Content

Agricultural Enzymes Market Size and Growth 2025 to 2034

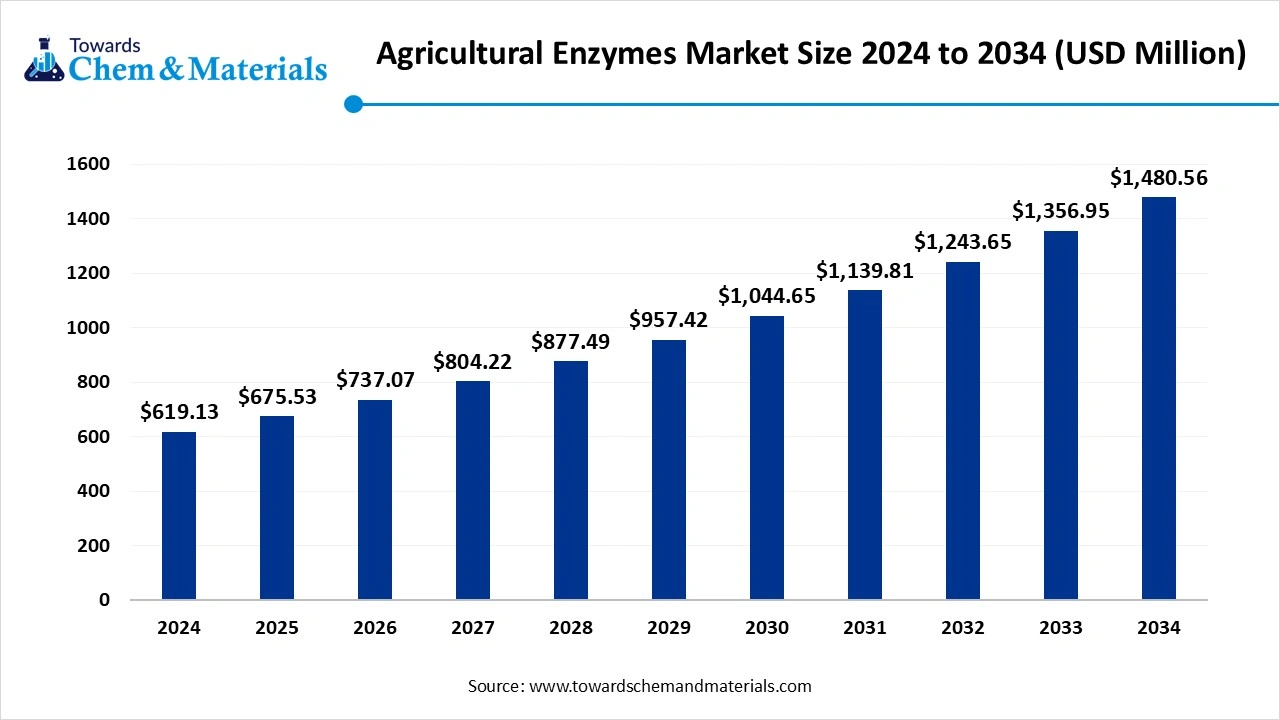

The global agricultural enzymes market size was valued at USD 619.13 million in 2024. The market is projected to grow from USD 675.53 million in 2025 to USD 1480.56 million by 2034, exhibiting a CAGR of 9.11% during the forecast period. The increasing awareness regarding the role of sustainable agricultural techniques is the key factor driving market growth. Also, the surge in research and development initiatives in enzyme technology coupled with the innovations in biotechnology can fuel the market growth further.

Key Takeaways

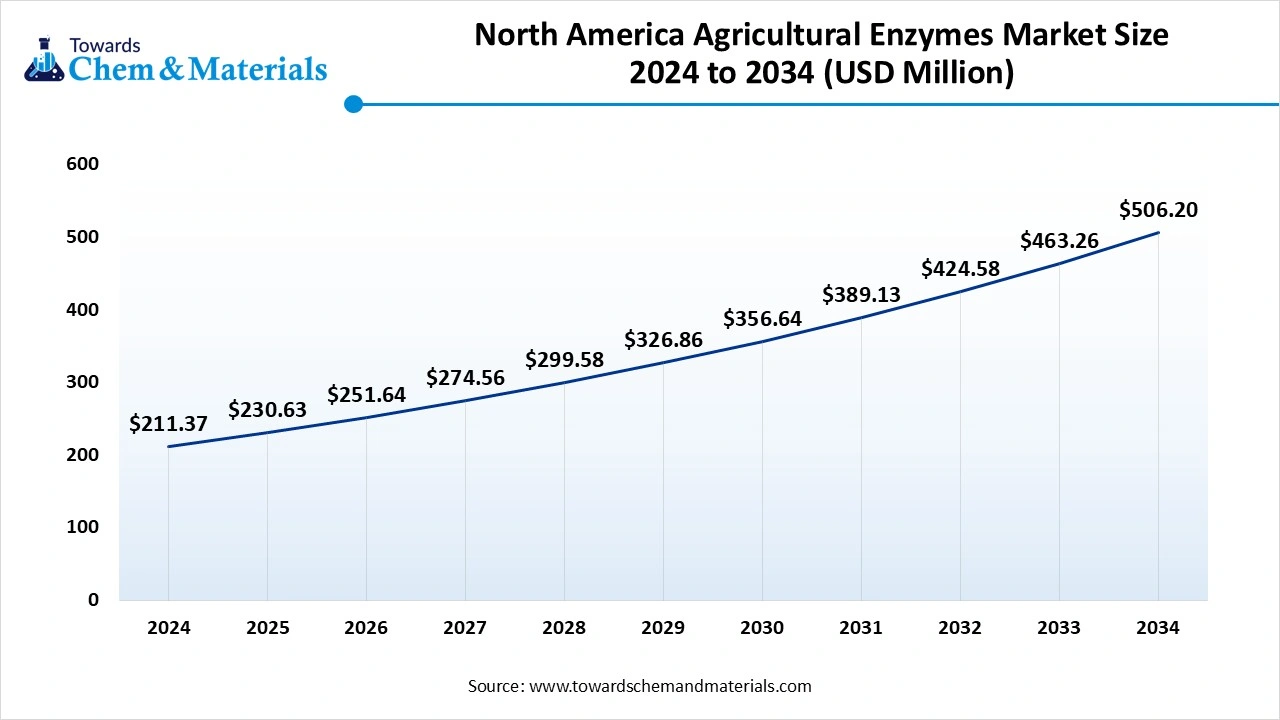

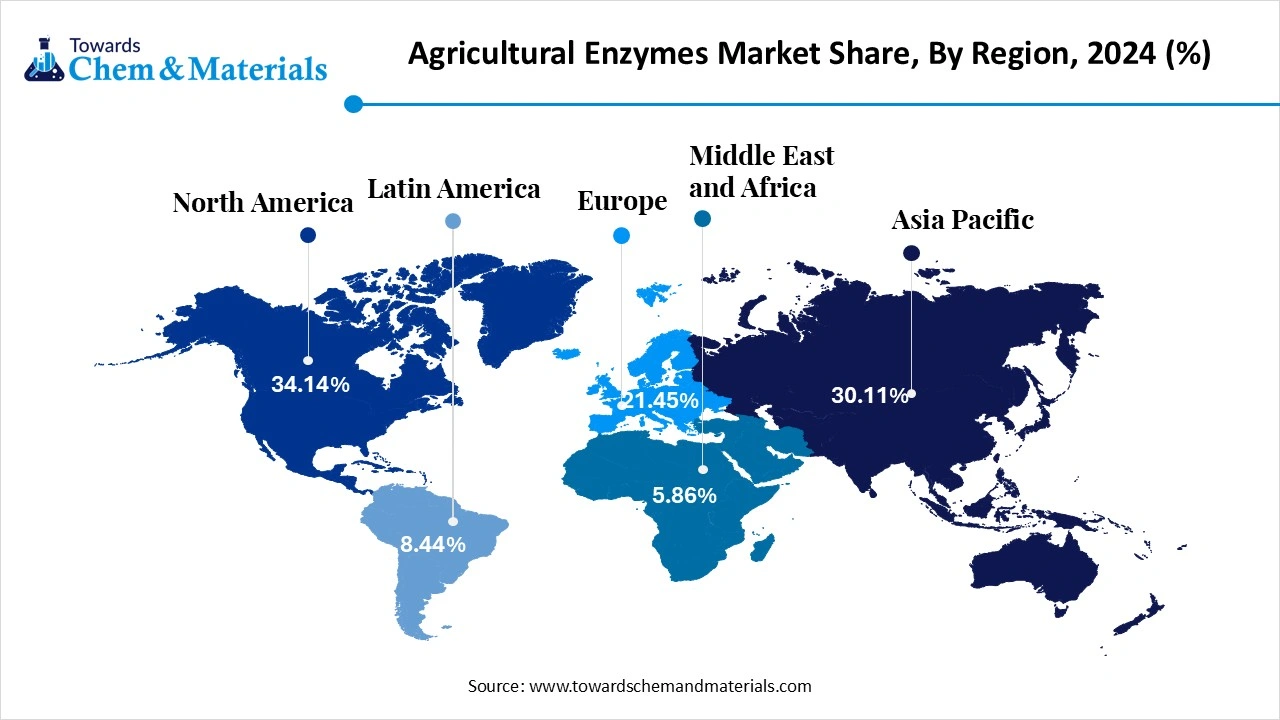

- North America dominated the market and accounting for a 34.14% share in 2024.

- By product, the Phosphatases dominated the market and accounted for a share of approximately 38.19% in 2024.

- By crop type, the Cereals & grains dominated the market and accounted for a share of approximately 35.17% in 2024.

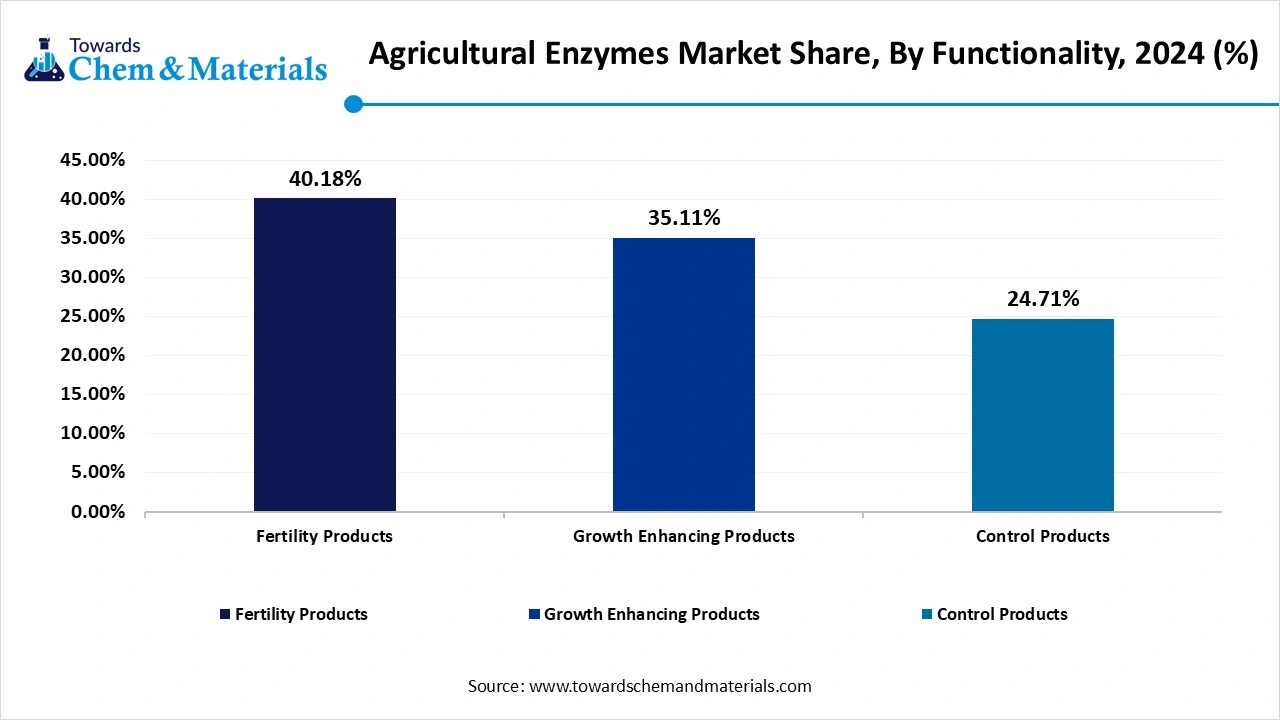

- By end use, the Fertility products dominated the market with a revenue share of 40.18% in 2024.

Sustainable Agricultural Practises Expanding Market Growth

The market refers to the sector for enzymes utilized in agriculture to enhance crop yields, and soil health and decrease reliance on chemical fertilizers and pesticides. These enzymes act as biological catalysts and help with different processes in the plants and soil, such as the decomposition of organic matter, nutrient release, and plant growth regulation.

The adoption of agricultural enzymes reflects a crucial transition towards eco-friendly farming practices, propelled by the need to address challenges like pest resistance, environmental degradation, and nutrient depletion. Growing adoption of bio-based solutions and rising government support for sustainable practices are impacting overall market growth positively.

What Are the Key Trends Influencing the Agricultural Enzymes Market?

- The increasing adoption of precision agriculture by farmers is the major trend driving the market growth. This approach depends on the accumulation and process of data from different sources, like sensors, satellite imagery, and geographic information systems (GIS), to make firm decisions regarding crop management. This surge also impacts the agricultural enzyme demand.

- Technological advancement is another significant factor impacting market growth positively. Innovations in the production of enzymes and formulation technologies have facilitated the development of targeted and more effective enzyme products, creating a positive landscape for market expansion. Also, ongoing enhancements in enzyme stability, activity, and specificity are boosting market expansion further.

- The exponential surge in demand for food across the globe is the latest trend strengthening the market growth. This demographic pressure, climate change, and soil degradation require advanced resource efficiency. Moreover, enzymes found in livestock feed such as phytases, enhance the rapid absorption of nutrients, allowing farmers to produce milk, meat, and eggs while utilizing fewer resources.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 675.53 Million |

| Expected Market Size by 2034 | USD 1,480.56 Million |

| Growth Rate from 2025 to 2034 | CAGR 9.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Product, By Crop Type, By Functionality , By Region |

| Key Companies Profiled | AB Enzymes, Advanced Enzyme Technologies, Amano Enzymes Inc., Antozyme Biotech Pvt Ltd., Biolaxi Enzymes Pvt Ltd., Biorizon Biotech, Creative Enzymes, Elemental Enzymes, Inc., Field International UK Limited, Grotech Production Ltd., Infinita Biotech Private Limited, Kemin Industries, Inc., Novozymes A/S |

How is the Government Supporting the Agricultural Enzymes Market?

The Indian government promotes the market by facilitating eco-friendly agricultural practices and investing heavily in bio-based technologies, to foster collaboration among different stakeholders. This support aims to minimize post-harvest losses, improve crop production, and enhance market access to promote sustainable market growth.

The BioE3 Policy introduces initiatives such as bio-foundry clusters, innovative biomanufacturing facilities, and bio-AI hubs to support the development of bio-based products and their commercialization. The policy focuses on ethical alignment and biosafety with global regulatory standards. It also emphasizes using local biomass to create jobs in tier-II and tier-III cities.

Market Opportunity

Innovations in Biotechnological Research

Ongoing breakthroughs in biotechnology, particularly in genetic engineering and microbial fermentation have revolutionized the market by creating lucrative opportunities. These innovations have facilitated the creation of efficient, highly specific, and cost-effective enzyme formulations specific to different agricultural needs. Furthermore, Biotechnology optimizes the development of enzyme mixes specifically for crops like legumes, cereals, or fruits that are suited for distinct regions.

- In September 2024, The University of Queensland introduced an AU$45 million.ARC Centre of Excellence in Quantum Biotechnology to solve global problems in energy, health, and agriculture. The initiative involves partnering between government, industry, and five Australian universities.(Source: thequantuminsider)

Market Challenge

Competition from Synthetic Chemicals

Synthetic pesticides and fertilizers, while not eco-friendly are generally perceived as readily available and more efficient by farmers, which makes them a strong competitor to the market, hindering market expansion further. Moreover, the efficacy of agricultural enzymes mainly relies on environmental conditions like temperature, moisture levels, soil pH, and microbial activity which can constrain their overall performance.

Regional Insights

The North America agricultural enzymes market is expected to increase from USD 230.63 million in 2025 to USD 505.46 million by 2034, growing at a CAGR of 9.13% throughout the forecast period from 2025 to 2034. North America held the largest agricultural enzymes market share in 2024. The dominance of the region can be attributed to the increasing focus on eco-friendly agriculture practices in nations such as the U.S., Canada, and Mexico. In addition, the strong presence of major market players along with the extensive research and development (R&D) facilities in the US is promoting regional growth further. Farmers in the region are increasingly integrating precision and sustainable agriculture techniques that depend on enzyme technologies.

Agricultural Enzymes Market in the U.S.

In North America, the US led the market owing to the innovations in biotechnology coupled with the wide extension services, that optimizes the adoption of enzymes in the country. In the US, enzymes are used to enhance soil health, particularly in challenging climates. Enzyme-based solutions provide specialized solutions for various crops and production systems, resolving specific hurdles to soil fertility.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing demand for sustainable solutions which leads to the development of enzyme-based biopesticides. The raised emphasis on localized solutions to make sure that these enzymes are efficient and effective is supporting regional growth soon. Furthermore, the region is distinguished by a wide range of climates, crops, and other conditions, fuelling market growth quickly.

- In August 2024, S&T Minister Dr. Jitendra Singh released a new BioE3 policy to facilitate employment generation. BioE3 policy can become a milestone to the economy and also a game ganger for Viksit Bharat @2047," said the minister.(Source: pib.gov)

Agricultural Enzymes Market in China

In Asia Pacific, China dominated the market due to the growing preference for natural biological products such as agricultural enzymes, especially in organic farming. The country's emphasis on enhancing agricultural productivity and addressing soil pollution challenges creates substantial market opportunities in the market soon. The Chinese government has also launched several incentives and policies to support sustainable agriculture practices.

Who are the Top Agriculture Companies in India by Revenue in 2025?

| Name | Revenue (in USD) |

| Godrej Industries Limited | USD 2.11 Billion |

| Godrej Agrovet Limited | USD 1.14 Billiom |

| Jain Irrigation Systems Limited | USD 737.00 Million |

| KRBL Limited | USD 643.15 Million |

| Bayer CropScience Limited | USD 611.82 Million |

(Source: stockviz)

Segmental Insight

Product Insights

Which product type segment dominated the agricultural enzymes market in 2024?

The phosphatase segment led the market in 2024. The dominance of the segment can be attributed to the important role of phosphates in improving plant growth and soil fertility. These enzymes enable the breakdown of phosphorus compounds in the soil, to transform them into inorganic forms that can be easily absorbed by plants. In addition, the extensive applicability of phosphatases and their influence on crop yield can drive segment growth soon.

The dehydrogenase segment is expected to grow at the fastest CAGR over the forecast period over the forecast period. The growth of the segment can be linked to the increasing need for enzyme-based solutions to optimize restoration efforts and soil remediation. Moreover, dehydrogenase enzymes are crucial indicators of soil microbial activity, which is crucial for the decomposition of organic matter, soil health, and nutrient cycling.

Crop Type Insights

Why ereals & grains segment led the agricultural enzymes market in 2024?

The cereals & grains segment dominated the market in 2024. The dominance of the segment can be credited to the increasing emphasis on eco-friendly farming practices which leads to the adoption of enzymes in grain and cereal cultivation. Additionally, enzymes utilized in grain and cereal farming improve nutrient uptake, enhance soil health, and optimize efficient growth. Products such as cellulases, glucanases, and esterases can disrupt mycotoxin production and degrade fungal cell walls, helping to tackle mycotoxin contamination.

The oilseeds and pulses segment are expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing need for oil fuels and plant-based proteins boosts the demand for pulse production and oilseed. Furthermore, technological innovations in agricultural enzymes like the enhanced applications and development of new enzyme types are increasingly improving their effectiveness.

Functionality Insights

How did fertility product segment hold the largest agricultural enzymes market share in 2024?

Fertility products segment held the largest market share in 2024. The dominance of the segment is owning to the increasing adoption of soil fertility products to minimize its reliance on chemical fertilizers and enhance long-term soil quality. These products enhance nutrient availability, improve soil structure, and are rich in enzymes. The demand is especially strong in regions with extensive farming practices.

Growth growth-enhancing products segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the ability of these enzymes to grow plant quality and productivity. Agricultural enzymes, particularly phosphatases help to unlock stored nutrients in the soil, which makes them easily available for plant uptake. Also, Enzymes can boost metabolic processes and photosynthesis which leads to faster plant growth.

- In June 2024, Basecamp Research, a global leader in AI-based design of proteins and biological systems, in collaboration with the Ferruz Laboratory announced the release of ZymCTRL, a ChatGPT-like tool that creates new sequences from scratch based on enzyme identification code.(Source: prnewswire)

Recent Developments

- In November 2024, -Ferment's bio-based product company that uses sensors, enzymes, and AI to enhance product quality unveiled a new $20 million studio fund to translate biology into products that can solve various problems across different sectors such as materials, energy, and health.(Source: Businesswire.com)

- In May 2024, Rizobacter BioSoluções launched RizoPower an innovative BioActivator made from cotton, corn, soy, rice, and sugarcane for foliar application that possess a good novelty for the area of bioactivators the UBP molecule. (Source: agriculturepost)

Companies List

- AB Enzymes

- Advanced Enzyme Technologies

- Amano Enzymes Inc.

- Antozyme Biotech Pvt Ltd.

- Biolaxi Enzymes Pvt Ltd.

- Biorizon Biotech

- Creative Enzymes

- Elemental Enzymes, Inc.

- Field International UK Limited

- Grotech Production Ltd.

- Infinita Biotech Private Limited

- Kemin Industries, Inc.

- Novozymes A/S

Segments Covered

By Product

- Phosphatases

- Dehydrogenases

- Sulfatases

- Other Products

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Other Crop Types

By Functionality

- Fertility Products

- Growth Enhancing Products

- Control Products

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait