Content

Bio-Solvents Market Size and Growth 2025 to 2034

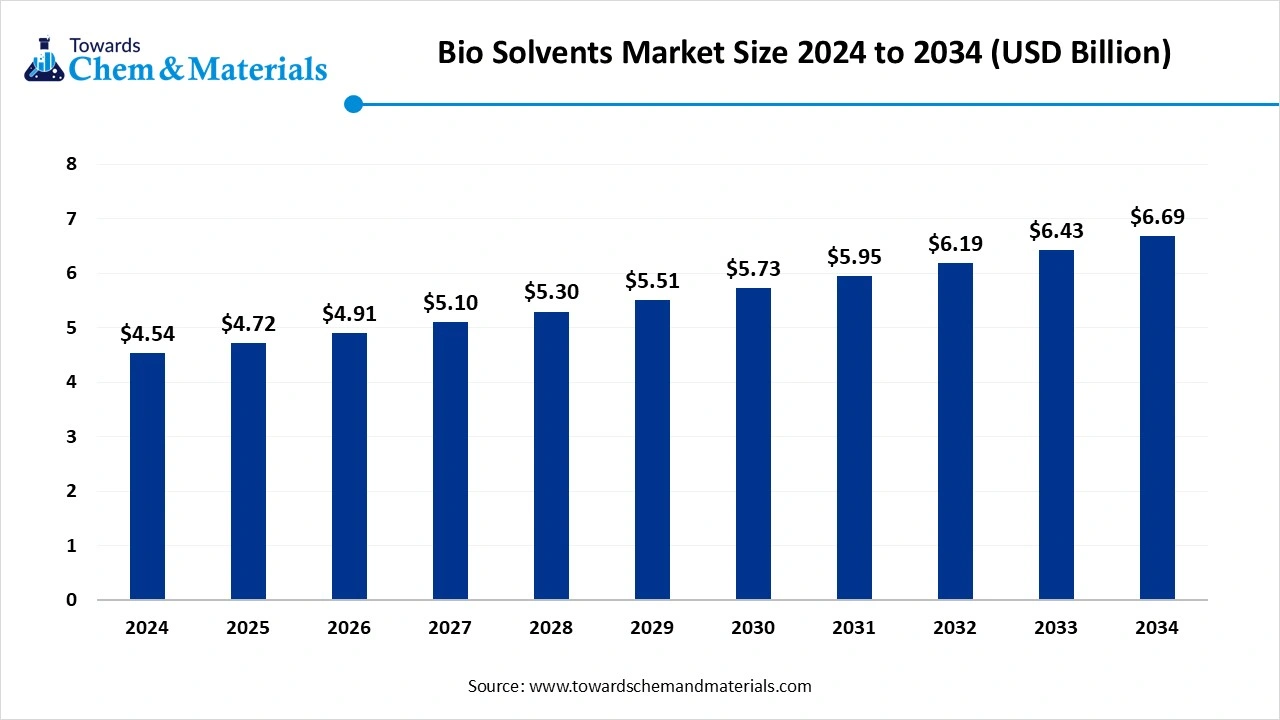

The global bio-solvents market size was reached at USD 4.54 billion in 2024 and is expected to be worth around USD 6.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.95% over the forecast period 2025 to 2034. The increased need for sustainable manufacturing has fueled industry potential in the current period.

Key Takeaways

- By region, Asia Pacific dominated the bio-solvents market in 2024, owing to rapid industrialization with a sudden increase in population.

- By region, Europe is expected to grow at a notable rate in the future, akin to the implementation of stronger environmental policies by the regional government in recent years.

- By solvent type, the bio-alcohols segment led the market in 2024, due to having unique properties such as wide availability, easy usability, and affordability.

- By solvent type, the bio-based esters segment is expected to grow at the fastest rate in the market during the forecast period, due to the increased need for high-performance solvents with a lower environmental impact.

- By source type, the plant-based segment emerged as the top-performing segment in 2024, because they are easily available, renewable, and widely accepted by consumers and industries.

- By source type, the microbial-based segment is expected to lead the market in the coming years, because they are produced using biotechnology, offering high purity, customization, and sustainability.

- By application, the paint & coatings segment led the market in 2024, because these products need large volumes of solvents for formulation and application.

- By application, the pharmaceutical segment captured the biggest portion of the market in 2024, due to the increasing demand for cleaner, safer, and more sustainable manufacturing processes.

Market Overview

Advancing Sustainability: The Growing Demand for Bio-Solvents in Chemical Manufacturing

The bio-solvents market is a rapidly expanding sector within the chemical industry, focusing on sustainable and eco-friendly alternatives to traditional petroleum-based solvents. Bio solvents are derived from renewable resources such as crops, biomass, and microbial fermentation, offering advantages like lower toxicity, biodegradability, and a reduced carbon footprint. This market is primarily driven by increasing environmental awareness, stringent government regulations on volatile organic compound (VOC) emissions, and a growing demand for green chemistry solutions across various industries. While facing challenges such as raw material availability fluctuations and potential performance limitations compared to conventional solvents, continuous technological advancements and increasing R&D investments are fostering its growth and expanding its application scope.

Which Factor Is Driving the Bio-Solvents Market?

The sudden increased demand for eco-friendly and non-toxic chemical alternatives is spearheading the industry's growth in recent years. Moreover, the global government is actively playing a major role in industry’s growth by implementing stricter regulations against harmful carbon emissions from manufacturing in recent years. Furthermore, the sectors such as the paint, cleaning products, and coating are heavily providing the wider consumer base to the industry in recent years.

Market Trends

- The sudden shift towards green construction and the eco-friendly paint adoptions are driving the industry's potential in recent years. Furthermore, the regional government is supporting sustainable building practices.

- The increased need for high-performance solvents has contributed to market growth in recent years. Moreover, several sectors are actively looking for a reliable and high-performance solvents option for their work nowadays.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 4.72 Billion |

| Expected Size by 2034 | USD 6.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Solvent Type, By Source, By Application, By Region |

| Key Companies Profiled | BASF SE, Dow Inc., DuPont de Nemours, Inc., Cargill, Incorporated , Evonik Industries AG, Solvay S.A. , Archer Daniels Midland Company (ADM), Mitsubishi Chemical Corporation , Lanxess AG , Kuraray Co., Ltd. , Celanese Corporation, Mitsui Chemicals Inc. , Toray Industries, Inc., PTT Global Chemical Public Company Limited , Syensqo , Merck KGaA, Corbion , Stepan Company, Circa Group AS, Green Hills Software |

Market Opportunity

The Future of Solvents Lies in High Performance Bio Based Esters

The development of high-performance bio-based esters is likely to create significant opportunities for the industry in the upcoming years. Moreover, several major sectors are actively seen in demanding excellent solvency holding solvent, where the manufacturer can gain a major industry share in the coming years as per the industry expectations. Also, technological advances can help the manufacturer to gain significant industry upgrades in the coming years.

Market Challenge

Bio Solvents Sectors Confront Financial Strains Despite Green Potential

The high production cost is expected to hinder market growth in the upcoming years. The production cost of the bio-solvents is slightly higher than regular petroleum-based solvents, where the new entrants and mid-size manufacturers can face some industry hurdles in the coming years.

Regional Insights

Asia Pacific dominated the market in 2024, akin to rapid industrialization with a sudden increase in population. Moreover, the regional governments are seen as actively implementing the sustainability standards in their region recently. The manufacturers in countries such India, China, and Japan have observed the heavy promotion of their biodegradable manufacturing in the past few years, where the governments are supporting with the release of attractive benefits such as subsidies and tax reduction policies.

How is China’s Expansive Chemical Infrastructure Powering its Bio Solvents Growth?

China maintained its dominance in the bio-solvents market, owing to its enlarged chemical manufacturing infrastructure. The manufacturers in the country are seen under the heavy green initiative adoption. Moreover, the government in China has supported manufacturers who have implemented the sustainability standards in their manufacturing. Also, the availability of sustainable raw materials has driven the country’s growth forward in recent years.

Europe is expected to capture a major share of the market during the forecast period, owing to the implementation of stronger environmental policies by the regional government in recent years. Moreover, religion is seen under the heavy demand for sustainable products these days. Also, the heavy manufacturers have been actively seeking biodegradable alternatives in the past few years in the region.

Can R&D Investments in Biodegradable Materials Make Germany a Global Sustainability Hub?

Germany is expected to rise as a dominant country in the region in the coming years, owing to having presence of the advanced chemical industry. Several manufacturers are seen putting investment in R&D activities for the advanced bio-degradable materials in the region recently. Moreover, the bio refinery owner has actively observed the establishment of collaborations with research institutes to develop bio-degradable materials in the past few years.

North America is seen to grow at a notable rate during the forecast period. Government policies like the Clean Air Act and growing consumer awareness about eco-friendly products have further accelerated demand. Additionally, the presence of a mature chemical manufacturing base and investment in bio-refining technologies has enabled companies to scale production of key bio-solvents like bio-alcohols, esters, and glycols. With ongoing innovation in green chemistry and a shift toward circular and carbon-neutral processes, North America is expected to remain at the forefront of bio-solvent development and adoption in the coming years.

How did the Bio-Alcohols Segment Dominate the Bio-Solvents Market in 2024?

The bio-alcohols segment held the largest share of the market in 2024, due to having unique properties such as wide availability, easy usability, and affordability. Moreover, bio alcohols are actively seen in consumption in applications such as cleaners, paints, and personal care as According to recent observations, with development from the natural resources such as corn and sugarcane, the bio alcohols have gained immense industry attention, where sustainability initiatives rise globally.

The bio-based esters segment is expected to grow at a notable rate during the predicted timeframe due to the increased need for high-performance solvents with a lower environmental impact. Moreover, these solvents are seen in use in high-end applications, which has drawn industry attention in recent years. Furthermore, several industries are seen as replacing their old solvents with these solvent alternatives, which is likely to create significant opportunities in the coming years.

Source Type Insights

Why does the Plant-based Segment Dominate the Bio-Solvents Market by Source Type?

The plant-based segment held the largest share of the bio-solvents market in 2024, because they are easily available, renewable, and widely accepted by consumers and industries. Common raw materials include corn, sugarcane, soybeans, and palm oil. These sources offer a stable supply chain and are already used in large-scale agricultural and industrial systems.

The microbial-based segment is expected to grow at a notable rate because they are produced using biotechnology, offering high purity, customization, and sustainability. These solvents are created through fermentation processes using engineered microbes, which can convert biomass into complex, high-value chemicals.

Application Insights

Why Did the Paint & Coatings Segment Dominate the Bio-Solvents Market in 2024?

The paint & coatings segment dominated the market with the largest share in 2024, because these products need large volumes of solvents for formulation and application. Traditional paints often contain VOCs (volatile organic compounds), which are harmful to health and the environment. Bio solvents offer a safer, eco-friendly alternative while maintaining performance.

The pharmaceutical segments are expected to grow at a notable rate due to the increasing demand for cleaner, safer, and more sustainable manufacturing processes. Bio solvents are used in drug formulation, extraction, and purification because they are less toxic and more biodegradable than petrochemical alternatives. With tighter regulations on solvent residues in medicines and growing concern over environmental impact, pharmaceutical companies are shifting toward green chemistry.

Recent Developments

- In January 2024, Syensqo recently invested in Bioeutectics. The main motive of these investments is to boost the sustainable solvent production of Bioeutectics, which is the startup, as per the report published by the company recently.(Source: www.syensqo.com)

- In May 2025, the Advent introduced its latest solvents. The newly launched solvent is designed for the pharmaceutical sector, and these solvents are LCN (Low Non-volatile Chromatography) and LN (Low Non-volatile) grade solvents as per the company's claim(Source: www.adventchembio.com)

Top Companies List

- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- Evonik Industries AG

- Solvay S.A.

- Archer Daniels Midland Company (ADM)

- Mitsubishi Chemical Corporation

- Lanxess AG

- Kuraray Co., Ltd.

- Celanese Corporation

- Mitsui Chemicals Inc.

- Toray Industries, Inc.

- PTT Global Chemical Public Company Limited

- Syensqo

- Merck KGaA

- Corbion

- Stepan Company

- Circa Group AS

- Green Hills Software

Segment Covered

By Solvent Type

- Bio-alcohols

- Bio-based Esters

- Bio-based Ketones

- D-Limonene

- Glycerol Derivatives

- 2-Methyltetrahydrofuran

- Bio-glycols

- Bio-diols

- Other Solvent Types

By Source

- Plant-Based

- Microbial Based

- Animal-Based

By Application

- Paints & Coatings

- Industrial & Domestic Cleaning

- Pharmaceuticals

- Cosmetics & Personal Care

- Printing Inks

- Adhesives & Sealants

- Agriculture

- Chemical Intermediates

- Other Applications

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE