Content

Formic Acid Market Size and Growth Factors 2025 to 2034

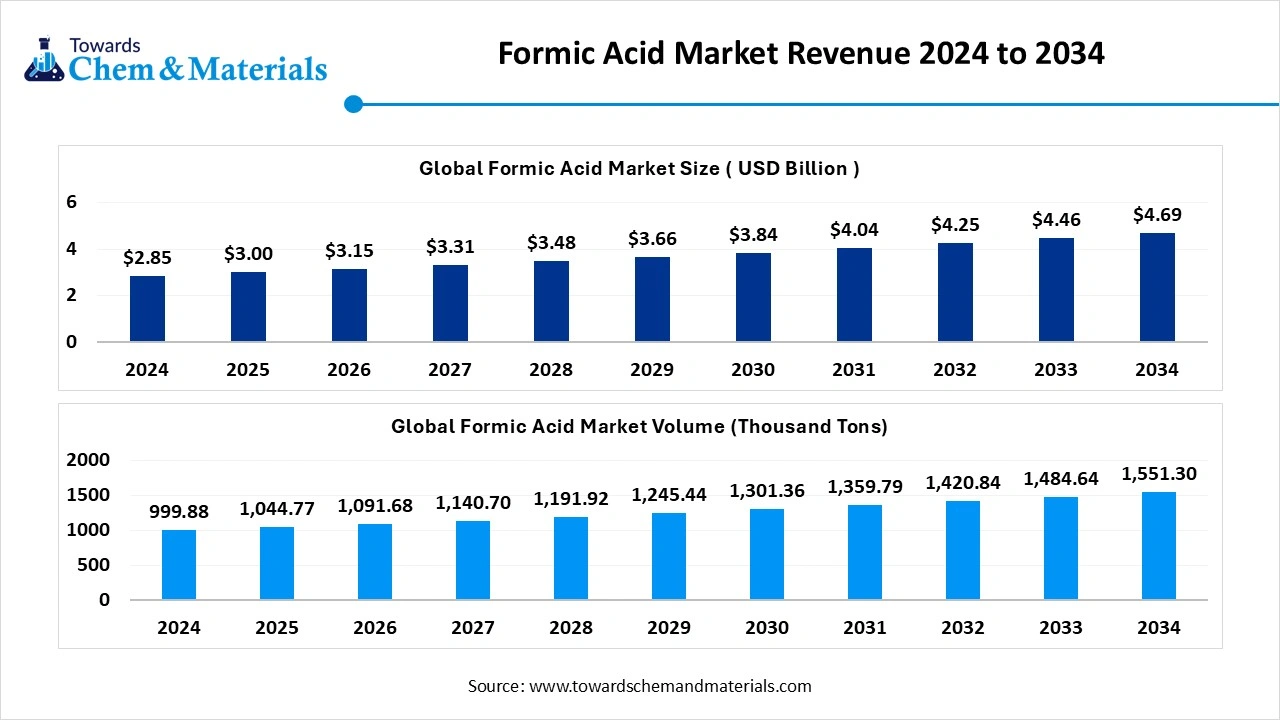

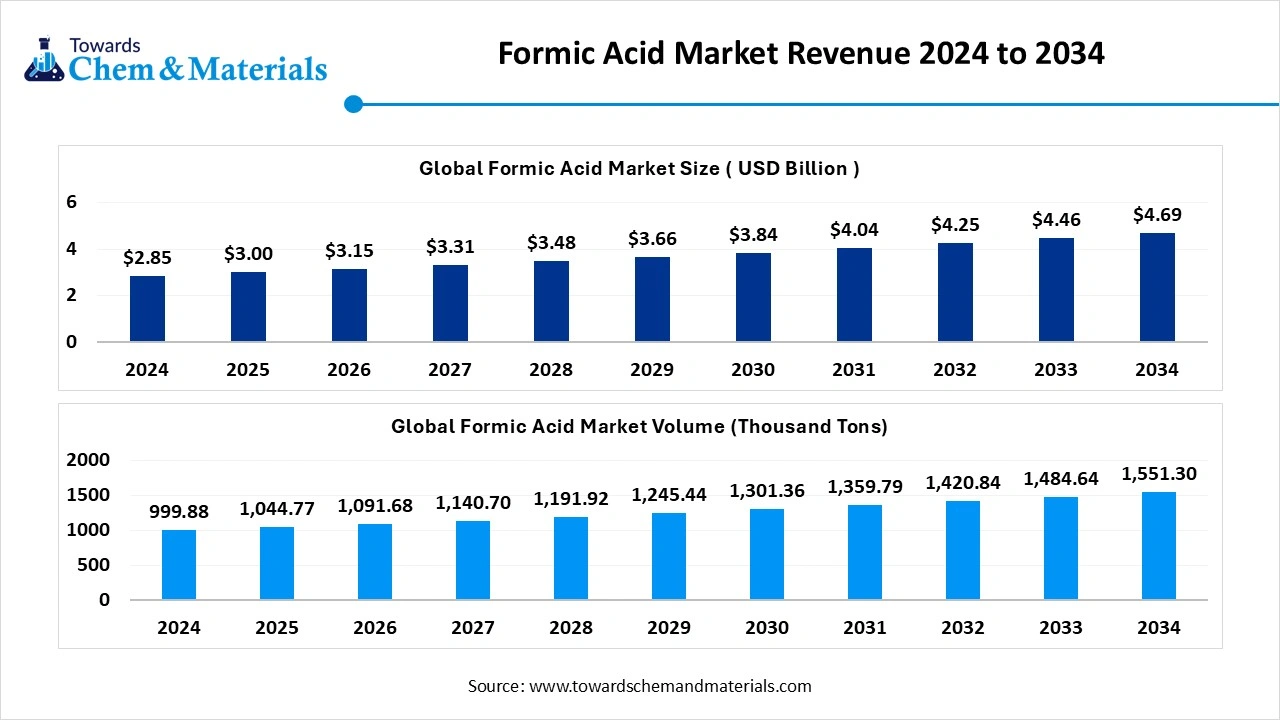

The global formic acid Market is expected to reach a volume of approximately 999.88 thousand tons in 2024, with a forecasted increase to 1,551.30 thousand tons by 2034, growing at a CAGR of 4.49% from 2025 to 2034.

The global formic acid market size was estimated at USD 2.85 billion in 2024 and is expected to hit around USD 4.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034. Increasing product demand from the agriculture sector is the key factor driving market growth. Also, a surge in global population, coupled with the rapid innovations in production technologies, can fuel market growth further.

Formic Acid Market Report Highlights

- By region, Asia Pacific dominated the market with approximately 50% share in 2024. The dominance of the region can be attributed to the rapid urbanisation and increasing population.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing investment in the production of formic acid.

- By grade, the industrial grade segment dominated the market by holding approximately 50% share in 2024. The dominance of the segment can be attributed to the increasing adoption of formic acid in the manufacturing of pharmaceutical intermediates.

- By grade, the feed grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for antibacterial agents.

- By form, the liquid segment held approximately 80% market share in 2024. The dominance of the segment can be linked to the increase in sustainable manufacturing methods.

- By form, the solid/powder segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the ongoing shift towards green chemicals.

- By production process, the methanol carbonylation segment dominated the market by holding approximately 60% share in 2024. The dominance of the segment is owed to its scalability and efficiency for large-scale production.

- By production process, the oxidation of hydrocarbons segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the rising use of formic acid in key sectors.

- By application, the leather & textile segment held approximately 35% market share in 2024. The dominance of the segment can be attributed to the growing demand for high-grade, durable products.

- By application, the agriculture/animal feed segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rapid surge in global agricultural production.

- By end user, the leather & textile manufacturers segment held approximately 40% market share in 2024. The dominance of the segment can be linked to the growing demand for sustainable, high-quality, and eco-friendly materials.

- By end user, the livestock & agriculture companies' segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by the growing global demand for dairy and meat products.

What is Formic Acid?

The formic acid market encompasses the production, supply, and industrial use of formic acid (HCOOH), a colorless, corrosive, and pungent carboxylic acid. It is primarily used as a preservative and antibacterial agent in livestock feed, a coagulant in rubber production, a leather tanning and textile finishing agent, and as a chemical intermediate in pharmaceuticals, adhesives, and cleaning agents.

The Growing demand is driven by the rapid expansion of livestock farming, leather and textile industries, and chemical manufacturing, along with increasing adoption in de-icing, fuel cells, and environmentally friendly industrial processes. Asia Pacific dominates consumption and production due to raw material availability, low production costs, and growing industrial activity, while Europe and North America focus on high-purity and specialty-grade applications.

What Are the Key Trends Influencing the Formic Acid Market?

- Growing demand for antibacterial agents and preservatives is the latest trend shaping a positive market trajectory. Formic acid has natural antibacterial properties that can be widely used as an antibacterial agent and preservative in various food products such as bakery items, processed meats, and beverages.

- The expansion of the textile and leather industry is another major trend in the market. Formic acid is used in dyeing of textiles, tanning leather, and finishing operations. The growth of the fashion sector, coupled with the growing inclination of consumers towards leather and textile products, has facilitated the demand for formic acid.

- Formic acid is used in creating esters, formates, and solvents due to its anti-inflammatory and anti-microbial properties. It also serves as a precursor in chemical derivatives and pharmaceutical substances, which are generally used in drug formulations. Also, it plays a crucial role in sample preparation for the analysis of drugs and other chemical substances.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.00 Billion |

| Expected Market Size by 2034 | USD 4.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Grade, By Form, By Production Process, By Application, By End User, By Region |

| Key Companies Profiled | BASF SE, Eastman Chemical Company, Perstorp, Feicheng Acid Chemicals Co., Ltd., Chongqing Chuandong Chemical (Group) Co., Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC), LUXI GROUP |

Market Opportunity

Increasing Demand for Formic Acid as a Preservative

The growing demand for formic acid as a preservative in various industries is the major factor creating lucrative opportunities in the market. Formic acid plays an important role in the production of silage, a process utilized to preserve green fodder during the winter months. Formic acid is widely utilised in the process because of its exceptional preservation capabilities. Formic acid is used in the production of dilage manufacturing, which contributes to the efficiency of the animal feed industry.

Market Challenge

Environmental Concerns in Production

The manufacturing process of formic acid can contribute to environmental pollution, if not controlled properly, which is the major factor hindering market growth. Moreover, cheaper or safer alternatives such as microflora enhancers, peptides, potassium sorbate, acetic acid, and citric acid can perform similar functions in certain applications, limiting formic acid's market share further.

Regional Insight

Asia Pacific Formic Acid Market Trends

Asia Pacific dominated the market with the largest share in 2024. The dominance of the region can be attributed to the rapid urbanisation and increasing population, which leads to the raised demand for meat products. In addition, the region's rising demand for sustainable solutions and eco-friendly chemical production also contributes to its leading market position.

China Formic Acid Market Trends

In the Asia Pacific, China dominated the market owing to the rapid expansion of the agriculture sector, along with the growing demand for meat products in the country. Moreover, companies in China are emphasising technological advancements and strategic partnerships to keep their dominance in the regional market.

North America Formic Acid Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing investment in the production of formic acid and technological innovations in the manufacturing process. Furthermore, ongoing research and development emphasise creating more efficient reactor designs, enhancing formic acid production, and overall economic viability.

Segmental Insight

Grade Insight

Which Grade Type Segment Dominated the Formic Acid Market in 2024?

The industrial-grade segment dominated the market in 2024. The dominance of the segment can be attributed to the increasing adoption of formic acid in the manufacturing of pharmaceutical intermediates, along with the ongoing shift towards sustainable alternatives in the textiles and leather industry. Additionally, rising demand for antibiotic-free animal feed contributes to the use of formic acid as a natural antibacterial agent.

The feed grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for antibacterial agents and preservatives in animal feed, coupled with the surge in the global livestock industry. Also, formic acid is considered a low-toxicity, biodegradable alternative to other chemicals.

Form Insight

How Much Share Did the Liquid Segment Held in 2024?

The liquid segment held the largest market share in 2024. The dominance of the segment can be linked to the increase in sustainable manufacturing methods such as CO2 conversion and bio-based routes and rising formic acid demand in developing economies. Moreover, formic acid is a crucial coagulating agent in the manufacturing of natural rubber, enhancing consistency and quality.

The solid/powder segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the ongoing shift towards green chemicals as well as the versatility of formic acid as a low-toxicity option to harmful chemicals. The solid or powdered form of formic acid is used as a feed additive in feed mixtures, leading to further segment expansion.

Production Process Insight

Why Methanol Carbonylation Segment Dominated the Formic Acid Market in 2024?

The methanol carbonylation segment dominated the market in 2024. The dominance of the segment is owed to its scalability and efficiency for large-scale production, which leads to consistent quality and cost-effectiveness as compared to other methods, such as the oxalic acid process. Furthermore, rapid innovations in manufacturing technologies, such as enhanced process optimization by minimizing environmental impact, can support the overall segment growth.

The oxidation of hydrocarbons segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the rising use of formic acid in key sectors such as the textile & leather industry and the agriculture industry. Formic acid acts as a corrosion inhibitor in the hydraulic fracturing process, which is essential for oil and gas extraction. This is directly associated with the processing of hydrocarbons.

Application Insight

Which Application Segment Held a Largest Formic Acid Market Share in 2024?

The leather & textile segment held the largest market share in 2024. The dominance of the segment can be attributed to the growing demand for high-grade, durable products and stringent regulations supporting sustainable alternatives. In addition, rapid economic development in countries such as China, India, and Brazil, with strong production bases for leather and textiles, will fuel segment growth soon.

The agriculture/animal feed segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rapid surge in global agricultural production, coupled with the bans on growth-supporting antibiotics. Furthermore, formic acid serves as a key additive in animal feed for its antimicrobial and preservative properties.

End User Insight

How Much Share Did The Leather & Textile Manufacturers Segment Held In 2024?

The leather & textile manufacturers segment held the largest market share in 2024. The dominance of the segment can be linked to the growing demand for sustainable, high-quality, and eco-friendly materials, along with the ongoing trend towards using biodegradable chemicals. Formic acid plays an essential role in enhancing the texture, durability, and appearance of leather and textile products.

The livestock & agriculture companies' segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by growing global demand for dairy and meat products, which boosts the need for efficient animal feed preservatives. Furthermore, the expanding livestock sector, especially in regions such as the Asia-Pacific and North America, creates lucrative opportunities for the companies.

Formic Acid Market - Value Chain Analysis

- Feedstock Procurement : It is the sourcing and acquisition of raw materials necessary for the industrial production of formic acid.

- Chemical Synthesis and Processing : It involves the various technologies and methods used to produce formic acid on an industrial scale and then refine it for various other applications.

- Packaging and Labelling : Labelling needs for formic acid include a typical "Danger" with some other precautionary statements.

- Regulatory Compliance and Safety Monitoring : This stage in the market is important due to the substance's flammable and corrosive nature and its extensive industrial use.

Recent Development

- In June 2024, Kemin Industries introduced a state-of-the-art feed acidifier called FORMYL for the U.S. swine health. The products offer acidification to improve pathogen control efforts by improving overall intestinal health. Encapsulation technology also ensures safer handling of the animal with maximum impact. (Source: www.nationalhogfarmer.com)

Formic Acid Market Top Companies

- BASF SE

- Eastman Chemical Company

- Perstorp

- Feicheng Acid Chemicals Co., Ltd.

- Chongqing Chuandong Chemical (Group) Co., Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC)

- LUXI GROUP

Segments Covered

By Grade

- Industrial Grade

- Standard Industrial Grade

- High-Performance Industrial Grade

- Feed Grade

- Silage Preservative

- Livestock Feed Additive

- Pharmaceutical / Laboratory Grade

- Others

By Form

- Liquid

- Aqueous Solution

- Concentrated Solution

- Solid / Powder

- Others

By Production Process

- Methanol Carbonylation

- Oxidation of Hydrocarbons

- Other Chemical Synthesis Routes

By Application

- Leather & Textile

- Tanning & Dyeing

- Textile Finishing

- Agriculture / Animal Feed

- Silage Preservative

- Livestock Feed Additive

- Chemical Intermediate

- Adhesives & Resins

- Pharmaceutical Intermediates

- De-icing & Preservative

- Fuel Cells

- Industrial Cleaning

- Others

By End User

- Leather & Textile Manufacturers

- Livestock & Agriculture Companies

- Chemical Manufacturers

- Automotive & De-icing Solution Providers

- Pharmaceutical Companies

By Region

- North America

- Europe

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Figures

- Global Formic Acid Market Size (USD 2.85 Billion), 2024–2034

- Global Formic Acid Market Volume ( 999.88 Thousand Tons), 2024–2034

- Global Formic Acid Market Growth Rate (CAGR 4.49%), 2025–2034

- Regional Market Share of Formic Acid, 2024 – Asia Pacific 50%, Europe 22%, North America 15%, Latin America 7%, Middle East & Africa 6%

- Regional CAGR Forecast for Formic Acid Market, 2025–2034 – North America 6.0%, Asia Pacific 4.7%, Europe 4.2%, Latin America 3.8%, Middle East & Africa 3.5%

- Market Share by Grade, 2024 – Industrial Grade 50% (Standard 30%, High-Performance 20%), Feed Grade 25% (Silage Preservative 12%, Livestock Feed Additive 13%), Pharmaceutical/Laboratory Grade 15%, Others 10%

- Market Share by Form, 2024 – Liquid 80% (Aqueous Solution 45%, Concentrated Solution 35%), Solid/Powder 15%, Others 5%

- Market Share by Production Process, 2024 – Methanol Carbonylation 60%, Oxidation of Hydrocarbons 25%, Other Chemical Synthesis Routes 15%

- Market Share by Application, 2024 – Leather & Textile 35% (Tanning & Dyeing 20%, Textile Finishing 15%), Agriculture/Animal Feed 25% (Silage Preservative 12%, Livestock Feed Additive 13%), Chemical Intermediate 20% (Adhesives & Resins 10%, Pharmaceutical Intermediates 5%, De-icing & Preservative 3%, Fuel Cells 1%, Industrial Cleaning 1%), Others 20%

- Market Share by End User, 2024 – Leather & Textile Manufacturers 40%, Livestock & Agriculture Companies 25%, Chemical Manufacturers 15%, Automotive & De-icing Solution Providers 10%, Pharmaceutical Companies 10%

- Competitive Landscape – Market Share of Key Companies, 2024 – BASF SE 20%, Eastman Chemical Company 15%, Perstorp 12%, Feicheng Acid Chemicals Co., Ltd. 12%, Chongqing Chuandong Chemical (Group) Co., Ltd. 10%, GNFC 8%, LUXI GROUP 8%, Others 15%

List of Tables

- Global Formic Acid Market Size, 2024–2034 (USD 2.85 Billion, 999.88 Thousand Tons, CAGR 4.49%)

- Regional Market Size and Forecast, 2024–2034 – Asia Pacific 50%, Europe 22%, North America 15%, Latin America 7%, Middle East & Africa 6%

- Market Share and Growth Rate by Grade, 2024–2034 – Industrial Grade 50% (Standard 30%, High-Performance 20%), Feed Grade 25% (Silage Preservative 12%, Livestock Feed Additive 13%), Pharmaceutical/Laboratory Grade 15%, Others 10%

- Market Share and Growth Rate by Form, 2024–2034 – Liquid 80% (Aqueous Solution 45%, Concentrated Solution 35%), Solid/Powder 15%, Others 5%

- Market Share and Growth Rate by Production Process, 2024–2034 – Methanol Carbonylation 60%, Oxidation of Hydrocarbons 25%, Other Chemical Synthesis Routes 15%

- Market Share and Growth Rate by Application, 2024–2034 – Leather & Textile 35% (Tanning & Dyeing 20%, Textile Finishing 15%), Agriculture/Animal Feed 25% (Silage Preservative 12%, Livestock Feed Additive 13%), Chemical Intermediate 20% (Adhesives & Resins 10%, Pharmaceutical Intermediates 5%, De-icing & Preservative 3%, Fuel Cells 1%, Industrial Cleaning 1%), Others 20%

- Market Share and Growth Rate by End User, 2024–2034 – Leather & Textile Manufacturers 40%, Livestock & Agriculture Companies 25%, Chemical Manufacturers 15%, Automotive & De-icing Solution Providers 10%, Pharmaceutical Companies 10%

- Competitive Landscape – Market Share of Key Companies, 2024 – BASF SE 20%, Eastman Chemical Company 15%, Perstorp 12%, Feicheng Acid Chemicals Co., Ltd. 12%, Chongqing Chuandong Chemical (Group) Co., Ltd. 10%, GNFC 8%, LUXI GROUP 8%, Others 15%