Content

Green Cement Market Size and Growth 2025 to 2034

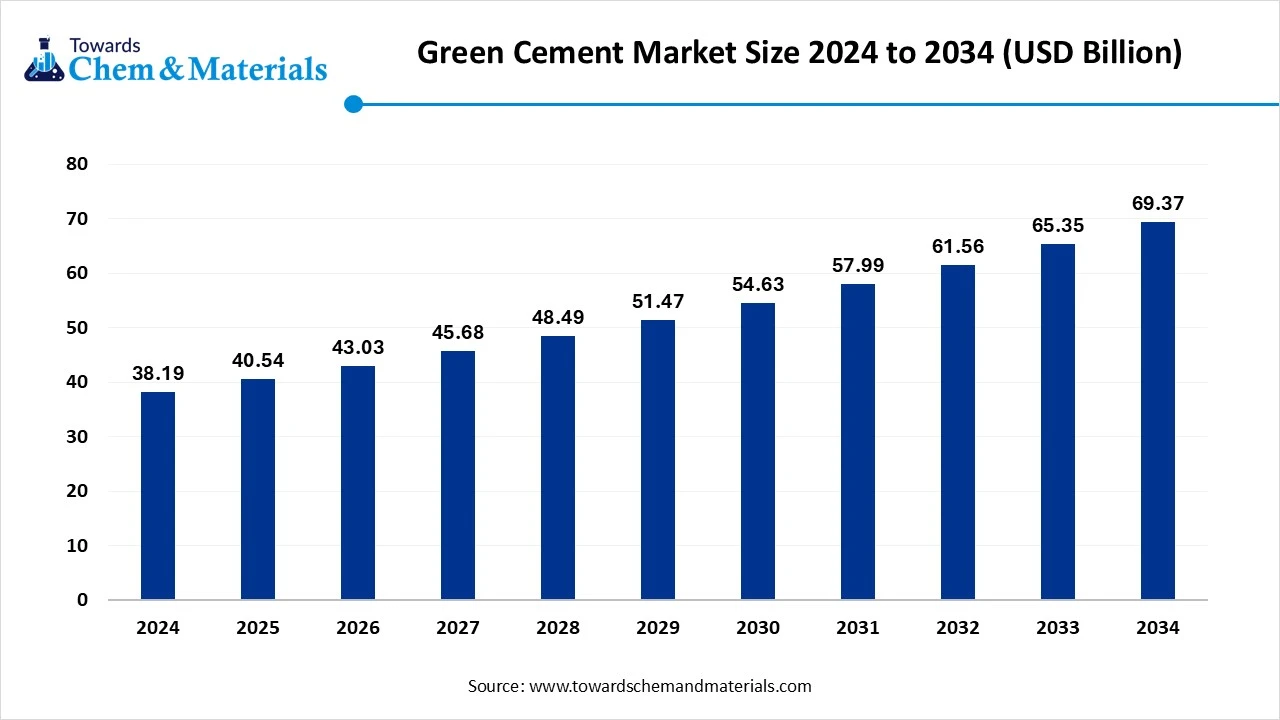

The global green cement market size was reached at USD 38.19 billion in 2024 and is expected to be worth around USD 69.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% over the forecast period 2025 to 2034.

Key Takeaways

- By region, Asia Pacific dominated the green cement market in 2024 with 45% of the industry share, akin to the sudden infrastructure updation and urbanization.

- By region, Europe is expected to grow at a notable rate in the future, owing to the implementation of stricter environmental regulations by regional governments and the push for sustainable manufacturing practices.

- By product type, the fly ash-based cement segment led the market in 2024 with 40% market share, due to factors such as cost-effectiveness, wide availability, and the ability to reduce carbon emissions effectively.

- By product type, the geopolymer cement & LC3 segment is expected to grow at the fastest rate in the market during the forecast period, kin to it is considered the next generation low carbon alternatives.

- By end-use industry, the building and construction segment emerged as the top-performing segment in the market in 2024 with 50% industry share, due to the housing, commercial spaces, and urban infrastructure projects being major consumers of green cement in the current period.

- By end use, the institution and government projects segment is expected to lead the market in the coming years, because governments are major investors in infrastructure, smart cities, and public buildings.

- By technology type, the alternative fuels and biomass segment led the market in 2024 with 35% market share because they help reduce reliance on fossil fuels like coal in cement kilns.

- By technology type, the carbon capture & utilization segment is expected to capture the biggest portion of the market in the coming years, because it is the most effective long-term solution for reducing cement industry emissions.

- By distribution channel, the direct sales to contractors segment led the market in 2024 with 55% market share, because construction companies prefer direct sourcing from manufacturers for cost savings and reliability.

- By distribution channel, the government procurement programs segment is expected to grow at the fastest rate in the market during the forecast period, because public sector projects will mandate green cement adoption.

Market Overview

From Waste to Wonder: The Power of Green Cement in Modern Construction

The global green cement market covers the production, distribution, and utilization of low-carbon, eco-friendly cement manufactured using alternative raw materials and innovative technologies that reduce CO₂ emissions compared to traditional Portland cement.

Green cement includes products made with industrial by-products (fly ash, slag, silica fume), recycled materials, and alternative fuels, as well as emerging technologies like carbon capture and utilization (CCU). Market growth is driven by stricter environmental regulations, sustainable construction initiatives, infrastructure modernization, and increasing demand from green buildings and smart cities projects.

What Factor is Driving the Green Cement Market?

The sudden shift towards sustainability and reducing carbon emissions initiatives has spearheaded industry growth in recent years. As several global regions are seen under the heavy implementation of the eco-friendly manufacturing laws, where the building and construction industry is considered the key industry. Also, initiatives like green building development and energy-efficient building construction have provided immense attention to the green cement industry in recnt years.

Market Trends

- The increase in technology advancement is driving industry growth in recent years, as the technology has actively improved the durability, performance, and quality of the cement.

- The growing adoption of alternative fuels like industrial waste, biomass, and others for the production of green cement has contributed to industry’s growth in the past few years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 40.54 Billion |

| Expected Size by 2034 | USD 69.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By End-User Industry, By Technology, By Distribution Channel, By Region |

| Key Companies Profiled | Heidelberg Cement, LafargeHolcim Ltd, Taiheiyo Cement Corporation, Taiwan Cement Corporation, Ecocem Ireland Ltd, ACC Limited, UltraTech Cement Ltd, Calera Corporation, Ceratech Inc, Solidia Technologies Inc |

Market Opportunity

As Coal Fades, Green Cement Rises to Fill the Gap

Boosting the production of green cement products, such as the LC3 and geopolymer cement, is likely to create lucrative opportunities for manufacturers in the coming years. Furthermore, by decreasing the accessibility of fly ash due to shutting down coal plants, manufacturers can gain significant industry share by providing these alternatives in the coming years.

Market Challenge

Green Cement Growth Faces Hurdles from Rising Production Costs

The higher production cost of green cement is anticipated to hinder the industry's growth in the coming years. Moreover, green cement also requires advanced technology with advanced materials, where the small and mid-sized companies are likely to face growth barriers during the upcoming years, as per the industry's future industry observation.

Regional Insights

Asia Pacific Green Cement Market Trends

Asia Pacific dominated the market in 2024, akin to the sudden infrastructure updation and urbanization. Moreover, the regional countries such India, China, and Japan are seen under the heavy and technologically advanced infrastructure adoption, which is leading to the industry growth in recent years. Furthermore, the global shift towards sustainability has significantly contributed to market potential in the past few years.

Why Does China Continue to Lead the Global Green Cement Market?

China maintained its dominance in the market, owing to the country being known as the leading producer of cement with greater consumption globally. Furthermore, the greater government push for eco-friendly manufacturing due to serious air pollution and carbon emission concerns is leading the industry growth in the current period, as per the recent market survey. Furthermore, the manufacturers in China have been actively seen in investing in eco-friendly compounds in recent years.

Europe Green Cement Market Trends

Europe is expected to capture a major share of the market, owing to the implementation of stricter environmental regulations by regional governments and the push for sustainable manufacturing practices. Moreover, the region has self-development programs like net zero emissions by 2050, and others are severely contributing to the industry growth in the current period. Furthermore, the heavy investment in advanced and recyclable materials has gained major industry in the past few years, as per the latest observation.

Segmental Insights

Product Type Insights

How did the Fly Ash-Based Cement Segment Dominate the Green Cement Market in 2024?

The fly ash-based cement segment held the largest share of the market in 2024, due to factors such as cost-effectiveness, wide availability, and the ability to reduce carbon emissions effectively. Moreover, by improving strength and durability, the fly ash has gained major industry attention in recent years. Furthermore, in green cement making, fly ash lowers the use of traditional clinker, which contributes to the industry's growth by reducing energy consumption.

The geopolymer cement & LC3 segment is expected to grow at a notable rate during the predicted timeframe, akin to it is considered the next generation low carbon alternatives. Moreover, cutting down the CO2 emissions effectively than the fly ash-based cement, the geopolymer cement & LC3 is expected to get heavy recommendation from the building and construction sectors in the upcoming years as per the observation.

End-Use Industry Insights

Why Does The Building And Construction Segment Dominate The Green Cement Market By End Use Industry?

The building and construction segment held the largest share of the market in 2024, due to the housing, commercial spaces, and urban infrastructure projects being major consumers of green cement in the current period. Furthermore, the government's push for an eco-friendly environment has played a major role in the growth of the segment in recent years.

The institution and government projects segment is expected to grow at a notable rate because governments are major investors in infrastructure, smart cities, and public buildings. They are under strong pressure to meet national and international climate targets, so they will increasingly mandate green cement use in roads, bridges, schools, hospitals, and other public works.

Technology Type Insights

How did the Alternative Fuels and Biomass Segment Dominate the Green Cement Market in 2024?

The alternative fuels and biomass segment dominated the market with the largest share in 2024 because they help reduce reliance on fossil fuels like coal in cement kilns. Cement manufacturing is energy-intensive, and switching to biomass, waste-derived fuels, or other alternatives lowers emissions while reducing energy costs

The carbon capture & utilization (CCU) segment is expected to grow at a significant rate because it is the most effective long-term solution for reducing cement industry emissions. Cement production is one of the biggest industrial sources of CO₂, and CCU technology can capture these emissions directly from factories.

Distribution Channel Insights

How Direct Sales to the Contractors Segment Gained Green Cement Market Attention?

The direct sales to contractors segment held the largest share of the market in 2024 because construction companies prefer direct sourcing from manufacturers for cost savings and reliability. Buying directly ensures a stable supply of green cement for large-scale projects like housing, offices, and roads. Contractors often have long-term agreements with cement producers, which helps secure bulk pricing and timely delivery.

The government procurement programs segment is expected to grow at a notable rate during the predicted timeframe because public sector projects will mandate green cement adoption. Governments are among the largest cement buyers for infrastructure like highways, railways, airports, and public buildings. With stronger climate policies, they will enforce sustainability requirements in tenders and contracts.

Green Cement Market Value Chain Analysis

Distribution to Industrial Users

The proppants are generally distributed in the form of sand, ceramic, and resin-coated particles

- Key Players: Carbo Ceramics Inc., Hexicon Inc., and U.S Silica Holdings

Chemical Synthesis and Processing

The chemical synthesis and processing of the proppants include the transformation of raw materials using higher temperatures, material selection, formulation and mixing, sintering, and polymerization.

Regulatory Compliance and Safety Monitoring

Proppants require rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality with the API and ISO standards.

Recent Developments

- In August 2025, Ramco Cements unveiled its latest production of eco-friendly plasters. Also, the newly launched eco-friendly product line of the company is called the low-water construction products, as per the company's claim.(Source : hefederal.com)

- In January 2025, Cemvision introduced its latest high-performance low-carbon cement. Also, the company has launched its cement in the United Kingdom as per the report published by the company recently.(Source: www.worldcement.com)

Green Cement Market Top Companies

- Heidelberg Cement

- LafargeHolcim Ltd

- Taiheiyo Cement Corporation

- Taiwan Cement Corporation

- Ecocem Ireland Ltd

- ACC Limited

- UltraTech Cement Ltd

- Calera Corporation

- Ceratech Inc

- Solidia Technologies Inc

Segment Covered

By Product Type

- Fly Ash-Based Cement

- Slag-Based Cement

- Limestone Calcined Clay Cement (LC³)

- Silica Fume-Based Cement

- Geopolymer Cement

- Others (Carbon Capture & Recycled Materials)

By End-User Industry

- Building & Construction

- Infrastructure & Public Works

- Industrial & Manufacturing

- Institutional & Government Projects

By Technology

- Carbon Capture & Storage (CCS)

- Carbon Capture & Utilization (CCU)

- Alternative Fuels & Biomass

- Waste Heat Recovery & Energy-Efficient Processes

By Distribution Channel

- Direct Sales to Contractors & Developers

- Construction Material Distributors

- Government Procurement Programs

- Online / Project-Based Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait