Content

What is the Current Structural Adhesives Market Size and Volume?

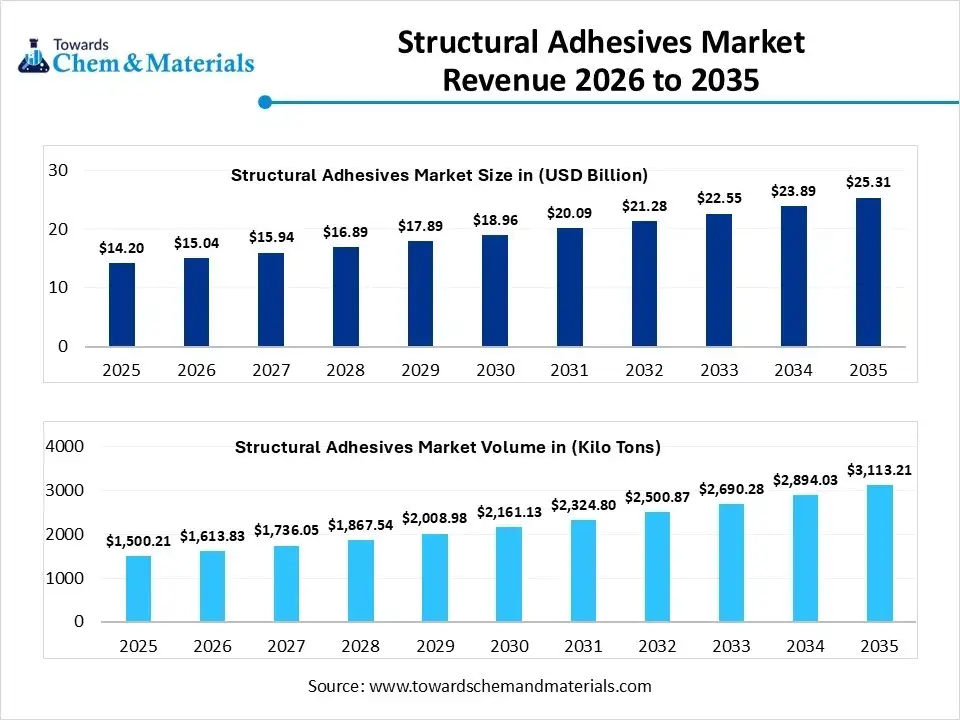

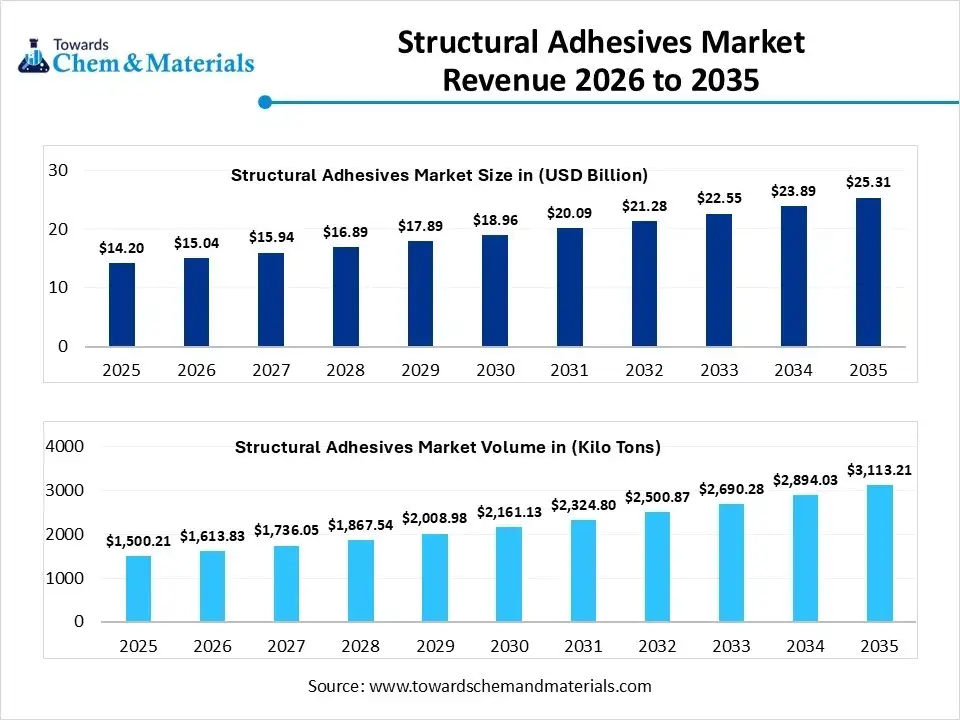

The global structural adhesives market size was estimated at USD 14.20 billion in 2025 and is expected to increase from USD 15.04 billion in 2026 to USD 25.31 billion by 2035, growing at a CAGR of 5.95% from 2026 to 2035. In terms of volume, the market is projected to grow from 1500.21 kilo tons in 2025 to 3113.21 kilo tons by 2035. growing at a CAGR of 7.57% from 2026 to 2035. Asia Pacific dominated the structural adhesives market with the largest volume share of 44% in 2025.The growing demand for lightweight materials is the key factor driving market growth. Also, the expanding construction sector, coupled with the growing demand for sustainable compounds, can fuel market growth further.

Market Highlihgts

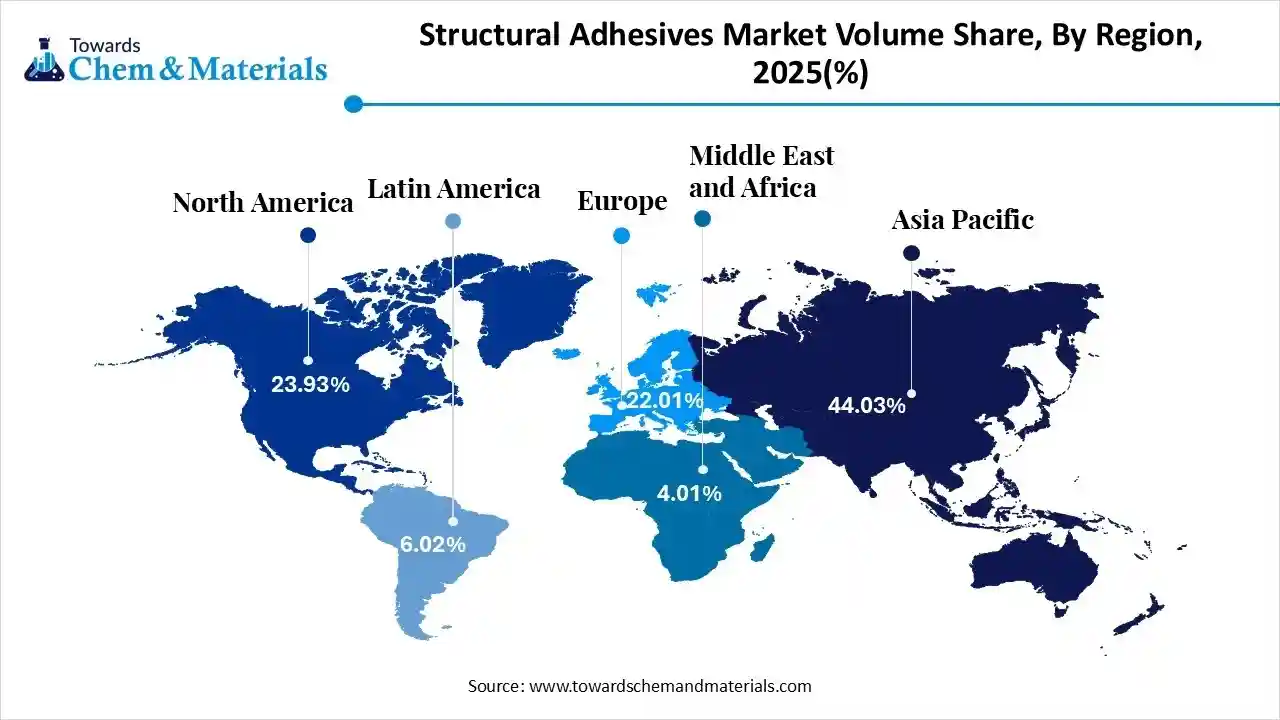

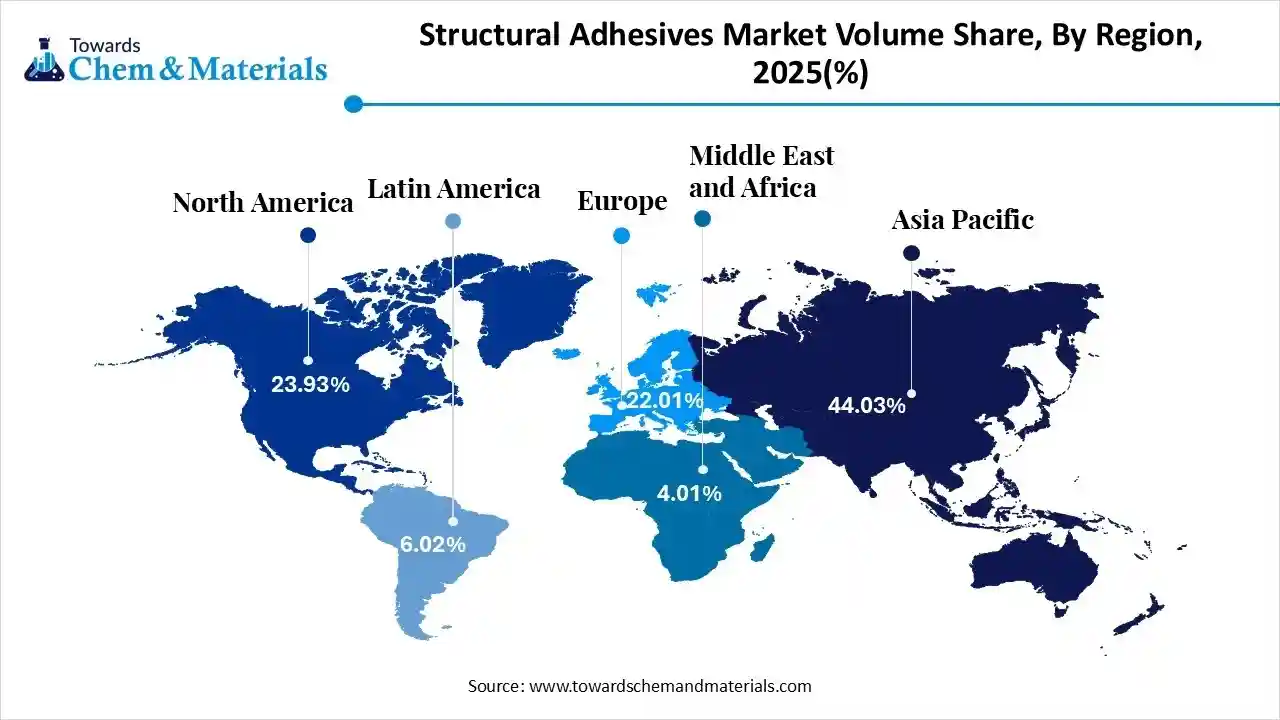

- The Asia Pacific dominated the structural adhesives market with the largest volume share of 44% in 2025.

- The structural adhesives market in North America is expected to grow at a substantial CAGR of 6.78% from 2026 to 2035.

- The Europe structural adhesives market segment accounted for the major volume share of 22.01% in 2025.

- By resin type, the epoxy segment dominated the market and accounted for the largest volume share of 42% in 2025.

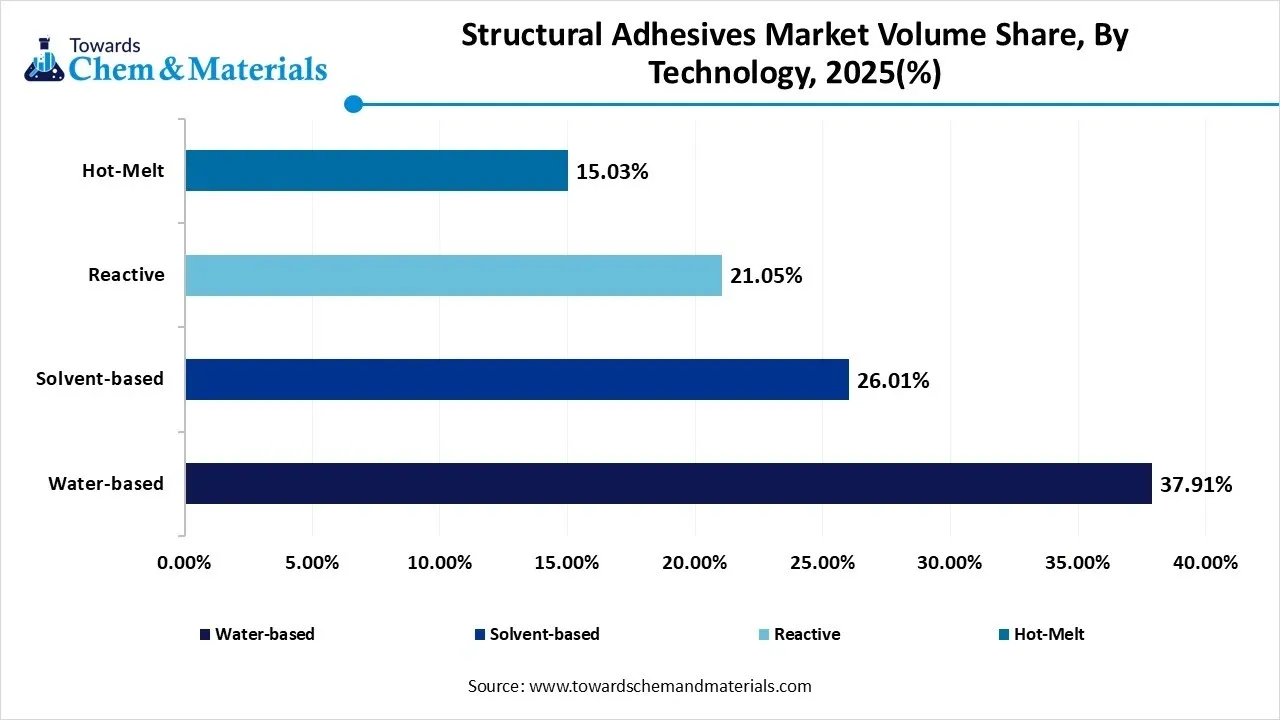

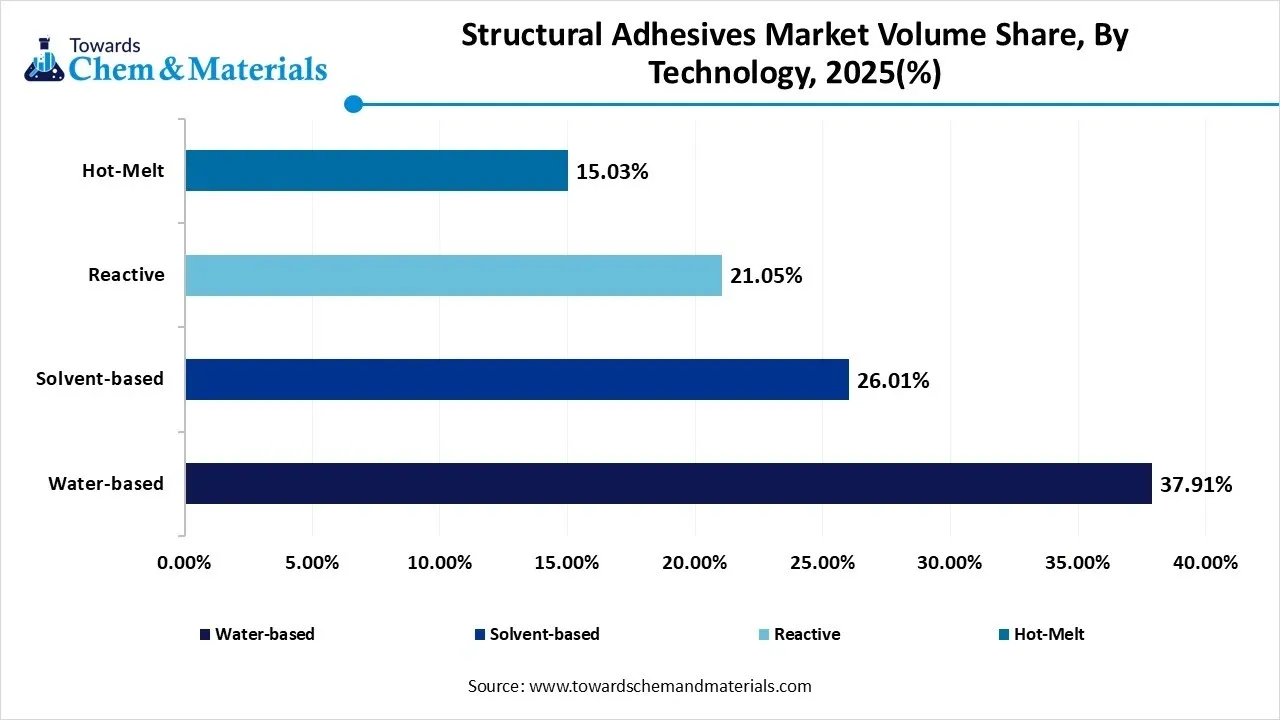

- By technology, the water-based segment led the market with the largest revenue volume share of 38% in 2025.

- By technology, the reactive segment is expected to grow at the fastest CAGR of 10.70% from 2026 to 2035 in terms of volume.

- By substrate type, the metals segment dominated the market and accounted for the largest volume share of 36% in 2025.

- By application, the automotive segment led the market with the largest revenue volume share of 32% in 2025.

What is a Structural Adhesive?

Structural adhesives are high-performance bonding agents engineered for load-bearing applications where joints must withstand extreme shear, peel, and environmental stress. Unlike mechanical fasteners, they distribute stress evenly across the bond line, enabling permanent, lightweight, and vibration-resistant joining of diverse substrates such as metals, composites, and plastics in mission-critical industries.

How Cutting-Edge Technologies Are Revolutionizing the Structural Adhesives Market?

Advanced technologies are transforming the market through advanced materials, Artificial Intelligence -driven formulation, and smart automation, enabling specialized and high-performance bonding that reduces weight, enhances durability, and replaces mechanical fasteners. Furthermore, AI algorithms can process vast amounts of material data to develop adhesives while reducing overall R&D time.

Trade Analysis of the Structural Adhesives Market: Import & Export Statistics

- In between Jun 2024 to May 2025, the United States made 55,198 adhesive export shipments. Most of the Adhesive exports from the United States go to Mexico, India, and Vietnam.

- India's adhesive imports surged in between June 2024 to May 2025, reaching 36,951 shipments. This represents a 48.8% year-on-year increase from May 2024, and a 21% month-on-month rise over April 2025.

Structural Adhesives Market Trends

- The growing demand for high-performance and lightweight materials is the latest trend in the market. This growing preference for lightweight materials in aerospace, automotive, and industrial applications is creating lucrative demand for the product in the market soon.

- The surge in sustainable and bio-based adhesives is another major trend shaping positive market expansion. Governments across the globe are increasingly enforcing stricter environmental regulations, impelling industries to transition towards more eco-friendly alternatives.

- The ongoing technological advancements in manufacturing processes are improving the adhesives performance, such as the development of hybrid resins that combine the advantages of various adhesive types for superior flexibility and strength, leading to market growth.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 15.04 Billion / 1,613.38 kilo tons |

| Revenue Forecast in 2035 | USD 25.31 Billion / 3,113.21 kilo tons |

| Growth Rate | CAGR 5.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin Type, By Technology, By Substrate Type, By Application, By Region |

| Key companies profiled | Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Arkema S.A. (Bostik), DuPont de Nemours, Inc., Huntsman Corporation, Illinois Tool Works Inc. (ITW), Dow Inc., Lord Corporation (Parker Hannifin), Ashland Global Holdings Inc., Master Bond Inc., Permabond Engineering Adhesives, Scott Bader Company Ltd., Hubei Huitian New Materials Co., Ltd. |

Structural Adhesives Market Value Chain Analysis

- Feedstock Procurement: It is the strategic sourcing of essential raw materials, mainly monomers, resins, and solvents required to manufacture high-performance bonding agents.

- Major Players: Sika AG,3M

- Chemical Synthesis and Processing: It refers to the tailored production techniques used to manufacture, formulate, and cure cutting-edge, high-performance bonding agents.

- Major Players: Huntsman Corporation, Dow Inc.

- Packaging and Labelling :It includes containers and essential labelling designs to safeguard, dispense, and identify high-performance adhesives, which are used for bonding structural components.

- Major Players: Scott Bader Company Ltd, Arkema S.A

- Regulatory Compliance and Safety Monitoring: It involves adhering to strict regional and international standards to ensure environmental sustainability, product safety, and overall performance.

- Major Players: DuPont, Huntsman Corporation.

Structural Adhesives Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| North America (primarily the US) | The EPA regulates VOC emissions under the Clean Air Act and has recently finalized bans and strict restrictions on toxic chemicals like trichloroethylene (TCE) and perchloroethylene (PCE) used in adhesives, to reduce health risks. |

| Europe (EU) | Construction Products Regulation (CPR) (EU) No 305/2011: This regulation sets rules for marketing construction products within the EU, requiring manufacturers to demonstrate compliance through labeling and external testing. |

| China | China has introduced specific national standards, such as the new GB 4806.15-2024 for adhesives in food contact materials, which categorises adhesives into direct and indirect food contact applications with different requirements and approved substance lists. |

Segmental Insights

Resin Type Insights

How Much Share Did the Epoxy Segment Held in 2025?

The epoxy segment dominated the market with 42% share in 2025. The dominance of the segment can be attributed to the growing need for lightweighting in the aerospace& automotive sectors, along with the growth in renewable energy. In addition, epoxy adhesives give exceptional properties such as high durability, strength with minimal shrinkage, and temperature stability.

The acrylic segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing product demand in building & construction because ofits high impact strength, excellent water resistance, and aesthetic appearance. Rapid advancements in adhesive formulations are expanding their ability in various environments.

Technology Insights

Which Technology Type Segment Dominated Structural Adhesives Market in 2025?

The water-based segment volume was valued at 568.73 kilo tons in 2025 and is projected to reach 1128.85 kilo tons by 2035, expanding at a CAGR of 7.91% during the forecast period from 2025 to 2035. The water-based segment held 38% market share in 2025. The dominance of the segment can be linked to the rapid innovations in polymer technology, along with the growing demand for sustainable solutions in woodworking and furniture. Moreover, this adhesive provides safety benefits over solvent-based options to minimize flammability, which makes it convenient for workers and crucial for indoor and consumer applications.

The reactive segment volume was valued at 315.79 kilo tons in 2025 and is projected to reach 788.26 kilo tons by 2035, expanding at a CAGR of 25.32% during the forecast period from 2025 to 2035. The reactive segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in demand for superior durability, performance, and lightweighting in sectors such as aerospace, automotive, and construction. Additionally, there is an ongoing shift in medical production towards reactive adhesives for bonding metals and resins, leading to segment growth soon.

Structural Adhesives Market Volume and Share, By Technology, 2025-2034

| By Technology | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Water-based | 37.91% | 568.73 | 1128.85 | 7.91% | 36.26% |

| Solvent-based | 26.01% | 390.20 | 878.24 | 9.43% | 28.21% |

| Reactive | 21.05% | 315.79 | 788.26 | 10.70% | 25.32% |

| Hot-Melt | 15.03% | 225.48 | 317.86 | 3.89% | 10.21% |

Substrate Type Insights

Which Substrate Type Segment Dominated Structural Adhesives Market in 2025?

The metals segment dominated the market with 36% share in 2025. The dominance of the segment is owing to the rising need for high durability, bond strength, and chemical resistance. Furthermore, adhesives enable the joining of dissimilar and complex metal parts without welding distortions and fasteners, allowing for more advanced product designs.

The composites segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to ongoing urbanisation across the globe, coupled with the growing demand for stronger and safer sustainable building techniques. Composites are mainly utilized for prefabricating and modular buildings.

Application Insights

Which Application Type Segment Dominated Structural Adhesives Market in 2025?

The automotive segment held a 32% market share in 2025. The dominance of the segment can be attributed to the surge in adoption of electric vehicles (EVs) requiring cutting-edge bonding for lightweight materials and batteries. Furthermore, adhesives enhance crash performance, enhance structural integrity and durability, fulfilling much higher safety needs.

The wind energy segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rising need for lightweight and high-strength materials in larger turbines. Heavy investments and supportive policies in wind power infrastructure, particularly offshore, are boosting segment growth shortly.

Regional Insights

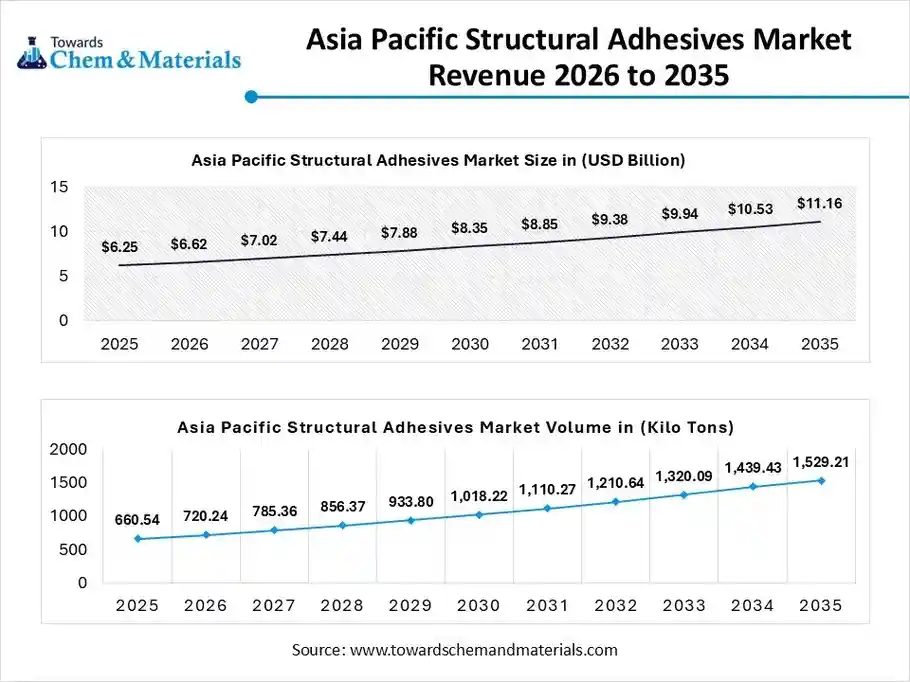

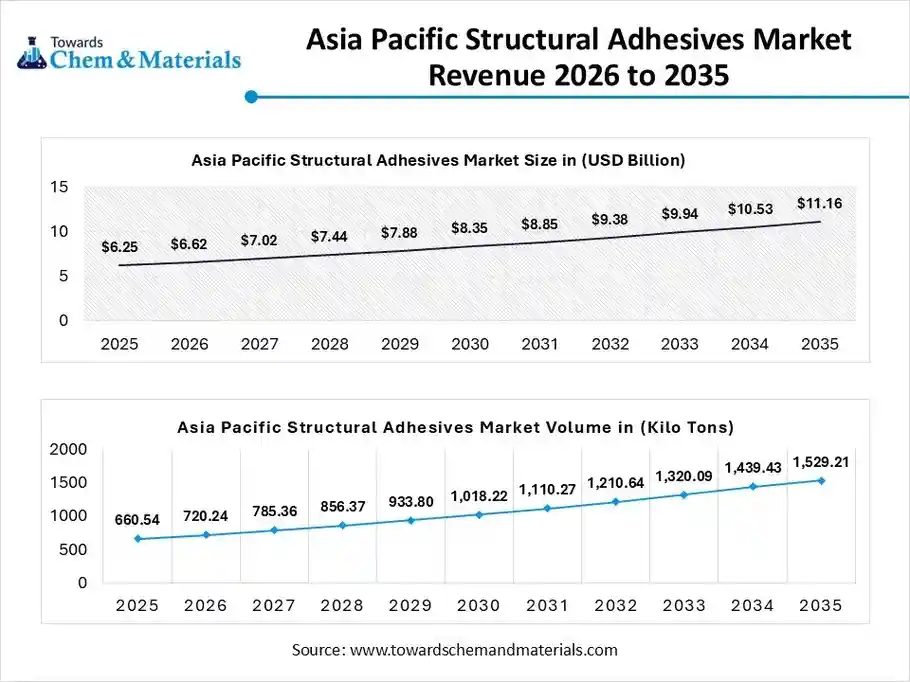

The Asia Pacific structural adhesives market size was valued at USD 6.25 billion in 2025 and is expected to be worth around USD 11.16 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.97% over the forecast period from 2026 to 2035.

The Asia Pacific structural adhesives volume was estimated at 660.54 kilo tons in 2025 and is projected to reach 1,529.21 kilo tons by 2035, growing at a CAGR of 8.75% from 2026 to 2035.Asia Pacific dominated the market with the largest share of 44% in 2025. The dominance of the region can be attributed to the ongoing urbanisation, industrialisation, and extensive infrastructure development, especially in emerging economies. In addition, the region benefits from strong supply chains, lower labor costs, and huge production bases, attracting major companies across the globe to set up manufacturing and distribution.

China Structural Adhesives Market Trends

In the Asia Pacific, China dominated the market owing to a surge in EV production, extensive infrastructure projects, and the expanding automotive/aerospace industry. Also, stringent VOC emissions standards enforce the adoption and development of bio-based and water-borne adhesives, boosting green innovation.

North America Structural Adhesives Market Trends

The North America structural adhesives volume was estimated at 359.00 kilo tons in 2025 and is projected to reach 647.86 kilo tons by 2035, growing at a CAGR of 6.78% from 2026 to 2035. North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing demand for adhesives with high durability, strength, and resistance to harsh conditions. Furthermore, rapid advancements in adhesive formulations, like the nanotechnology integration and manufacturing of hybrid adhesives, are improving the overall efficiency of the adhesives.

U.S. Structural Adhesives Market Trends

In North America, the U.S. led the market due to stringent regulations preferring advanced materials, coupled with the rapid advancements in high-performance materials. Moreover, the expansion of the construction sector in the country is surging due to urbanisation and growing infrastructure investment. Structural adhesives are utilised for bonding different materials in commercial and residential projects.

Europe Structural Adhesives Market Trends

The Europe structural adhesives volume was estimated at 330.20 kilo tons in 2025 and is projected to reach 626.38 kilo tons by 2035, growing at a CAGR of 7.37% from 2026 to 2035. The Europe structural adhesives market is currently experiencing steady growth and dynamic change, underpinned by several key trends. Structural adhesives which bond materials in automotive, aerospace, construction, and industrial manufacturing are becoming increasingly important as manufacturers seek alternatives to mechanical fasteners that reduce weight and improve product performance. In automotive and aerospace sectors, rising production of electric vehicles and lightweight composite structures is driving strong demand for high-performance epoxy, polyurethane, and acrylic adhesives that offer superior strength, vibration resistance, and long-term durability.

Germany Structural Adhesives Market Trends

In Germany, the structural adhesives market is a growing and strategically important segment of the broader adhesives industry, driven by the country’s advanced manufacturing base and strong presence in key end-use sectors. A major factor behind this growth is Germany’s automotive industry, where structural adhesives are increasingly used in lightweighting, electric vehicle (EV) assembly, and high-strength bonding applications that replace mechanical fasteners to improve performance and reduce vehicle weight.

Structural Adhesives Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 23.93% | 359.00 | 647.86 | 6.78% | 20.81% |

| Europe | 22.01% | 330.20 | 626.38 | 7.37% | 20.12% |

| Asia Pacific | 44.03% | 660.54 | 1529.21 | 9.78% | 49.12% |

| South America | 6.02% | 90.31 | 182.12 | 8.11% | 5.85% |

| Middle East & Africa | 4.01% | 60.16 | 127.64 | 8.72% | 4.10% |

Recent Developments

- In December 2025, Big Dog Adhesives introduced a reload adhesive system with reusable cartridges. This system replaces conventional single-use cartridges with a precision and reusable engineered housing compatible with pneumatic and standard manual dispensers.(Source: www.compositesworld.com)

Structural Adhesives Market Companies

- Henkel AG & Co. KGaA: Henkel AG & Co. KGaA is a dominant global leader in the structural adhesives market, holding the #1 spot through its Adhesive Technologies division, renowned for brands like Loctite, Teroson, and Technomelt.

- 3M Company:3M Company is a recognized pioneer and leading player in the structural adhesives market, known for its extensive R&D capabilities and high-performance bonding solutions across diverse industries, including aerospace, automotive, and construction.

- Sika AG: It is a globally dominant player in the structural adhesive and construction chemicals market, recognized as a leader in bonding, sealing, damping, reinforcing, and protection.

- H.B. Fuller Company

- Arkema S.A. (Bostik)

- DuPont de Nemours, Inc.

- Huntsman Corporation

- Illinois Tool Works Inc. (ITW)

- Dow Inc.

- Lord Corporation (Parker Hannifin)

- Ashland Global Holdings Inc.

- Master Bond Inc.

- Permabond Engineering Adhesives

- Scott Bader Company Ltd.

- Hubei Huitian New Materials Co., Ltd.

Segments Covered in the Report

By Resin Type

- Epoxy

- Polyurethane (PU)

- Acrylic (including MMA)

- Cyanoacrylate

- Others (Silicone/Phenolic)

By Technology

- Water-based

- Solvent-based

- Reactive

- Hot Melt

By Substrate Type

- Metals

- Composites

- Plastics

- Wood & Others

By Application

- Automotive

- Building & Construction

- Aerospace

- Wind Energy

- Electrical & Electronics

- Marine & Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa