Content

Europe Green Building Materials Market Size and Growth 2025 to 2034

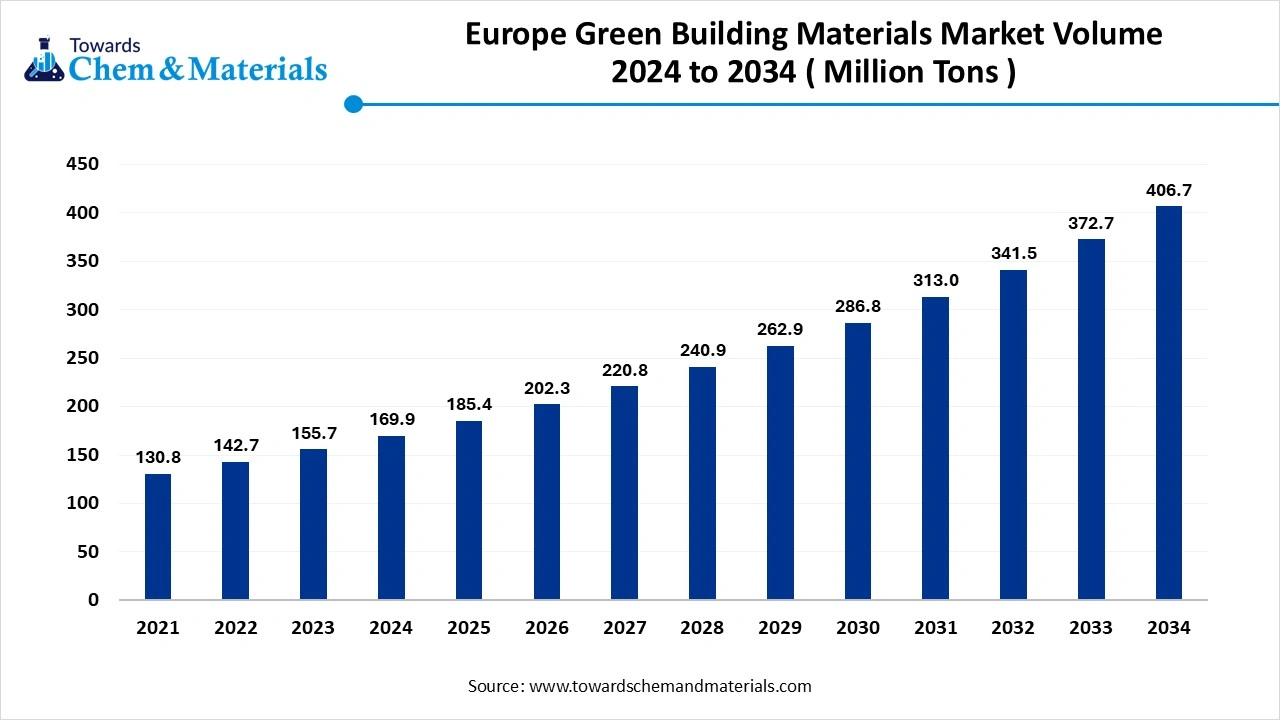

The Europe green building materials market volume was reached at 169.9 million tons in 2024 and is expected to be worth around 406.7 million tons by 2034, growing at a compound annual growth rate (CAGR) of 9.12% over the forecast period 2025 to 2034. The surge in environmental awareness is the key factor driving market growth. Also, a rise in government incentives coupled with innovations in building technologies can fuel market growth further.

Key Takeaways

- By region, the Western Europe region dominated the market with a 50% market share in 2024. The dominance of the region can be attributed to the ongoing implementation of various government initiatives.

- By region, the Northern Europe region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the strict regulations supporting energy-efficient buildings.

- By material type, the insulation materials segment held a 40% Europe green building materials market share in 2024. The dominance of the segment can be attributed to the increasing concerns associated with shifting climatic conditions.

- By material type, the green concrete segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the ongoing advancements in concrete production.

- By end use- application, the residential segment led the market by holding 45% market share in 2024. The dominance of the segment can be linked to the changing consumer inclination towards healthier living spaces.

- By end use- application, the commercial segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by increasing focus on minimizing carbon footprints to improve the sustainability of commercial structures.

- By technology, the energy-efficient technologies segment dominated the market with 35% market share in 2024 and is expected to sustain its dominance over the forecast period. The dominance of the segment is owed to the growing demand for cost-effective and sustainable building solutions.

- By technology, the recyclability & sustainability segment is expected to grow at a notable CAGR during the projected period. The growth of the segment is due to the rising focus on the circular economy in construction.

Innovations in Building Technologies are Expanding Market Growth

The European green building materials market refers to the market for materials used in the construction and renovation of buildings that are designed to minimize their environmental impact. These materials are energy-efficient, sustainable, and environmentally friendly. They focus on reducing waste, enhancing energy efficiency, and improving indoor air quality.

The market includes materials used in insulation, flooring, roofing, paints, windows, and other building components, with a growing emphasis on eco-friendly alternatives, energy savings, and sustainable sourcing. Major players in the market are increasingly focusing on advancements, acquisitions, and strategic collaborations to expand their market presence in the region.

What Are the Key Trends Influencing the Europe Green Building Materials Market?

- There is a surge in demand for sustainable construction materials because of the increasing adoption of eco-friendly practices across various industries, with construction being the latest trend in the market. Also, the growing awareness among most people regarding the benefits of sustainable construction materials is boosting market growth soon.

- The increase in the construction of smart cities is another trend shaping positive market growth.

- Smart cities use data and technology to improve sustainability, create efficiencies, and enhance overall quality-of-life factors for people working and living in the city. Green building materials provide better energy efficiency by minimizing the needs of buildings and infrastructure.

- Technological innovations in material science, like eco-friendly insulation and smart energy systems, are making green buildings more affordable and accessible, contributing to market expansion soon. There is a growing focus on redeveloping existing buildings to enhance their climate resilience and environmental performance.

How is the Government Supporting the Europe Green Building Materials Market?

Governments in the region are actively promoting the market through a combination of financial incentives, regulations, and public procurement policies. These efforts are minimizing carbon emissions by improving energy efficiency and supporting sustainable construction practices. Moreover, schemes such as LEED and BREEAM optimise the utilisation of sustainable materials in construction techniques, impacting positive market growth soon.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 185.4 Million Tons |

| Expected Volume by 2034 | 406.7 Miliion Tons |

| Growth Rate from 2025 to 2034 | CAGR 9.12% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By End-Use Application, By Technology, By Region |

| Key Companies Profiled | Saint-Gobain, Rockwool International, BASF SE, Kingspan Group, Johns Manville (a Berkshire Hathaway company), Owens Corning, CSR Limited, Knauf Insulation, Sika AG, Mineral Resources Limited, Etex Group, Interface, Inc., 3M, Boral Limited, Dow Inc., Green Building Council (GBC), Solvay SA, Titan Cement International S.A., USG Corporation, Kingspan Insulated Panels |

Market Opportunity

Innovations in Green Building Materials

Green building materials have experienced a substantial development in recent years, with an emphasis on eco-friendly and sustainable alternatives for insulation, creating lucrative opportunities in the market. Furthermore, mycelium composites, a latest class of green building materials, are increasingly gaining traction. Made from mycelium, these composites provide exceptional insulation properties and are easily biodegradable.

- In April 2025, T2Earth, a green building materials company, introduced the OnWood Plywood, a sustainable, fire-resistant wood. Designs without toxic chemicals, this product offers a sustainable design and Class A fire retardancy, giving developers and builders a higher-performing option.(Source: www.woodworkingnetwork.com)

Market Challenges

Need for Specialized Labor

Green building projects necessitate skilled labor with high expertise in BIM, energy-efficient design, and sustainable construction methods, which leads to higher labor costs, hampering market growth. Moreover, deploying renewable energy systems like geothermal and smart technologies, such as HVAC, adds further to the upfront investment, which again increases the overall implementation costs.

Country Insight

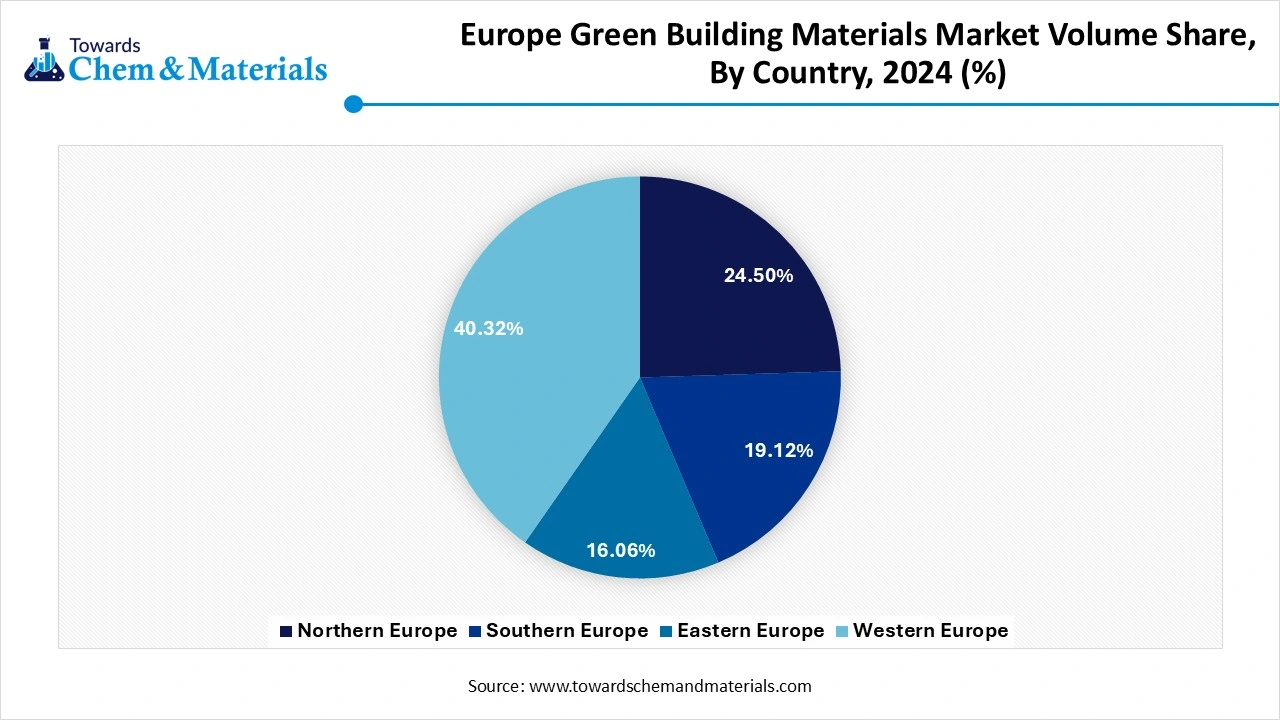

The Western Europe region dominated the market with a 50% market share in 2024. The dominance of the region can be attributed to the ongoing implementation of various government initiatives, which focus on smart renovations utilising green building materials to improve the sustainability of Europe's housing sector. In addition, innovations in ventilation, smart heating, and air conditioning (HVAC) systems are propelling energy usage in green buildings.

Europe Green Building Materials Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Northern Europe | 24.50% | 41.6 | 23.12% | 94.0 | 9.47% |

| Southern Europe | 19.12% | 32.5 | 20.10% | 81.7 | 10.80% |

| Eastern Europe | 16.06% | 27.3 | 17.67% | 71.9 | 11.36% |

| Western Europe | 40.32% | 68.5 | 39.11% | 159.1 | 9.81% |

| Total | 100.00% | 169.9 | 100.00% | 406.7 | 9.12% |

The Northern Europe region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the strict regulations supporting energy-efficient buildings, raised environmental awareness, and innovations in material science. Furthermore, northern European regions are especially emphasizing enhancing energy efficiency in buildings, which directly impacts the positive regional growth.

Who is the Top 5 Biggest Construction Companies in Europe?

| Company | Revenue 2024 (First nine months) (EUR Million) |

| Bouygues SA | 41,500 |

| ACS SA | 29,702 |

| VINCI SA | 23,545 |

| Eiffage SA | 14,834 |

| Strabag SE | 13,618 |

Segmental Insight

Material Type Insight

Which Material Type Segment Dominated the Europe Green Building Materials Market in 2024?

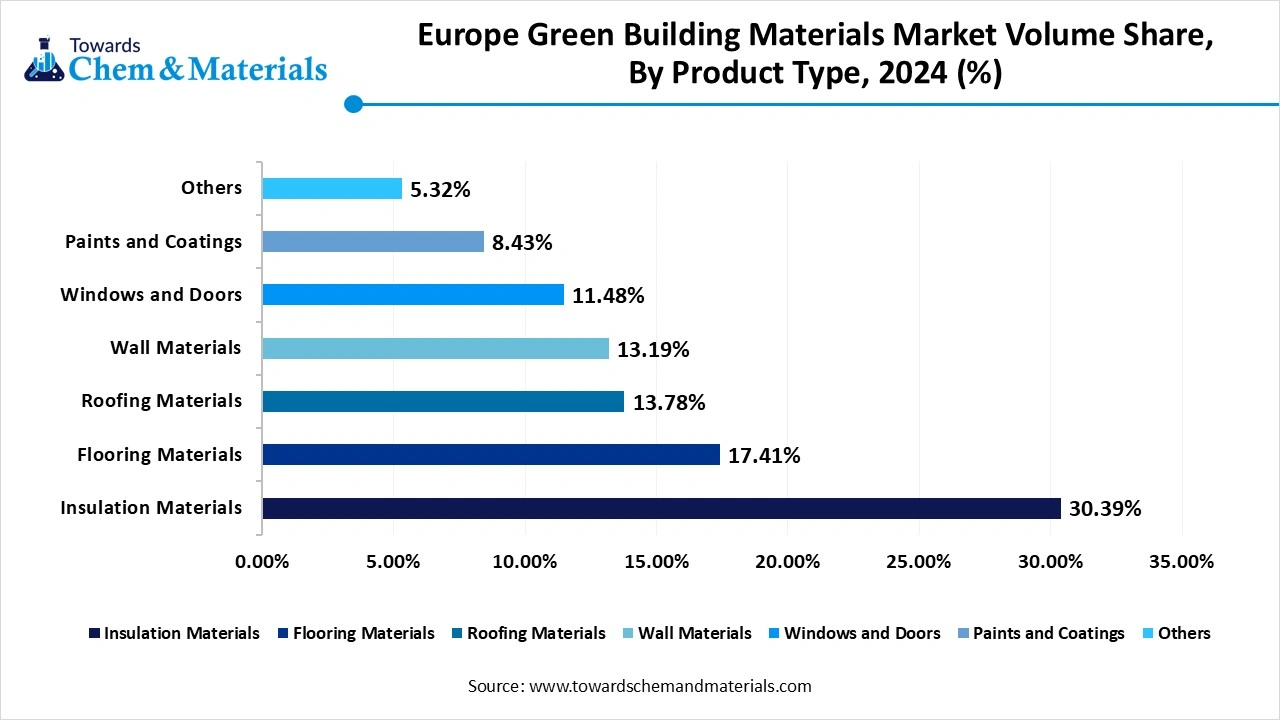

The insulation materials segment held a 40% market share in 2024. The dominance of the segment can be attributed to the increasing concerns associated with shifting climatic conditions, along with the growing need for energy-efficient insulation materials. Additionally, green insulation possesses superior properties to conventional insulation materials to emphasize minimizing carbon emissions and energy consumption.

The green concrete segment expects the fastest growth over the forecast period. The growth of the segment is due to the ongoing advancements in concrete production, such as the use of substitute raw materials with improved performance characteristics, which are enabling green concrete to become more appealing. Both commercial and residential sectors are witnessing growing adoption of green concrete due to its performance benefits.

Europe Green Building Materials Volume Share, By Material Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Insulation Materials | 30.39% | 51.6 | 29.58% | 120.3 | 9.85% |

| Flooring Materials | 17.41% | 29.6 | 16.41% | 66.7 | 9.46% |

| Roofing Materials | 13.78% | 23.4 | 14.30% | 58.2 | 10.64% |

| Wall Materials | 13.19% | 22.4 | 15.12% | 61.5 | 11.87% |

| Windows and Doors | 11.48% | 19.5 | 9.50% | 38.6 | 7.89% |

| Paints and Coatings | 8.43% | 14.3 | 9.22% | 37.5 | 11.28% |

| Others | 5.32% | 9.0 | 5.87% | 23.9 | 11.39% |

| Total | 100% | 169.9 | 100% | 406.7 | 9.12% |

End-Use Application Insight

Why the Residential Segment Held a Largest Europe Green Building Materials Market Share in 2024?

The residential segment led the market by holding 45% market share in 2024. The dominance of the segment can be linked to the changing consumer inclination towards healthier living spaces, coupled with the innovations in material science. Moreover, many European governments are offering subsidies and incentives for green building projects, further driving the adoption of green building practices in the residential sector, fuelling market growth shortly.

The commercial segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by increasing focus on minimizing carbon footprints to improve the sustainability of commercial structures. Also, the surge in research and development in green building technologies in emerging economies is boosting the adoption of sustainable materials in the commercial sector.

Technology Insight

How Did the Energy-Efficient Technologies Segment Dominated the Europe Green Building Materials Market in 2024?

The energy-efficient technologies segment dominated the market with 35% market share in 2024 and is expected to sustain its dominance over the forecast period. The dominance of the segment is owed to the growing demand for cost-effective and sustainable building solutions along with the rapid advancements in green building materials, like energy-efficient windows and advanced insulation, which are enabling green building to become more affordable and accessible in the region, leading to segment expansion soon in the market.

The recyclability & sustainability segment is expected to grow at a notable CAGR during the projected period. The growth of the segment is due to the rising focus on the circular economy in construction, emphasizing recycling, reuse, and reducing waste. Furthermore, governments across the region are increasingly implementing regulations and policies to facilitate sustainable construction across Europe.

Recent Developments

- In March 2025, the European Commission introduced the Clean Industrial Deal, a deal designed to boost Europe's industrial competitiveness while propelling Europe's decarbonisation efforts. The deal is in response to the increasing geopolitical tensions across the globe.(Source: www.globalelr.com )

Top Companies List

- Saint-Gobain

- Rockwool International

- BASF SE

- Kingspan Group

- Johns Manville (a Berkshire Hathaway company)

- Owens Corning

- CSR Limited

- Knauf Insulation

- Sika AG

- Mineral Resources Limited

- Etex Group

- Interface, Inc.

- 3M

- Boral Limited

- Dow Inc.

- Green Building Council (GBC)

- Solvay SA

- Titan Cement International S.A.

- USG Corporation

- Kingspan Insulated Panels

Segments Covered

By Material Type

- Insulation Materials

- Rigid Foam Insulation

- Spray Foam Insulation

- Fiberglass Insulation

- Cellulose Insulation

- Mineral Wool Insulation

- Flooring Materials

- Recycled Wood Flooring

- Bamboo Flooring

- Cork Flooring

- Rubber Flooring

- Linoleum Flooring

- Roofing Materials

- Solar Roof Panels

- Green Roofing

- Reflective Roofing

- Metal Roofing (recycled)

- Wall Materials

- Recycled Steel

- Clay Brick

- Timber

- Concrete with low carbon emissions

- Windows and Doors

- Low-emissivity Windows

- Triple-glazed Windows

- Thermally Broken Windows

- Sustainable Wood Doors

- Paints and Coatings

- Low VOC Paints

- Natural Paints

- Eco-Friendly Sealants and Coatings

- Others

- Green Concrete

- Recycled Steel

- Green Adhesives

By End-Use Application

- Residential

- Commercial

- Industrial

- Institutional (Hospitals, Schools, Government Buildings)

By Technology

- Energy-Efficient Technologies

- Passive Design Techniques

- Solar Panel Integration

- Smart Building Materials (Smart Windows, Energy Monitoring Systems)

- Recyclability & Sustainability

- Recycled Content Materials

- Biodegradable Building Materials

- Materials with Reduced Carbon Footprint

- Water Conservation Technologies

- Water-Resistant Materials

- Water-Permeable Paving

- Green Roofs for Stormwater Management

By Region

- Western Europe

- Northern Europe

- Southern Europe

- Eastern Europe