Content

Asia Pacific Gas Pipeline Infrastructure Market Size and Growth 2025 to 2034

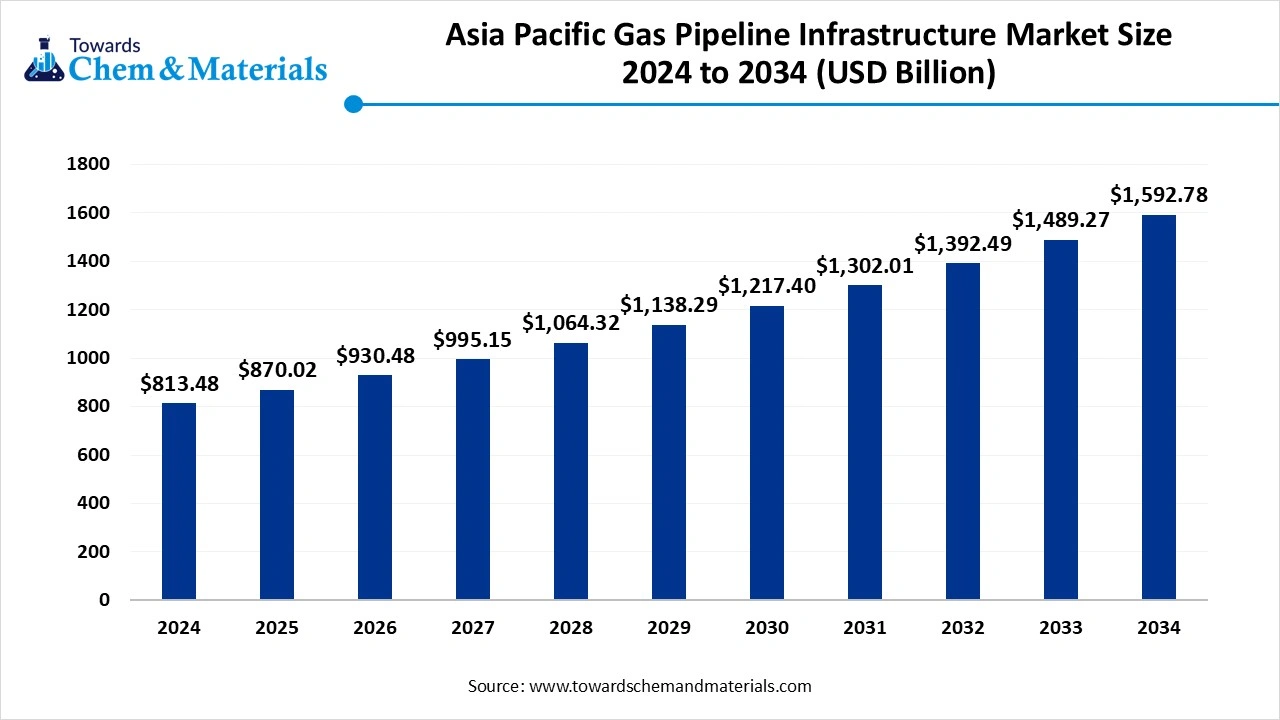

The Asia Pacific gas pipeline infrastructure market size was valued at USD 813.48 billion in 2024 and is expected to be worth around USD 1,592.78 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.95% over the forecast period from 2025 to 2034. The growing demand for energy, focus on clean energy, and expansion of pipeline network drive the market growth.

Key Takeaways

- By operation, the distribution segment led the market in 2024 due to the growing industrialization.

- By operation, the transmission segment is expected to grow at the fastest CAGR in the market during the forecast period due to the high consumption of natural gas.

- By equipment, the pipeline segment led the market in 2024 due to the high demand for transportation of natural gas.

- By equipment, the compressor station segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing investment in compression stations.

- By application, the onshore segment led the market in 2024 due to the low maintenance cost.

- By application, the offshore segment is expected to grow at the fastest CAGR in the market during the forecast period due to deepwater exploration.

Role of Asia Pacific Gas Pipeline Infrastructure in Energy Security

Asia Pacific gas pipeline infrastructure is a connected system of pipelines and compressor stations for the transportation of natural gas. The region consists of metering equipment, underground pipes, and compression stations. Asia Pacific includes projects like the Urja Ganga Gas Pipeline, Dumai-Medan Gas Pipeline, China’s West-to-East Gas Pipeline, and many more.

Factors like growing demand for energy, shift towards cleaner energy, strong government support, technological advancements, focus on energy security, high investment in LNG terminals, and growing expansion of pipeline networks contribute to the growth of the Asia Pacific gas pipeline infrastructure market.

- China has 431 units of natural gas pipelines.(Source: www.bakerinstitute.org)

- The Japan has total 261167 km of gas pipeline.(Source: www.iea.org)

- The authorized natural gas pipelines are 33347 km in India in 2023.(Source: www.pngrb.gov.in)

- The natural gas transmission pipelines are 42000 km in Australia.(Source: apga.org.au)

Growing Energy Demand Drives the Market Growth

The rapid urbanization and growing industrialization increase demand for energy. The growing consumption of energy in various sectors, like industrial, power, and transportation, increases demand for gas pipeline infrastructure. The increasing development of cities and the government's focus on energy security increase demand for gas pipeline infrastructure.

The growing consumption of energy in commercial and residential settings increases demand for gas pipeline infrastructure. The growing development of various infrastructure projects like roads, bridges, and others increases demand for energy. The growth in electrification and the high development of data centers increase energy demand.

Market Trends

- Growing Shift towards Cleaner Energy: The growing shift towards cleaner energy in applications like residential, power generation, and industrial processes increases demand for gas pipeline infrastructure.

- Rising Industrialization: The rapid urbanization and growing industrialization, like transportation & power generation, increase demand for gas pipeline infrastructure for the supply of energy.

- Government Support: The strong government support through various initiatives like the TAPI pipeline, India’s Urja Ganga Project, and the Central Asia-China Pipelines, and growing government investment in gas pipeline infrastructure help the market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 870.02 Billion |

| Expected Size by 2034 | USD 1,592.78 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Operation, By Equipment, By Application |

| Key Companies Profiled | China National Petroleum Corporation (CNPC), Sinopec Corp., Korea Gas Corporation (KOGAS), PetroChina Company Limited, Oil and Natural Gas Corporation (ONGC), Woodside Energy Group, Chevron Corporation, Petronas, GAIL (India) Limited, Shell |

Market Opportunity

Technological Advancements Unlock Market Opportunity

The ongoing technological advancements in gas pipeline infrastructure in the Asia Pacific enhance the safety of the pipeline. Advancements like digitalization, smart monitoring systems, integration with Machine Learning and Artificial Intelligence, advanced materials, and drone monitoring help to lower maintenance costs and enhance the durability of the pipeline. The growing integration of sensors and IoT helps in detecting leaks & anomalies of pipelines.

Advancements like machine learning & AI help in optimizing maintenance schedules and predicting failures of pipelines. The smart monitoring systems and drone monitoring enhance visual inspections of pipelines. The technological advancements create an opportunity for the growth of the Asia Pacific gas pipeline infrastructure market.

Market Challenge

High Capital Investment Limits Expansion of the Market

Despite several benefits of the gas pipeline infrastructure for energy security, the high capital investment restricts the market growth. Factors like fluctuations in the cost of raw materials, development of pipelines, need for specialized equipment, and specialized labor are responsible for high capital investment. The development of metering facilities, long-distance pipelines, and compressor stations requires high investment.

The fluctuations in the cost of raw materials like stainless steel increase the investment. The high cost of installation, operation, equipment, and maintenance directly affects the market. The regulatory hurdles and high investment in land acquisition increase the cost. The high capital investment hampers the growth of the Asia Pacific gas pipeline infrastructure market.

Regional Insights

Japan Asia Pacific Gas Pipeline Infrastructure Market Trends

Japan dominated the market in 2024. The well-established pipeline network and high LNG imports increase the development of gas pipeline infrastructure. The government investment, like JBIC, and a strong focus on energy security, help the market growth. The growing implementation of extensive regasification and decarbonization facilities enhance the growth for gas pipeline infrastructure. The presence of advanced infrastructure and energy transition policies drives the overall growth of the market.

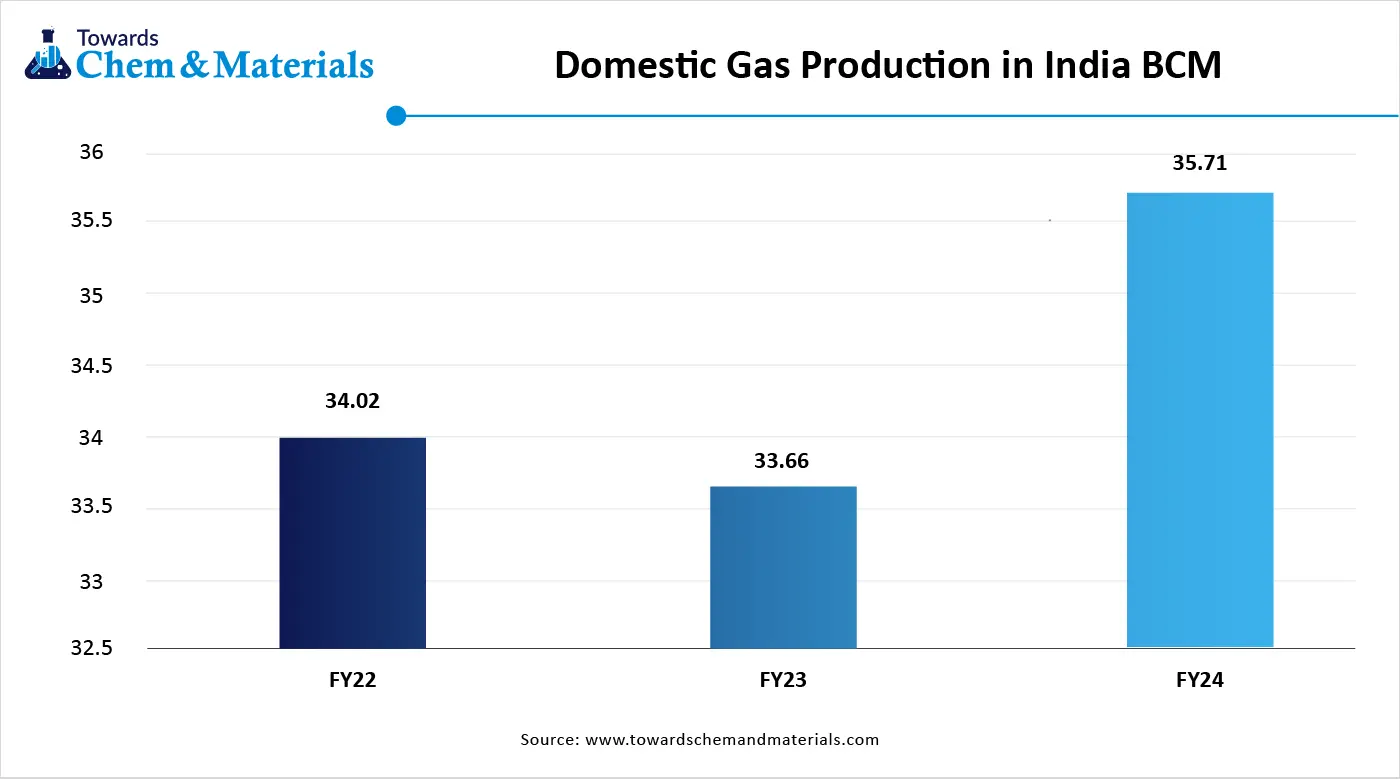

India Asia Pacific Gas Pipeline Infrastructure Market Trends

India is experiencing the fastest growth in the market during the forecast period. The presence of robust pipeline networks and high consumption of energy increases demand for gas pipeline infrastructure.

The growing shift towards clean fuels in the residential, industrial, and transportation sectors increases demand for gas pipeline infrastructure. The increasing expansion of City Gas Distribution and strong government support for the oil & gas sector increase demand for gas pipeline infrastructure. The strong focus on energy security and the need for enhancing LNG availability support the overall growth of the market.

- The operational natural gas pipelines are 24723km in India in 2023.(Source: www.pngrb.gov.in)

- The under construction natural gas pipelines are 10498km in India in 2023.(Source: www.pngrb.gov.in)

Segmental Insights

Operation Insights

Why did Operation Segment Dominate the Asia Pacific Gas Pipeline Infrastructure Market?

The distribution segment dominated the market in 2024. The growing industrialization in countries like Southeast Asia, China, and India increases demand for distribution. The high investment in pipeline networks and focus on energy security increases demand for distribution. The growing development of LNG import terminals and high consumption of energy increases the adoption of distribution.

The transmission segment is the fastest-growing in the market during the forecast period. The high consumption of natural gas and the energy transition increase demand for transmission. The strong focus on energy security and growing utilization of natural gas in the residential, industrial, & commercial sectors increases demand for transmission. The high investment in the modernization of transmission networks supports the overall growth of the market.

Equipment Insights

How the Pipeline Segment Held the Largest Share in the Asia Pacific Gas Pipeline Infrastructure Market?

The pipeline segment held the largest revenue share in the market in 2024. The focus on national energy security and growing consumption of energy increases demand for pipelines. The need for transportation of a large volume of natural gas and increasing demand for an environmentally friendly solution increase the adoption of pipelines. The focus on long-distance transmission and the need for handling a high volume of gas increase demand for pipelines. The high investment in pipeline networks and the need for a reliable energy delivery system drive the overall growth of the market.

The compressor station segment is experiencing the fastest growth in the market during the forecast period. The high consumption of natural gas and focus on ensuring efficient flow of gas increase demand for a compression station. The increasing cross-border gas trade and acceptance of compressor stations. The high investment in the development of the compression station and advancements in compressor technology support the overall growth of the market.

Application Insights

Which Application Segment Dominated the Asia Pacific Gas Pipeline Infrastructure Market?

The onshore segment dominated the market in 2024. The easier installation and growing demand for energy increase the demand for onshore. The need for transportation energy and a lower overall cost increases the adoption of onshore. The growing shale gas production and increasing investment in onshore pipelines help the market growth. The low maintenance of onshore, like frequent repairs & monitoring, and growing demand across power & industrial sectors, drives the market growth.

The offshore segment is the fastest-growing in the market during the forecast period. The growing consumption of energy and focus on the discovery of offshore gas fields increase demand for offshore. The focus on the transportation of high volumes of gas and the need for energy security increases demand for offshore. The increasing exploration of deepwater gas and high investment in the energy transportation system increase demand for offshore, supporting the overall growth of the market.

Asia Pacific Gas Pipeline Infrastructure Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for the Asia Pacific gas pipeline infrastructure includes natural gas and pipeline infrastructure like smart pigs, pipelines, & terminals & stations.

- Quality Testing and Certification: The quality testing involves pneumatic testing, leak testing, hydrostatic testing, magnetic particle testing, & visual inspection, and certification involves ISO 55001.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance involves the Petroleum and Natural Gas Regulatory Board, the Energy Commission, Trans-ASEAN Gas Pipeline, and BPH Migas across various Asia Pacific countries, and safety monitoring involves pipeline integrity, DFOS, leak detection, and security monitoring.

Recent Developments

- In August 2025, China launched a new gas pipeline, the Sichuan-to-East Gas Transmission Pipeline, to boost energy security. The capacity of the new pipeline is 3 billion cubic meters per year and supports energy consumption optimization.(Source: english.scio.gov.cn)

- In March 2025, Indian Oil collaborated with Hindustan Petroleum and Bharat Petroleum to launch the world's longest LPG pipeline in India. The pipeline is 2800Km long and has a yearly transport capacity of 8.3 million tons. It supports the expansion of energy infrastructure and enhances road safety.(Source: pgjonline.com)

- In March 2025, GSPL introduced the Chhara gas pipeline. The annual capacity of the pipeline is five million tons and connects with HPCL. The pipeline helps to lower environmental impact and consists of a receiving terminal at Lothpur. The pipeline has multiple valve stations and supports energy security in India.(Source: chemindigest.com)

Asia Pacific Gas Pipeline Infrastructure Market Top Companies

- China National Petroleum Corporation (CNPC)

- Sinopec Corp.

- Korea Gas Corporation (KOGAS)

- PetroChina Company Limited

- Oil and Natural Gas Corporation (ONGC)

- Woodside Energy Group

- Chevron Corporation

- Petronas

- GAIL (India) Limited

- Shell

Segments Covered

By Operation

- Transmission

- Distribution

By Equipment

- Pipeline

- Compressor Station

- Metering Skids

- Valves

- Others

By Application

- Onshore

- Offshore