven by growth in construction, solar PV, semiconductors, and specialty applications such as fillers, coatings, and filtration. The demand for high-grade silica is increasing because rapid technological innovations push for more lightweight, sophisticated, and high-performance consumer electronics.

What Are the Key Trends Influencing the Global Silica Market?

- The growing demand for paints and coatings is the major trend in the market, driving positive expansion. Due to its unique qualities, specialty silica is important to enhancing the ability and functionality of these goods. Sillica strengthens coatings in the automotive sector by boosting their resistance to corrosion and longevity.

- The increasing demand for advanced and highly efficient rubber tires in the automotive sector is another trend shaping a positive market trajectory. This silica enhances the overall durability of rubber compounds utilized in the production of tires because of its special qualities, such as high surface area and particle size.

- There is a surge in the use of specialty silica forms like fused silica, precipitated silica, and nano-silica for their cutting-edge applications in battery and electronics technology. Also, the increasing emphasis on circular economy principles is pushing market players to adopt strategic shifts in process innovations and sourcing.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 40.85 Billion |

| Expected Market Size by 2034 | USD 98.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Application, By End-Use Industry, By Region, |

| Key Companies Profiled | Evonik Industries AG, Imerys S.A., Nissan Chemical Corp., Oriental Silicas Corp., PPG Industries Inc., Solvay SA, Tosoh Corporation, W.R. Grace & Co., Wacker Chemie AG |

Market Opportunity

Rising Use in Personal Care and Electronics

The versatility of specialty silica across various sectors is the major factor creating lucrative opportunities in the market. In the personal care industry, it is used in products such as antiperspirants, lipsticks, toothpaste, and sunscreen. Furthermore, in food and beverage, it can be used as a viscosity modifier, an anti-caking agent, and as a flavor and fragrance carrier. The strategic collaboration among market players can improve sustainability and advancements in specialty silica applications in different sectors.

- In November 2024, Vesuvius introduced a new alumina-silica plant in Visakhapatnam. The facilities in the plant are investments of Vesuvius's in India to improve the overall manufacturing process and fulfill growing demand from the iron and steel sectors.(Source: www.manufacturingtodayindia.com)

Market Challenges

Health and Environmental Regulations

Stringent environmental regulations controlling occupational safety have raised the overall operational costs for silica producers, which is the major factor hampering market growth. Moreover, the market is more prone to fluctuations in the availability and price of raw materials, such as silica sand and quartz, hindering market expansion further.

Regional Insight

Asia Pacific Global Silica Market Trends

Asia Pacific dominated the market by holding approximately 45% share in 2024. The dominance of the region can be attributed to the extensive product demand from the construction and automotive sectors, along with the increasing silica demand in agriculture as a soil conditioner. In addition, heavy investment in research and development and nanotechnology in economies such as Japan and South Korea boosts the demand for cutting-edge silica applications.

China Global Silica Market

In the Asia Pacific, China led the market due to the strong manufacturing base in the country, with growing demand for electric vehicles, which is fuelling the need for specialty and green-grade silica in the Chinese market. Also, the country benefits from a robust supply chain and an extensive presence of major industries such as cosmetics product producers and manufacturers.

North America Global Silica Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to its strong focus on green technologies, coupled with the rapid investments in new production facilities. Furthermore, the region also possesses a wide natural reserve of high-grade silica sand, especially in the U.S. and Canada, which ensures a convenient domestic supply for the glass.

Who is the Top Sand Exporting Countries in 2024?

| Country | Exports in Millions |

| United States | US$908.4 million |

| Netherland | $261.5 million |

| Cambodia | $218 million |

| Germany | $160.1 million |

Segmental Insight

Type Insight

Which Type Segment Dominated the Global Silica Market in 2024?

The crystalline silica segment dominated the market with approximately 45% share in 2024. The dominance of the segment can be attributed to the growing product demand from the electronics sector for the development of solar panels and semiconductors. Additionally, silica's properties, like low thermal expansion and shock resistance, make it a crucial ingredient in glass manufacturing for various applications.

The nano-silica segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing environmental concerns and ongoing innovations in electronics and healthcare applications. Nanosilica is utilized as a reinforcing filler to improve the heat resistance, tensile strength, and flexibility of various rubber types, which are necessary for the surging automotive sector.

Application Insight

Why Glass Manufacturing Segment Dominated the Global Silica Market in 2024?

The glass manufacturing segment held approximately 35% market share in 2024. The dominance of the segment can be linked to the ongoing advancements in glass manufacturing, such as the use of nanotechnology to improve product efficiency and quality. Furthermore, the rising need for specialized glass applications in sectors such as optics and electronics necessitates high-purity silica, which impacts production strategies.

The electronics & semiconductors segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for high-grade silica to design innovative components such as semiconductors and display panels, coupled with the growing popularity of tablets, smartphones, wearables, and other smart devices, which need high-performance semiconductor components.

End-Use Industry Insight

How Much Share Did the Building & Construction Segment Held in 2024?

The building & construction segment dominate the market by holding approximately 40% share in 2024. The dominance of the segment is owing to the rapid infrastructure development in developing regions such as the Asia-Pacific and increasing preference for sustainable building materials. Moreover, nanosilica is increasingly being used in paints and coatings to enhance flexibility, durability, and weather resistance, contributing to its utilisation in the construction industry.

The renewable energy segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for high-grade silica sand to produce solar cells and panels. Furthermore, the expanding EV market depends on low-rolling resistance tires to improve overall battery performance, which makes silica a crucial additive for enhancing fuel efficiency and reducing carbon emissions in vehicles.

Global Silica Market Value Chain Analysis

- Feedstock Procurement: It refers to sourcing sustainable materials to produce silica. The major renewable feedstock is agricultural waste, which is abundant in silica.

- Chemical Synthesis and Processing: In this stage, the sustainable methods are developed to produce high-grade silica from biological sources, like agricultural waste. This approach also provides a renewable alternative to conventional silica production.

- Packaging and Labelling: This stage refers to the industry inclination towards using more renewable, sustainable, and eco-friendly packaging materials for products made from silica.

- Regulatory Compliance and Safety Monitoring: It includes the stringent rules and regulations used to manage environmental, health, and chemical hazards of silica production. This is a major market factor because of the health risk related to crystalline silica dust.

Recent Development

- In September 2025, HPQ Silicon attains a pilot-scale milestone in commercial fumed silica manufacturing by achieving a surface area of 136 m²/g, surpassing previous results and meeting the commercial-grade standards.(Source: stockhouse.com)

Global Silica Market Top Companies

- Evonik Industries AG

- Imerys S.A.

- Nissan Chemical Corp.

- Oriental Silicas Corp.

- PPG Industries Inc.

- Solvay SA

- Tosoh Corporation

- W.R. Grace & Co.

- Wacker Chemie AG

Segments Covered

By Type

- Crystalline Silica

- Amorphous Silica

- Fused Silica

- Colloidal Silica

- Silica Gel

- Precipitated Silica

- Others

By Application

- Glass Manufacturing

- Foundry

- Construction

- Paints & Coatings

- Rubber & Plastics

- Electronics & Semiconductors

- Chemicals

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Electronics

- Chemicals

- Renewable Energy

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait