Content

Bentonite Market Size and Growth Factors 2025 to 2034

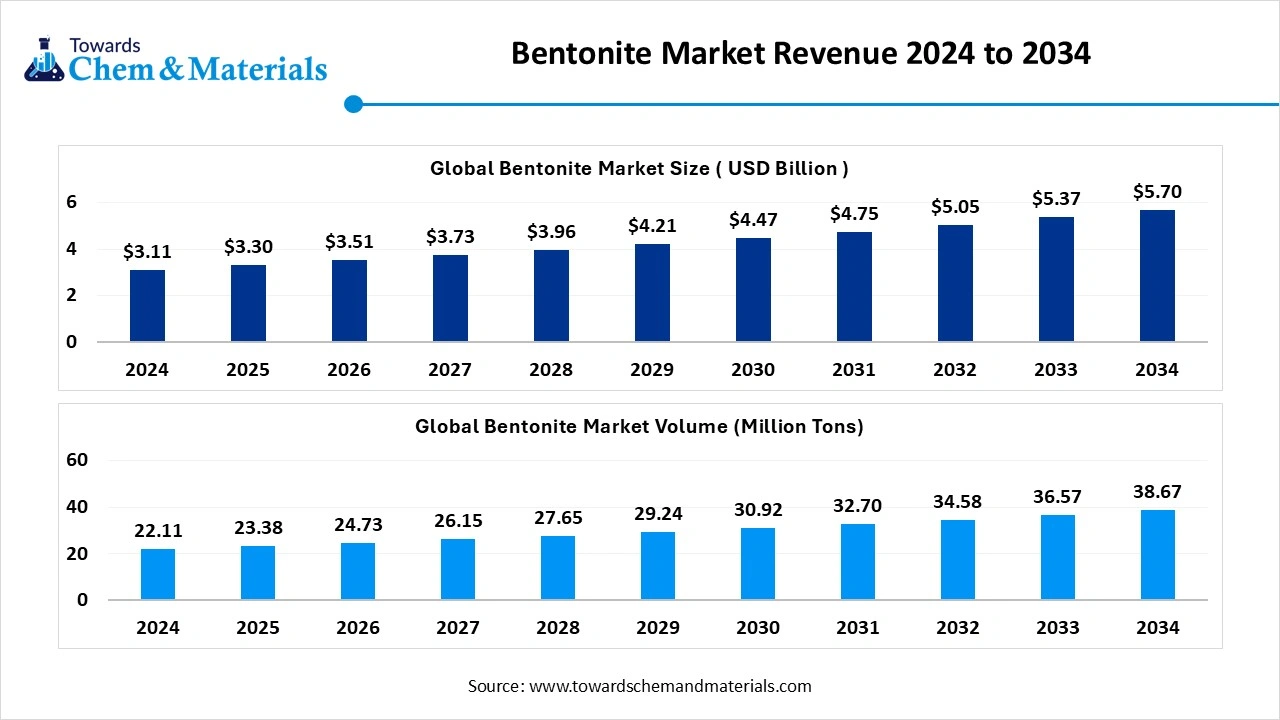

The global bentonite market size was estimated at USD 3.11 billion in 2024 and is expected to hit around USD 5.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing demand from various industries and growing applications in various industries, aligning with the environmental regulations, which fuel the growth of the market.

The global bentonite market stood at approximately volume 22.11 million tons in 2024 and is anticipated to be likely to reach approximately volume 38.67 million tons in 2034. growing at a compound annual growth rate (CAGR) of 5.75%% over the forecast period from 2025 to 2034.

Bentonite Market Report Highlights

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 45% share in the market in 2024. Asia Pacific dominates consumption due to infrastructure development and mineral availability.

- By region, North America is expected to have significant growth in the market in the forecast period. North America focuses on high-value applications in the industrial and pharmaceutical sectors.

- By type, the sodium bentonite – water-absorbent segment dominated the market in 2024. The sodium bentonite – water-absorbent segment held approximately 50% share in the market in 2024. extensively utilized in oil and gas exploration for mud drilling, civil engineering for soil stabilization, and waste containment.

- By type, the calcium bentonite–activated segment is expected to grow significantly in the market during the forecast period. Calcium bentonite is known for its lower swelling capacity compared to sodium bentonite.

- By form, the powder segment dominated the market in 2024. The powder segment held approximately 55% share in the market in 2024. It is widely utilized in drilling fluids, foundries, construction materials, and personal care formulations.

- By form, the granules segment is expected to grow in the forecast period. Granular bentonite is primarily used in agricultural, wastewater treatment, and environmental applications.

- By application, the drilling fluids/oil & gas segment dominated the market in 2024. The drilling fluids/oil & gas segment held approximately 40% share in the market in 2024. It enhances wellbore stability, prevents fluid loss, and assists in efficient drilling operations.

- By application, the environmental/wastewater treatment segment is expected to grow in the forecast period. In wastewater treatment, bentonite is valued for its adsorptive capacity to remove impurities, heavy metals, and organic contaminants.

- By end user, the oil & gas industry segment dominated the market in 2024. The oil & gas industry segment held approximately 45% share in the market in 2024. Continuous investment in upstream exploration projects supports long-term market growth in this end-use industry.

- By end user, the pharmaceutical & personal care segment is expected to grow in the forecast period. The demand for bentonite in these industries is expected to rise significantly, especially in emerging markets focused on wellness.

Market Overview

What Are The Key Significance Of Bentonite In The Market?

The bentonite market refers to the production and application of naturally occurring clay composed mainly of montmorillonite, known for its unique swelling, binding, and rheological properties. Bentonite properties make it significant for use, especially due to its physical and chemical properties like swelling capacity, high absorbency, and binding ability. Its high-end industrial applications, from construction to health, make it a more preferred choice of product by many. Its ability to absorb and immobilize contaminants makes it valuable and significant for environmental protection. The high-purity calcium bentonite is widely used in health and beauty products due to its significant therapeutic and detoxifying properties.

What Are The Key Growth Drivers That Support The Growth Of the Bentonite Market?

Bentonite is widely used across industries, including construction, drilling, foundry, iron ore pelletizing, adhesives, cosmetics, pharmaceuticals, and wastewater treatment, which increases the demand for the market. Its ability to absorb water, form gels, and act as a rheology modifier makes it indispensable for drilling mud, binder formulations, and sealing applications, driving growth due to its application in various industries. The market growth is driven by increasing oil & gas exploration, rising construction activities, expanding iron ore pelletization, and demand in industrial and personal care applications.

Market Trends

- Construction Boom : Expansion in infrastructure and urban development projects worldwide is a primary driver, increasing demand for bentonite in sealing, binding, and filling applications.

- Oil & Gas Sector : The growing global energy demand, due to population growth and urbanization, is boosting bentonite usage in drilling fluids for preventing leaks and carrying drill cuttings.

- Agriculture & Animal Feed : The adoption of sustainable farming practices and rising demand for meat and dairy products are increasing bentonite's role in soil conditioning and animal feed.

- Foundry & Iron Pelletizing : Bentonite remains crucial in the foundry industry and for iron ore pelletizing, particularly in major industrial regions like the Asia Pacific and Europe.

- Environmental Applications : Stricter environmental regulations, especially in Europe, drive the use of high-swelling bentonite in landfill sealing (geosynthetic clay liners) to prevent groundwater contamination.

Bentonite Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.30 Billion |

| Expected Market Size by 2034 | USD 5.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type , By Form, By Application , By End User , By Regional |

| Key Companies Profiled | Minerals Technologies Inc. , Imerys, Wyo-Ben, Inc., Clariant, Tolsa Group, Laviosa Minerals SpA, LKAB Minerals, Kunimine Industries Co., Ltd, Huawei Bentonite, Elementis , Ashapura Group, Swellwell Minechem Pvt. Ltd., Kutch Bentoclay, CMS Industries, Samio Minerals, Mahalaxmi Minerals, Gujarat Aksha Fertilizer Company Neelkanth Minechem, Maruti Mineral Industries, Nav Bharathi Chemicals Pvt Ltd. |

Market Opportunity

Increasing Construction Activities

Bentonite market opportunities are driven by rising demand from the construction, foundry, oil & gas, and iron ore pelletizing industries, fueled by urbanization, infrastructure development, and increased demand for industrial components. Significant opportunities also exist in environmental applications like wastewater treatment and landfill sealing, the expanding pet care market for cat litter, and the personal care & cosmetics sector, which values natural, purifying ingredients. Growth is particularly strong in emerging economies, driven by increasing disposable incomes, industrial expansion, and a focus on sustainability.

Market Challenge

Raw Material Price Fluctuation And High Price

The key growth challenges that hinder the growth of the market are the raw material scarcity and quality, as they are naturally occurring materials, which also disrupts the supply chain management and fluctuates raw material prices due to shortage, which limits the growth of the market. Other challenges are regulatory and environmental challenges, market and economic challenges, like intensifying competition and price sensitivity. High production and raw material costs can lead to higher prices for end-users, especially in price-sensitive sectors, potentially hindering market expansion.

Regional Insights

How Did Asia Pacific Dominated The Market In 2024?

Asia Pacific dominated the market in 2024. Asia Pacific dominates the market, driven by large-scale consumption in oil drilling, construction, and wastewater treatment. Countries like China and India are leading consumers due to infrastructure expansion, urbanization, and increased energy exploration. In addition, the region’s growing cosmetics and personal care industry fuels demand for calcium bentonite. Agricultural applications, particularly in soil conditioning, are also widespread. With strong manufacturing bases, abundant natural reserves, and rising environmental awareness, the Asia Pacific continues to be the largest and fastest-growing regional market for bentonite.

India Has Seen Growth Driven By The Extensive Use In Oil And Gas.

India is one of the largest producers and consumers of bentonite, with abundant reserves of both sodium and calcium varieties. The material is extensively used in drilling fluids for oil and gas exploration, as well as in construction, steelmaking, and wastewater management. India also exports significant volumes of bentonite, particularly sodium bentonite, to global markets. The country’s growing pharmaceutical and personal care industries are contributing to rising demand for calcium bentonite. With infrastructure expansion and industrial growth, India continues to play a pivotal role in the global bentonite supply chain.

North America Has Seen Growth Driven By The Increasing Support And Growing Projects, Which Fuel The Growth

North America is expected to have significant growth in the market in the forecast period. North America remains a mature yet significant market for bentonite, particularly due to the strong oil and gas industry in the U.S. The use of bentonite in drilling fluids supports steady demand in shale gas and deep drilling projects. Environmental applications, such as wastewater treatment and landfill sealing, are also well-established. Additionally, the personal care industry in the U.S. drives demand for calcium bentonite in natural skincare. The region’s focus on sustainability and remediation projects ensures continued adoption across industrial and consumer applications.

Segmental Insights

Type Insights

Which Type Segment Dominated The Bentonite Market In 2024?

The sodium bentonite – water-absorbent segment dominated the market in 2024. Sodium bentonite is widely used for its high swelling capacity and water-absorbent properties, making it essential in drilling fluids, sealing ponds, and geotechnical engineering projects. Its ability to absorb several times its dry weight in water provides superior binding and sealing qualities. This type is extensively utilized in oil and gas exploration for mud drilling, civil engineering for soil stabilization, and waste containment. With growing industrial applications and environmental projects, sodium bentonite remains a critical material in both the energy and construction industries.

The calcium bentonite–activated segment expects significant growth in the market during the forecast period. Calcium bentonite is known for its lower swelling capacity compared to sodium bentonite, but is highly valued for its adsorptive and purification properties. Activated calcium bentonite finds application in personal care, pharmaceuticals, wine clarification, and environmental treatment processes. Its high binding and detoxifying capacity make it suitable for removing impurities and heavy metals in wastewater treatment. Additionally, it is gaining importance in the cosmetics industry for skin care formulations. The versatility of calcium bentonite supports its increasing demand across diverse industries beyond traditional uses.

Form Insights

How Did the Powder Segment Dominated The Bentonite Market In 2024?

The powder segment dominated the market in 2024. Powdered bentonite is the most used form due to its ease of handling, quick solubility, and uniform dispersion. It is widely utilized in drilling fluids, foundries, construction materials, and personal care formulations. Powdered bentonite provides a consistent performance in absorption, binding, and viscosity control, making it the preferred choice for industrial processing. In environmental applications, powdered bentonite ensures efficient sealing in landfills and ponds. Its wide availability and adaptability across the oil and gas, construction, and consumer products industries highlight its dominant position in the market.

The granules segment expects significant growth in the bentonite market during the forecast period. Granular bentonite is primarily used in agricultural, wastewater treatment, and environmental remediation applications. Granules offer a slower release and longer-lasting performance, making them suitable for soil conditioning and water retention in agriculture. In wastewater treatment, granular bentonite aids in heavy metal adsorption and pollutant control. It is also employed in cat litter due to its excellent clumping and deodorizing properties. With rising demand for sustainable environmental solutions and natural absorbents, granular bentonite continues to gain traction in industries where controlled performance and durability are required.

Application Insights

Which Application Segment Dominated The Bentonite Market In 2024?

The drilling fluids/oil & gas segment dominated the market in 2024. Bentonite plays a central role in drilling fluids within the oil and gas sector due to its viscosity, lubricating, and cooling properties. It enhances wellbore stability, prevents fluid loss, and assists in efficient drilling operations. Sodium bentonite’s swelling nature makes it especially valuable in this application, reducing risks in complex drilling conditions. With increasing exploration and drilling activities, the use of bentonite in drilling fluids continues to rise. Its established role in oilfield operations ensures steady demand from the energy sector, especially in key producing regions.

The environmental/wastewater treatment segment expects significant growth in the market during the forecast period. In wastewater treatment, bentonite is valued for its adsorptive capacity to remove impurities, heavy metals, and organic contaminants. It is also used in environmental applications such as landfill liners, pond sealing, and remediation projects to prevent leaching and groundwater contamination. Both powdered and granular forms are applied depending on project requirements. Growing concerns over water pollution and environmental protection are driving the demand for bentonite in the treatment and remediation industries. Its natural origin and eco-friendly performance further strengthen its adoption in environmental projects.

End User Insights

How Did the Oil And Gas Industry Segment Dominated The Bentonite Market In 2024?

The oil & gas industry segment dominated the market in 2024. The oil and gas industry accounts for one of the largest end-user segments of bentonite, especially for drilling and well-completion activities. Sodium bentonite, with its high swelling and rheological properties, is critical in ensuring wellbore stability and drilling efficiency. With exploration activities expanding globally, demand for bentonite in this sector remains resilient. Additionally, bentonite is used in sealing boreholes and preventing leakage during drilling operations. Continuous investment in upstream exploration projects supports long-term market growth in this end-use industry.

The pharmaceutical & personal care segment expects significant growth in the bentonite market during the forecast period. Bentonite is increasingly used in pharmaceuticals and personal care due to its natural healing, detoxifying, and binding properties. In medicine, it is applied in antidiarrheal formulations, detoxification therapies, and wound healing products. In personal care, bentonite is used in face masks, cleansers, and skincare products for its oil-absorbing and purifying qualities. With growing consumer preference for natural ingredients in healthcare and beauty products, the demand for bentonite in these industries is expected to rise significantly, especially in emerging markets focused on wellness.

Recent Developments

- In September 2025, OMV, which is a mineral supplier, launches a new Valkenburgh milling facility plant in Mpumalanga. The site has a process control lab, wiring infrastructure development, and construction material supply.(Source: www.engineeringnews.co.za)

Bentonite Market Top Companies

- Minerals Technologies Inc.

- Imerys

- Wyo-Ben, Inc.

- Clariant

- Tolsa Group

- Laviosa Minerals SpA

- LKAB Minerals

- Kunimine Industries Co., Ltd

- Huawei Bentonite

- Elementis

- Ashapura Group

- Swellwell Minechem Pvt. Ltd.

- Kutch Bentoclay

- CMS Industries

- Samio Minerals

- Mahalaxmi Minerals

- Gujarat Aksha Fertilizer Company

- Neelkanth Minechem

- Maruti Mineral Industries

- Nav Bharathi Chemicals Pvt Ltd.

Segments Covered

By Type

- Sodium Bentonite

- Water-Absorbent Grade

- Drilling Grade

- Calcium Bentonite

- Activated Grade

- Non-Activated Grade

- Others

By Form

- Powder

- Granules

- Pellets

- Others

By Application

- Drilling Fluids / Oil & Gas

- Foundry

- Iron Ore Pelletizing

- Construction & Civil Engineering

- Cosmetics & Pharmaceuticals

- Animal Feed

- Environmental / Wastewater Treatment

- Adhesives & Sealants

- Others

By End User

- Oil & Gas Industry

- Foundries

- Construction Companies

- Pharmaceutical & Personal Care Companies

- Iron & Steel Industry

- Agriculture & Animal Feed Companies

By Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

List of Figures

- Figure 1. Global Bentonite Market Size (USD Billion), 2024–2034

- Figure 2. Global Bentonite Market Volume (Million Tons), 2024–2034

- Figure 3. Regional Market Share (Asia Pacific 45%, Europe 25%, North America 18%, Central & South America 7%, Middle East & Africa 5%), 2024

- Figure 4. Regional Market Forecast (Asia Pacific 42%, Europe 24%, North America 20%, Central & South America 8%, Middle East & Africa 6%), 2034

- Figure 5. Type Market Share (Sodium Bentonite – Water-Absorbent 50%, Sodium Bentonite – Drilling Grade 20%, Calcium Bentonite – Activated 15%, Calcium Bentonite – Non-Activated 10%, Others 5%), 2024

- Figure 6. Type Market Forecast (Sodium Bentonite – Water-Absorbent 48%, Sodium Bentonite – Drilling Grade 18%, Calcium Bentonite – Activated 17%, Calcium Bentonite – Non-Activated 12%, Others 5%), 2034

- Figure 7. Form Market Share (Powder 55%, Granules 25%, Pellets 15%, Others 5%), 2024

- Figure 8. Form Market Forecast (Powder 50%, Granules 28%, Pellets 17%, Others 5%), 2034

- Figure 9. Application Market Share (Drilling Fluids / Oil & Gas 40%, Foundry 15%, Iron Ore Pelletizing 12%, Construction & Civil Engineering 10%, Cosmetics & Pharmaceuticals 8%, Animal Feed 5%, Environmental / Wastewater Treatment 7%, Adhesives & Sealants 3%), 2024

- Figure 10. Application Market Forecast (Drilling Fluids / Oil & Gas 37%, Foundry 14%, Iron Ore Pelletizing 12%, Construction & Civil Engineering 11%, Cosmetics & Pharmaceuticals 10%, Animal Feed 6%, Environmental / Wastewater Treatment 8%, Adhesives & Sealants 2%), 2034

- Figure 11. End User Market Share (Oil & Gas Industry 45%, Foundries 15%, Construction Companies 12%, Pharmaceutical & Personal Care Companies 10%, Iron & Steel Industry 10%, Agriculture & Animal Feed Companies 8%), 2024

- Figure 12. End User Market Forecast (Oil & Gas Industry 42%, Foundries 14%, Construction Companies 13%, Pharmaceutical & Personal Care Companies 12%, Iron & Steel Industry 10%, Agriculture & Animal Feed Companies 9%), 2034

- Figure 13. Global Bentonite Market CAGR Comparison (Value 6.25%, Volume 5.75%), 2025–2034

- Figure 14. Competitive Landscape: Market Share of Top 10 Companies, 2024

List of Tables

- Table 1. Global Market Value and Volume Forecast, 2024–2034

- Table 2. Regional Market Share & Forecast (Asia Pacific 45%→42%, Europe 25%→24%, North America 18%→20%, Central & South America 7%→8%, Middle East & Africa 5%→6%), 2024 vs. 2034

- Table 3. Type Market Share & Forecast (Sodium Bentonite – Water-Absorbent 50%→48%, Sodium Bentonite – Drilling Grade 20%→18%, Calcium Bentonite – Activated 15%→17%, Calcium Bentonite – Non-Activated 10%→12%, Others 5%→5%), 2024 vs. 2034

- Table 4. Form Market Share & Forecast (Powder 55%→50%, Granules 25%→28%, Pellets 15%→17%, Others 5%→5%), 2024 vs. 2034

- Table 5. Application Market Share & Forecast (Drilling Fluids / Oil & Gas 40%→37%, Foundry 15%→14%, Iron Ore Pelletizing 12%→12%, Construction & Civil Engineering 10%→11%, Cosmetics & Pharmaceuticals 8%→10%, Animal Feed 5%→6%, Environmental / Wastewater Treatment 7%→8%, Adhesives & Sealants 3%→2%), 2024 vs. 2034

- Table 6. End User Market Share & Forecast (Oil & Gas Industry 45%→42%, Foundries 15%→14%, Construction Companies 12%→13%, Pharmaceutical & Personal Care Companies 10%→12%, Iron & Steel Industry 10%→10%, Agriculture & Animal Feed Companies 8%→9%), 2024 vs. 2034

- Table 7. CAGR Analysis by Region, 2025–2034

- Table 8. Recent Developments in the Bentonite Market, 2023–2025

- Table 9. Competitive Landscape of Key Companies, 2024