Content

Bio-based Polycarbonate Market Size and Growth 2025 to 2034

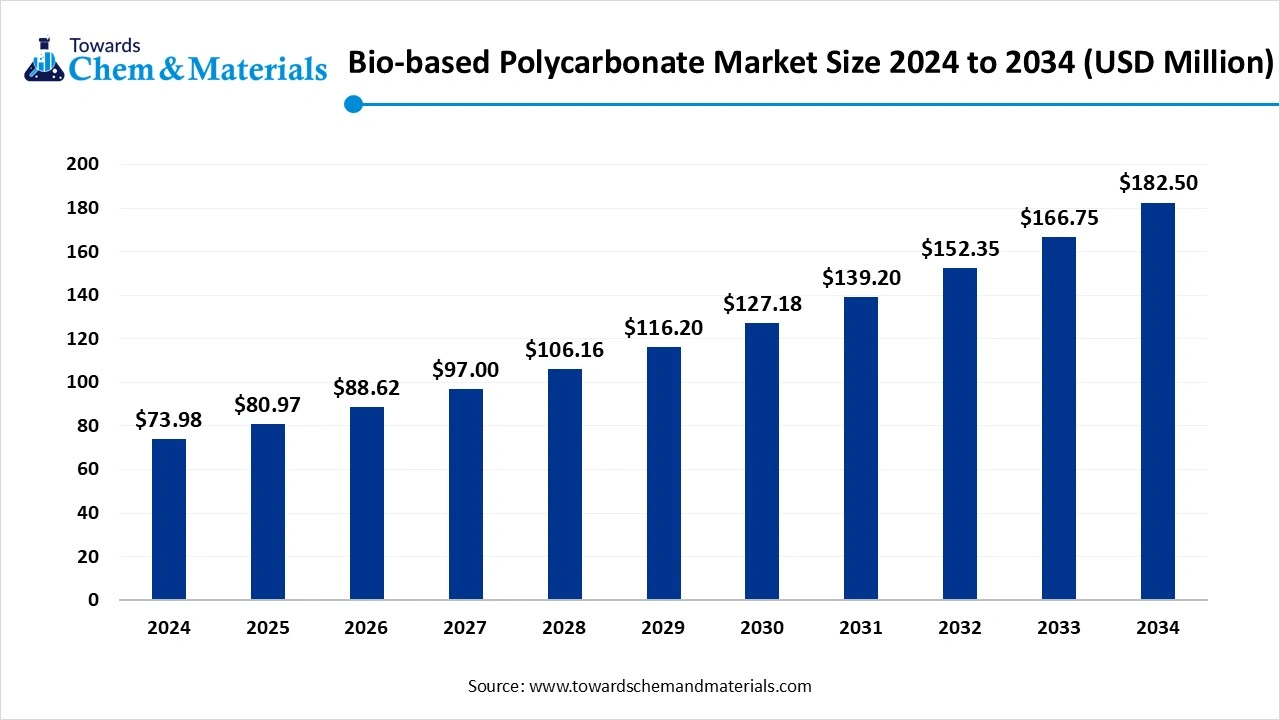

The global bio-based polycarbonate market size accounted for USD 80.97 million in 2025 and is forecasted to hit around USD 182.5 million by 2034, representing a CAGR of 9.45% from 2025 to 2034. Increasing thermoplastic industrial applications is the key factor driving market growth. Also, raised awareness regarding the environmental effect of petrochemical disposals coupled with the introduction of bio-based polycarbonate in high-performance applications can fuel market growth further.

Key Takeaways

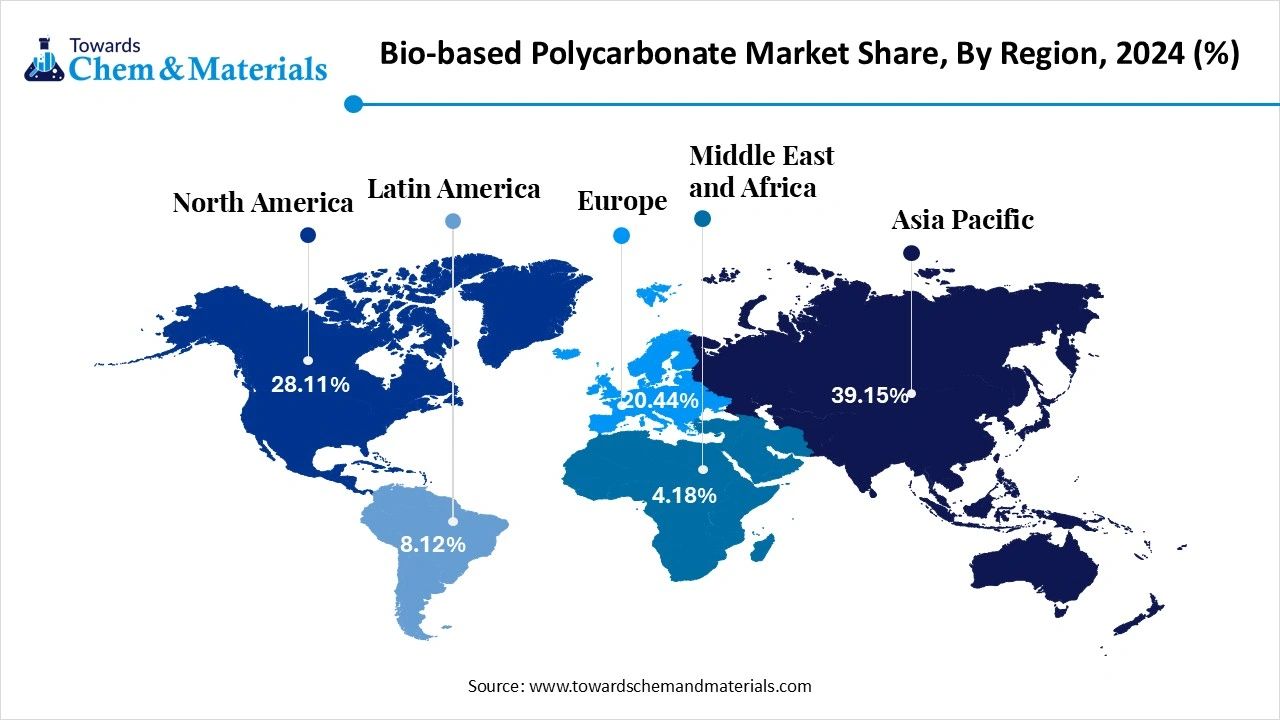

- The Asia Pacific bio-based polycarbonate market dominated globally and accounted for the largest revenue share of 39.15% in 2024. The dominance of the region can be attributed to the ongoing urbanization, industrialization, and favourable government policies.

- The North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the consumer and corporate preferences for sustainable materials.

- By molecular structure, the aromatic bio-polycarbonate segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for sustainable materials and strict environmental regulations.

- By molecular structure, the aliphatic-aromatic co-polymer segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the superior properties of these copolymers than the traditional ones.

- By product form, the resin segment held the largest market share in 2024. The dominance of the segment can be driven by ongoing technological advancements and surging environmental awareness across the globe.

- By product form, the blended compound segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be linked to the growing demand for eco-friendly alternatives to conventional petroleum-based polycarbonates.

- By application, the consumer electronics segment dominated the bio-based polycarbonate market in 2024. The dominance of the segment is owing to the stringent regulations, growing environmental awareness, and the development of sustainable and high-performance materials.

- By application, the packaging segment is expected to grow at a significant CAGR over the projected period. The growth of the segment is due to its exceptional durability, barrier properties, and optical clarity.

- By bio-content, the partially-bio-based segment led the market in 2024. The dominance of the segment can be attributed to the innovations in bio-based polymer technology, growing environmental awareness along supportive government regulations.

- By bio-content, the fully bio-based segment is expected to grow the fastest CAGR during the project period. The growth of the segment can be linked to the ongoing strategic collaborations supporting commercialization, innovations in polymerization technologies, and better performance of bio-based options.

Innovations in Bio-Based Technologies is Expanding Market Growth

The market includes the manufacturing and sale of polycarbonate plastics extracted from renewable biomass feedstocks rather than conventional fossil fuels. Mainly, it's an eco-friendly alternative to traditional petroleum-based polycarbonate, providing similar characteristics while decreasing dependence on non-renewable resources by lowering the overall carbon footprint. Bio-based polycarbonates are created from sources such as agricultural waste, sugars, and other biomass, which makes them a more preferred option. Government initiatives supporting green technologies are boosting market growth soon.

What Are the Key Trends Influencing the Bio-based Polycarbonate Market?

- Bio-based Polycarbonate has superior chemical and physical properties, which makes it a preferred option for a wide range of applications and is the key trend driving market growth. Also, in terms of durability and strength, these polycarbonates can match their conventional counterparts offering their mettle in different environments.

- The medical device sector's increasing focus on sustainability presents substantial opportunities for the market. Fuelled by consumer demand for sustainable products and rising regulatory pressures. Market players are rapidly seeking new alternatives to conventional petroleum-based materials, leading to market expansion further.

- Ongoing innovations in feedstock optimization and biopolymer synthesis are enhancing the processing capabilities and mechanical properties of bio-based polycarbonate, which makes them a convenient option for conventional engineering plastics. Advancements in bio-based bisphenol-A (BPA) alternatives are solving crucial challenges associated with heat resistance and polymer stability.

How the Government is Supporting the Bio-based Polycarbonate Market?

Governments across the globe are actively promoting the market through various initiatives, such as grants, funding for research and development, and tax incentives to support the adoption of sustainable materials and decrease dependence on fossil fuels. These measures impel companies to create and use bio-based alternatives to conventional plastics, especially in sectors such as healthcare, automotive, and electronics.

Policies such as Extended Producer Responsibility (EPR) regulations are increasingly being deployed to guide industries toward adopting circular economy principles. The initiatives encourage market players to take accountability for the end-of-life management of their products.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 80.97 Million |

| Market Size by 2034 | USD 182.5 Million |

| Growth rate from 2024 to 2025 | CAGR 9.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Molecular Structure, By Product Form, By Application, Bio-Content Insight |

| Key Profiled Companies | Covestro AG, Teijin Limited, Mitsubishi Chemical Group, SABIC, Chimei Corporation, NatureWorks LLC, Avient Corporation, Trinseo, 3A Composites, Plazit Polygal, Novomer, BASF, Other Players |

Market Opportunity

Growing Demand in Electronics Products

Rising demand for polycarbonate in the electronics industry is the major driver creating lucrative opportunities in the market. In the electronics sector, they are rapidly being used in housing and components due to their durability and heat resistance properties. Furthermore, electronic devices generate more heat, and polycarbonates can bear these excess temperatures and heat without losing or deforming structural integrity. Also, their advanced optical clarity makes them convenient for applications necessitating light transmission or visibility.

- In February 2023, Teijin Markets joins Saudi Arabia's Sabic as a major supplier of bio-based polycarbonate for electronics and automotive industries. Tejin has also earned ISCC Plus certification from the International Sustainability and Carbon Certification (ISCC) system.(Source: plasticstoday.com)

Market Challenge

High Production Costs

The high production costs associated with bio-based polycarbonates are the major factor hindering the market growth. Bio-based polycarbonates are more costly to produce than conventional petroleum-derived polycarbonates. This is because of the complexities of deriving and refining bio-based raw materials along with the small-scale manufacturing facilities. Moreover, a lack of awareness and infrastructure development in emerging economies can hamper the market expansion further.

Regional Insights

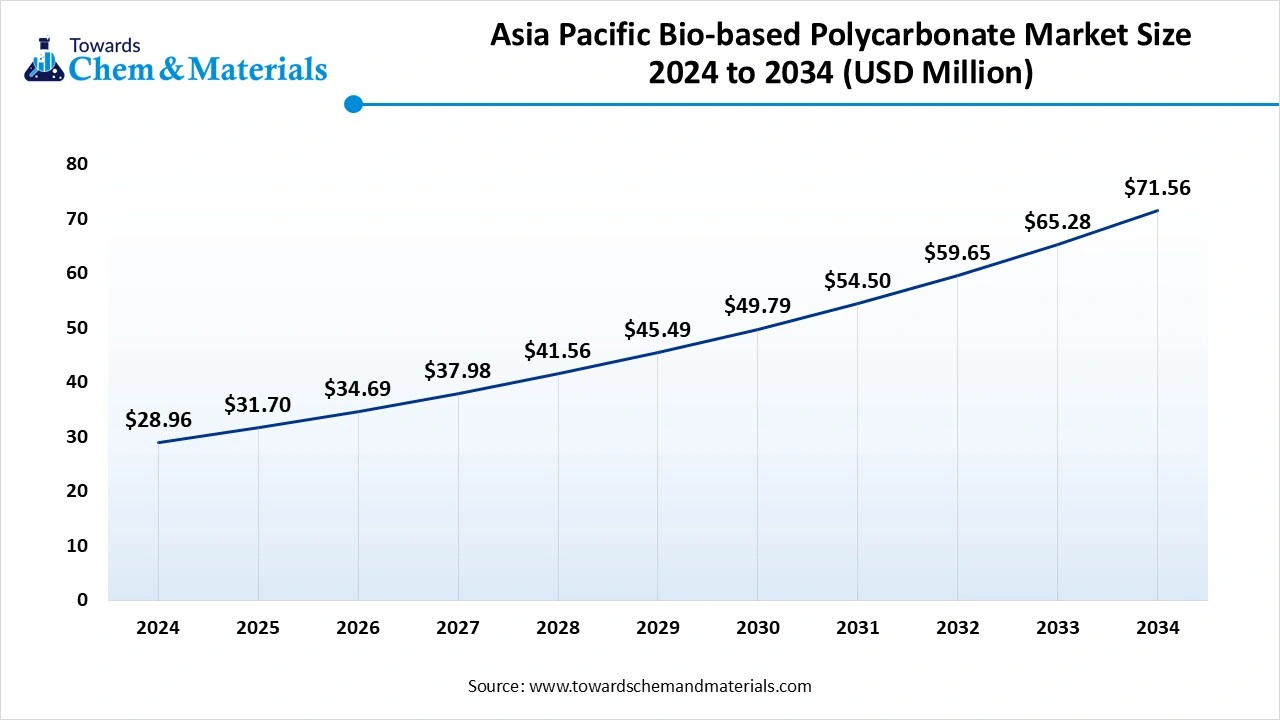

The Asia Pacific bio-based polycarbonate market is expected to increase from USD 31.70 million in 2025 to USD 71.56 million by 2034, growing at a CAGR of 9.47% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the bio-based polycarbonate market in 2024. The dominance of the region can be attributed to the ongoing urbanization, industrialization, and favourable government policies. The region's strong industrial base, especially in countries such as China, Japan, and India is contributing to this surge in need for bio-based polycarbonate. In addition, the growing emphasis on sustainable development and the strong presence of major end-user industries including electronics, automotive, and packaging are impacting positive market growth soon.

Bio-based Polycarbonate Market in China

In Asia Pacific, China led the market owing to the ongoing implementation of stringent regulations, rising environmental awareness, and the demand for sustainable materials in different industries. Also, Investments and collaborations in research and development are further boosting the expansion of the bio-based polycarbonate market in the country.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the consumer and corporate r preferences for sustainable materials. Various industries such as electronics, automotive, and packaging, are adopting green materials to fulfil goals for corporate sustainability that align with their environmental goals. Additionally, the growing investment in R&D activities in countries like the U.S. and Canada can further fuel this demand.

Bio-based Polycarbonate Market in the U.S.

In North America, the U.S. dominated the market by holding a large market share due to increasing consumer preference for sustainable products, particularly among Gen Z and millennials, which is boosting the adoption of bio-based polycarbonate. The emphasis on closed-loop systems and recyclability is matching with the sustainability goals of the market.

What are the Top Products with Growing Demand in Global Trade (2024–2025)?

| Product Type | Total Trade |

| Consumer Electronics | $2.7 trillion |

| Agricultural Commodities (Grains, Oilseeds) | $2.9 trillion |

| Automobiles & Auto Parts | $1.6 trillion |

| Pharmaceuticals | $834.8 billion |

| Textiles & Apparel | $807 billion |

(Source: tradeimex.in)

Segmental Insight

Molecular Structure Insight

Which Molecular Structure Type Segment Dominated The Bio-Based Polycarbonate Market In 2024?

The aromatic bio-polycarbonate segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for sustainable materials and strict environmental regulations. These polycarbonates give better performance than the conventional polycarbonate while minimizing dependence on fossil fuels. Aromatic bio-polycarbonates are extracted from sources such as CO2-based polymers, biomass, and plant-based isosorbide.

The aromatic-aliphatic copolymers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the superior properties of these copolymers than the traditional ones. These copolymers integrate the heat resistance and strength of aromatic components with the biodegradability and flexibility of aliphatic components, which makes them convenient for an extensive range of applications.

Product Form Insight

Why Resin Segment Dominated the Bio-Based Polycarbonate Market in 2024?

The resins segment dominated the market in 2024. The dominance of the segment can be driven by ongoing technological advancements and surging environmental awareness across the globe. Bio-based polycarbonates have a lesser carbon footprint as compared to their traditional counterparts, which aligns he global efforts to minimize greenhouse gas emissions. There is also a growing focus on combining renewable feedstocks in bio-based PC production, driving segment growth shortly.

- In October 2024, Accredo Packaging announced to launch 100% Bio-Based Resin Pouch at PACK EXPO International 2024. This product shows major innovations in more eco-friendly packaging, meeting the increasing demand for sustainable solutions, as compared to traditional packaging.(Source: packworld.com)

The blended compounds segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the growing demand for eco-friendly alternatives to conventional petroleum-based polycarbonates. These blends integrate bio-based polycarbonate with some other materials to improve specific properties such as thermal stability and impact resistance. Blended compounds are used in an extensive range of sectors.

Application Insight

How did the Consumer Electronic Segment Dominate the Bio-Based Polycarbonate Market in 2024?

The consumer electronic segment held the largest market share in 2024. The dominance of the segment is owing to the stringent regulations, growing environmental awareness, and the development of sustainable and high-performance materials. Also, governments across the globe are deploying stringent regulations on the use of sustainable materials and plastic waste. This obligation impels companies to adopt bio-based options such as polycarbonate.

The packaging segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to its exceptional durability, barrier properties, and optical clarity. The growing consumer inclinations towards sustainable packaging solutions and the need for minimizing plastic waste are substantial factors fuelling this trend. Bio-based polycarbonates can offer sturdy and clear packaging solutions.

Bio-Content Insight

Why Partially Bio-Based Segment Held the Largest Bio-Based Polycarbonate Market Share in 2024?

The partially bio-based segment led the market in 2024. The dominance of the segment can be attributed to the innovations in bio-based polymer technology, growing environmental awareness along supportive government regulations. In addition, growing applications in electronics, automotive, and medical industries coupled with cost competitiveness are also impactive positive segment growth further.

The fully biobased segment is expected to grow at the fastest CAGR over the studied period. The growth of the segment can be linked to the ongoing strategic collaborations supporting commercialization, innovations in polymerization technologies, and better performance of bio-based options. Furthermore, advancements in biotechnology like enzyme engineering, fermentation technology, and genetic modification have optimized the cost-effective production of fully biobased materials and chemicals.

Recent Developments

- In May 2025, Primex launched Prime Sulapac sheets, a bio-based material created by Helsinki-based Sulapac Ltd. This material acts as a substitute for conventional plastics for packaging applications. The sheets are produced using wood from industrial side streams integrated with biodegradable biopolymers.(Source: plasticstoday.com)

- In February 2024, Covestro introduced a Bio-based Aniline Pilot Plant. The plant will produce a 100% plant-based version of aniline to use on an industrial scale. The project is funded by the German government along with some private partners such as CAT Catalytic Center and RWTH Aachen.(Source: plasticstoday.com)

Top Companies List

- Covestro AG

- Teijin Limited

- Mitsubishi Chemical Group

- SABIC

- Chimei Corporation

- NatureWorks LLC

- Avient Corporation

- Trinseo

- 3A Composites

- Plazit Polygal

- Novomer

- BASF

- Other Players

Segments Covered

By Molecular Structure

- Aromatic Bio-Polycarbonate

- Aliphatic Bio-Polycarbonate

- Aromatic-Aliphatic Copolymers

- CO₂-Based Polycarbonate Polyols

By Product Form

- Resins / Pellets / Granules

- Films & Sheets

- Coated Substrates

- Blended Compounds

- Bio-PC + PLA

- Bio-PC + ABS

- Other bio-polymer blends

- High Optical Clarity Grades

- Medical or Regulatory-Compliant Grades (FDA/ISO)

By Application

- Packaging

- Rigid bottles & jars

- Cosmetics

- Personal care

- Transparent containers (food-grade)

- High-barrier films and wraps

- Consumer Electronics

- Phone/laptop housings

- Screen covers, buttons, connectors

- Wearable components

- Smartwatches

- Earbuds

- Automotive

- Headlamp lenses

- Interior panels and trims

- Dashboard components

- Lightweight glazing alternatives

- Medical Devices

- Syringe barrels

- Diagnostic equipment

- Drug delivery systems

- Transparent sterilizable containers

- Optical & Imaging

- Eyewear lenses

- Optical discs (CD/DVD)

- Laser printer parts

- Building & Construction

- Transparent roofing

- Skylights and partitions

- Safety glazing

- Greenhouse panels

- Others (3D Printed Parts, etc.)

By Bio-Content

- Partially Bio-Based (30–70%)

- Fully Bio-Based (>90%)

- BPA-Free Grades

- Carbon-Neutral or Carbon-Negative Grades

- Compostable Blends (with other bioplastics)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait