Content

Analytical Chemistry Market Size | Top Companies Analysis

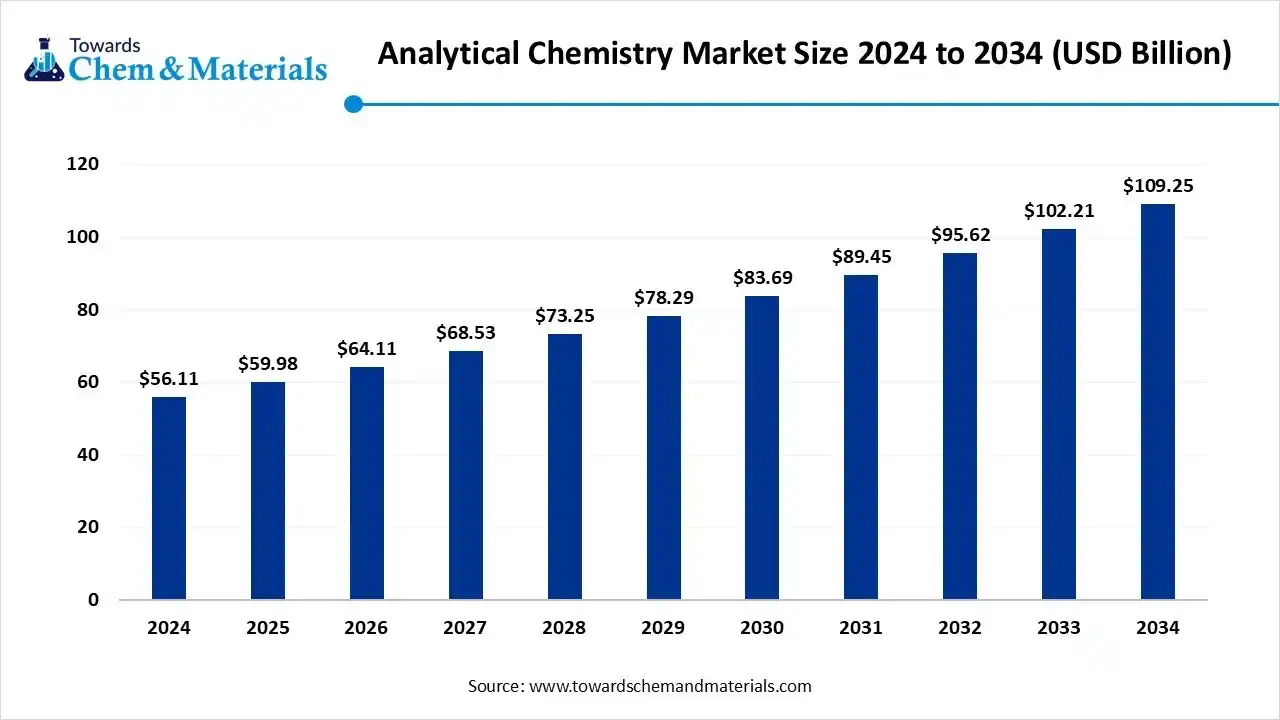

The global analytical chemistry market size was valued at USD 59.98 billion in 2025 and is forecasted to surpass around USD 109.25 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.89% over the forecast period from 2025 to 2034.

The growth of the market is driven by the growing research and development in pharmaceutical and biotechnology, environmental regulation, and stringent food safety, which fuel the growth of the market.

Key Takeaways

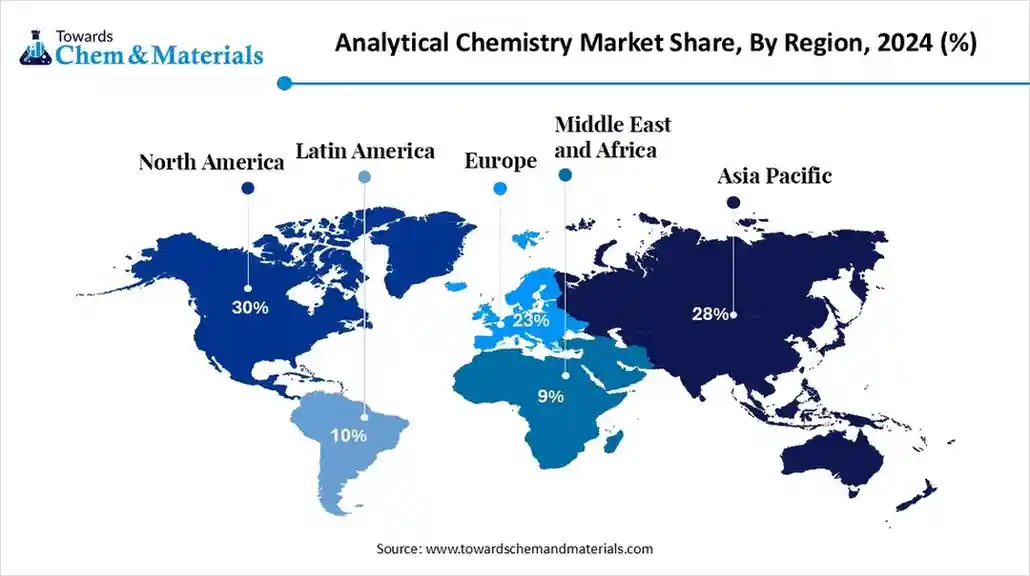

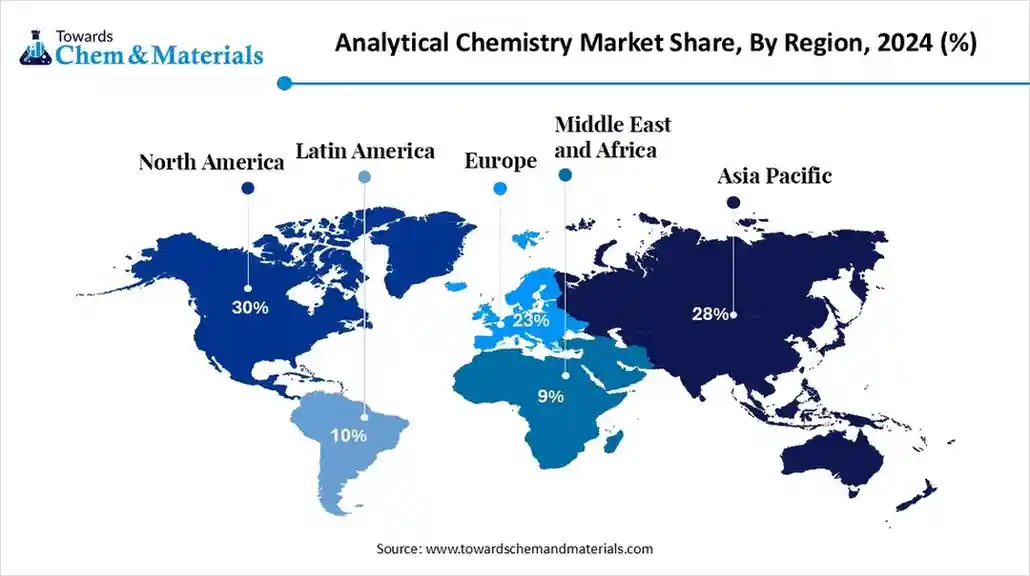

- By region, North America dominated the market in 2024. The North America region held approximately 30% share in the market in 2024.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period.

- By technique, the chromatography segment dominated the market in 2024. The chromatography segment held approximately 35% share in the market in 2024.

- By technique, the spectrometry segment is expected to grow significantly in the market during the forecast period.

- By product type, the instruments segment dominated the market in 2024. The instruments segment held approximately 50% share in the market in 2024.

- By product type, the reagents segment is expected to grow in the forecast period.

- By application, the pharmaceutical & biotechnology segment dominated the market approximately 40% share in the market in 2024.

- By application, the environmental testing segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Analytical Chemistry Market?

The growing pharmaceutical and other industries, such as food and beverages, demand testing, which increases the demand for the market, fueling the growth. The rapid technological advancement, stringent environmental regulation, food safety, rapid testing, and stringent regulatory requirements for product safety further drive the growth of the market. The integration of Artificial Intelligence and growing demand for automation also help in market expansion, contributing to the growth of the market.

Analytical Chemistry Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is expected to experience expansion due to growing factors and demand like regulatory testing, pharmaceutical R&D, food-safety screening, and semiconductor/materials characterization. The demand for high-precision techniques and lab automation further increases the growth.

- Sustainability Trends: the shift towards eco-friendly and sustainable techniques and methods is changing choices and reshaping methods. The increased adoption of green sample workflows, bio-based/green solvents, solvent-minimizing microextraction techniques, and low-waste consumables by labs is a growing trend that fuels the growth of the market.

- Global Expansion: key players and manufacturers are expanding rapidly by expanding capacity and support footprints in the Asia Pacific. This is due to increasing pharmaceutical, semiconductor, and food testing end markets, which drive the growth. Leading instrument and consumable players are increasing production and service centers in these geographies to shorten lead times and capture faster growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 59.98 Billion |

| Expected Size by 2034 | USD 109.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.89% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Technique, By Product Type, By Application, By Region |

| Key Companies Profiled | Shimadzu Corporation, Horiba, Ltd., Sartorius AG , Anton Paar , AB Sciex , Danaher Corporation , JEOL Ltd. , Bio-Rad Laboratories , LECO Corporation , Hitachi High-Technologies Corporation , FOSS Analytical , Malvern Panalytical , Labcorp Drug Development , Agilent Technologies , Milestone Inc |

Key Technological Shifts In The Analytical Chemistry Market:

The key technological shifts in the analytical chemistry market are the integration of AI and machine learning, which helps in enhancing data analysis, and also helps in automation in technology, which enhances precision and optimizes the process, which increases the demand for the market in the near future.

The adoption of process analytical technology for real-time analysis and monitoring of manufacturing and processing also further creates great opportunity for growth, aligning with a strong push towards Green Analytical Chemistry (GAC) to reduce waste and environmental impact.

Trade Analysis Of Analytical Chemistry Market: Import & Export Statistics

- World shipped out 296 Analytical Chemistry shipments from September 2023 to August 2024 (TTM). These exports were handled by 38 global exporters to 28 buyers.(Source: www.volza.com)

- Globally, the United States, the United Kingdom, and Germany are the top three exporters of Analytical Chemistry. The United States is the global leader in Analytical Chemistry exports with 211 shipments, followed closely by the United Kingdom with 71 shipments, and Germany in third place with 51 shipments.(Source: www.volza.com)

- Most of the world's exports in Analytical Chemistry are shipped to Colombia, Peru, and the Philippines.(Source: www.volza.com)

- Netherlands shipped out 97 Analytical shipments from October 2023 to September 2024 (TTM).

- These exports were handled by 22 Dutch exporters to 25 buyers.(Source: www.volza.com)

- Based on broader chemical export data, the United States, Japan, and China are identified as the leading global exporters.

- The United States, United Arab Emirates, and the United Kingdom are frequently highlighted as major export destinations, particularly from India.

Analytical Chemistry Market Value Chain Analysis

- Chemical Synthesis and Processing: Analytical chemistry is the science of separating, identifying, and quantifying matter.

- Key players: Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, and Mettler Toledo

- Distribution to Industrial Users: Analytical chemistry is used in medicine, manufacturing, Biotechnology, life sciences, environmental protection, Mining and metallurgy, and law enforcement.

- Key players: Vimta Labs, Bureau Veritas, Kalpataru Environment & Engineering Services, The Coca-Cola Company, and Food Research Lab.

Specialty Chemicals’ Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. FDA (Food and Drug Administration), EPA, NIST (National Institute of Standards and Technology) | - 21 CFR Part 11 (electronic records/data integrity) - EPA SW-846 methods (environmental testing) |

Method validation - Laboratory quality systems - Environmental & pharmaceutical testing compliance |

FDA requires GLP-compliant analytical methods for drug approval; EPA mandates validated methods for pollutants. |

| European Union | EMA (European Medicines Agency), ECHA, CEN (European Committee for Standardization) | - EU GMP Annex 11 & 15 (analytical validation & computerized systems) - REACH testing guidelines |

- Analytical method validation - Lab accreditation - Chemical safety & reporting |

EMA requires validated analytical methods for pharmaceuticals. ISO/IEC 17025 accreditation is widely enforced across EU labs. |

| China | CNAS (China National Accreditation Service for Conformity Assessment), NMPA (National Medical Products Administration) | ISO/IEC 17025 equivalent) - Chinese Pharmacopoeia analytical methods - GB/T standards for testing |

Lab competence - Pharmaceutical & food safety testing - National method harmonization |

Strong emphasis on harmonization with ISO/IEC 17025. Local method validation may be required in addition to international standards. |

| India | NABL (National Accreditation Board for Testing and Calibration Laboratories), CDSCO (Central Drugs Standard Control Organization), BIS | NABL accreditation based on ISO/IEC 17025 - Indian Pharmacopoeia methods - BIS standards for food/water analysis |

Analytical method reliability - Drug/food/water testing - Lab accreditation |

NABL accreditation is mandatory for labs seeking government recognition. Analytical validation is key in pharmaceutical regulatory submissions. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency), JIS (Japanese Industrial Standards) | - Japanese Pharmacopoeia analytical methods - JIS testing standards - ISO/IEC 17025 for lab accreditation |

Analytical quality assurance - Pharmaceutical & industrial testing - International method harmonization |

Japan requires strict adherence to pharmacopoeial methods for drug development; JIS standards apply in industrial testing. |

Segmental Insights

Technique Insights

Which Technique Segment Dominated The Analytical Chemistry Market In 2024?

The chromatography segment dominated the market, holding an approximate 35% share in 2024. Chromatography is a key analytical technique widely used for separating and identifying chemical mixtures in pharmaceutical, food, and environmental applications. Its high precision, ability to detect trace compounds, and compatibility with various sample types make it indispensable in research and industrial quality control.

Growing pharmaceutical R&D, along with increasing regulatory requirements for food and environmental safety testing, continues to drive the adoption of chromatography systems worldwide.

The spectrometry segment expects significant growth in the analytical chemistry market during the forecast period. Spectrometry techniques, including mass spectrometry (MS), atomic absorption spectrometry (AAS), and infrared spectrometry (IR), play a vital role in detecting molecular structures and quantifying chemical components. Their ability to provide rapid, highly sensitive, and accurate results makes them integral to pharmaceutical development, biotechnology, and forensic testing. The demand for spectrometry is steadily rising, driven by healthcare innovations, precision medicine, and environmental monitoring programs aimed at ensuring safety and compliance.

Product Type Insights

How Did Instruments Segment Dominate the Analytical Chemistry Market In 2024?

The instruments segment dominated the market, holding an approximate 50% share in 2024. Analytical instruments form the backbone of the market, covering chromatography systems, spectrometers, and other high-precision devices. These instruments are critical for applications ranging from drug discovery to environmental analysis.

Demand for automated and high-throughput systems is growing as laboratories seek efficiency, accuracy, and reproducibility. Investment in advanced instruments remains strong, supported by expanding pharmaceutical pipelines, stringent regulatory compliance, and global demand for enhanced product safety testing.

The reagents segment expects significant growth in the analytical chemistry market during the forecast period. Reagents are essential consumables used in conjunction with analytical instruments to conduct accurate testing and research. This segment includes solvents, buffers, standards, and specialty chemicals tailored for chromatography and spectrometry applications. Growing R&D activities in pharmaceuticals, life sciences, and environmental testing are boosting demand for high-purity reagents. Additionally, the rise of customized and ready-to-use reagent kits is enhancing laboratory efficiency and reliability.

Application Insights

Which Application Segment Dominated The Analytical Chemistry Market In 2024?

The pharmaceutical & biotechnology segment dominated the market, holding an approximate 40% share in 2024. The pharmaceutical and biotechnology sector accounts for a significant share of the market due to its reliance on precise testing for drug discovery, development, and quality assurance. Analytical techniques are used extensively in clinical trials, pharmacokinetics, and biopharmaceutical production to ensure safety and efficacy. With the rise of biologics, biosimilars, and personalized medicine, demand for high-sensitivity analytical solutions continues to expand globally in this sector.

The environmental testing segment expects significant growth in the analytical chemistry market during the forecast period. Environmental testing is another major application, leveraging analytical chemistry techniques to monitor air, water, and soil quality. Governments and regulatory authorities impose strict guidelines to address pollution, climate change, and public health risks. Increasing industrialization and urbanization have intensified the need for robust environmental monitoring solutions. Advancements in portable analytical systems are enabling on-site testing, improving efficiency, and supporting global sustainability and compliance initiatives.

Regional Analysis

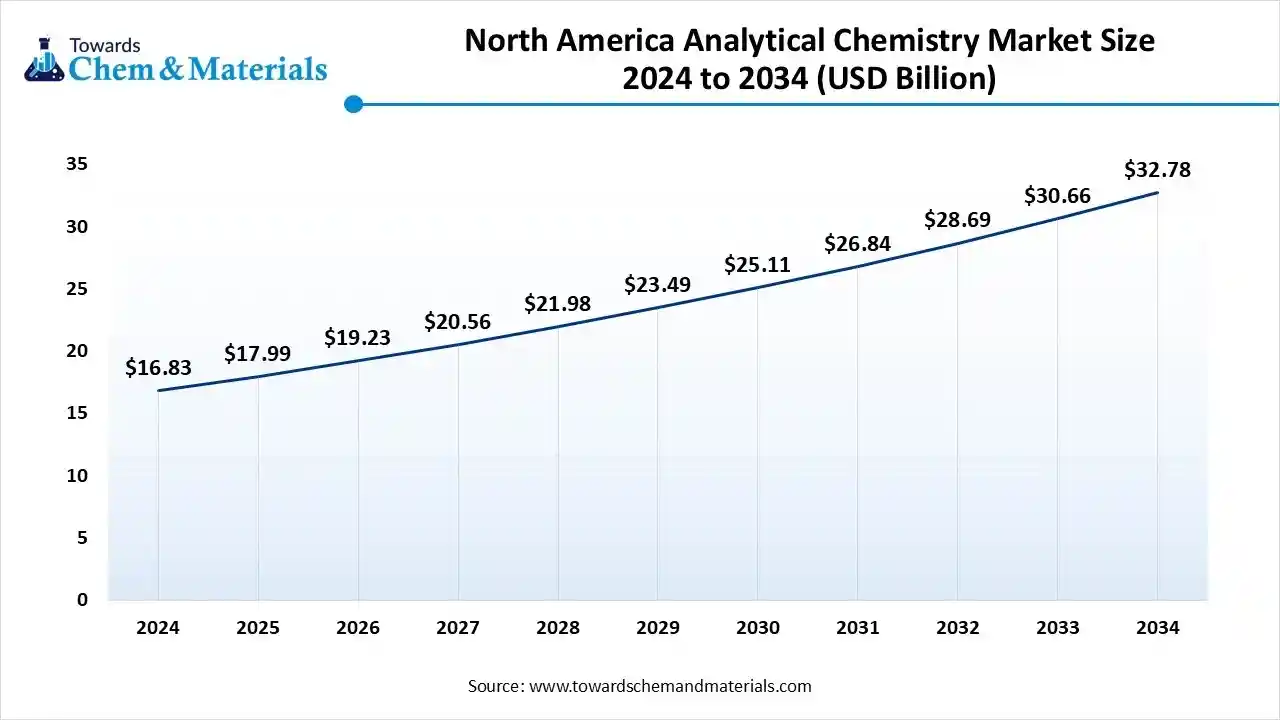

North America Dominate The Analytical Chemistry Market Size, Industry Report 2034

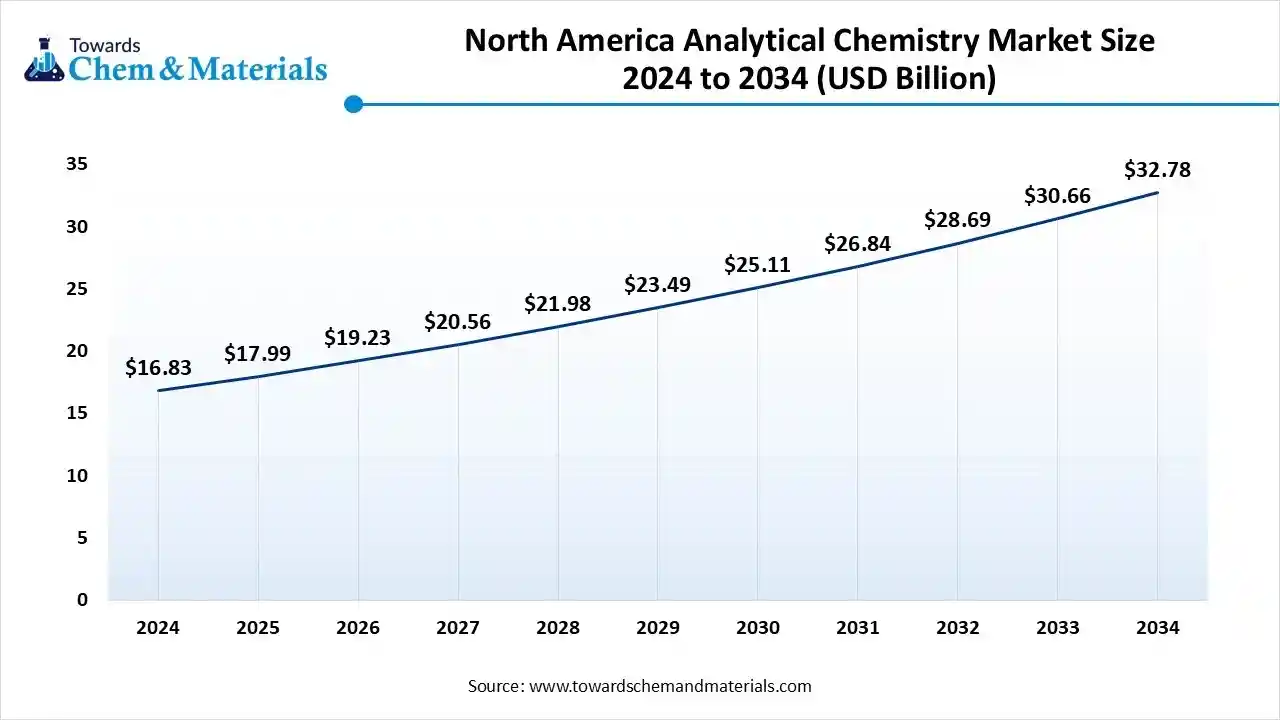

The North America analytical chemistry market size was valued at USD 17.99 billion in 2025 and is expected to surpass around USD 32.78 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.89% over the forecast period from 2025 to 2034.North America dominated the market in 2024.

The growth of the market is driven by the heavy investment in the pharmaceutical and biotechnology industries due to the growing industrial sector in the region, which demands the market. The demand for analytical chemistry is high due to well-established infrastructure and high demand for precision testing across various applications like drug development, environmental monitoring, and food safety, which further drives the growth of the market.

The Emerging Applications In The Market Drive The Growth.

The U.S. is experiencing significant growth in the analytical chemistry market, and the growth of the market is driven by the stringent regulations in the pharmaceutical and biotechnology sectors, increased R&D investments, and growing demands for food and environmental safety. The rise in public and private investments in research and development increases the demand for advanced analytical tools and services, fueling the growth and expansion of the market in the country. Aligning with the emerging applications in proteomics and metabolomics, which further drives the growth.

Asia Pacific Is Expected To Experience Growth, Driven By Rapid Industrialization

Asia Pacific is expected to experience significant growth in the analytical chemistry market in the forecast period. The growth of the market is driven by rapid industrialization and increasing demand for reliable testing in various industries, such as environmental sectors, the food and beverage sector, and the pharmaceutical sector, due to high demand for chemical analysis to ensure product quality and regulatory compliance, which drives the growth of the market in the region.

Country-level Investments & Funding Trends for the Analytical Chemistry Industry:

- India: The Gujarat Biotech Venture Fund and CANBANK Venture Capital Fund are active in the biotech space, which intersects with analytical chemistry.(Source: btm.gujarat.gov.in)

- China: The "China Plus One" strategy has prompted global manufacturers to diversify their supply chains, making India an attractive alternative for manufacturing and R&D.

- Germany: Germany boasts a strong tradition of research and a high level of industry-academia collaboration, which stimulates investment in cutting-edge analytical methods(Source: cefic.org)

- Netherlands: The strong international position of the Netherlands in pharmaceutical development and production continues to attract investment into innovative medicines, a segment of the chemical industry(Source: think.ing.com)

Recent Developments

- In May 2025, Boots introduced "Modern Chemistry," a new own-label brand featuring ingredient-led, science-backed skincare and supplements that blend health and beauty products like serums and supplements. This launch, which began its rollout in July 2025, aligns with a wider industry movement of retailers creating proprietary brands with a scientific emphasis.(Source: www.boots-uk.com)

- In September 2025, Scientists at the Palacký University Faculty of Science are developing a universal "Meccano set" to simplify the assembly and testing of microfluidic devices. This toolkit is intended for use in various applications, including medicine, pharmaceuticals, and industrial quality control. (Source: www.zurnal.upol.cz)

Top players in the Analytical Chemistry Market & Their Offerings:

- Thermo Fisher Scientific: A global leader in scientific instrumentation, Thermo Fisher provides a comprehensive portfolio of analytical chemistry solutions, including chromatography systems, mass spectrometry, spectroscopy instruments, and laboratory consumables.

- Agilent Technologies: Specializes in analytical instrumentation and software, offering advanced solutions in chromatography, spectroscopy, and mass spectrometry, widely used in pharmaceuticals, food safety, and environmental testing.

- PerkinElmer: Offers a wide range of analytical instruments, including atomic absorption, infrared spectroscopy, and chromatography systems, with strong expertise in life sciences, environmental monitoring, and materials testing.

- Waters Corporation: Known for its leadership in liquid chromatography and mass spectrometry (LC-MS), Waters provides high-performance analytical instruments, consumables, and software for pharmaceutical, food, and clinical research.

- Merck KGaA: Through its life science division, Merck supplies reagents, consumables, and advanced analytical chemistry instruments, supporting applications in biopharma, academic research, and industrial laboratories.

Other Top Players Are

- Shimadzu Corporation

- Horiba, Ltd.

- Sartorius AG

- Anton Paar

- AB Sciex

- Danaher Corporation

- JEOL Ltd.

- Bio-Rad Laboratories

- LECO Corporation

- Hitachi High-Technologies Corporation

- FOSS Analytical

- Malvern Panalytical

- Labcorp Drug Development

- Agilent Technologies

- Milestone Inc.

Segments Covered

By Technique

- Chromatography

- Liquid Chromatography (HPLC, UHPLC)

- Gas Chromatography (GC)

- Ion Chromatography (IC)

- Supercritical Fluid Chromatography (SFC)

- Spectroscopy

- Atomic Spectroscopy

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- Atomic Spectroscopy

- Molecular Spectroscopy

- UV-Vis Spectroscopy

- Infrared Spectroscopy (IR)

- Mass Spectrometry (MS)

- Raman Spectroscopy

- Electrophoresis

- Gel Electrophoresis

- Capillary Electrophoresis

- Microscopy

- Electron Microscopy

- Optical Microscopy

- Scanning Probe Microscopy

- Titration

- Potentiometric Titration

- Volumetric Titration

- Thermal Analysis

- Differential Scanning Calorimetry (DSC)

- Thermogravimetric Analysis (TGA)

By Product Type

- Instruments

- Chromatographs

- Spectrometers

- Microscopes

- Other Analytical Instruments

- Reagents

- Standard Solutions

- Chemical Reagents

- Solvents

- Consumables

- Columns and Filters

- Sample Containers

- Electrodes

By Application

- Pharmaceutical & Biotechnology

- Drug Discovery

- Quality Control & Assurance

- Clinical Diagnostics

- Environmental Testing

- Water & Wastewater Analysis

- Soil & Air Testing

- Food & Beverage

- Food Safety & Quality Control

- Nutritional Analysis

- Forensics & Criminal Investigation

- Toxicology

- Trace Evidence Analysis

- Petrochemical & Oil & Gas

- Fuel Testing

- Chemical Composition Analysis

- Chemicals & Materials

- Process Monitoring

- Material Quality Control

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait