Content

Gelatin Market Size and Growth 2025 to 2034

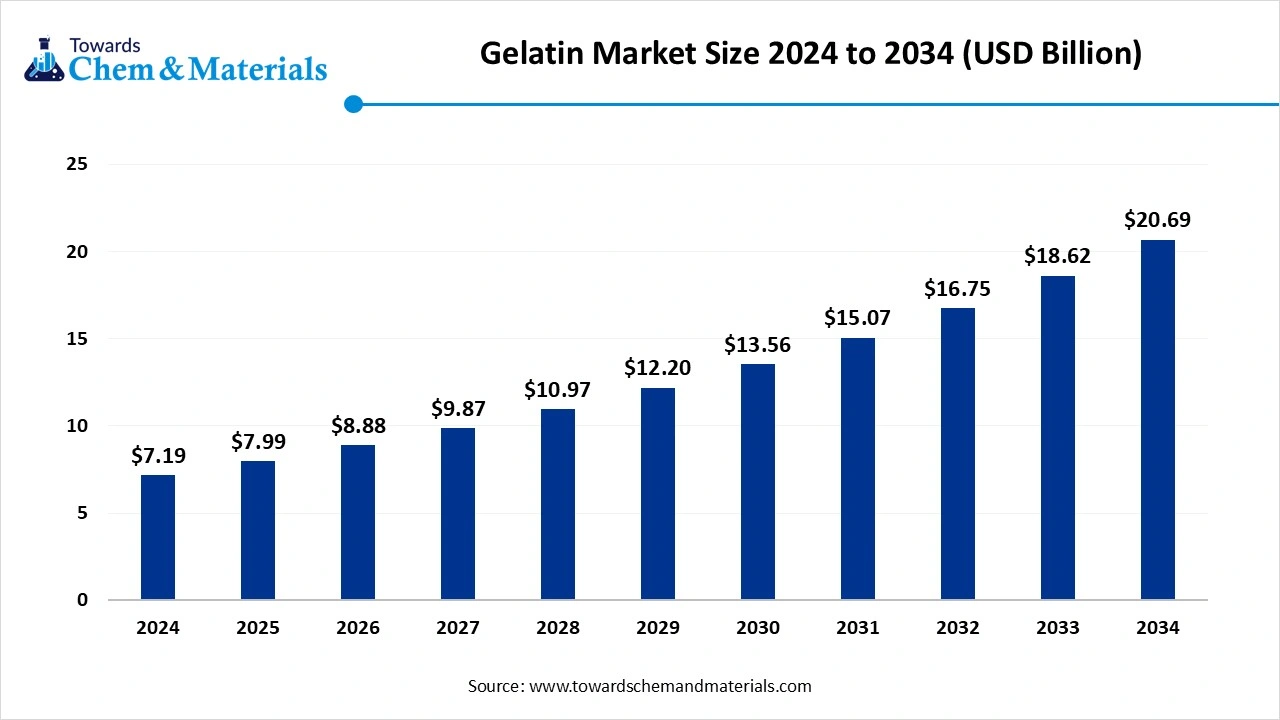

The global gelatin market size was accounted for USD 7.19 billion in 2024 and is expected to be worth around USD 20.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.15% during the forecast period 2025 to 2034. The growing health awareness and rising demand from various industries like food & beverage, pharmaceuticals, & cosmetics drive the overall growth of the market.

Key Takeaways

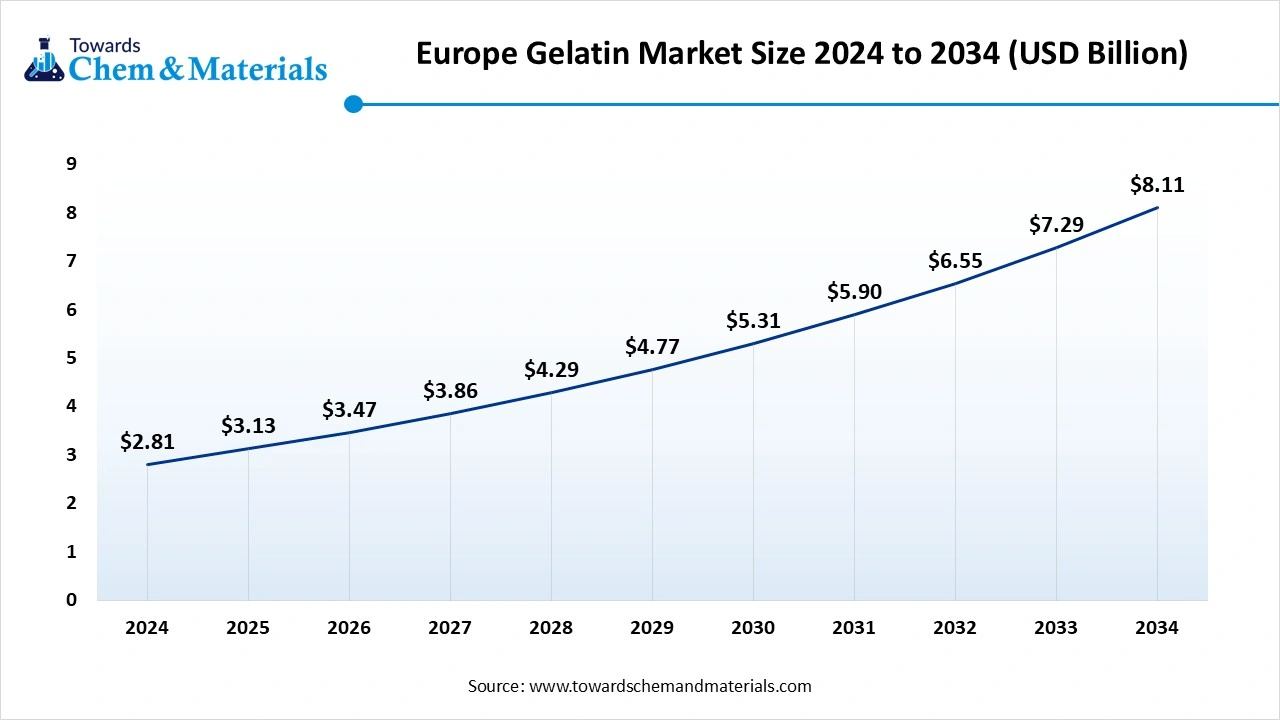

- The Europe gelatin industry is expected to grow from USD 3.13 billion in 2025 to USD 8.10 billion by 2034, at a CAGR of 11.18% during this period.

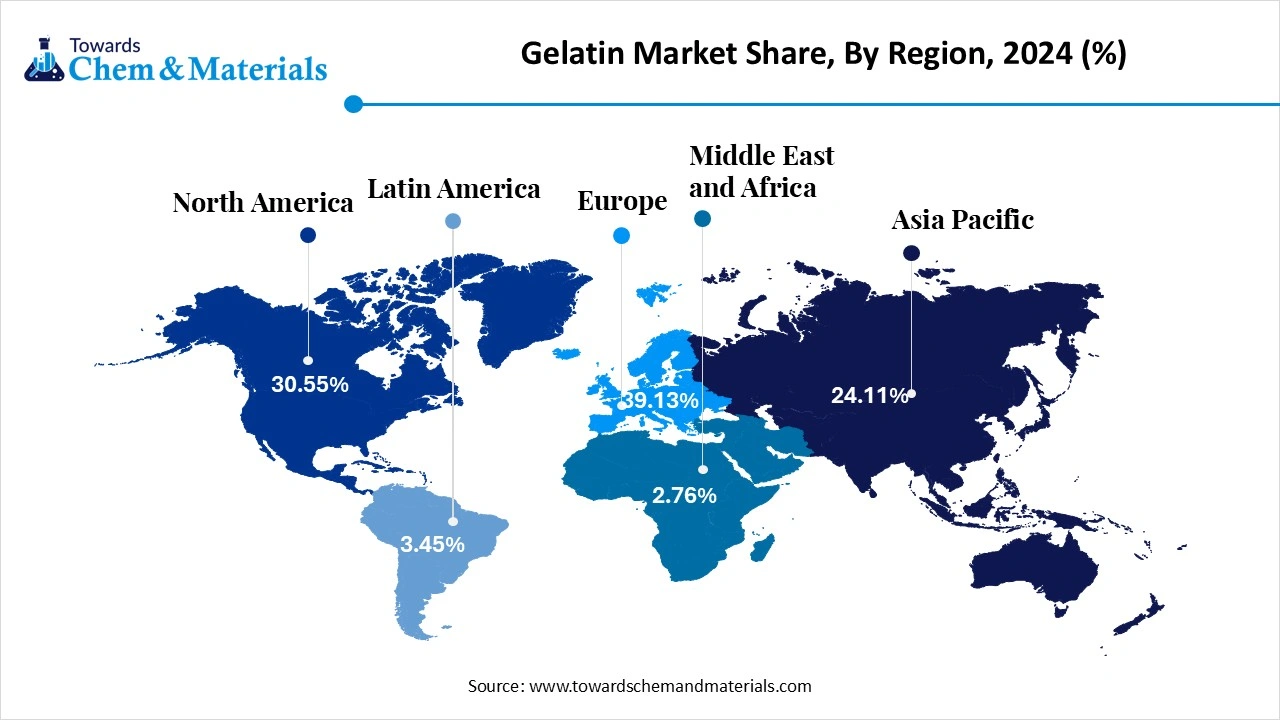

- The Europe dominated the market with the highest revenue share of 39.13% in 2024, due to its well-established gelatin production capacity.

The Asia Pacific is experiencing the fastest growth in the market during the forecast period due to the growing demand for wellness & health products. - By source, the Bovine sourced gelatin accounted for the largest market revenue share of 36.11% in 2024.due to the growing demand from various industries like food & beverage and pharmaceuticals.

- By source, the marine sourced segment is growing at the fastest CAGR in the market during the forecast period due to the increasing demand for fat alternatives.

- By application, the food & beverage segment dominated the market with the largest share in 2024 due to the growing demand for natural & healthy food products.

- By application, the healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of capsules and tablets.

- By function, the stabilizer segment held the largest market revenue share 41.89 in 2024 due to the growing demand for various food products like jelly, jams, and yogurts.

- By function, the gelling agent application segment is experiencing the fastest growth in the market during the forecast period due to the rising demand for dietary supplements.

Gelatin: A Silent Star Behind Beauty and Culinary

Gelatin is a flavourless, translucent, colorless food ingredient and protein derived from animal connective tissues, bones, and skin. It is derived from animal sources like fish, cows, and pigs. Gelatin is used as a thickening, stabilizing, and gelling agent. Gelatin is derived from sources like bovine, porcine, marine, poultry, and various other sources. It is a good source of protein and is easily digestible. Gelatin is gluten-free, and it has a high amount of protein. It maintains & builds body tissues and supports the function of various organs. The growing conditions, like brittle nails, diarrhea, aging skin, obesity, and osteoporosis, utilize gelatin.

The growing production of food products like salads, sausages, marshmallows, gummies, jelly, and jam helps in the market growth. The growing production of various pharmaceutical products increases demand for gelatin. Gelatin is also used in packaging films, photography, and adhesives. The growing demand for functional foods increases the demand for gelatin. Factors like growing demand from food & beverages, pharmaceuticals, cosmetics & personal care products, increasing nutritional benefits, rising demand for dietary supplements, and technological advancements in gelatin extraction contribute to the growth of the gelatin market.

- Brazil exported $377M of gelatin in 2023. (Source: oec.world)

- India exported 103802 shipments of gelatin. (Source: Volza)

- India exported 8349 shipments of pharmaceutical gelatin. (Source: Volza )

- France exported $216M of gelatin in 2023. (Source: oec.world )

- World Export data of Gelatin, MINHYANG BIOCHEMISTRY VIET NAM CO is the leading supplier of gelatin in the world. (Source: Volza )

The Growing Demand for Cosmetics & Personal Care Products

The growing demand for various cosmetics and personal care products increases the demand for gelatin. The growing consumer preference for sustainable and natural products increases demand for gelatin. The growing adoption of clean beauty products and affordable personal care products fuels demand for gelatin. The growing disposable incomes increase spending on personal care products like shampoos, moisturizers, and many more. Gelatin is widely used in shampoos, creams, and lotions due to properties like moisture retention & film -forming. It is widely used in various cosmetics, skincare, and haircare products as emulsifiers, thickening agents, gelling agents, and stabilizers. The growing demand for creams and lotions increases the adoption of gelatin.

The growing various skin problems like pimples, blackheads, whiteheads, and skin tightening increase demand for gelatin for the production of face masks. The increasing production of shampoos and conditioners fuels demand for gelatin due to its film-forming properties. The growing demand for temporary hair color and rapid growth in hair treatment utilize gelatin. Products like moisturizer, shampoos, lipsticks, face masks, and many more use gelatin. The growing cosmetics and personal care industry is a key driver for the growth of the gelatin market.

Market Trends

- Growing health awareness: The growing health awareness in consumers increases demand for gelatin for various applications like collagen formation and joint health promotion. Gelatin offers various health benefits, like a source of essential amino acids and proteins. It offers benefits for joint, nail, gut, skin, and hair health.

- Growing demand for clean label products: The growing focus on clean label products in the food industry increases demand for gelatin. It is a natural protein without any synthetic additives. Gelatin widely supports clean-label products and is derived from animals.

- Technological advancements: The growing technological advancements in gelatin manufacturing help in the market growth. Technological advancements like ultrasound-assisted extraction, enzymatic hydrolysis, improving functionality, and optimizing processing equipment. Advancements help to enhance applications in various industries.

Market Report

| Report Attributes | Details |

| Market Size in 2025 | USD 7.99 Billion |

| Expected Size by 2034 | USD 20.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 11.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Europe |

| Segment Covered | By Source, By Application, By Function, By Region |

| Key Companies Profiled | Rosselot, STERLING GELATIN, Junca Gelatines SL, PAN Biotech GmbH, Tessenderlo Group, GELITA AG, PB Leiner, Weishardt Holdings SA, Nitta Gelatin, Inc., Shanghai AI-Amin Biosource Co., Ltd. |

Market Opportunity

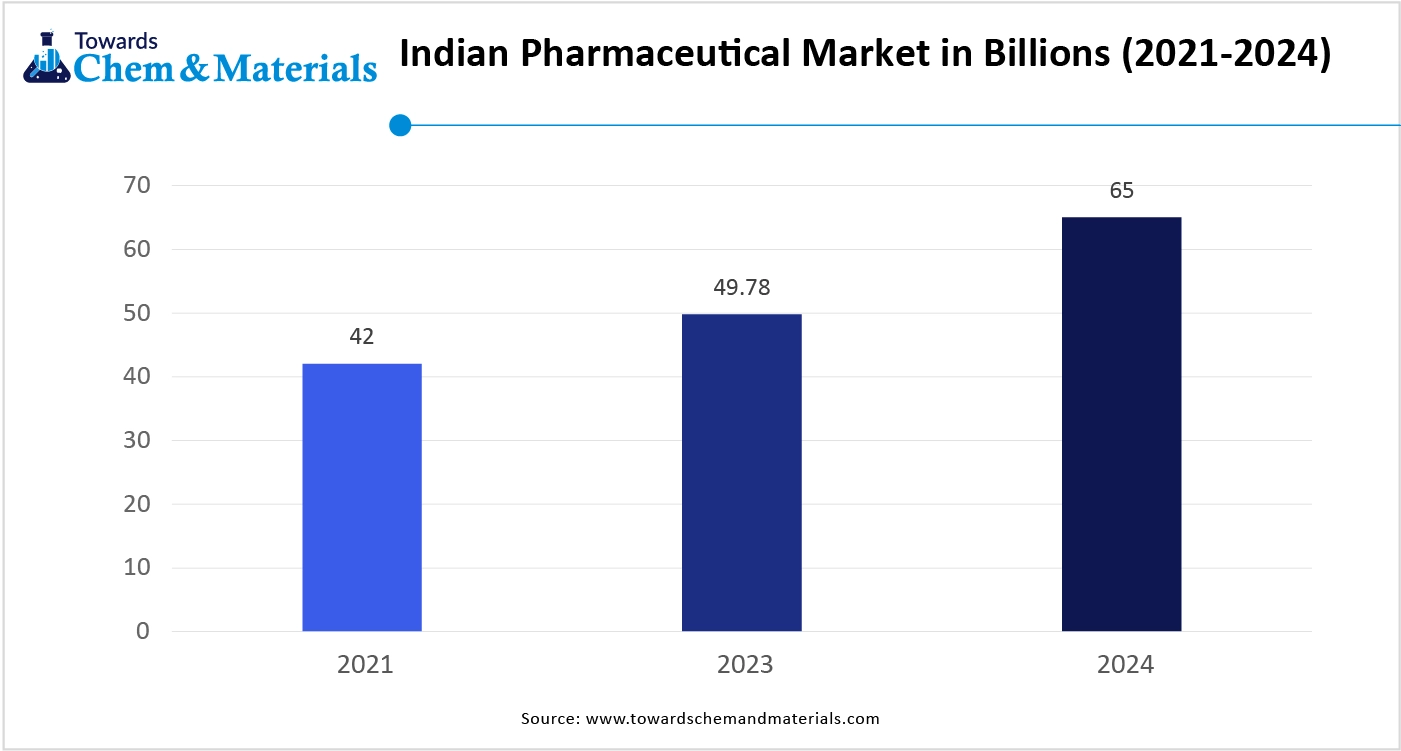

The Growing Pharmaceutical Industry Surges Demand for Gelatin

The growing expansion of the pharmaceutical industry in various regions increases demand for gelatin for various pharmaceutical applications. The pharmaceutical industry uses gelatin for applications like drug delivery systems and pharmaceutical formulations. The growing production of soft and hard gelatin capsules increases demand for gelatin. The growing production of various pharmaceutical formulations like tablet coatings, fluid dosages, and sweeteners increases demand for gelatin as stabilizers & thickening agents.

The growing demand for medical applications like wound healing products, hemostatic sponges, and ostomy patches fuels demand for gelatin. The increasing demand for pharmaceutical-grade gelatin for drug delivery systems helps in market growth. The growing production of various vaccines to treat various conditions increases demand for gelatin as stabilizers. Gelatin, like porcine gelatin, is widely used in the pharmaceutical industry. The growing prevalence of chronic diseases increases the production of gelatin to produce long-term medications. The growing pharmaceutical industry creates an opportunity for gelatin market growth.

Market Challenge

Volatility in Raw Materials Limits the Expansion of the Gelatin Market

Despite several benefits of gelatin in various industries, volatility in raw materials restrains market growth. Gelatin is derived from animal-based raw materials, and animals are prone to various diseases like Bovine Spongiform Encephalopathy and African Swine Fever causes volatility in raw materials. Gelatin manufacturing is based on animal connective tissues, hides, and bones, and volatility in livestock availability directly impacts raw materials supply.

The fluctuation in the cost of animal byproducts increases the overall cost. The growing food and mouth diseases in animals can affect the production of gelatin. The fluctuations in feed costs due to various factors like global demand, crop yields, and transportation increase the overall cost of gelatin production. The volatility in raw materials hampers the growth of the market.

Regional Insights

Why Did Europe dominate The Gelatin Market In 2024?

The Europe gelatin market size was valued at USD 2.81 billion in 2024 and is expected to be worth around USD 8.10 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 11.18% over the forecast period 2025 to 2034. Europe held the largest revenue share of the gelatin market in 2024. The well-established gelatin manufacturing capabilities in countries like the UK, Germany, and France help in the growth of the market. The stringent environmental regulations for food quality & safety, and growing consumer demand for clean-label products, increase demand for gelatin. The growing consumer preference for sustainable and healthier products fuels demand for gelatin for applications like cosmetics, food supplements, and many more. The availability of raw materials like bovine bones & hides increases the production of gelatin. The growing demand from key industries like healthcare, food & beverage, healthcare, nutraceuticals, and cosmetics drives the market growth. The presence of key players like Biogel AG, Gelita AG, and Prowico contributes to the overall market growth.

What are the Growth Factors for the Gelatin Market In Germany?

Germany is a major contributor to the gelatin market. The growing confectionery industry, like demand for marshmallows & gummy candies, increases demand for gelatin. The growing demand for clean-label and natural products helps the growth of the market. The growing gelatin production and extraction due to the presence of the dairy & meat industry helps market growth. The strong presence of manufacturing companies like Biogel AG, Gelita AG, and Prowico drives market growth. Additionally, growing demand from various industries like wellness products, food processing, and pharmaceuticals supports overall market growth.

Germany exported $256M of Gelatin in 2023. (Source: oec.world )

The leading gelatin manufacturer in Germany is Trobas Gelatin GmbH. (Source: essfeed.com )

Why is Asia Pacific Growing in the Gelatin Market?

Asia Pacific is growing at the fastest CAGR in the market during the forecast period. The growing demand for collagen-based functional foods and supplements increases the adoption of gelatin. The growing demand for functional foods in the region increases demand for gelatin to improve nutritional value, texture, and flavor. The growing consumption of dietary supplements like collagen supplements for skin health helps in the market growth.

The growing disposable incomes and increasing middle-class population increase demand for wellness & health products, fueling demand for gelatin. The growing orthopaedic surgeries and the presence of emerging and well-established gelatin manufacturers drive market growth. The stricter regulations for food quality and safety increase demand for gelatin. The growing demand from various industries like pharmaceutical, food & beverage, and medical drives the overall market growth.

China’s Gelatin Market Trends

China is a key contributor to the gelatin market. The well-established agriculture sector and animal husbandry produce a vast number of raw materials to produce gelatin, helping in the market growth. The growing consumer spending and rising disposable incomes increase demand for high-quality food products, fueling the adoption of gelatin. The rapid urbanization and growing industrialization increase demand for gelatin for various industries like food & beverage, pharmaceuticals, and cosmetics. Additionally, growing demand for capsules, tablets, and food products like jello & gummies supports the overall growth of the market.

- China exported $295M of Gelatin in 2023. (Source: oec.world )

- China exported 2897 shipments of industrial gelatin. (source: volza )

- China exported 2735 shipments of pharmaceutical gelatin. (Source: volza )

Segmental Insights

Source Insights

Why did bovine sourced dominate the gelatin market?

The bovine sourced segment dominated the gelatin market in 2024. The growing demand for various products like pharmaceuticals, food & beverage, nutritional supplements, and cosmetics helps in the market growth. The growing consumption of kosher and halal food increases demand for the bovine sourced gelatin. The availability of raw materials like hides & bones increases the production of bovine gelatin. The growing demand for pharmaceutical products, desserts, and meat products increases demand for bovine sourced gelatine. This kind of gelatin is used as a thickening agent, gelling agent, & stabilizer and is readily available. The growing demand for functional foods & beverages and rising health awareness increases demand for natural protein sources, contributing to the overall growth of the market.

The marine sourced segment expected to experience the fastest growth in the market during the forecast period. The growing demand for nutraceutical and cosmetic products increases demand for marine sourced gelatin. The growing demand for a fat alternative in the food & beverage industry helps in the market growth. The growing focus on environmental sustainability increases demand for marine sourced gelatin, which is a byproduct of fish skin and bones. The growing focus on nutritional value, like lower calorie count, high protein content, and high amino acids, increases demand for marine sourced gelatin. The growing demand for artificial ingredients-free products and clean-label products drives the overall growth of the market.

Application Insights

Why Did the Food & Beverage Segment Dominate the Gelatin Market In 2024?

The food & beverages segment held the largest revenue share of the gelatin market in 2024. The growing expansion of the food & beverage industry and increasing demand for natural & healthy food options help in the market growth. The growing demand for high-protein ingredients to manufacture nutritious food & beverages increases demand for gelatin. The growing demand for bakery products and confectionery items fuels demand for gelatin to provide stability, texture, and structure to food products. The growing demand for desserts and various beverages increases the demand for gelatin. The growing production of gummy candies helps in the market growth. Gelatin is used as a gelling agent, thickener, stabilizer, and protein fortifier in various food & beverages. The growing consumer preference for sustainable and convenient food production increases demand for gelatin, contributing to the market growth.

The healthcare segment expects the fastest growth in the market during the forecast period. The aging population and growing prevalence of chronic diseases increase demand for capsules and various medications, fueling the adoption of gelatin. The growing number of chronic wounds increases demand for gelatin-based wound care medications. Gelatin is the main ingredient for the production of tablets & capsules and is used as a stabilizer in the production of vaccines. The growing tissue engineering applications increase demand for gelatin to support the growth of the cells. The growing production of various medical devices like bone plugs, hemostatic sponges, and surgical adhesives drives the overall market growth.

Function Insights

What Made the Stabilizer Segment Dominate the Gelatin Market In 2024?

The stabilizer application segment held the highest revenue share of the gelatin market in 2024. The growing demand for various supplements and medications increases the adoption of stabilizers. The growing production of various kinds of vaccines increases demand for stabilizers, helping in the market growth. The growing demand for food products like ice creams, high-fat yogurts, fruit jelly, salads, sausages, and meat products increases demand for gelatin as a stabilizer. The growing demand for convenience & processed foods and rising consumption of food products like jellies, yogurts, and jams support the overall market growth.

The gelling agent application segment expects the fastest growth in the market during the forecast period. The growing demand for clean-label products and minimal additives, and natural products increases demand for gelling agents. The growing demand for various food and beverages helps in the market growth. Gelling agents extend shelf life and offer stability to products. The growing demand for various food products like gummies, cream cheese, low-fat yogurts, desserts, marshmallows, and margarine increases demand for gelatin as a gelling agent. The growing demand for packaged foods like jams, frozen sweets, and fruit snacks fuels demand for gelling agents. The growing demand for dietary supplements like protein bars & others and the increasing production of nutraceuticals drive the overall growth of the market.

Recent Developments

- In July 2024, KMC launched a potato-based gelling agent for gummy candies. The gelling agent dried at 55 degrees Celsius and became stable at just 25 degrees Celsius. It is known as Gelamyl 625, and it offers a soft texture to gummies with a non-sticky & chewy bite. (Source: vegconomist.com )

- In March 2023, GELITA launched fast-setting gelatin for fortified gummy production. The CONFIXX gelatin offers starch-free production of gummies and simplifies the production process. The gelatin-based gummies can be produced with any active ingredients like vitamins, collagen, minerals & peptides. It easily works with active ingredients and heat-sensitive ingredients. It lowers the overall footprint of the process and minimizes production time from 2 days to a few hours. (Source: expresssharma)

- In November 2024, SCTIMST developed gelatin-based bioink for 3D bioprinting of tissue. The bioink is developed for personalised drug development, drug discovery, and chemical testing. The key ingredient for the development of bioink is chemically modified gelatin known as GelMA. Bioink can create functional organ structures, and these organs can be used for restoring the function of damaged organs & organ replacement. (Source: timesofindia.indiatimes.com)

- In May 2024, Nitta Gelatin India collaborated with a Japanese MNC and launched a Rs. 60 crore expansion projects in Kerala. Japanese MNC announced Rs. 200 crore investment for the expansion of collagen peptide. (Source: www.aninews.in)

Top Companies List

- Rosselot

- STERLING GELATIN

- Junca Gelatines SL

- PAN Biotech GmbH

- Tessenderlo Group

- GELITA AG

- PB Leiner

- Weishardt Holdings SA

- Nitta Gelatin, Inc.

- Shanghai AI-Amin Biosource Co., Ltd.

Segments Covered in the Report

By Source

- Bovine

- Marine

- Porcine

- Poultry

- Others

By Application

- Food & Beverages

- Functional Foods

- Functional Beverages

- Confectionery

- Meat Processing

- Dietary Supplements

- Desserts

- Healthcare

- Cosmetics

- Others

By Function

- Stabilizer

- Gelling Agent

- Thickener

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait