Content

U.S. Ammonia Market Size and Growth 2025 to 2034

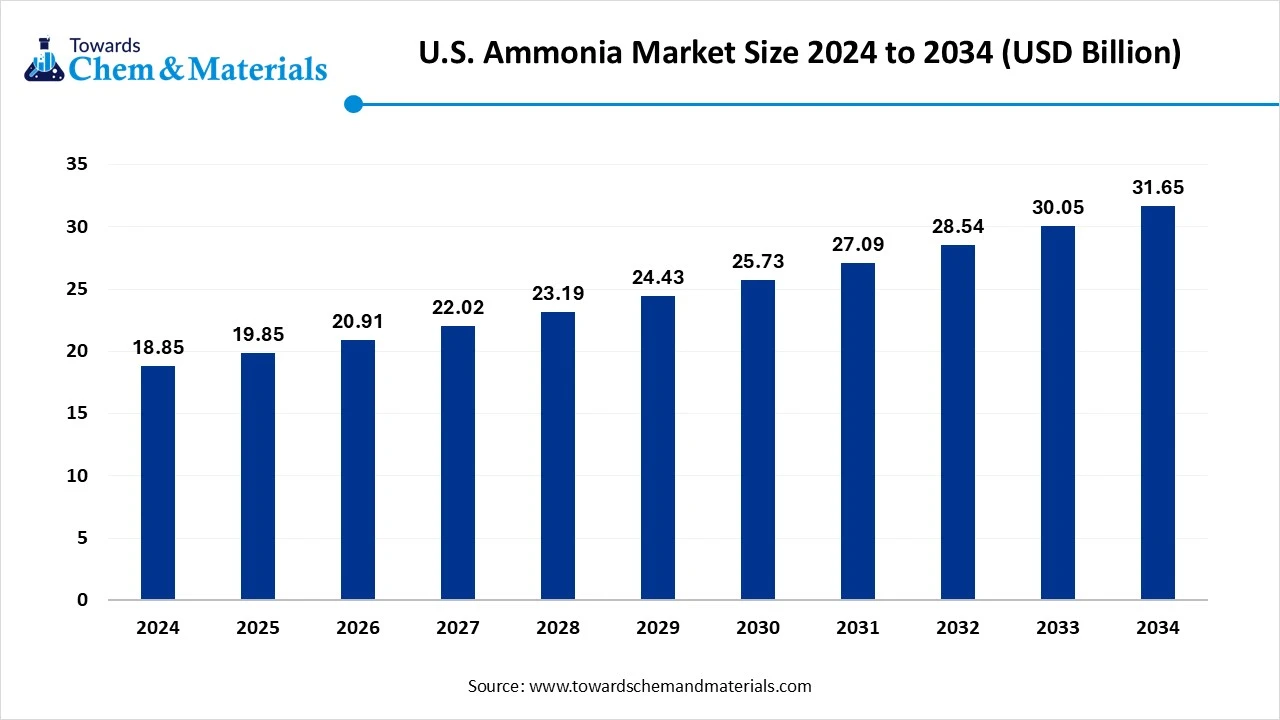

The U.S. ammonia market surpassed USD 18.85 billion in 2024 and is estimated to hit around USD 31.65 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034. The expansion of the agriculture sector and modern agriculture practices has accelerated industry potential in the region in recent years.

Key Takeaways

- By form, the anhydrous ammonia segment led the U.S. ammonia market in 2024 with 55% market share, due to its direct use as a fertilizer in agricultural fields.

- By form, the aqueous ammonia segment is expected to grow at the fastest rate in the market during the forecast period, akin to the sudden increased need for industrial applications such as water treatment, power plants, and air pollution control systems.

- By end-use industry, the agriculture segment emerged as the top-performing segment in the market in 2024 with 60% industry share, due to farmers being considered the largest consumers of ammonia in the current period in the United States.

- By end-use industry, power and energy is expected to lead the market in the coming years, due to ammonia, known as a clean fuel and hydrogen carrier in the current period in the United States.

- By distribution channel, the direct supply and agrochemical distributors segment led the market in 2024 with approximately 70% market share because most ammonia is sold directly to farmers or through large fertilizer distributors.

- By distribution channel, the online and contract platform segment is expected to capture the biggest portion of the market in the coming years, as digitalization transforms the agriculture industry.

- By production method, the conventional production segment led the market in 2024 with approximately 80% market share, because it uses natural gas as a feedstock, which is abundant and relatively cheap in the United States.

- By production method, the green ammonia segment is expected to grow at the fastest rate in the market during the forecast period, because it is produced using renewable energy sources like wind and solar, making it carbon-free.

Market Overview

Ammonia’s Rising Value in a Sustainable United States

The U.S. ammonia market covers the production, distribution, and application of ammonia (NH₃), a key chemical used in fertilizers, industrial chemicals, refrigeration, water treatment, and energy applications. Ammonia is essential for nitrogen-based fertilizers that support U.S. agricultural productivity, while industrial uses include plastics, explosives, textiles, and emerging applications such as green ammonia for hydrogen energy. Market growth is influenced by rising food demand, the shift toward sustainable farming, increased industrial demand, and the transition toward low-carbon ammonia production.

What Factor is driving the U.S. Ammonia Market?

The increased need for better crop yield in the agriculture sector has spearheaded the industry's growth in recent years. As ammonia is considered the crucial raw material in the fertilizers category, where farmers of the United States are seen under heavy demand for it nowadays. Furthermore, sustainability initiatives like biofuel production and others are actively contributing to industry growth in the current period in the country, as per the recent survey.

Market Trends

- The sudden shift towards the green ammonia is driving the industrial potential in the United States in the past few years as investment by individuals in green ammonia has suddenly grown.

- The rising adoption of digital platforms is observed as several farmers are observed as buying ammonia through online platforms.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 19.85 Billion |

| Expected Size by 2034 | USD 31.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.32% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Form, By End-User Industry, By Distribution Channel, By Production Method, |

| Key Companies Profiled | CF Industries Holdings Inc, LSB Industries Inc., Koch Fertilizer, Dyno Nobel, Gulf Coast Ammonia , UBE, Dakota Gasification Company, ExxonMobil |

Market Opportunity

Government-Backed Sustainability Drives Green Ammonia Expansion

The establishment of the green ammonia production facilities is anticipated to create lucrative opportunities for the ammonia manufacturers in the United States. Furthermore, the regional governments are actively pushing environmentally friendly initiatives in every manufacturing sector, where the manufacturers can gain significant advancement in the coming years. Also, the manufacturer is likely to build a plant that can depend on solar and wind energy in the upcoming years.

Market Challenge

CO2 and Consequences: Why Traditional Ammonia Faces a Tipping Point

The higher carbon footprint of ammonia is expected to hinder the industry's potential during the forecast period. Traditional ammonia is produced by using natural gas, which emits CO2. Thus, the global drift towards an ecologically friendly environment is likely to create growth barriers for the traditional ammonia manufacturer in the coming years, as per the recent regional observation.

Segmental Insights

From Type Insights

How did the Anhydrous Ammonia Segment Dominate the U.S. Ammonia Market in 2024?

The anhydrous ammonia segment held the largest share of the market in 2024, due to its direct use as a fertilizer in agricultural fields. Moreover, by having a highly concentrated source of nitrogen, the anhydrous ammonia segment has gained immense industry attention in recent years. Furthermore, the cost-effectiveness and easy storage are actively providing the sophisticated consumer base to the segment in recent years, as per the recent industry observation.

The aqueous ammonia segment is expected to grow at a notable rate during the predicted timeframe, akin to the sudden increased need for industrial applications such as water treatment, power plants, and air pollution control systems. Moreover, by having factors such it being safe to transport and handle as compared to anhydrous ammonia, the aqueous ammonia is expected to gain major industry share in the coming years.

End Use Industry Type Insights

Why does the Agriculture Segment dominate the U.S. Ammonia Market by End Use Industry Type?

The agriculture segment held the largest share of the U.S. ammonia market in 2024, due to farmers being considered the largest consumers of ammonia in the current period in the United States. Furthermore, farmers are actively seeking fertilizers that provide better soil fertility while improving crop yields in recent years. Enlarged fertilizer use and sustainable farming practices are becoming the backbone of the ammonia industry in the current period.

The power and energy segment is expected to grow at a notable rate due to ammonia, known as a clean fuel and hydrogen carrier in the current period in the United States. Moreover, the government pushes for sustainability, which leads to green ammonia products, where the power and energy sector has actively consumed green ammonia in the past few years in the country, as per the observation.

Distribution Channel Type Insights

How did the Direct Supply and Agrochemical Distributors Segment Dominate the U.S. Ammonia Market in 2024?

The direct supply and agrochemical distributors segment dominated the market with the largest share in 2024 because most ammonia is sold directly to farmers or through large fertilizer distributors. Farmers prefer buying from established distributors who provide bulk deliveries, technical advice, and consistent supply for large farming operations. Since ammonia requires specialized storage and handling, trusted distributors play an important role in ensuring safe delivery. The online & contract platform segment is expected to grow at a significant rate, as digitalization transforms the agriculture industry.

Farmers are increasingly adopting e-commerce platforms to purchase fertilizers and ammonia at competitive prices. Online platforms make it easier to compare suppliers, track deliveries, and secure better deals. Contract-based platforms also ensure long-term supply agreements, protecting both buyers and suppliers from market fluctuations.

Product Method Insights

Is Natural Gas the Secret Behind Ammonia’s Market Stronghold?

The conventional production segment held the largest share of the market in 2024 because it uses natural gas as a feedstock, which is abundant and relatively cheap in the United States. The Haber-Bosch process, which combines nitrogen and hydrogen to make ammonia, has been the standard method for decades. This process is highly efficient and well-established, supporting large-scale production to meet strong demand from agriculture and industry.

The green ammonia segment is expected to grow at a notable rate during the predicted timeframe because it is produced using renewable energy sources like wind and solar, making it carbon-free. With growing global pressure to reduce greenhouse gas emissions, green ammonia offers a sustainable alternative to conventional ammonia. The U.S. government is pushing clean energy initiatives and offering incentives for low-carbon technologies, which will accelerate adoption.

U.S. Ammonia Market Value Chain Analysis

Distribution to Industrial Users : The ammonia is mainly distributed by the large-scale industrial sectors.

- Key Players: CF Industries Holdings, Inc., Koch Fertilizer, LLC, Nutrien

Chemical Synthesis and Processing : The ammonia chemical synthesis includes the Haber-Bosch process, which combines nitrogen and hydrogen under high pressure, as per the information.

- Key Players - CF Industries Inc. and Koch Industries

Regulatory Compliance and Safety Monitoring : Ammonia processes require rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality, which is held by agencies such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) for sustainability checkups.

Recent Developments

- In 2025, Marubeni and ExxonMobil signed a new low-carbon ammonia deal. Moreover, the newly established collaboration aims to drive the new energy supply, support the nation, like the United States and Japan, and job growth, as per the report published by the company recently.(Source: corporate.exxonmobil.com)

- In 2025, the CF industries established a collaboration with JERA Co., and Mitsui & Co./ Ltd. These collaborations include factors such as the low-carbon ammonia production facility construction and joint operations, as per the company's claim.(Source: www.cfindustries.com)

U.S. Ammonia Market Top Companies

- CF Industries Holdings Inc

- LSB Industries Inc.

- Koch Fertilizer

- Dyno Nobel

- Gulf Coast Ammonia

- UBE

- Dakota Gasification Company

- ExxonMobil

Segment Covered

By Form

- Anhydrous Ammonia

- Aqueous Ammonia (Liquid Ammonia Solutions)

- Ammonium Compounds (as derivatives in fertilizer & industrial uses)

By End-User Industry

- Agriculture

- Chemicals & Petrochemicals

- Food & Beverages (Cooling & Refrigeration)

- Power & Energy

- Others (Pulp & Paper, Mining)

By Distribution Channel

- Direct Supply to Farmers & Industrial Users

- Agrochemical Distributors

- Chemical Distributors

- Online / Contract Platforms

By Production Method

- Conventional Ammonia (Natural Gas-based, Haber-Bosch)

- Green Ammonia (Renewable Energy-based)

- Blue Ammonia (Natural Gas + Carbon Capture & Storage)