Content

What is the Current Pressure Sensitive Adhesives Market Size and Volume?

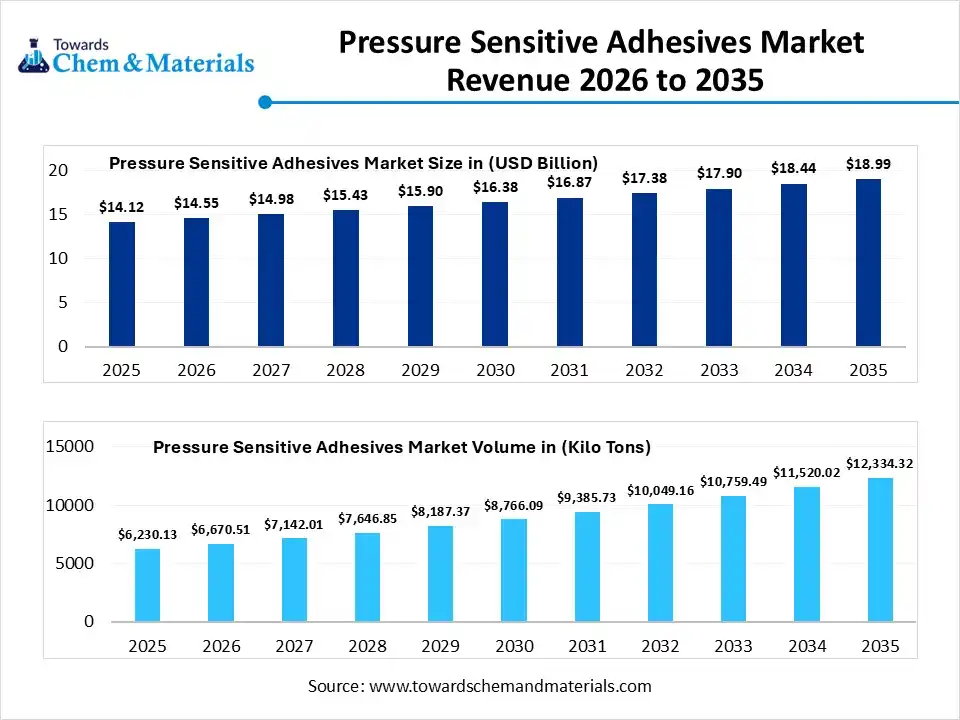

The global pressure sensitive adhesives market size was estimated at USD 14.12 billion in 2025 and is expected to increase from USD 14.55 billion in 2026 to USD 18.99 billion by 2035, growing at a CAGR of 3.01% from 2026 to 2035. In terms of volume, the market is projected to grow from 6230.13 kilo tons in 2025 to 12334.32 kilo tons by 2035. growing at a CAGR of 7.07% from 2026 to 2035. Asia Pacific dominated the pressure sensitive adhesives market with the largest volume share of 45.7% in 2025.The market is driven by regulatory pressure, technological innovation, sustainability goals, and industrial applications.

Key Takeaways

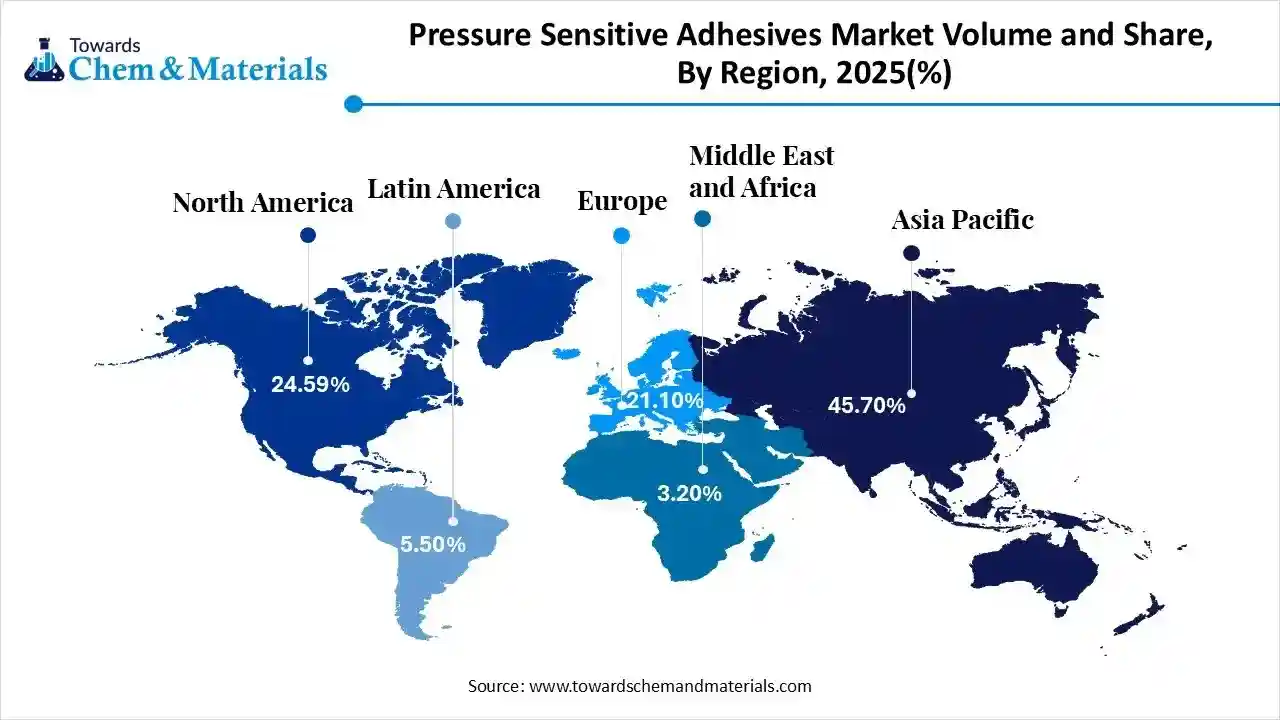

- The Asia Pacific dominated the pressure sensitive adhesives market with the largest volume share of 45.7% in 2025.

- The pressure sensitive adhesives market in North America is expected to grow at a substantial CAGR of 8.08% from 2026 to 2035.

- The Europe pressure sensitive adhesives market segment accounted for the major volume share of 21.01% in 2025.

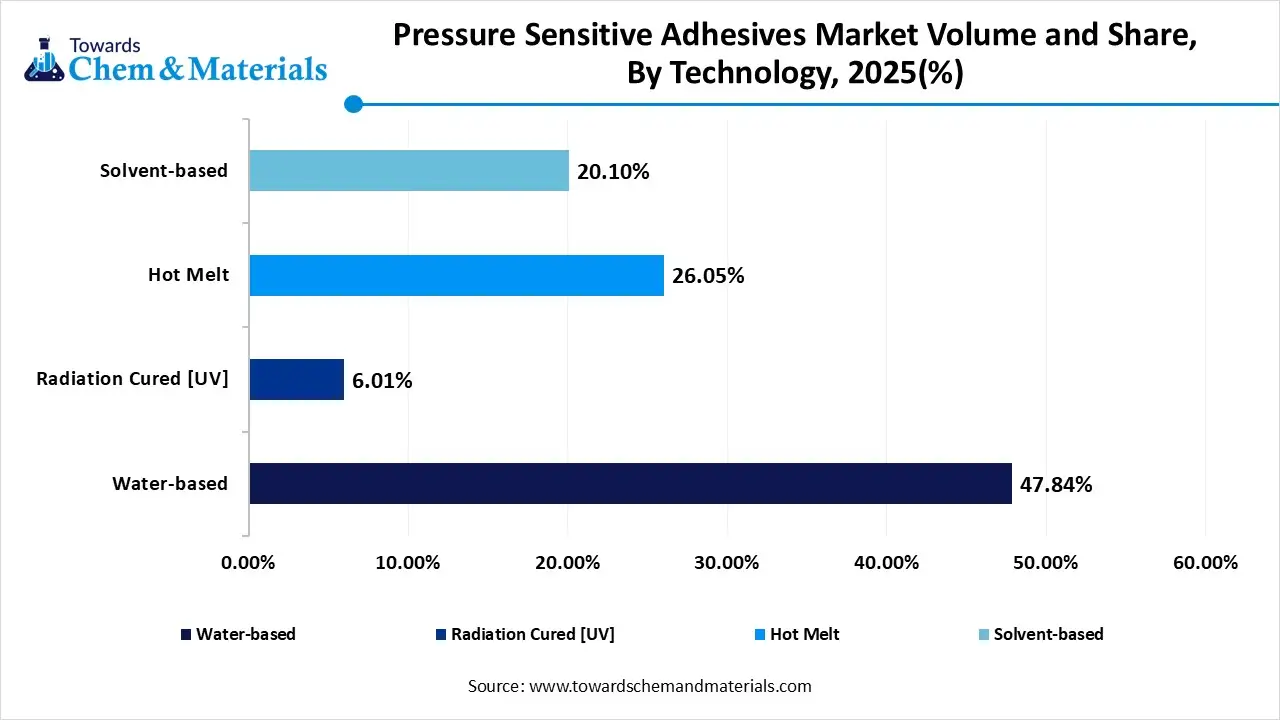

- By technology, the water-based segment dominated the market and accounted for the largest volume share of 48% in 2025.

- By technology, the radiation-cured (UV) segment is expected to grow at the fastest CAGR of 10.65% from 2026 to 2035 in terms of volume.

- By chemistry, the acrylic segment led the market with the largest revenue volume share of 52% in 2025.

- By application, the tapes segment dominated the market and accounted for the largest volume share of 44% in 2025.

- By end-use industry, the packaging segment led the market with the largest revenue volume share of 35% in 2025.

Market Overview

What are the Growth Factors for the Pressure Sensitive Adhesives Market?

The pressure sensitive adhesives are materials that allow two surfaces to bond using slight pressure without the need for heat, curing, or water due to their performance efficiency, versatility, that driving the innovation include bio-based adhesives and smart adhesives. The. The regulatory pressure for VOC emissions is pushing manufacturers towards ecologically friendly alternatives.

The rising demand for PSAs in medical tape, automotive lightweighting, packaging, construction, electronics, and miniaturization, with balanced performance to meet regulatory compliance driving the next stage of market evolution with efficient bonding solutions for consumer goods.

Pressure Sensitive Adhesives Market Trends

- Focus on Sustainability & Circular Economy Innovation: The rising consumer demand for sustainable solutions due to strict environmental regulation fostering innovation in recyclable and biodegradable adhesive formulations to meet global carbon neutrality goals.

- Automotive and Healthcare Applications: The demand for lightweight vehicles in automation is increasingly using PSA to improve fuel efficiency, while the rising need for skin-friendly and hypoallergenic adhesives pushes healthcare towards the adoption of PSA.

- E-Commerce and Packaging Development: The implementation of e-commerce and the requirement to reduce waste in packaging, driving the demand for PSA tapes, labels, and repulpable adhesives during the recycling process for high-speed automated packaging lines.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 14.55 Billion / 6670.51 Kilo Tons |

| Revenue Forecast in 2035 | USD 18.99 Billion / 12334.32 Kilo Tons |

| Growth Rate | CAGR 3.01% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Chemistry, By Technology, By Application, By End-Use Industry, By Region |

| Key companies profiled | 3M Company (USA), Henkel AG & Co. KGaA (Germany), Avery Dennison Corporation (USA), H.B. Fuller Company (USA), Arkema S.A. (Bostik) (France), Dow Inc. (USA), Nitto Denko Corporation (Japan), Sika AG (Switzerland), tesa SE (Beiersdorf AG) (Germany), Ashland Global Holdings (USA), Corporation, Illinois Tool Works Inc. (ITW) (USA), Wacker Chemie AG (Germany), BASF SE (Germany), Jowat SE (Germany) |

Key Technological Shifts and AI in the Pressure Sensitive Adhesives Market

The shift towards smart manufacturing, like embedded sensors and energy optimization improve bond integrity and reduces energy consumption. The technological innovation focuses on the development of UV-cured systems, low-VOC formulation, and nanotechnology to enhance performance in electronic and medical devices.

AI integration reduces the development cycle and improves predictive performance, making an adaptive solution for large-scale production. The digitalization enhances customer interaction and improves supply chain flexibility by using predictive logistics. Additionally, Industry 4.0 integration is driving the use of convolutional neural networks to detect defects and improve accuracy through real-time monitoring.

Trade Analysis of the Global Pressure Sensitive Adhesives Market: Import and Export Statistics

- Vietnam exported 2,869 shipments of pressure sensitive adhesive.

- China exported 2,811 shipments of pressure sensitive adhesive.

- India exported 877 shipments of pressure sensitive adhesive.

- From June 2024 to May 2025, the world exported 4,954 shipments of pressure sensitive adhesive.

Pressure Sensitive Adhesives Market: Value Chain Analysis

- Feedstock Procurement: The sourcing and supply of raw materials like acrylic monomers, tackifier resins, synthetic rubber, and specialty additives from the petrochemical industry.

- Key Players: BASF SE, Evonik Industries, ExxonMobil

- Adhesive Manufacturing: The key stage where raw materials are processed into various types of PSA, such as hot-melt, solvent-based, through R&D and specialized processing.

- Key Players: 3M Company, Henkel AG & Co. KGaA, Avery Dennison Corporation.

- End-Use Industries: Diversified industries like packaging, automotive, healthcare, and electronics are adopting the PSAs in final products for labelling, bonding, and assembly functions.

- Key Players: Tesla, Samsung Electronics, FedEx, Amazon, Huawei, Volkswagen Group

Regulatory Framework: Pressure Sensitive Adhesives Market

| Region | Regulatory Framework | Regulatory Focus |

| North America | EPA (TSCA), OSHA HSC (Hazard Communication Standard) | Focus on bans on toxic solvents used in adhesives and low-VOC emissions |

| Asia-Pacific | India BIS, China GB Standards | Strict laws for pollution control and limits on VOCs in consumer adhesives. |

| European Union | EU REACH, CLP Regulation; One Substance, One Assessment laws | Focus on microplastic emissions and ensure human health and environmental protection |

Segmental Insights

Chemistry Insights

Why the Acrylic Segment Dominates the Pressure Sensitive Adhesives Market?

The acrylic segment dominated the market with approximately 52% share in 2025 due to its long-term stability, resistance to environmental degradation, and formulation precision. Acrylics are naturally immune to oxidation, yellowing, and UV damage due to their saturated molecular structure, maintaining bond integrity. In modern electronics, they provide superior optical clarity by adopting water-based and UV-cured systems, offering eco-friendly, high-performance without compromising adhesion.

The silicone segment is the fastest-growing in the market during the forecast period, driven by its unparalleled performance in extreme environments with a unique inorganic backbone that offers exceptional thermal stability and flexibility from cryogenic to hot temperatures. Its superior biocompatibility and low skin toxicity make silicones ideal for medical devices and wound care. Additionally, their bonding to low-surface-energy substrates, resistance to moisture and chemicals, ensures their reliability in aerospace and electronic applications.

Technology Insights

How did the Water-Based Segment hold the Largest Share in the Pressure Sensitive Adhesives Market?

The water-based segment volume was valued at 2980.49 kilo tons in 2025 and is projected to reach 6508.82 kilo tons by 2035, expanding at a CAGR of 9.07% during the forecast period from 2025 to 2035. The water-based segment held the largest revenue share of approximately 48% in the market in 2025, acting as a primary catalyst for sustainable industry growth, offering high performance with low VOC, non-flammability, and versatility across substrates like paper, film, and foil used in packaging and labelling. Advances in acrylic emulsion polymerization enhance clarity, UV stability, and moisture resistance, making it suitable for medical and automotive uses. By aligning operational efficiency with supportive eco-friendly initiatives and circular economy goals, it remains prominent in modern adhesive manufacturing.

The radiation-cured (UV) segment volume was valued at 374.43 kilo tons in 2025 and is projected to reach 931.24 kilo tons by 2035, expanding at a CAGR of 10.65% during the forecast period from 2025 to 2035. The radiation-cured (UV) segment is experiencing the fastest growth in the market during the forecast period due to its ability to enable instant curing and high-speed production. They are solvent-free, reduce manufacturing &c operational costs, and are used in electronics and medical fields for low-heat bonding. The adoption of UV-LED curing systems offers sustainability and environmental compliance, fostering innovation for high-performance and rapid industrial assembly.

Pressure Sensitive Adhesives Market Volume and Share,By Technology, 2025-2035

| By Technology | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Water-based | 47.84% | 2980.49 | 6508.82 | 9.07% | 52.77% |

| Radiation Cured [UV] | 6.01% | 374.43 | 931.24 | 10.65% | 7.55% |

| Hot Melt | 26.05% | 1622.95 | 2976.27 | 6.97% | 24.13% |

| Solvent-based | 20.10% | 1252.26 | 1917.99 | 4.85% | 15.55% |

Application Insights

Which Application Dominated the Pressure Sensitive Adhesives Market?

The tapes segment dominated the market with an approximately 44% share in 2025. Driven by e-commerce and logistics needs for quick sealing and labelling without heat or mechanical fasteners. Tapes are cost-effective, reliable, and efficient for modern manufacturing. Their versatility in automotive, electronics, and demanding sectors like aerospace is enhanced by advanced backing materials and bio-based adhesives, driving the expansion.

The graphics & films segment is anticipated to grow fastest in the market during the forecast period. propelled by demand for vehicle wraps and architectural films. These materials enable surface transformations without damage, used in retail, directional signage and decorative finishes. Innovations like air-release liners and a shift towards sustainable, PVC-free films support environmental standards, making them critical in automotive, commercial, and interior design sectors.

End-Use Industry Insights

How did the Packaging Segment hold the Largest Share in the Pressure Sensitive Adhesives Market?

The packaging segment held the largest revenue share of approximately 35% in the market in 2025. Acting as vital for global supply chains and retail because of rising e-commerce and logistics infrastructure. These adhesives enable fast bonding and seamless integration into high-speed production, boosting efficiency. Rising demand for sustainable flexible packaging and resealable food containers relies on adhesives that maintain strong bond integrity. The growing focus on circular economy solutions, like labels that separate simply during recycling, drives innovation and growth, linking industrial efficiency with environmental goals.

The automotive/EV segment is experiencing the fastest growth in the market during the forecast period. driven by electrification and lightweighting trends. Adhesives are important for bonding lightweight materials, aiding in battery assembly, thermal management, and vibration damping. The integration of smart interiors and driver-assist systems is speeding up assembly and improving vehicle performance. This industry fuels the development of advanced, durable adhesives for next-generation vehicle technologies.

Regional Insights

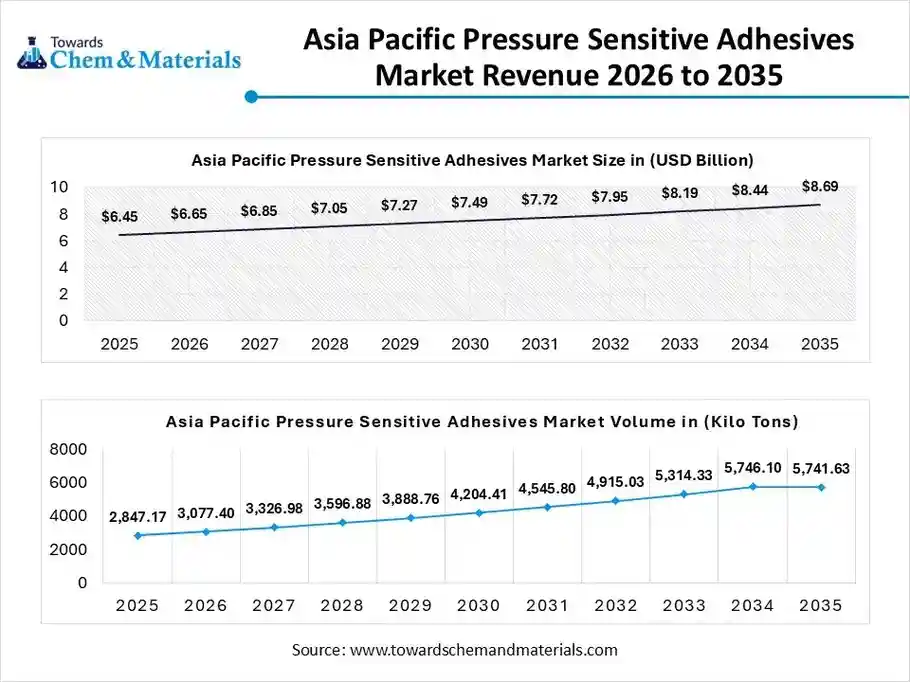

The Asia Pacific pressure sensitive adhesives market size was valued at USD 6.45 billion in 2025 and is expected to be worth around USD 8.69 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 3.03% over the forecast period from 2026 to 2035.

The Asia Pacific pressure sensitive adhesives volume was estimated at 2847.17 kilo tons in 2025 and is projected to reach 5741.63 kilo tons by 2035, growing at a CAGR of 8.11% from 2026 to 2035. Asia Pacific dominated the market with an approximately 45.7% share in 2025. The Asia Pacific region leads the global pressure-sensitive adhesives market, driven by its large industrial base, especially in electronics and automotive sectors, and a robust e-commerce network demanding high-performance packaging tapes. Supported by an integrated raw material supply chain, it balances cost-efficient production with sustainable innovations

China Pressure Sensitive Adhesives Market Trends

China maintains its dominance is Asia Pacific market driven by its vast production and consumption of advanced packaging tapes and labelling solutions. The advancement in electric vehicle battery bonding and integrating with the domestic level logistic network is pushing China towards technological and regional expansion.

North America is expected to grow at the fastest CAGR in the market during the forecast period, driven by emphasis on high-performance, eco-friendly technologies in specialized industries like medical and automotive sectors, where low-emission and advanced systems like solvent-free systems is required that meet strict regulatory standards. Especially in electric vehicle batteries and wearables, solidifying its role in technical innovation and environmentally friendly manufacturing.

U.S. Pressure Sensitive Adhesives Market Trends

The U.S. maintains its dominance in the North America market, serving as a key hub for medical and electronic adhesive innovations, while the region is driven by electric vehicle growth and domestic transition to radiation-cured and bio-based formulation, balancing performance with rigorous environmental and safety regulations.

Europe: High Sustainability Focus

Europe's market is driven by circular economy initiatives and the implementation of bio-based, recyclable adhesives with strong demand from the automotive and medical sectors. The region shows strict environmental mandates prioritized low-carbon emission and sustainability, which is driving the innovation of high-performance adhesives with high precision.

Germany Pressure Sensitive Adhesives Market Trends

Germany remains a strategic leader in Europe market of chemical engineering and high precision manufacturing, with a focus on advanced, recyclable adhesives for the automotive and packaging industries that focus on sustainable materials. The manufacturers are fostering innovation in recycling-compatible formulation and environmental standards across the region.

Pressure Sensitive Adhesives Market Volume and Share,By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 24.59% | 1531.99 | 3083.58 | 8.08% | 25.00% |

| Europe | 21.01% | 1308.95 | 2479.20 | 7.35% | 20.10% |

| Asia Pacific | 45.70% | 2847.17 | 5741.63 | 8.11% | 46.55% |

| South America | 5.50% | 342.66 | 629.05 | 6.98% | 5.10% |

| Middle East & Africa | 3.20% | 199.36 | 400.87 | 8.07% | 3.25% |

Recent Development

- In October 2025, Henkel AG and Dow Inc. announced a strategic partnership to produce hot-melt adhesives by using low-carbon feedstock and renewable electricity. This collaboration focuses on decarbonization goals which aims to reduce 20-40% reduction of carbon for product lines.(Source: packagingeurope.com)

- In September 2025, BioBond Adhesives, Inc. launched BioMelt™, a groundbreaking biobased technology of a new bio-based fingernail adhesive offering high-performance, low toxicity with zero microplastics, useful for beauty and consumer goods.(Source: www.prnewswire.com)

Top Market Players in the Pressure Sensitive Adhesives Market and Their Offerings

- 3M Company (USA): The major leader offerings high performance acrylics and specialty tapes in the automotive and healthcare sectors by maintaining leadership in supply and a proactive approach to sustainability.

- Henkel AG & Co. KGaA (Germany): Offers advanced water-based and hot-melt solutions and tech-based melt adhesives, focusing on low-VOC formulations and eco-friendliness.

- Avery Dennison Corporation (USA): The global leader in the PSA industry that offers labels, graphics films, and specialty tapes strong focus on material-specific solutions and sustainability.

- H.B. Fuller Company (USA)

- Arkema S.A. (Bostik) (France)

- Dow Inc. (USA)

- Nitto Denko Corporation (Japan)

- Sika AG (Switzerland)

- tesa SE (Beiersdorf AG) (Germany)

- Ashland Global Holdings (USA)

- LINTEC Corporation (Japan)

- Illinois Tool Works Inc. (ITW) (USA)

- Wacker Chemie AG (Germany)

- BASF SE (Germany)

- Jowat SE (Germany)

Segment Covered in the Report

By Chemistry

- Acrylic

- Silicone

- Rubber-based

- Others (EVA, Polyurethane)

By Technology

- Water-based

- Radiation-Cured (UV)

- Hot Melt

- Solvent-based

By Application

- Tapes

- Graphics & Films

- Labels

- Others (Medical, Hygiene)

By End-Use Industry

- Packaging

- Automotive/EV

- Electronics

- Construction

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa