Content

What is the Current Bio-Polyamide Market Size and Share?

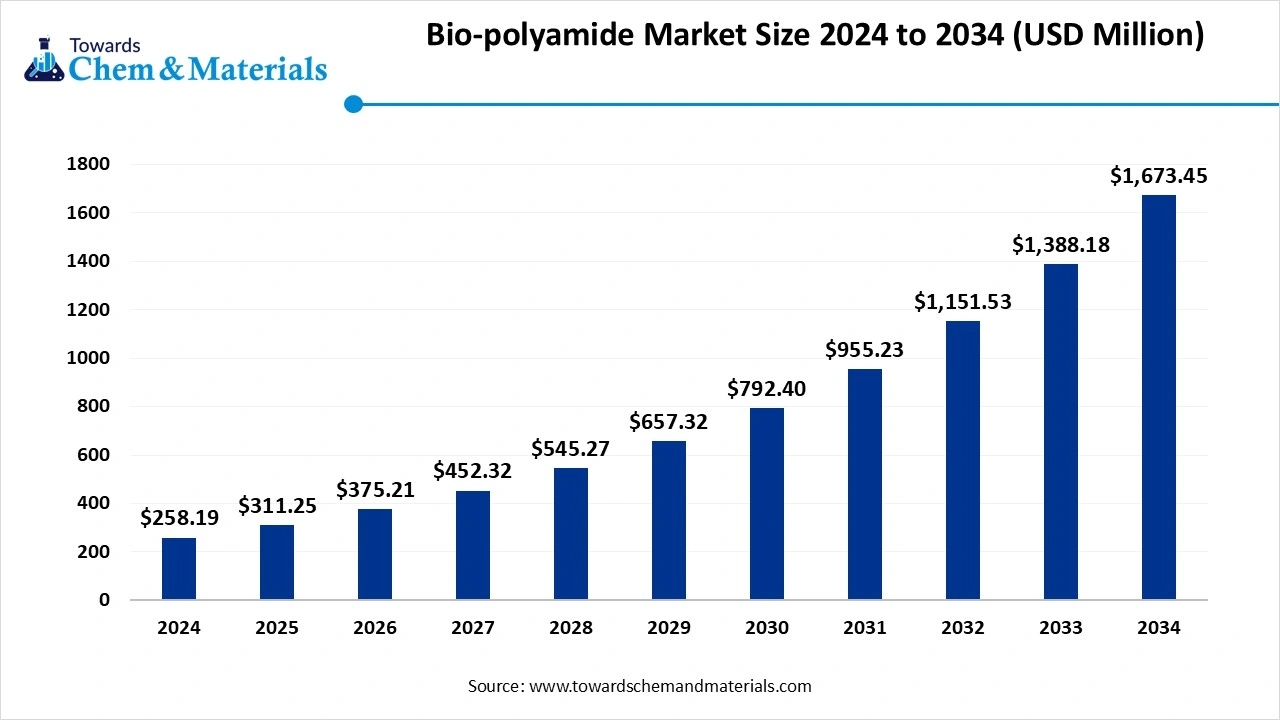

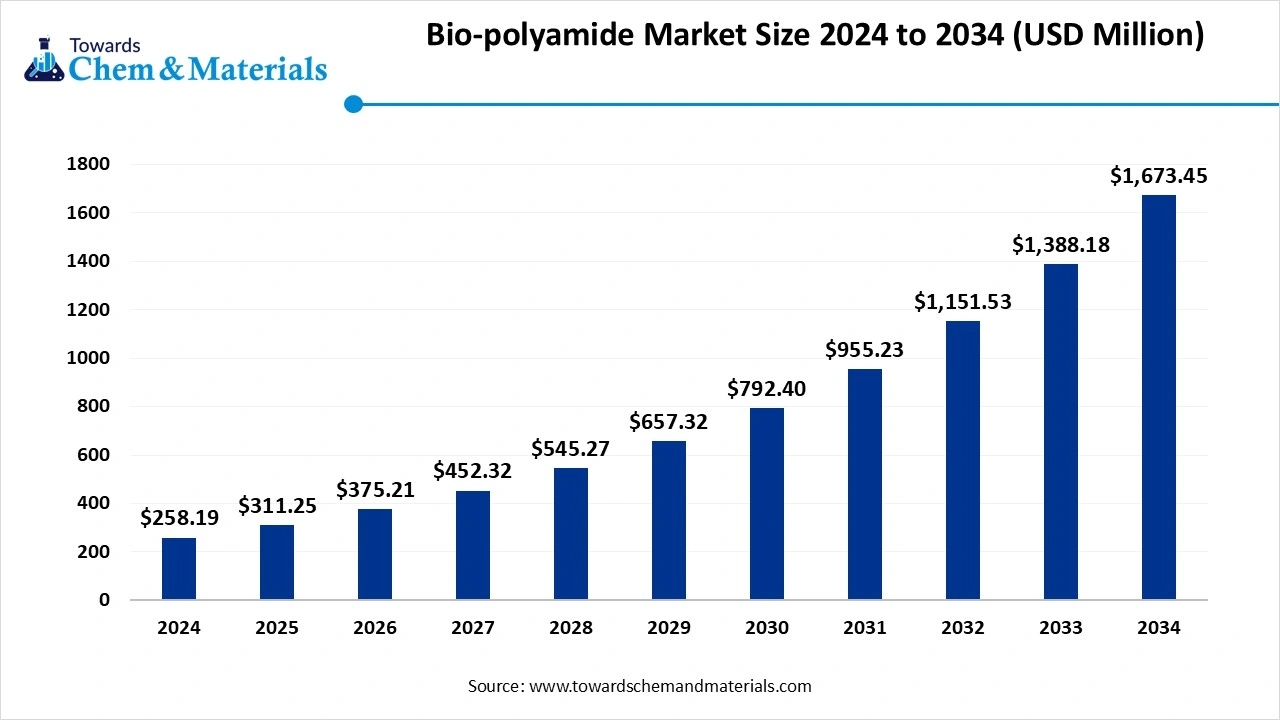

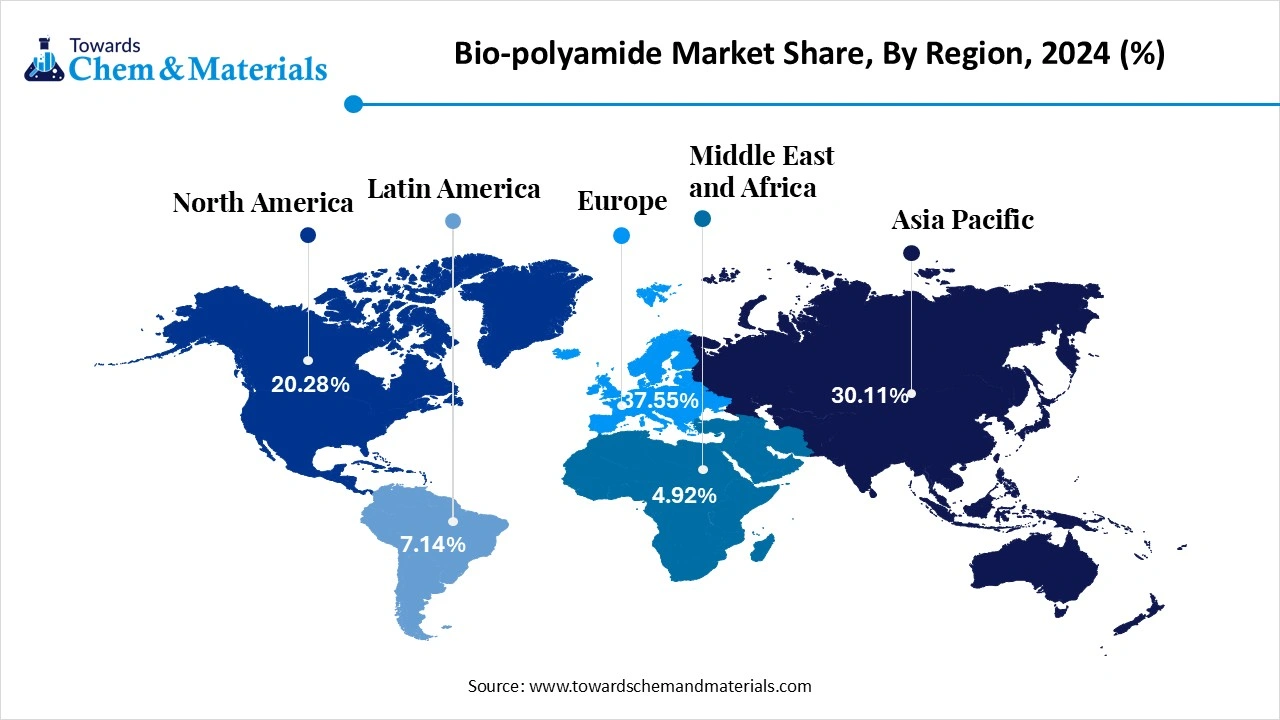

The global bio-polyamide market size was USD 311.25 million in 2025 and is predicted to increase from USD 375.21 million in 2026 and is expected to be worth around USD 2,017.35 million by 2035, growing at a CAGR of 20.55% from 2026 to 2035. Europe dominated the bio-polyamide market with the largest revenue share of 38.72% in 2025. The rising demand for sustainable materials amid rising environmental concerns, technological advancements to enhance properties, and a shift towards sustainable practices and demand from various industries drive the growth of the market.

Market Highlihgts

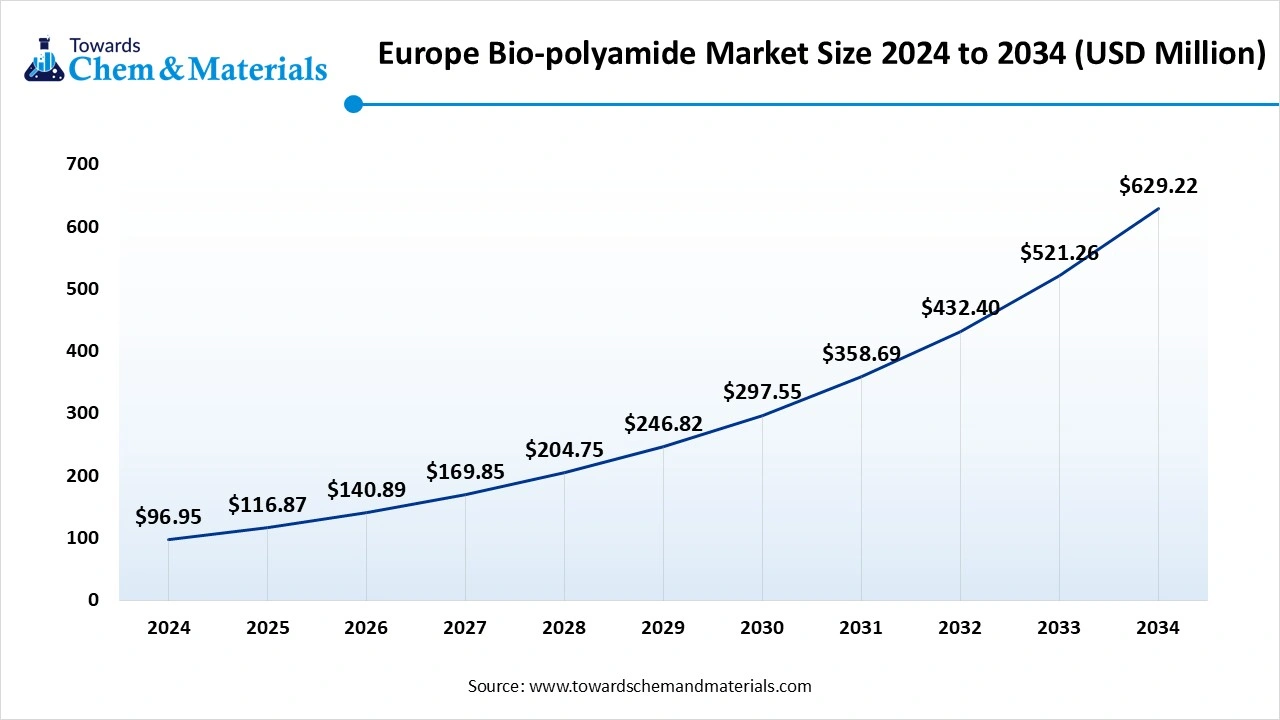

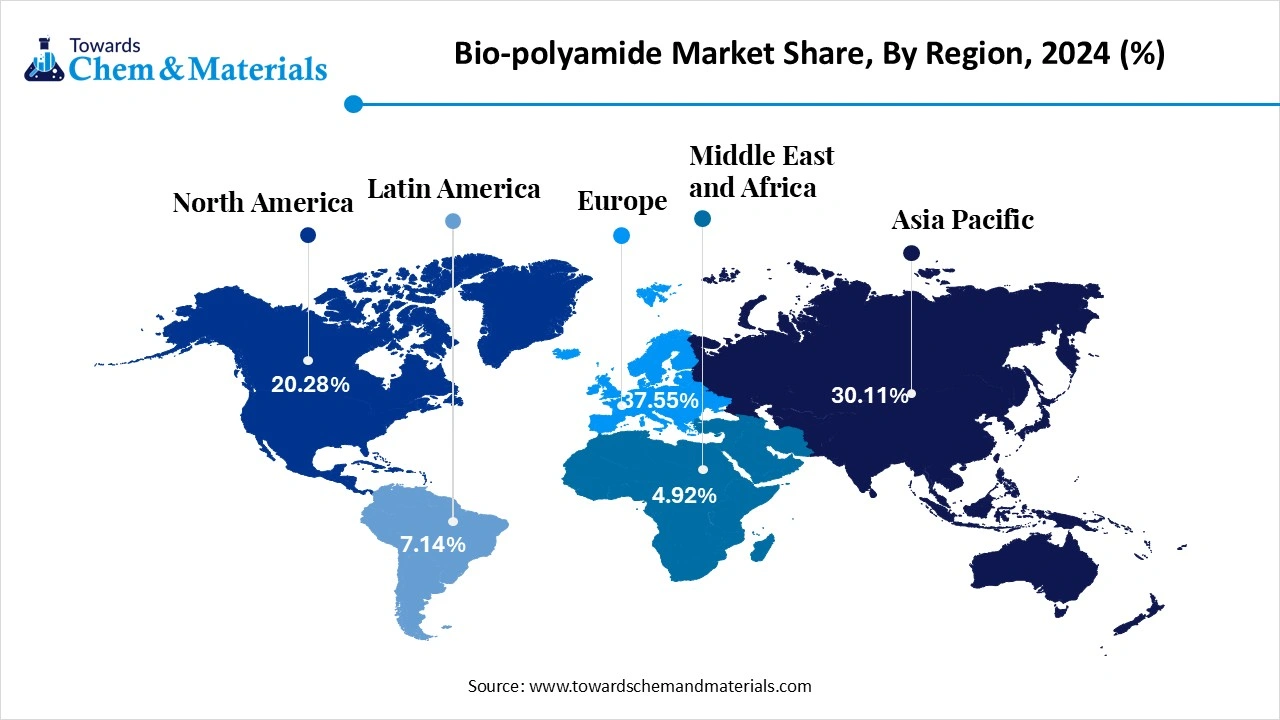

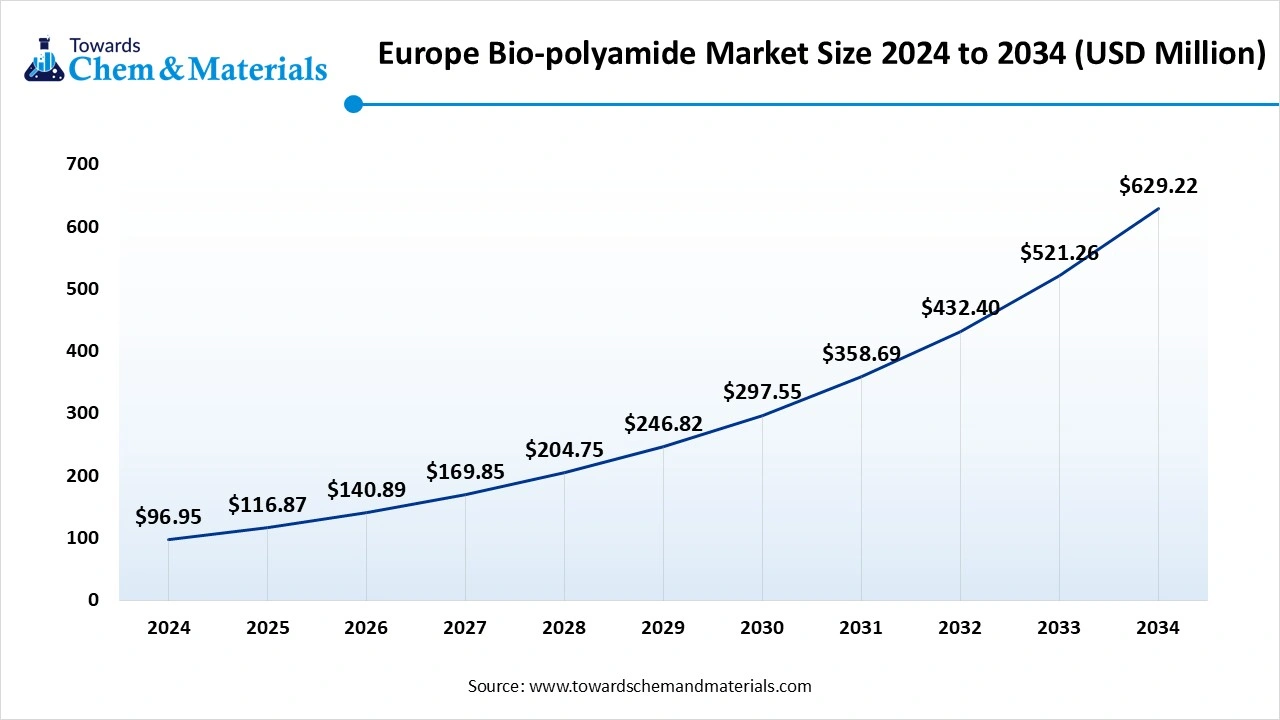

- The Europe dominated the global bio-polyamide market with the largest volume share of 36.15% in 2025.

- By product, the PA-66 segment dominated the market with the largest revenue share of over 51.98% in 2025.

- By application, the engineering plastics segment dominated the market and accounted for the largest share of 68.89% in 2025.

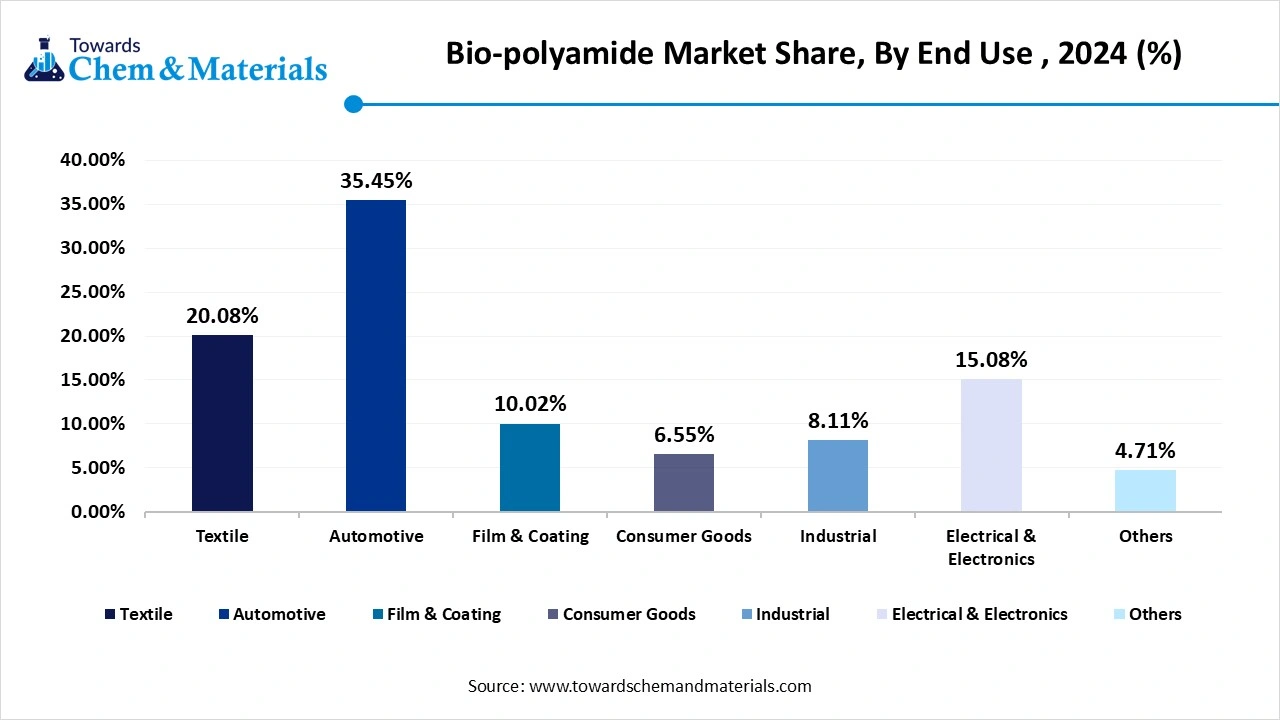

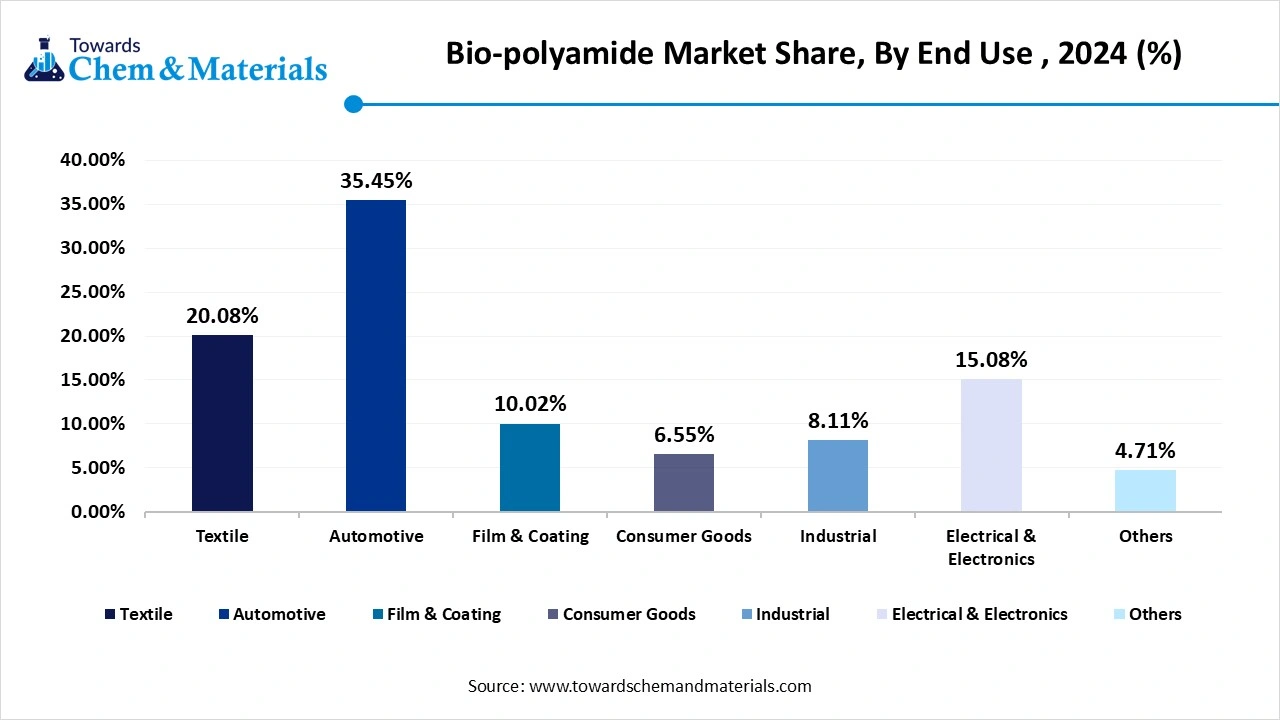

- By end use, the automotive segment dominated the market and accounted for the largest share of over 36.55% in 2025.

Market Trends

- Growing demand for sustainable materials amid growing environmental concerns drives the demand for bio-polyamides, a sustainable alternative to traditional petroleum-based polyamides.

- Technological advancements to improve durability, performance, and thermal stability are a growing trend in the market, which helps grow the market.

- A wide range of applications in various industries like automotive, textile, and electronics, an alternative to traditional materials due to its strength and thermal resistance, drives the growth.

- Advancement in production processes to help lower production costs is a growing trend in the market, which supports the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 375.21 Million |

| Expected Size by 2035 | USD 2,017.35 Million |

| Growth Rate from 2026 to 2035 | CAGR 20.55% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Europe |

| Segment Covered | By Product, By Application, By End-use, By Region |

| Key Companies Profiled | Evonik Industries AG, Huntsman International LLC, LANXESS, BASF SE, UBE Corporation, INVISTA, DOMO Chemicals GmbH, Arkema, Asahi Kasei Corporation, Honeywell International Inc., DSM, TORAY INDUSTRIES, INC., Radici Partecipazioni SpA, DuPont, Solvay, ZIG SHENG INDUSTRIAL CO., LTD, Quadrant Group Limited, LEALEA ENTERPRISE CO., LTD., EMS-CHEMIE HOLDING AG |

Value Chain Analysis

- Feedstock Sourcing and Precursor Production: This involves procuring renewable raw materials, such as castor oil, corn, or sugar, and processing them into intermediate chemical precursors.

- Key Players: Archer Daniels Midland, Cargill, TotalEnergies Corbion, and CJ CheilJedang.

- Research and Development:This focuses on developing new bio-polyamide grades with enhanced properties and the actual polymerization process that turns the precursors into polymer resins.

- Key Players: BASF SE, Arkema, Evonik Industries, DSM, UBE Corporation, RadiciGroup, DuPont, and Solvay.

- Compounding and Formulation:In this raw bio-polyamide, resins are often modified by compounding them with fillers, additives, and colorants to meet specific application requirements.

- Key Players: Envalior and Ascend Performance Materials.

- Manufacturing and Processing:In this, the compounded bio-polyamide materials are then used by manufacturers to produce components or products using techniques such as injection molding and extrusion.

- Key Players: Arkema S.A., BASF SE, and Evonik Industries AG.

Market Dynamics

Market Drivers

The bio-polyamide market is driven by rising demand for sustainable and high-performance engineering plastics across automotive, electrical and electronics, consumer goods, and industrial applications. Increasing regulatory pressure to reduce carbon footprints and dependence on fossil-based polymers is accelerating adoption of bio-based polyamides derived from renewable feedstocks such as castor oil. Automotive lightweighting initiatives and electrification trends are supporting substitution of conventional plastics and metals with bio-polyamides that offer high mechanical strength, thermal resistance, and chemical stability. Growing use of durable, bio-based materials in consumer products and industrial components is further reinforcing market growth.

Market Restraints

The bio-polyamide market faces restraints related to higher production costs compared to petroleum-based polyamides, which can limit adoption in cost-sensitive applications. Dependence on agricultural feedstocks introduces supply variability and exposure to raw material price fluctuations. Limited production capacity and a smaller supplier base compared to conventional polymers can constrain large-scale commercialization. Processing challenges and compatibility issues with existing manufacturing equipment may also require additional investment by end users. In some regions, limited awareness of performance parity between bio-based and conventional polyamides slows market penetration.

Market Opportunities

Significant opportunities exist in expanding bio-polyamide use in electric vehicles, renewable energy systems, and advanced electronics, where material performance and sustainability are both critical. Growth in circular economy initiatives is encouraging development of recyclable and partially bio-based polyamide grades with improved lifecycle performance.

Advances in polymer chemistry and compounding technologies are enabling broader property customization, opening applications in high-temperature and high-load environments. Increasing demand from premium consumer goods and sports equipment manufacturers seeking sustainable differentiation is also creating new growth avenues. Expansion of bio-based materials adoption in Asia Pacific and Latin America presents additional long-term opportunities.

Market Challenges

Key challenges for the bio-polyamide market include balancing sustainability benefits with cost competitiveness and consistent material performance. Scaling production while maintaining quality and feedstock sustainability requires coordinated investment across the value chain. Certification, standardization, and clear labeling of bio-based content remain uneven across regions, complicating market transparency. Competition from alternative bio-based polymers and recycled engineering plastics is intensifying. Ensuring long-term feedstock availability without impacting food supply or land use continues to be a critical challenge for sustained market expansion.

Segmental Insights

Product Insights

Which Product Segment Dominated the Bio-Polyamide Market in 2025?

The PA-66 segment dominated the bio-polyamide market in 2025. The growing applications and properties like high melting points, good mechanical properties, chemical resistance, durability, and versatility of the product drive the demand for the market. PA66 is produced through polycondensation, where two monomers react to form a long chain polymer with amide groups through semi-crystalline thermoplastics. A wide range of applications in various industries like automotive, manufacturing, textiles, and electronics, due to its properties, boosts the growth of the market.

The PA-6 segment expects significant growth in the bio-polyamide market during the forecast period. PA6 is a versatile engineering thermoplastic polymer. The growth is driven using Materials due to their properties, like excellent mechanical strength, including strength, resistance to chemicals and other factors, and toughness fuels the growth. It is synthesised through a ring-opening polymerization process. The key properties and characteristics like moderate melting point, moisture absorption, good stability and growing demand, and adoption by automotive, electrical, textile, engineering, consumer goods, industrial machinery, and electrical industry drive the growth of the market and help in the expansion of the market.

Application Insights

How Did the Engineering Plastics Segment Dominate the Bio-Polyamide Market In 2025?

The engineering plastics segment dominated the market in 2025. The engineering plastics are a polymer that are in increasing demand due to its properties like mechanical, thermal, electrical, and chemical properties, and resistance to stress drives the demand for the market, which helps in growth. Engineering plastics are used in a wide range of applications in automotive for body parts, in electronics for devices and connectors, in aerospace for aircraft and spacecraft, in medical devices, and other industries, boosting the growth of the market.

The fiber segment expects significant growth in the bio-polyamide market during the forecast period. Fibers play a significant and crucial role in industrial applications like manufacturing and construction to improve the strength, appearance, durability, and resistance to cracking, and help in the reduction of weight. This drives the growth of the market and helps in the expansion of various industries.

End Use Insights

How did the Automotive Segment Dominate the Bio-Polyamide Market in 2025?

The automotive segment dominated the market in 2025. The growing de, and for eco-friendly lightweight materials, which have enhanced strength and durability and reduced weight, is increasing the demand for the market. The growing automotive sector and demand for biobased materials for door panels, dashboards, and seats boost the growth of the market and help in its expansion.

The textile segment expects significant growth in the bio-polyamide market during the forecast period. The growing demand for biobased alternatives to traditional synthetic materials to lower the environmental impact drives the demand. They are used in the manufacturing of sportswear, workwear, and fashion garments, and technical textiles, and demand for long-lasting, resistant to certain conditions, along with breathable properties, which drives the demand and helps in the growth of the market.

Regional Insights

The Europe bio-polyamide market is expected to increase from USD 116.87 million in 2025 to USD 758.74 million by 2035, growing at a CAGR of 20.57% throughout the forecast period from 2025 to 2035. Europe dominated the bio-polyamide market in 2025. The growth of the market is driven by the strong focus on sustainability due to stringent environmental regulations in the region, expanding industrial sectors in the region, like automotive, textile, and packaging industry, increasing the demand for bio-polyamide demand which drives the growth in the region. Ongoing research and development also offer wide applications and enhance performance capabilities. The rapid growth experienced by the region is due to major consumers and producers in Europe fuels the growth of the market and also helps in the expansion of the market.

The Green Initiatives and Sustainability Initiatives in The UK Help in The Growth of The Market.

The growth of the market is driven by the growing industrial sectors in the country, due to increasing sustainability and eco-friendly product use increases the demand for bio-polyamide. The textile, automotive, and packaging industry demand for durable, lightweight, and sustainable alternatives that offer benefits to the industry and do not impact heavily on the environment heavily, which fuels the growth in the country. Major players in the bio-polyamide market, like DuPont, Honeywell International, Toray Industries, Mitsui Chemicals, and Nippon Steel Chemical, play a crucial role in the growth and development of the market in the country.

- European Union Export data, the European Union shipped out 113 polyamide shipments. The exports made by 31 exporters to 34 buyers. (Source: Volza)

Growing Industrial and Sustainability Initiatives in North America Drive the Growth of The Market

North America is expected to experience steady growth in the bio-polyamide market in the forecast period. The growing manufacturing units in the region expand the demand for the market due to its application and properties, which drive the growth. The growing construction sector in the region drives the demand for green buildings due to the rising shift towards sustainability and increasing innovation and development in the clothing sector, and demand for bio-based products and polymers boosts the growth of the market, aligning with the regulatory and government bodies' strict environmental regulations drive growth.

The Growing Technological Advancement in Manufacturing and Processing in The Country Drives the Growth.

The growth of the market is driven by the growing technological advancements in the country, for advancement in the processing of products to ensure enhanced properties and efficiency of the product, and product design fuels the growth of the market in the country. The growing packaging industry and demand for eco-friendly and sustainable packaging solutions with unique processing technologies for user user-friendly experience fuel the growth of the market. The country's bio-polyamide market is a promising area for growth, driven by sustainability trends, technological advancements, and supportive regulatory environments, which help in the growth and expansion of the market.

- The world shipped out 2,165,646 polyamide shipments from November 2023 to October 2024 (TTM). These exports were handled by 40,204 exporters to 46,347 buyers, showing a growth rate of 23% over the previous 12 months.(Source: Volza)

- Globally, China, Turkey, and Vietnam are the top three exporters of polyamide. China is the global leader in Materials Composite exports with 2,025,885 shipments, followed closely by Turkey with 1,348,658 shipments, and Vietnam in third place with 1,073,461 shipments.(Source: Volza)

Emergence of Asia Pacific in the Bio-Polyamide Market

Asia Pacific is experiencing notable growth in the global market, driven by rapid industrialization, strong government support for sustainability, and increased consumer awareness of eco-friendly products. Countries such as China, Japan, South Korea, and India are implementing stringent environmental regulations and providing incentives to promote sustainable materials while reducing reliance on traditional petroleum-based plastics. The region benefits from abundant, cost-effective biomass feedstocks like corn, sugarcane, and cassava, which are essential for bio-polyamide production.

India Bio-Polyamide Market Trends

India plays a crucial role in this region, as it is the world's largest producer and exporter of castor oil, a key raw material for bio-polyamide production. The booming automotive and textile industries in India are increasingly adopting bio-polyamides to meet sustainability standards and minimize environmental impact. Regulatory initiatives like the ban on certain single-use plastics and the Make in India program are creating a favorable market environment.

How will Latin America surge in the Bio-Polyamide Market?

Latin America is also a significantly growing region in the global market, driven by the availability of renewable feedstocks, rising environmental awareness, and supportive government regulations. Industries in Latin America, particularly in Brazil and Argentina, are modernizing their manufacturing processes and expanding into high-performance applications such as automotive components and engineering plastics. Governments in the region are enforcing stricter environmental standards and offering incentives and policy frameworks to promote the use of bio-based materials.

Brazil Bio-Polyamide Market Trends

Brazil is an emerging market within this region that focuses on bio-based polymers, leveraging its extensive biomass resources. The country's abundant sugarcane and forest resources provide a sustainable feedstock foundation for biopolymer production, including bio-based polyethylene derived from sugarcane ethanol. Brazil has an active biopolymer industry supported by institutions like the Brazilian Biopolymer Institute, which promotes the development of these materials.

How will the Middle East and Africa contribute to the Bio-Polyamide Market?

The Middle East and Africa are also key contributors to the global market, due to increasing awareness of environmental sustainability, growing demand from the automotive and electronics industries, and supportive government initiatives aimed at economic diversification and green technologies. Increased investment in research and development, along with strategic collaborations, is fostering the development of bio-polyamides. Countries such as Saudi Arabia and the UAE are implementing policies and initiatives to diversify their economies beyond oil and promote sustainable manufacturing practices.

The UAE Bio-Polyamide Market Trends

The UAE stands out within this region, focusing on sustainability through strategic policy and investment. The government aims to position the UAE as a regional hub for sustainable materials by leveraging its advanced industrial infrastructure and strategic trade location. Initiatives like the UAE Circular Economy Policy and incentives for green technology investments are driving demand for sustainable polyamides.

Recent Developments

- In June 2025, British material science company Pangaia debuted 365 Seamless Activewear, a five-piece collection featuring bio-based nylon and an elastane alternative with 98% renewable resources.(Source: www.greenqueen.com.hk)

- In March 2025, KAIST (represented by President Kwang Hyung Lee) announced on the 20th of March that a research team led by Distinguished Professor Sang Yup Lee from the Department of Chemical and Biomolecular Engineering has developed microbial strains through systems metabolic engineering to produce various eco-friendly, bio-based poly(ester amide)s.(Source: www.technologynetworks.com)

Top Companies List

- Evonik Industries AG

- Huntsman International LLC

- LANXESS

- BASF SE

- UBE Corporation

- INVISTA

- DOMO Chemicals GmbH

- Arkema

- Asahi Kasei Corporation

- Honeywell International Inc.

- DSM

- TORAY INDUSTRIES, INC.

- Radici Partecipazioni SpA

- DuPont

- Solvay

- ZIG SHENG INDUSTRIAL CO., LTD

- Quadrant Group Limited

- LEALEA ENTERPRISE CO., LTD.

- EMS-CHEMIE HOLDING AG

Segments Covered in the report

By Product

- PA-6

- PA-66

- Specialty Polyamides

By Application

- Fiber

- Engineering Plastics

By End-use

- Textile

- Automotive

- Film & Coating

- Consumer Goods

- Industrial

- Electrical & Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait