Content

Ethylene Vinyl Acetate Market Size and Forecast 2025 to 2034

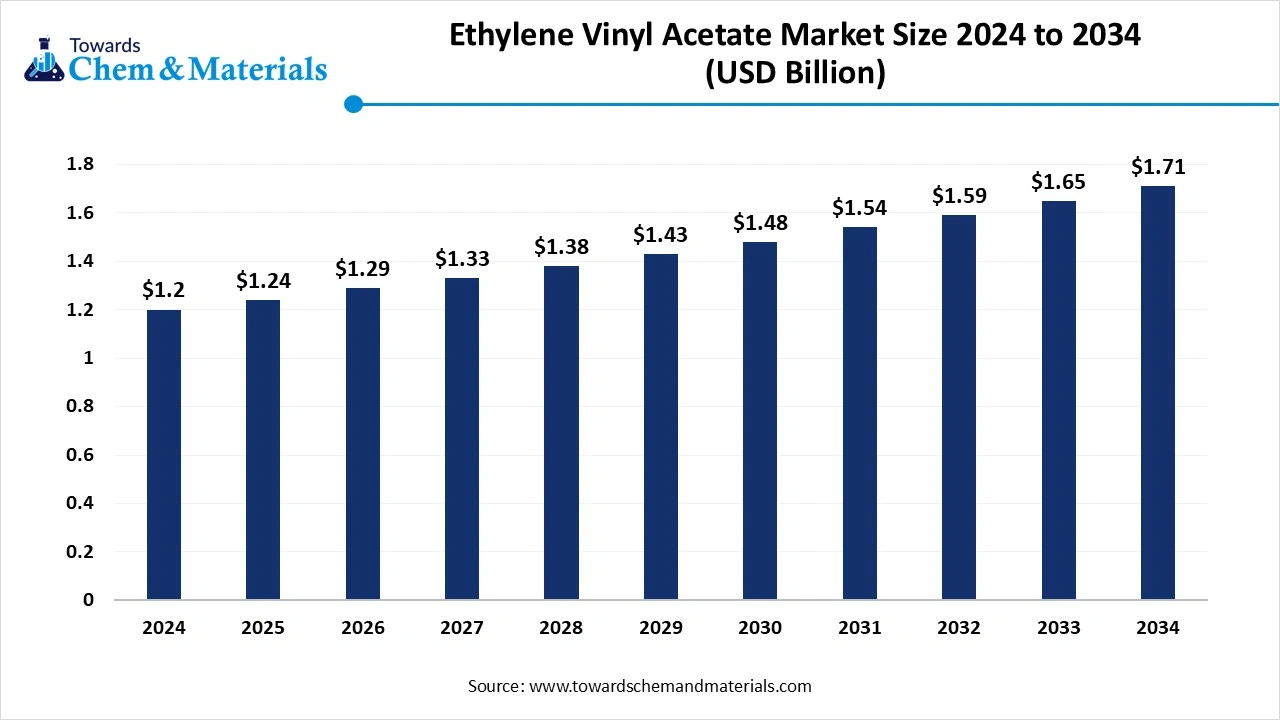

The global ethylene vinyl acetate market size is calculated at USD 1.2 billion in 2024, grew to USD 1.24 billion in 2025, and is projected to reach around USD 1.71 billion by 2034. The market is expanding at a CAGR of 3.60% between 2025 and 2034.The growing demand from renewable energy, the packaging industry, footwear, and adhesives drives the growth of the market.

Ethylene Vinyl Acetate Market Key Takeaways

- By region, Asia Pacific dominated the ethylene vinyl acetate market due to growing industrialization and rapid infrastructure development.

- By region, North America is experiencing the fastest growth in the market due to the extensive presence of an industrial landscape.

- By type, the high-density segment dominated the market in 2024 due to the rising demand from footwear, automotive, and solar energy.

- By type, the medium density segment is expected to grow at the fastest rate in the market during the forecast period due to the rising demand from emerging economies.

- By application, the foaming for insulation segment dominated the market with the largest share in 2024 due to the rising demand from sports equipment.

- By application, the hot melt adhesives segment is expected to grow at the fastest rate in the market during the forecast period due to the rising demand from packaging and hygiene.

- By end user, the packaging segment dominated the ethylene vinyl acetate market in 2024 due to the rapid expansion of the e-commerce sector in various regions.

- By end user, the adhesives & sealants segment is expected to grow at a significant rate in the market during the forecast period due to the growing construction projects in the commercial and residential sectors.

The Rise Of Ethylene Vinyl Acetate in Consumer Products And Industrial Applications

Ethylene Vinyl Acetate(EVA) is a versatile and flexible copolymer made up of two different monomers like vinyl acetate and ethylene. The weight of vinyl acetate varies from 10 to 50% and has properties like resistance to low temperature, softness, and flexibility. It is useful for applications where resilience and cushioning are required. It can easily be molded into various forms and shapes due to this is widely used in the customization of products.

EVA can easily form bonds with other materials, and it is suitable for coatings, adhesives, and sealants. It has better resistance to UV radiation and chemicals like oil & solvents. ethylene vinyl acetate is widely used in foam production, and this foam is widely used in padding materials, sports shoes, and yoga mats. It is widely used in the automotive & construction industries as sealants, and in electrical wires & cables is used as coatings. ethylene vinyl acetate is strongly used in medical applications & instruments due to its high tolerance to chemical effects.

The rapid expansion of the e-commerce sector increases demand for packaging, which helps in the growth of the market. The growing innovations in the development of bio-based ethylene vinyl acetate and advancements in the EVA resin production drive the market growth. Factors like the growing adoption of renewable energy, rising demand for high-performance packaging, and growing demand for casual & aesthetic footwear contribute to the growth of the ethylene vinyl acetate market.

- South Korea exported $1.49B of ethylene vinyl acetate copolymers in 2023.

- Saudi Arabia exported $415M of ethylene vinyl acetate copolymers in 2023.

The Booming Construction Industry Propels the growth of the Ethylene Vinyl Acetate Market

The growing construction industry in developing nations increases demand for various construction projects like infrastructure, residential, and commercial. The growing utilization of coatings, adhesives, and sealants in construction projects for various substrates like metal, wood, and cement fuels demand for ethylene vinyl acetate. Globally, governments are investing in the development of various infrastructure projects like public facilities, roads, and transportation facilities, which increases demand for ethylene vinyl acetate.

The population growth in urban areas increases demand for housing increases demand for durable & strong adhesives & sealants for strong bonding of construction materials. The growing applications of EVA in roofing and coatings for long-term protection help in market growth. The rise in the demand for long-lasting construction increases demand for ethylene vinyl acetate due to its properties like easy shaping & molding, which makes it suitable for various applications, and is the key driver for the ethylene vinyl acetate market growth.

Ethylene Vinyl Acetate Market Trends

- The growing demand from the packaging industry: The growing online shopping increases demand for high-performance packaging, which fuels demand for ethylene vinyl acetate. The ability to create temperature-resistant, sturdy, and flexible bags for various applications helps in the market growth. The growing demand from the pharmaceutical and food & beverage industry to avoid contamination is fueling demand for market.

- The growing footwear demand: EVA provides impact resistance & cushioning to the footwear. The growing utilization of various footwear like sandals, sports shoes, slippers, and many more increases the demand for ethylene vinyl acetate.

- The growing production of bio-based EVA: The growing adoption of sustainability fuels innovation in the production of bio-based EVA to lower environmental impact. The ethylene vinyl acetate made from cassava and sugarcane is gaining popularity, and it reduces reliance on fossil fuel.

Ethylene Vinyl Acetate Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.24 Billion |

| Expected Size in 2034 | USD 1.71 Billion |

| Growth Rate | CAGR of 3.60% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Application, By End User, By Region |

| Key Companies Profiled | Exxon Mobil, Corporation,Innospec,Celanese Corporation,DowDuPont,BASF SE,Arkema SA,Infineum International Limited,Clariant AG,Porex Corporation, United Plastic Components Inc.,USI corporation |

Ethylene Vinyl Acetate Market Opportunity

E-Commerce Expansion Creates an Opportunity for EVA Expansion

The e-commerce sector offers a wider range of products, increasing demand for packaging, which fuels demand for ethylene vinyl acetate. On the e-commerce platforms, there is a variety of products available, and consumer are nowadays giving priority to online shopping due to their busy lifestyle. ethylene vinyl acetate consists of better barrier properties against contaminants, moisture, and oxygen, which helps in protecting goods during shipping.

The growing adoption of sustainable packaging in the e-commerce sector increases demand for ethylene vinyl acetate made up of bio-based materials. In e-commerce packaging, EVA-based sheets & films are widely used in packaging applications.

The growing customer base, increased smartphone & internet usage, 24/7 accessibility of platforms, and convenience are responsible for e-commerce growth. The growing online shopping of various products like groceries, packaged foods, and consumer goods in various countries increases demand for high-quality packaging, which creates an opportunity for ethylene vinyl acetate market growth.

Ethylene Vinyl Acetate Market Challenge

Growing environmental concerns limit EVA expansion

Despite several applications of ethylene vinyl acetate in various industries, the growing environmental concerns restrict the growth of the market. ethylene vinyl acetate is hard to break down naturally, and it remains in the environment for a longer time that contributing to the pollution. The manufacturing of EVA releases volatile organic compounds, which create harmful effects on human health and increase air pollution. It degrades into microplastics, which can enter food chains and have harmful effects on wildlife.

The toxic additives, like stabilizers, plasticizers, and flame retardants, are present in some ethylene vinyl acetate products. EVA requires proper disposal, and it is known as hazardous waste. The growing production from non-renewable energy sources increases environmental degradation and carbon emissions, which hampers the growth of the ethylene vinyl acetate market.

Ethylene Vinyl Acetate Market Regional Insights

Asia Pacific Command Over the Ethylene Vinyl Acetate Market

Asia Pacific dominated the ethylene vinyl acetate market in 2024. The rapid industrialization in developing nations in the region and the growing infrastructure development help in the growth of the market. The strong investments in solar energy projects increase the demand for EVA.

The growing disposable incomes and rapid population growth in the region fuel demand for pharmaceuticals, footwear, and consumer goods, which directly increases the demand for EVA. The growing demand from end-user industries like automotive, construction, packaging, and footwear, fueling the market growth. Furthermore, the presence of key manufacturing facilities in developing nations like India, South Korea, China, and Japan, and favorable government policies encourage the adoption of agricultural modernization and renewable energy contributes to the growth of the market.

Well-Developed Manufacturing Hub Drives Ethylene Vinyl Acetate Demand in China

China held the largest share of the ethylene vinyl acetate market. The presence of an extensive manufacturing hub increases demand for raw materials helps in the growth of the market. The growing domestic demand and high production of EVA fuel the market growth. The growing expansion of the building & construction sector increases demand for sealants, adhesives, and other construction materials, which is fueling demand for the EVA.

The rapid expansion of solar energy and the growing adoption of sustainable packaging drive the market growth. Additionally, increasing demand from end-user industries like renewable energy, electronics, packaging, construction, and footwear supports the overall growth of the market.

- China exported $509 million of ethylene vinyl acetate copolymers in 2024.

- China exported $444M of ethylene vinyl acetate copolymers in 2023.

Evolution of EVA in India

India is the fastest growing in the ethylene vinyl acetate market. The strong government policies and growing investment in solar energy increase demand for ethylene vinyl acetate, which helps in the market growth. The growing focus on sustainability increases the adoption of bio-based ethylene vinyl acetate. The Indian government's strong support for renewable energy increases demand for EVA. The increasing demand from key industries like packaging, construction, and footwear contributes to the overall market growth.

- India exported $9.62M of ethylene vinyl acetate copolymers in 2023.

- In 2023, the ethylene vinyl acetate copolymers' main export destinations were: Brazil($389K), Bangladesh($896K), Russia($1.18M), Nepal($1.22M), and Saudi Arabia($3.22M).

North America experiences the fastest growth in the ethylene vinyl acetate market during the predicted period.

The extensive presence of industrial landscape and the presence of manufacturing & suppliers of ethylene vinyl acetate in the region help in the growth of the market. The strong investment in research and development for the development of new applications, fueling the growth of the market.

The presence of diverse end-user industries like packaging, agriculture, solar energy, footwear, and medical increases demand for EVA for various applications. The presence of strong infrastructure for logistics, distribution & production, and advanced manufacturing capabilities helps in the market growth. Furthermore, the government encourages the adoption of sustainable practices and renewable energy, driving the growth of the market.

The United States is Powering the Ethylene Vinyl Acetate Market

The United States is a major contributor to the growth of the market. The presence of a strong manufacturing sector and production capabilities of EVA in numerous companies helps in the market growth. The rapid growth in the solar energy and packaging industry in the region increases demand for ethylene vinyl acetate. The strong investment in research and development and innovations in EVA products, fueling the growth of the market. The growing demand from various sectors like renewable energy, packaging, electronics, and automotive, and rapid growth in the food & beverage industry, and growing agricultural activities, drive the growth of the market.

- The United States exported $353M of ethylene vinyl acetate copolymers in 2024.

Rise of Ethylene Vinyl Acetate in Canada

Canada is a key player in the growth of the ethylene vinyl acetate market. The presence of a strong industrial base, robust research & development infrastructure, and advanced manufacturing capabilities helps in the growth of the market. The growing adoption of sustainable packaging, rapid growth in e-commerce, and the rising utilization of consumer goods increase the demand for ethylene vinyl acetate. The strong infrastructure support for efficient trade and distribution of the EVA products, and growing demand from solar energy, packaging, and agriculture, support the overall growth of the market.

Ethylene Vinyl Acetate Market Segmental Insights

Type Insights

The high-density segment held the largest share of the ethylene vinyl acetate market in 2024. The demand for superior properties of EVA with better UV resistance and enhanced chemical resistance helps in the growth of the market. The wide utilization in protective coatings, adhesives, cement renders, sealants, and plasters increase demand for the high-density ethylene vinyl acetate.

High-density EVA consists of better hardness and mechanical strength. It consists of superior chemical resistance to various solvents & oils, and it is suitable for outdoor applications. The increasing demand for cost-effective solutions is fueling market growth. The growing demand from the footwear, automotive, industrial, and solar energy sectors contribute to the growth of the market.

The medium density segment is the fastest growing in the market during the forecast period. The multiple applications in various industries like medical, automotive, packaging, and footwear help in the growth of the market. Medium density ethylene vinyl acetate consists good balance between toughness, flexibility, and durability. The increasing demand for agricultural applications like mulch films and greenhouse covers helps in the market growth. The growing adoption of sustainable packaging increases the demand for medium-density EVA. The rising demand for ethylene vinyl acetate in emerging economies fuels demand for medium-density EVA, which supports the overall growth of the market.

Application Insights

The foaming segment dominated the ethylene vinyl acetate market in 2024. The growing demand from the footwear sector for shoe soles due to durability and comfort helps in the growth of the market. The rapid growth in the packaging sector increases demand for foams due to their excellent protection and shock absorption. Foam offers cushioning, resistance to high temperatures, flexibility, and is lightweight. The growing expansion of the medical industry increases demand for orthopaedic products like footwear & ortho-prostheses, which fuels demand for foams.

Furthermore, growing demand from various applications like floating eyewear, water sports equipment, and marine gear drives the growth of the market.

The hot melt adhesives segment expects the notable growth rate in the ethylene vinyl acetate market during the forecast period.

The growing demand from key industries like hygiene, packaging, and construction helps in the growth of the market. The growing versatility in various materials like wood, metal, plastic, cardboard, leather, rubber, foam, ceramics, and fabrics increases demand for hot-melt adhesives. These adhesives consist of good adhesion and high cohesive strength. The growing adoption of sustainable packaging fuels demand for hot-melt adhesives.

These adhesives are suitable for high-speed applications, and they are more cost-effective. The growing e-commerce boom increases demand for efficient packaging options, which support the growth of the market.

End User Insights

The packaging segment dominated and held the largest share of the ethylene vinyl acetate market in 2024. The rapid expansion of the food& beverage industry in various regions increases demand for EVA packaging to avoid spoilage and contamination of packaged food products. The growing production of various packaging options like shrink films, bags, pouches, and other options increases demand for ethylene vinyl acetate due to its properties like clarity & flexibility.

The growing online shopping and the rising demand for consumer goods increase the demand for reliable packaging that uses ethylene vinyl acetate. Additionally, growing adoption of sustainable & eco-friendly packaging and rising demand for personal care product packaging fuel the overall growth of the market.

The adhesives and sealants segment expects the fastest growth in the ethylene vinyl acetate market during the forecast period. The expanding demand for packaging due to e-commerce growth increases demand for adhesives & sealants, which helps in the market growth. The growing demand from the automotive industry for various automotive parts, like molded components and bumpers, increases demand for adhesives & sealants. The growing utilization of products like temperature guns in the medical and healthcare sector fuels demand for adhesives and sealants. The construction industry's strong reliance on adhesives and sealants helps in the market growth.

The growing urbanization in various regions and rising population increase demand for construction projects in commercial, residential, and infrastructure sectors, which drives the growth of the market.

Recent Developments in the Ethylene Vinyl Acetate Market

Univation Technologies

- Launch: In June 2024, Univation launched EVA and LDPE production technology. This provides licensed platforms for PE producers to create both ethylene vinyl acetate copolymer resins and low-density PE. The technology offers key benefits like safe & reliable operations, high-performance products, and diverse ethylene vinyl acetate capabilities.

Repsol

- Launch: In 2023, Repsol launched the first range of 100% circular copolymers. This solution helps in lowering the carbon footprint, and a new product is being marketed under Repsol Reciclex. The raw material used for the development of Repsol is derived from waste streams. The new range of products ensures suitability for sensitive applications like healthcare, food contact, and the cosmetic sector.

Xtellar

- Launch: In June 2023, Xtellar introduced the first flexible large-format 3D printing. This bio-based pellet brings sustainability and flexibility for large-format 3D printers. The pallet made from raw sugar cane feedstock.

Kane Footwear

- Launch: In April 2025, Kane Footwear, in partnership with 1% for Planet, launched an eco-friendly recovery shoe. The new shoe consists of features including comfort, breathability, and durability for post-training wear. The Brazilian sugar-cane-based ethylene vinyl acetate is used in the manufacturing of Kane footwear.

Ethylene Vinyl Acetate Market Top Companies List

- Exxon Mobil Corporation

- Innospec

- Celanese Corporation

- DowDuPont

- BASF SE

- Arkema SA

- Infineum International Limited

- Clariant AG

- Porex Corporation

- United Plastic Components Inc.

- USI corporation

Segments Covered in the Report

By Type

- High Density EVA

- Medium Density EVA

- Low-Density EVA

By Application

- Foaming

- Hot Melt Adhesives

- Film Extrusion

- Solar Cell Encapsulation

- Injection Molding

- Coatings

- Wires & Cables

- Others

By End User

- Packaging

- Adhesives & Sealants

- Renewable Energy

- Footwear

- Construction

- Electrical & Electronics

- Automotive

- Pharmaceuticals

- Agriculture

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait