Content

Cyclohexanone Market Size and Forecast 2025 to 2034

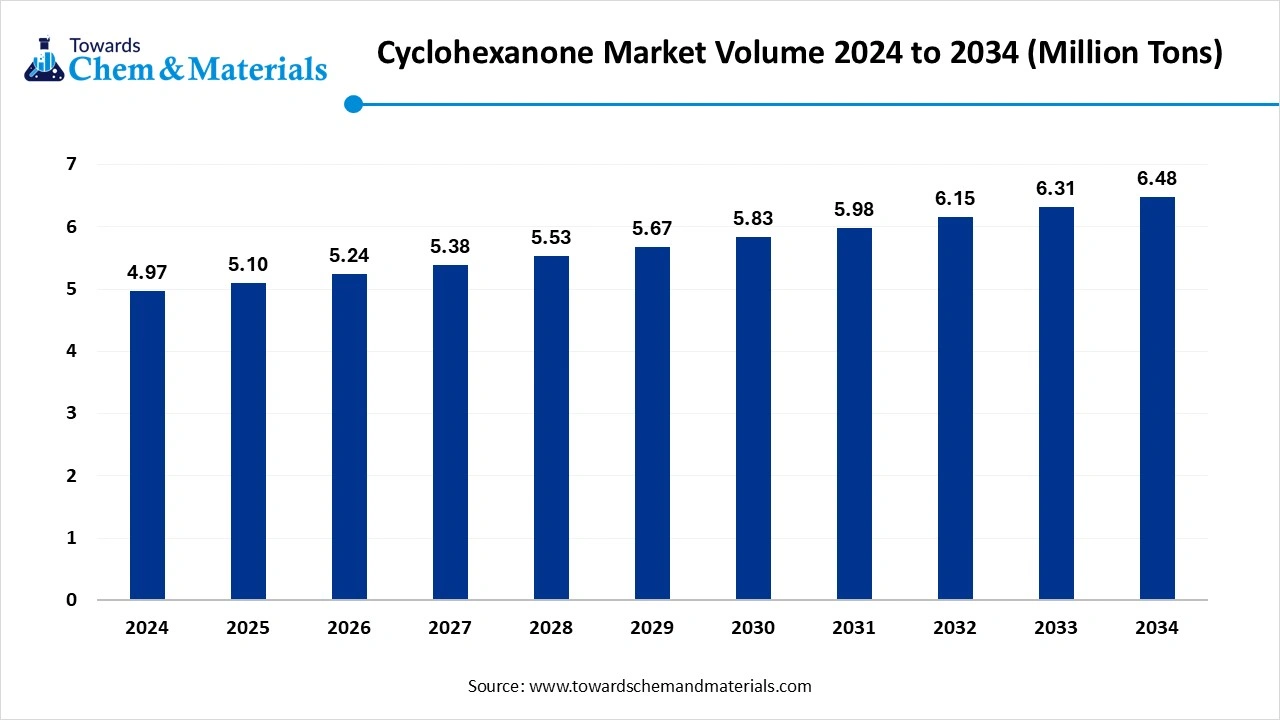

The global cyclohexanone market volume reached 5.1 million tons in 2025 and is forecast to witness steady growth, touching nearly 6.48 million tons by 2034 at a CAGR of 2.70 % from 2025 to 2034. The growing demand from various industries and application in various products drives the growth of the market.

Key Takeaways

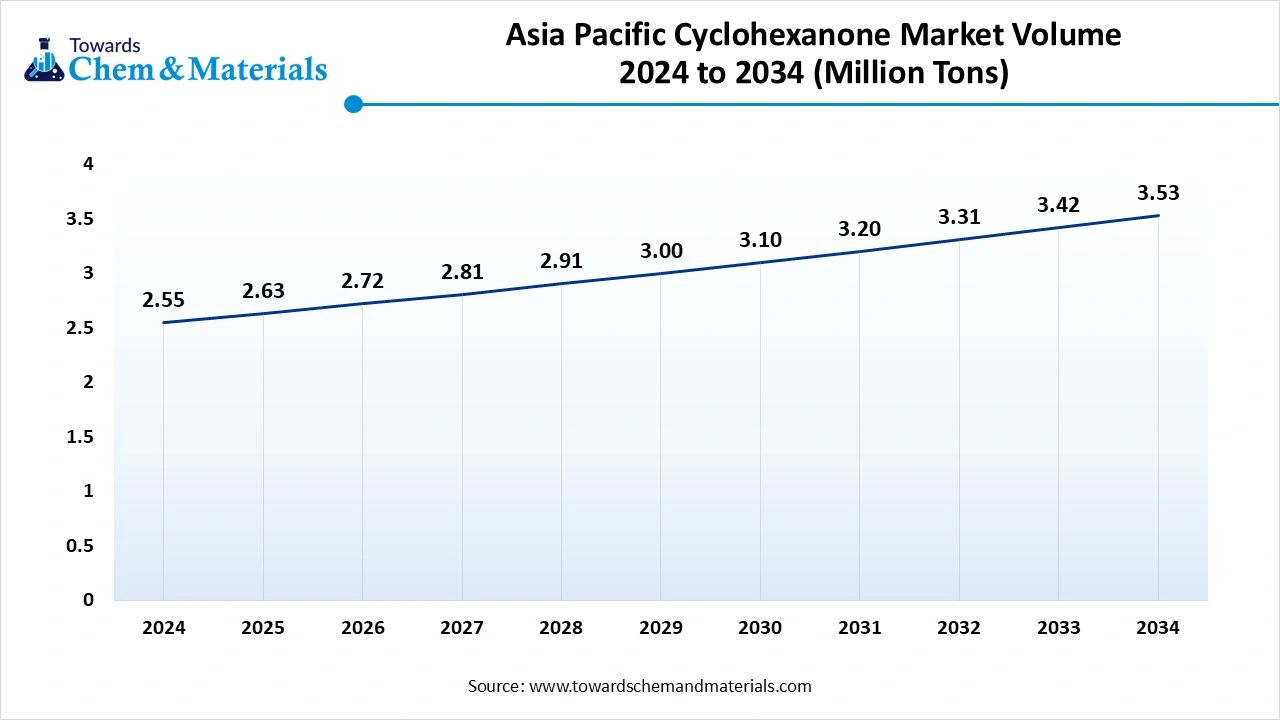

- The Asia Pacific cyclohexanone market Volume accounted for USD 2.63 million tons in 2025 and is forecasted to hit around USD 3.53 million tons by 2034, representing a CAGR of 3.31% from 2025 to 2034.

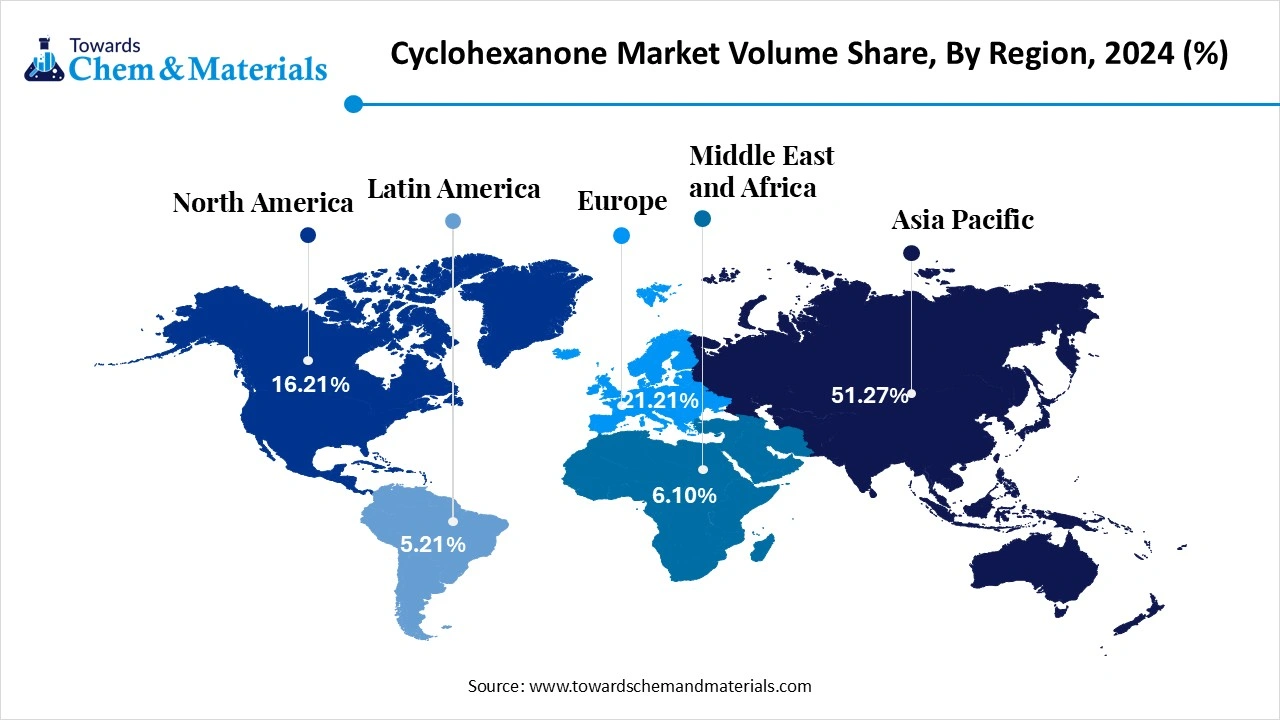

- The Asia Pacific cyclohexanone market held the largest volume Share of 51.27% of the global market in 2024.

- The North America Cyclohexanone market is expected to register the fastest CAGR of 1.98% over the forecast period by 2025-2034

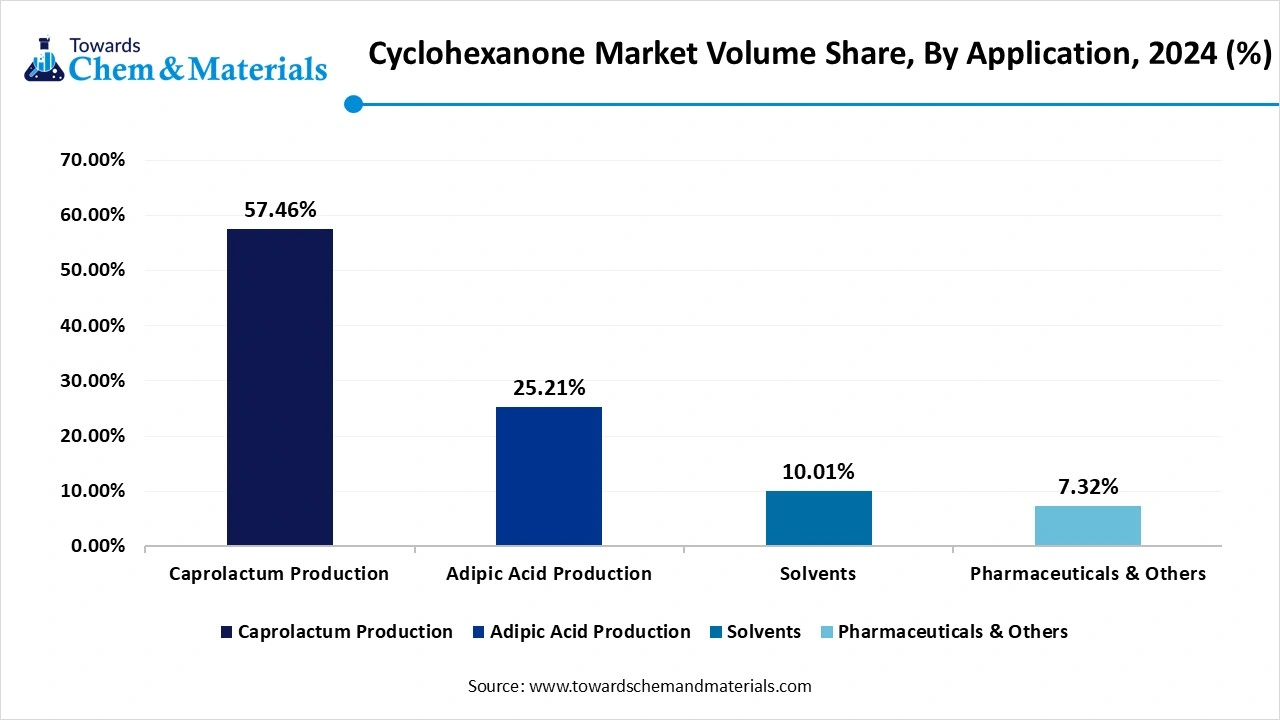

- By Application, the caprolactum production segment dominated the market with the largest volume Share of 57.46% in 2024.

- By Application, the adipic acid production segment is projected to grow at the fastest CAGR of 3.48% over the forecast period by 2025-2034

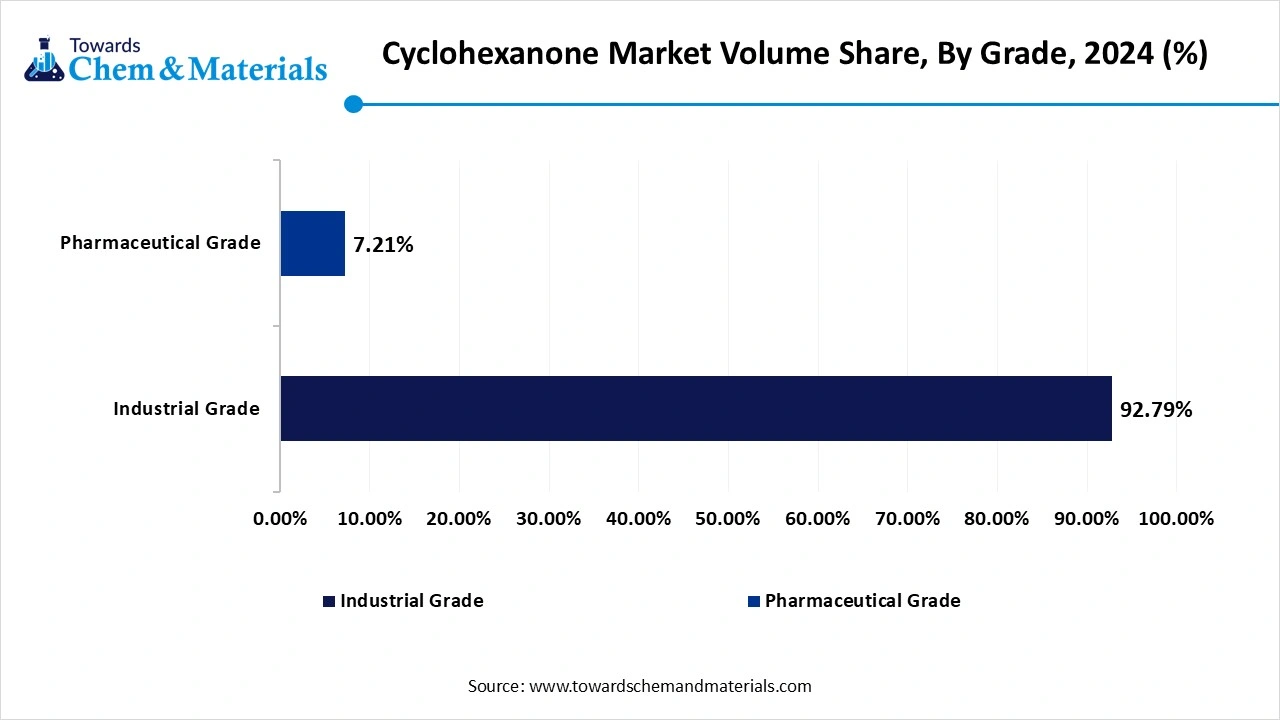

- By Grade, the industrial grade segment led the market with a volume Share of 92.79% in 2024

- By Grade, the pharmaceutical grade segment is projected to grow at the fastest CAGR of 11.28% over the forecast period.

Rising Demand for Nylon Materials: Cyclohexanone Market To Expand

Cyclohexanone is a clear, colorless to pale-yellow organic compound with a distinct, sharp odor, widely used as a solvent and chemical intermediate. Its chemical formula is C₆H₁₀O, and it is a cyclic ketone derived from cyclohexane. Cyclohexanone is primarily used in the production of nylon by serving as a key precursor for caprolactam and adipic acid. It is also employed as a solvent in the manufacture of paints, coatings, adhesives, and plastics. Industrially, it is produced through the oxidation of cyclohexane or by the hydrogenation of phenol. Due to its versatility and role in nylon synthesis, it holds significant importance in the chemical, textile, and automotive industries.

What Are The Key Drivers of the Cyclohexanone Market?

The primary drivers of the market include the rising demand for nylon products, especially nylon 6 and nylon 6,6, which are extensively used in the automotive, textile, and electronics industries due to their strength and durability. The compound's vital role as a precursor in the production of caprolactam and adipic acid makes it indispensable for nylon manufacturing. Additionally, growing industrialization, particularly in the Asia-Pacific region, and increasing use of cyclohexanone as a solvent in paints, coatings, and adhesives further fuel market growth. Technological advancements in production processes and a shift toward more sustainable chemical manufacturing also contribute to market expansion.

Cyclohexanone Market Trends

- Rising demand for nylon due to its expanding applications in automotive, electrical, textile and packaging industries drives growth.

- Growing usage of cyclohexanone as a solvent in paints, coatings, adhesives, and plastics drives the demand.

- Shift towards bio-based feedstocks, like research and production of bio-based cyclohexanone from renewable resources.

- Increasing environmental regulations on hazardous chemicals are pushing companies to improve production efficiency and waste management.

Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 5.1 Million Tons |

| Expected Volume by 2034 | 6.48 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 2.70% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application , By Grade, By Region |

| Key Companies Profiled | Gujarat State Fertilizers & Chemicals Limited (GSFC), Asahi Kasei Corporation, BASF, Domo Chemicals, Ostchem, Fibrant, Shreeji Chemicals., JIGCHEM UNIVERSAL, ARIHANT SOLVENTS AND CHEMICALS, Qingdao Hisea Chem Co., Ltd., LUXI GROUP, Chang Chun Group, UBE Corporation |

Cyclohexanone Market Opportunity

What is the Significant Opportunity for the Growth of the Cyclohexanone Market?

One significant opportunity in the cyclohexanone market lies in the development and commercialization of bio-based cyclohexanone as a sustainable alternative to the conventional petrochemical-derived version. With increasing global emphasis on reducing carbon emissions and environmental impact, industries are seeking greener production methods. Bio-based cyclohexanone, derived from renewable feedstocks such as biomass or plant-based raw materials, presents a compelling solution that aligns with environmental regulations and consumer preferences for sustainable products. This opportunity not only supports circular economy initiatives but also allows companies to differentiate themselves in a competitive market by offering eco-friendly chemical solutions, especially in applications like green nylon and sustainable coatings.

Cyclohexanone Market Challenge

The Factor Responsible for Hindering the Growth of the Market is Raw Material Prices

One major challenge in the market is the volatility of raw material prices, particularly for cyclohexane and phenol, which are key feedstocks in its production. Fluctuations in crude oil prices, geopolitical tensions, and supply chain disruptions can significantly impact the availability and cost of these raw materials, leading to unstable production costs and profit margins. This unpredictability poses a risk for manufacturers in planning and pricing strategies, especially in highly competitive markets. Additionally, dependence on non-renewable feedstocks raises concerns about long-term sustainability, prompting the need for investment in alternative production technologies, which can be capital-intensive and slow to implement.

Regional Insights

What Drives The Growth of the Cyclohexanone Market in Asia Pacific?

The Asia Pacific cyclohexanone market volume amounted to nearly 2.63 million tons worldwide in 2025 and is expected to rise to around 3.53 million tons by 2034, growing at a healthy CAGR of 3.31% between 2025 an 2034. Asia Pacific dominated the cyclohexanone market in 2024.

The growth is driven by rapid industrialization, urbanization, and robust growth in end-use sectors such as automotive, textiles, and construction. The region benefits from a strong manufacturing base and a growing demand for nylon-based products, which boosts the consumption of cyclohexanone as a key intermediate. Favorable economic conditions, increasing investments in chemical production infrastructure, and a skilled labor force further support market growth. Additionally, the rising demand for coatings, adhesives, and solvents due to expanding industrial and consumer goods sectors continues to create strong growth momentum for cyclohexanone in this region.

The Growth of the Market in China is Seen Due to its Large-Scale Chemical Manufacturing Industries, China is a key player in the global cyclohexanone market, driven by its large-scale chemical manufacturing industry and strong demand from sectors such as textiles, automotive, and electronics. The country accounts for a significant portion of global cyclohexanone production, supported by ongoing investments from major chemical companies to expand capacity and improve production technologies. This robust manufacturing base allows China to supply both domestic and international markets efficiently. Additionally, China's focus on innovation and sustainable production methods is helping to strengthen its position as a leading supplier in the market.

- The World exported 17,690 shipments of Cyclohexanone from Oct 2023 to Sep 2024 (TTM). 1,670 Exporters made exports to 2,125 Buyers, with the growth rate of 17% comparing previous year. (Source : Volza)

- The top three exporters of Cyclohexanone are Vietnam, China, and the United States. Vietnam leads the world in Cyclohexanone exports with 37,996 shipments, followed by China with 7,338 shipments, and the United States taking the third spot with 6,232 shipments. (Source: Volza)

Global Cyclohexanone Market Volume Share, By Region 2024 (%)

| By Region | Market Volume Share, 2024 (%) |

Market Volume- 2024 (Million Tons ) |

Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) |

| North America | 0.81 | 16.21% | 0.98 | 15.12% | 1.98% |

| Europe | 1.05 | 21.21% | 1.24 | 19.11% | 1.62% |

| Asia Pacific | 2.55 | 51.27% | 3.53 | 54.46% | 3.31% |

| Latin America | 0.26 | 5.21% | 0.40 | 6.21% | 4.51% |

| Middle East & Africa | 0.30 | 6.10% | 0.33 | 5.10% | 0.87% |

| Total | 4.97 | 100% | 6.48 | 100% | 2.69% |

The European Growth in the Market is Driven by its Well-Established Industrial Sector, Europe is anticipated to grow significantly in the cyclohexanone market in the forecasted period. The growth is primarily driven by its use in the production of caprolactam and adipic acid for nylon manufacturing. With well-established automotive, textile, and industrial sectors, the demand for nylon-based products supports consistent cyclohexanone consumption. Additionally, its role as a solvent in applications such as paints, coatings, and adhesives reinforces its importance across various end-use industries. The region also benefits from strong research and development capabilities, encouraging innovation in chemical processing and sustainable production methods. Europe’s focus on advanced manufacturing and environmental standards fosters continued growth and product diversification within the market.

The German Market is Seeing Significant Growth due to Advanced Chemical Manufacturing Infrastructure, Germany stands as a significant player in the European cyclohexanone market, driven by its advanced chemical manufacturing infrastructure and strategic position within the European Union. The nation’s robust industrial base, encompassing sectors such as automotive, textiles, and electronics, fuels the demand for cyclohexanone, primarily utilized in the production of nylon intermediates like caprolactam and adipic acid. Germany’s commitment to sustainability is evident through initiatives aimed at reducing carbon emissions and enhancing production efficiency. Notably, companies like BASF SE and Evonik Industries AG are investing in innovative technologies to improve cyclohexanone production processes, aligning with both environmental goals and market demands. These factors play a pivotal role in the market, balancing industrial growth with environmental responsibility.

Segmental Insights

Application Insights

The caprolactam segment dominated the cyclohexanone market in 2024. Caprolactam is the largest and most important segment within the cyclohexanone market, as it is the primary raw material used in the production of nylon-6 fibers and resins. Cyclohexanone is a key intermediate in the manufacture of caprolactam, which is highly demanded in industries such as textiles, automotive, packaging, and engineering plastics due to its strength, durability, and versatility. The increasing demand for nylon-based products in apparel, carpets, and industrial applications drives the growth of this segment. Additionally, innovations in caprolactam production aimed at improving efficiency and reducing environmental impact further support its market expansion. Because nylon-6 is widely used in high-performance and lightweight materials, this segment is a major revenue generator for the market.

Global Cyclohexanone Market Volume Share, By Application 2024 (%)

| By Application | Market Volume Share, 2024 (%) |

Market Volume- 2024 (Million Tons ) |

Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) |

| Caprolactum Production | 2.86 | 57.46% | 3.59 | 55.37% | 2.31% |

| Adipic Acid Production | 1.25 | 25.21% | 1.76 | 27.21% | 3.48% |

| Solvents | 0.50 | 10.01% | 0.73 | 11.21% | 3.86% |

| Pharmaceuticals & Others | 0.36 | 7.32% | 0.40 | 6.21% | 1.01% |

| Total | 4.97 | 100% | 6.48 | 100% | 2.69% |

The solvents segment expects significant growth in the cyclohexanone market during the forecast period. The solvents segment represents an important application area for cyclohexanone, where it is valued for its excellent solvency properties in various industrial processes. Cyclohexanone is widely used as a solvent in paints, coatings, adhesives, and sealants due to its ability to dissolve a broad range of resins and polymers, ensuring smooth application and quick drying times. This segment benefits from growing demand in the construction, automotive, and electronics industries, where high-quality coatings and adhesives are essential for product performance and durability. Moreover, cyclohexanone’s relatively low toxicity compared to some other solvents makes it a preferred choice for safer manufacturing processes. Increasing environmental regulations and a push for greener solvents are also influencing the development of more sustainable solvent formulations using cyclohexanone.

Grade Insights

The technical grade segment dominated the cyclohexanone market in 2024. The technical grade segment of cyclohexanone refers to the grade used primarily in industrial applications where ultra-high purity is not required. This grade is commonly utilized as a solvent or intermediate in the production of various chemicals, including agricultural chemicals, pharmaceuticals, and specialty chemicals. Its cost-effectiveness and adequate purity make it suitable for use in manufacturing processes where small impurities do not affect the final product’s performance. The demand for technical grade cyclohexanone is driven by industries looking for economical and efficient solvents or intermediates, especially in sectors such as coatings, adhesives, and rubber processing. This segment plays a crucial role in supporting broad industrial applications beyond the nylon production chain.

Global Cyclohexanone Market Volume Share, By Grade 2024 (%)

| By Grade | Market Volume Share, 2024 (%) |

Market Volume - 2024 (Million Tons ) |

Market Volume Share, 2034 (%) | Market Volume - 2034 (Million Tons ) | CAGR(2025 - 2034) |

| Industrial Grade | 0.46 | 92.79% | 0.67 | 91.68% | 3.73% |

| Pharmaceutical Grade | 0.04 | 7.21% | 0.06 | 8.32% | 5.36% |

| Total | 0.50 | 100% | 0.73 | 100% | 3.86% |

The reagent grade segment expects significant growth in the cyclohexanone market during the forecast period. The reagent grade cyclohexanone is characterized by its high purity and is primarily used in laboratory settings, pharmaceutical manufacturing, and specialized chemical syntheses where precise chemical reactions are essential. This grade ensures minimal impurities, which is critical for research and development, quality control, and the production of fine chemicals and pharmaceuticals. Its demand is driven by the need for consistent and reliable chemical performance in sensitive applications. Additionally, reagent-grade cyclohexanone is often used in the synthesis of high-value compounds and analytical procedures, making it a vital segment despite representing a smaller volume compared to industrial grades.

Recent Developments in Cyclohexanone Market

- In February 2025, Ube Chemicals of Japan announced the details and structure of its chemical activities. The company aims to expand its specialty chemical market.

Top Companies List

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Asahi Kasei Corporation

- BASF

- Domo Chemicals

- Ostchem

- Fibrant

- Shreeji Chemicals.

- JIGCHEM UNIVERSAL

- ARIHANT SOLVENTS AND CHEMICALS

- Qingdao Hisea Chem Co., Ltd.

- LUXI GROUP

- Chang Chun Group

- UBE Corporation

Segments Covered in the Report

By Application

- Caprolactam

- Adipic Acid

- Solvents

- Paints & Dyes

- Agriculture

- Others

By Grade

- Technical Grade

- Reagent Grade

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait