Content

Breathable Films Market Size and Growth 2025 to 2034

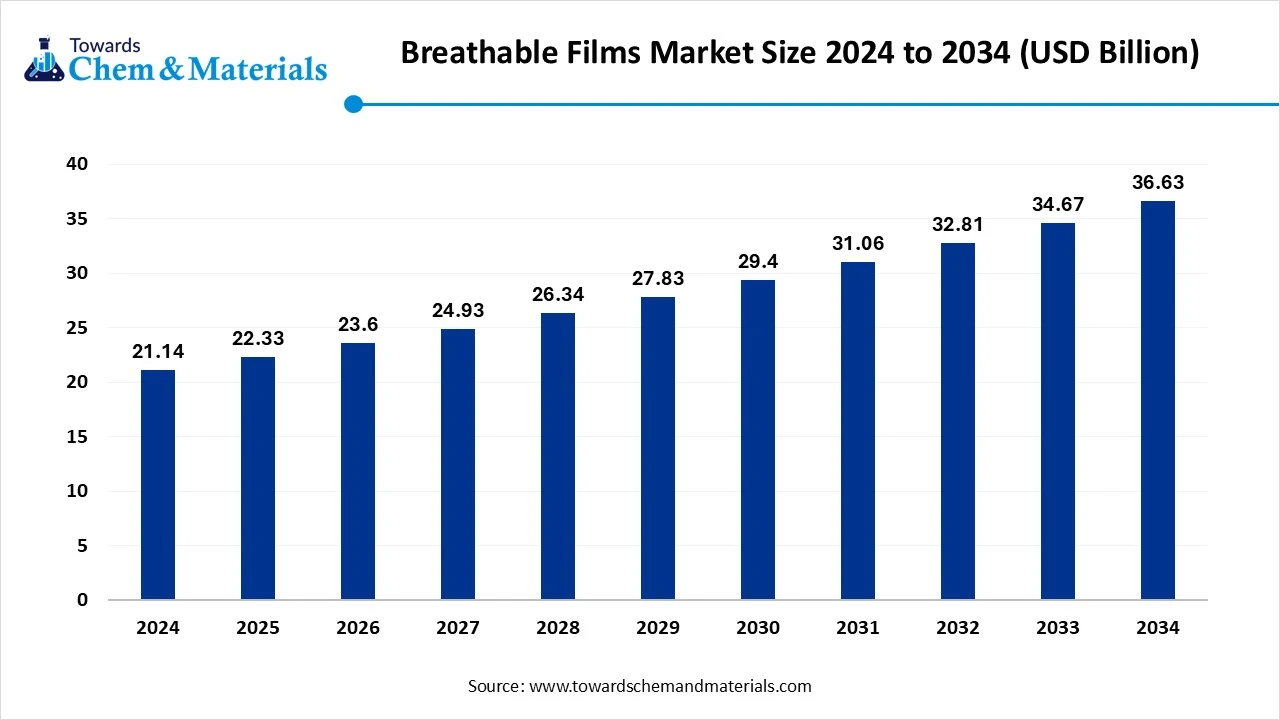

The global breathable films market size was reached at USD 21.14 billion in 2024 and is expected to be worth around USD 36.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034. The growing awareness about hygiene, the increasing production of disposable clothing, and the rise in construction activities drive the market growth.

Key Takeaways

- By region, Asia Pacific held approximately a 40% share in the market in 2024 due to the increasing demand for personal care products.

- By region, North America is growing at the fastest CAGR in the market during the forecast period due to the growing construction activities.

- By type, the polyethylene films segment held approximately a 45% share in the market in 2024 due to the growing demand for hygiene products.

- By type, the polyurethane films segment is expected to grow at the fastest CAGR in the market during the forecast period due to the superior mechanical properties.

- By technology, the microporous films segment held approximately a 55% share in the market in 2024 due to the strong moisture control properties.

- By technology, the monolithic films segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for personal protective equipment.

- By end-user industry, the packaging & consumer goods segment held approximately a 40% share in the market in 2024 due to the rise in ready-to-eat meals.

- By end-user industry, the healthcare & medical segment is expected to grow at the fastest CAGR in the market during the forecast period due to the development of various medical products.

- By distribution, the direct supply to OEMs segment held approximately a 60% share in the breathable films market in 2024 due to the high availability of customization.

- By distribution, the distributors & converters segment is expected to grow at the fastest CAGR in the market during the forecast period due to the availability of technical support.

Power of Breathable Films in Modern Applications and Smart Protection

Breathable films are a polymer films that consist of a microporous structure. Breathable films are permeable to water vapor, gases, and impermeable to liquids. They offer a barrier to microorganisms like bacteria, viruses, and others. They offer barrier protection against liquids, particles, and contaminants. Breathable films offer benefits like extension of product life, enhancement of user comfort, and improved hygiene.

The growing production of hygiene products like sanitary napkins, baby diapers, and many more uses breathable films. Breathable films are widely used in personal care & hygiene products, food packaging, protective clothing, medical applications, and building & construction materials. Factors like rising hygiene awareness, expanding healthcare demand, sustainable packaging innovations, and increasing use of lightweight breathable materials in construction & industrial applications contribute to the growth of the breathable films market.

- Vietnam exported 83,631 shipments of polyethylene film.(Source: www.volza.com)

- Vietnam exported 8,327 shipments of polypropylene (PP) film.(Source: www.volza.com)

- India exported 62,943 shipments of polyester film.(Source: www.volza.com)

Growing Construction Activities Surge Demand for Breathable Films

The rapid urbanization and growing construction activities in various regions increase demand for breathable films. The growth in residential construction activities increases the adoption of breathable films for the development of wall underlayments and roofing. The strong focus on sustainable construction practices and the increasing adoption of green building materials increase demand for breathable films.

The high investment in infrastructure projects and growing infrastructure development lead to higher adoption of breathable films. The strong focus on energy-efficient building materials and the focus on extending the lifespan of buildings increase demand for breathable films. The stringent building regulations and focus on maintaining healthy indoor environments increase the adoption of breathable films. The growing construction activities are a key driver for the growth of the breathable films market.

Market Trends

- Growing Hygiene Awareness: The increasing awareness about hygiene increases demand for hygienic disposable products like sanitary napkins, baby diapers, and adult diapers that use breathable films to prevent skin irritation and enhance comfort.

- Growth in Food Packaging: The growing packaging of vegetables, cereals, fruits, & other foods, and the rise in packaged foods, increases demand for breathable films to extend the shelf life of products and enhance product safety.

- Increasing Apparel Production: The growing production of apparel like activewear & sportswear, and the high rate of participation in sports activities, increases demand for breathable films due to their moisture-wicking properties.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 22.33 Billion |

| Expected Size by 2034 | USD 36.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Technology, By End-User Industry, By Distribution Model, By Region |

| Key Companies Profiled | Schweitzer-Mauduit International, Inc., Arkema, Berry Global, Inc, Fatra, a.s., Kimberley – Clark, Nitto Denko Corporation, Rahil Foam Pvt. Ltd., RKW North America, Inc., SILON s.r.o, SKYMARK, Daika Kogyo, American Polyfilm, Innovia Films, Mitsui Chemicals, Inc., Omya AG |

Market Opportunity

Growing Healthcare Sector Unlocks Market Opportunity

The growing expansion of healthcare infrastructure and advancements in healthcare increase demand for breathable films for various applications. The increasing need for wound dressing and wound care increases the adoption of breathable films to create a barrier. The increasing production of surgical gowns, disposable medical garments, surgical drapes, and protective medical clothing increases demand for breathable films to protect against microbes and permit sweat.

The increasing packaging of pharmaceutical products and medical devices increases demand for breathable films. The strong focus on infection control and growing healthcare spending increases the production of advanced medical products using breathable films. The increasing prevalence of chronic diseases and growth in surgeries rate increases demand for various medical products that require breathable films. The growing healthcare sector creates an opportunity for the breathable films market.

Market Challenge

High Manufacturing Cost Shuts Down Expansion of the Market

Despite several benefits of the breathable films in various industries, the high manufacturing cost restricts the market growth. Factors like complex manufacturing processes, need for specialized materials, stricter quality control, and volatility in raw material prices contribute to the high manufacturing cost. The need for specialized materials like thermoplastic polyurethane, polyester, and polypropylene increases the cost.

The complex manufacturing processes, like multilayer extrusion techniques and the need for specialized equipment, require high cost. The volatility in the prices of raw materials like petroleum derivatives increases the cost. The stricter quality control and heavy investment in research & development increase the cost. The high manufacturing cost hampers the growth of the breathable films market.

Regional Insights

Asia Pacific Breathable Films Market Trends

Asia Pacific dominated the market in 2024. The growing population and high spending on personal care products increase demand for breathable films. The strong focus on preventing skin irritation and growing awareness about hygiene increases the adoption of breathable films. The increasing medical applications, like surgical drapes, wound dressing, and others, increase demand for breathable films. The rising demand for hygiene products and rapid industrialization increases the adoption of breathable films. The growing packaging and personal care industry drives the overall growth of the market.

China Breathable Films Market Trends

China is a major contributor to the market. The growing demand for feminine hygiene products and the rapid growth in the food packaging sector increase demand for breathable films. The well-developed manufacturing sector and the availability of reliable feedstocks increase the production of breathable films. The well-established healthcare infrastructure and strong focus on sustainable packaging increase the adoption of breathable films, supporting the overall growth of the market.

- China exported 35,564 shipments of polyethylene film.(Source: www.volza.com)

- China exported 1.7K shipments of breathable film.(Source: www.volza.com)

- China exported 8,687 shipments of polypropylene (PP) film.(Source: www.volza.com)

North America Breathable Films Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The increasing consumption of packaged foods and growing construction activities increase demand for breathable films. The growing demand for hygiene products like adult incontinence products, skin-friendly diapers, and feminine products increases the adoption of breathable films.

The strong focus on sustainable packaging and increasing investment in research & development increases the development of breathable films. The growing demand for breathable films across industries like healthcare, construction, and packaging supports the overall growth of the market.

United States Breathable Films Market Trends

The United States is a key contributor to the breathable films market. The well-established healthcare infrastructure and growing production of various medical products increase demand for breathable films. The strong focus on personal hygiene and high utilization of adult incontinence products increases demand for breathable films. The stringent quality standards and increasing demand for comfort-oriented products fuel demand for breathable films, supporting the overall growth of the market.

Segmental Insights

Type Insights

Why did the Polyethylene Films Segment Dominate the Breathable Films Market?

The polyethylene (PE) films segment dominated the breathable films market in 2024. The strong focus on enhancing consumer comfort and the lightweight nature increase demand for PE films. The growing production of hygiene products like sanitary napkins & diapers increases the adoption of PE films. The affordability of raw materials and breathability properties increases demand for PE films. The growing industries like personal care and medical increase the adoption of PE films, driving the overall growth of the market.

The polyurethane (PU) films segment is the fastest-growing in the market during the forecast period. The growing production of medical products like medical garments, surgical gowns, and wound dressing increases the adoption of PU films. This film offers superior mechanical properties and enhances the comfort of the products. It consists of monolithic structures and offers a superior liquid barrier. The growing expansion of the personal care & hygiene industry increases demand for PU films, supporting the overall growth of the market.

Technology Insights

How the Microporous Films Segment Held the Largest Share in the Breathable Films Market?

The microporous films segment held the largest revenue share in the breathable films market in 2024. The strong focus on enhancing user comfort in athletic wear, diapers, and medical gowns increases demand for microporous films. The strong focus on moisture control and balancing breathability increases the adoption of microporous films. The growing demand for packaged food and the increasing production of protective apparel increase demand for microporous films. The growing demand for microporous films in industries like medical and building & construction drives the overall growth of the market.

The monolithic films segment is experiencing the fastest growth in the market during the forecast period. The growing production of medical garments, adult diapers, baby diapers, and sanitary napkins increases demand for monolithic films. The increasing need for personal protective equipment and the expansion of the healthcare sector increase demand for monolithic films. They offer superior moisture management and are highly permeable to water vapor. The growing demand for monolithic films in industries like medical, food packaging, hygiene, and textile supports the overall growth of the market.

End-User Industry Insights

Which End-User Industry Dominated the Breathable Films Market?

The packaging & consumer goods segment dominated the breathable films market in 2024. The growing consumption of packaged foods and the rise in ready-to-eat meals increase the adoption of breathable films. The growing consumer demand for products like adult incontinence products, diapers, and sanitary napkins increases the adoption of breathable films. The aging population and increasing birth rates increase demand for consumer goods. The increasing need for sustainable packaging and increasing demand for premium hygiene products increase the adoption of breathable films, driving the overall growth of the market.

The healthcare & medical segment is the fastest-growing in the market during the forecast period. The need for controlling infection and the focus on enhancing patient comfort increase the adoption of breathable films in various medical products.

The growing production of disposable medical products like surgical gowns and surgical drapes increases the adoption of breathable films. The growing awareness about health and innovations in healthcare increases demand for breathable films. The growing healthcare applications like wound care, disposable products, protective gear, and medical packaging support the overall growth of the market.

Distribution Model Insights

How Direct Supply to OEMs Segment Held the Largest Share in the Breathable Films Market?

The direct supply to OEMs segment held the largest revenue share in the market in 2024. The high-performance requirements and strong demand for customization increase the demand for direct supply to OEMs. The strong focus on consistent film quality and the need for maintaining a stable supply chain increase the adoption of direct supply to OEMs. The development of a unique product design and the availability of detailed technical data increase the adoption of direct supply to OEMs, supporting the overall growth of the market.

The distributors & converters segment is experiencing the fastest growth in the market during the forecast period. The focus on bridging the gap in supply chains and the high availability of technical expertise increase the adoption of distributors to converters. The availability of a wide product range and specialization in particular applications increases the adoption of distributors to converters. The strong focus on logistical agility and innovations in film technologies supports the overall growth of the market.

Breathable Films Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement of breathable films involves sourcing of feedstocks like polypropylene, polyester, polyethylene, polyurethane, and PTFE polymer.

- Chemical Synthesis and Processing : The chemical synthesis and processing of breathable films include processes like polymer selection & filler incorporation, melt blending & film formation, poration using techniques such as mechanical stretching and drying & gelling, and post-treatment such as surface treatment & heat setting.

- Regulatory Compliance and Safety Monitoring : The regulatory compliance includes European REACH standards & FDA guidelines, and safety monitoring utilizes technologies like IoT sensors to track real-time data.

Recent Developments

- In July 2025, Lintec launched solar control window film, BR-50UH RECYCLE 100. The film offers benefits like insect repellency, heat insulation, & crime prevention, and is made up of 100% recycled PET resin. The film offers high transparency and lowers interior heat. The film is applicable in commercial facilities, offices, buildings, and residences.(Source: www.lintec-global.com)

- In June 2025, Innovia to unveil sustainable & improved label materials at Labelexpo. The product range includes PVC-free graphic materials, pressure-sensitive labels, fully recyclable wet wipe labels, and RayoFloat shrink sleeve materials. The company supports end-of-life recyclability and helps in achieving sustainability goals.(Source: www.innoviafilms.com)

Breathable Films Market Top Companies

- Schweitzer-Mauduit International, Inc.

- Arkema

- Berry Global, Inc

- Fatra, a.s.

- Kimberley - Clark

- Nitto Denko Corporation

- Rahil Foam Pvt. Ltd.

- RKW North America, Inc.

- SILON s.r.o

- SKYMARK

- Daika Kogyo

- American Polyfilm

- Innovia Films

- Mitsui Chemicals, Inc.

- Omya AG

Segments Covered

By Type

- Polyethylene (PE) Breathable Films

- Polypropylene (PP) Breathable Films

- Polyurethane (PU) Breathable Films

- Polytetrafluoroethylene (PTFE) Breathable Films

- Others (Co-Polyester, Specialty Blends)

By Technology

- Microporous Films

- Monolithic Films

- Hybrid / Laminated Structures

By End-User Industry

- Healthcare & Medical

- Packaging & Consumer Goods

- Building & Construction

- Textiles & Apparel

- Industrial & Protective Applications

By Distribution Model

- Direct Supply to OEMs (Hygiene & Medical Product Manufacturers)

- Distributors & Converters

- Specialty Chemical & Film Suppliers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait