Content

Wood Preservative Chemical and Coating Active Ingredient Market Size and Share 2034

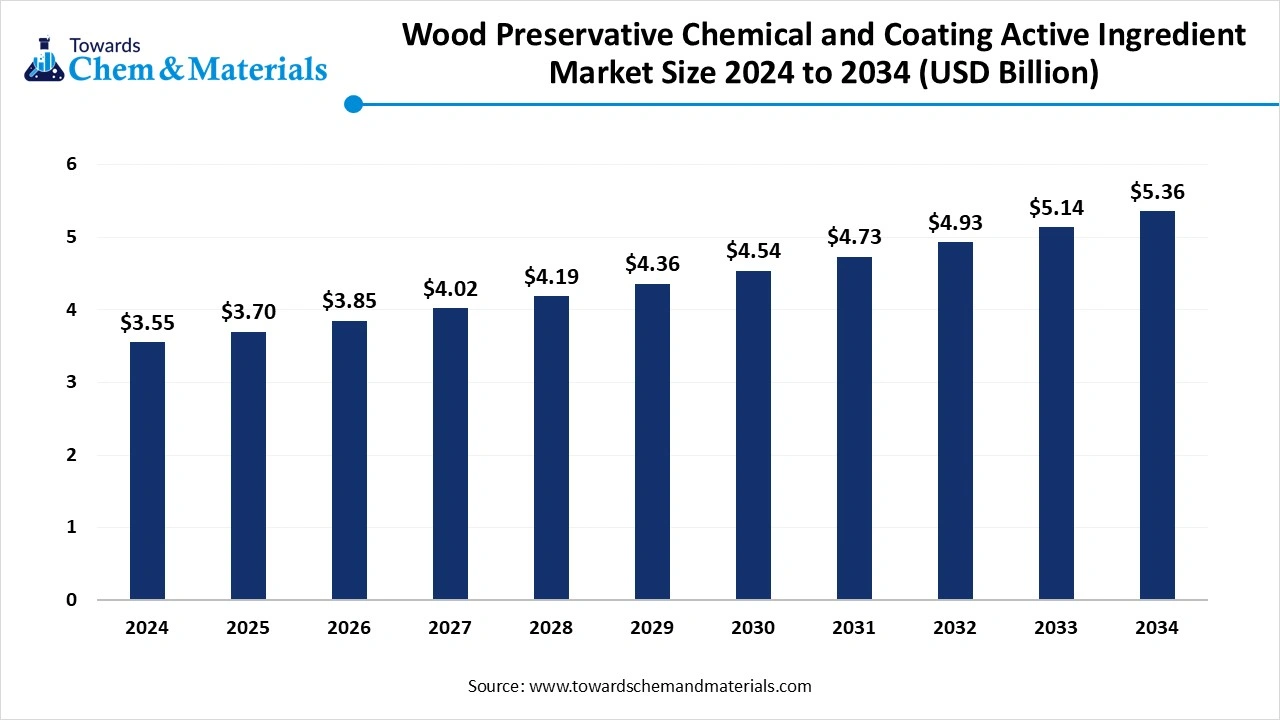

The global wood preservative chemical and coating active ingredient market size is calculated at USD 3.55 billion in 2024, grew to USD 3.70 billion in 2025, and is projected to reach around USD 5.36 billion by 2034. The market is expanding at a CAGR of 4.20% between 2025 and 2034. The increasing construction activity, growing environmental awareness, and advancement in preservation technologies drive the growth of the market.

Wood Preservative Chemical and Coating Active Ingredient Market Key Takeaway

- By region, North America dominated the market in 2024. High demand for durable, treated wood in residential, commercial, and outdoor applications drives the market in the region.

- By region, Asia Pacific is anticipated to have significant growth in the market in the forecasted period. The growth is driven by rapid urbanization, industrialization, and infrastructure development

- By application, the furniture dominated the market in 2024. Increasing demand for non-toxic, environmentally safe wood preservatives drives the growth.

- By application, the decking segment is anticipated to grow significantly in the wood preservative chemical and coating active ingredient market during the forecasted period. The consumers' demand for more sustainable and eco-friendly options drives the market.

- By formulation, the water-based segment dominated the market in 2024. The shift toward sustainable products and eco-friendly construction drives the demand.

- By formulation, the solvent-based segment is anticipated to grow in the forecasted period. High-performance applications increase the demand and help in expansion.

- By active ingredient, the copper compounds segment dominated the market in 2024. The growth is due to their effectiveness in preventing decay, insect infestation, and fungal growth.

- By active ingredient, the organic biocides segment is anticipated to grow in the forecasted period. The rising demand and need for green buildings and sustainability drive the growth.

- By end use, the residential segment dominated the wood preservative chemical and coating active ingredient market in 2024. The increasing need for durable, long-lasting wood in homes and outdoor areas drives the market.

- By end use, the commercial segment is anticipated to grow in the forecasted period. With increasing demand for eco-friendly materials, the commercial sector is also shifting towards more sustainable and non-toxic wood treatments, which drives the market.

Rising Demand For Durable Materials: Wood Preservative Chemical And Coating Active Ingredient Market To Expand

Wood preservatives, chemicals, and coating active ingredients are specialized substances used to protect wood from decay, insects, fungi, and harsh environmental conditions. They enhance the durability and lifespan of wood products, making them suitable for both indoor and outdoor applications.

These preservatives can be organic or inorganic, with growing demand for eco-friendly options that align with sustainability goals driving the growth of the market. They play a crucial role in the construction, furniture, and landscaping industries, which increases the demand for the product.

The wood preservative chemical and coating active ingredient market is driven primarily by the surge in construction activities, especially in residential, commercial, and infrastructure projects, where durable and decay-resistant wood is essential and in increasing demand. Increasing environmental awareness and stringent regulations against toxic chemicals like arsenic and chromium are pushing demand for eco-friendly, biodegradable preservatives.

Additionally, the growing popularity of outdoor wooden structures such as decks, fences, and landscaping features, along with innovations in preservation technologies like nanotechnology and micro-emulsions, are boosting market growth. Rising consumer preference for sustainable and certified wood products in regions further accelerates the adoption of advanced wood preservative solutions.

Wood Preservative Chemical and Coating Active Ingredient Market Trends

- Emphasis on sustainability and circular economy influences the market, growing focus on maximizing resource efficiency, minimizing waste, and promoting the sustainable use of resources.

- Rising demand for the market in construction and outdoor applications in the growing economic regions drives the market to grow.

- Shift towards eco-friendly preservatives is increasing the adoption of safer, biodegradable alternatives to traditional products such as borate-based treatment, plant-derived oils, etc.

- Technological advancement in preservation methods like nanotechnology, micro-emulsion formulation, and thermal modification enhances the efficiency of the product.

Wood Preservative Chemical and Coating Active Ingredient Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.70 Billion |

| Expected Size in 2034 | USD 5.36 Billion |

| Growth Rate | CAGR of 4.20% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Application, By Formulation, By Active Ingredient, By End Use, By Region |

| Key Companies Profiled | RPM International,Troy Corporation, Emerald Performance Materials,Ecolab ,Fuchs Petrolub ,ADAMA Agricultural Solutions ,Becker Acroma ,Arkema ,BASF, Clariant ,DuPont, Koppers ,Sherwin-Williams ,Lonza ,Westlake Chemical |

Wood Preservative Chemical and Coating Active Ingredient Market Opportunity

The Increasing Demand for Bio-Based And Plant-Derived Preservatives due to a Shift Towards Sustainability

A significant opportunity in the wood preservative chemical and coating active ingredient market lies in the growing demand for bio-based and plant-derived preservatives. With stricter environmental regulations and rising consumer awareness about sustainability, there is increasing interest in sustainable and eco-friendly alternatives to traditional synthetic chemicals.

Companies that develop effective, natural solutions using materials like essential oils, tannins, and lignin can gain a competitive advantage due to increasing demand. This shift will not only support eco-friendly construction but also open new market opportunities, especially in regions prioritizing green building practices and sustainability. Innovation in green chemistry is a major key in meeting the

Wood Preservative Chemical and Coating Active Ingredient Market Challenge

The High Cost Of Raw Materials and Eco-Friendly Products

One major challenge in the wood preservative chemical and coating active ingredient market is the high cost of eco-friendly alternatives. The strong demand for sustainable, non-toxic preservatives, developing and producing these bio-based solutions often involves higher research, production, and certification costs compared to traditional chemical treatments.

These increased costs make eco-friendly products less accessible or attractive, especially in price-sensitive markets. As a result, companies face the difficulty of balancing environmental responsibility with affordability, which slows down the widespread adoption of greener wood preservation technologies despite regulatory and consumer pressures, which hinders the growth of the market.

Wood Preservative Chemical and Coating Active Ingredient Market Regional Insights

North America Dominated The Market Due To The Strong Construction And Home Improvement Industries In The Region

North America dominated the market in 2024. North America is a leading market driven by strong construction and home improvement industries. The region is the primary contributor, with high demand for durable, treated wood in residential, commercial, and outdoor applications such as decking, fencing, and landscaping. Strict environmental regulations in the region are pushing manufacturers to develop and adopt eco-friendly preservatives, such as copper azole and alkaline copper quat. Additionally, growing consumer awareness of sustainability is driving the demand for non-toxic and biodegradable wood treatments, further boosting the wood preservative chemical and coating active ingredient market in North America.

The Strong Construction Sector and Rising Preference for Treated Wood in Various Applications

In the United States, the demand for wood preservatives is robust due to strong construction activities, particularly in residential, commercial, and outdoor sectors. There is a rising preference for treated wood in applications like decking, fences, and furniture, driven by the need for durability and resistance to decay. Canada also demonstrates solid market growth, influenced by increasing construction projects, especially in the residential housing sector. Both countries are increasingly shifting toward eco-friendly preservatives due to stricter environmental regulations and consumer demand for sustainable and non-toxic materials in construction and landscaping, which drives the growth of the wood preservative chemical and coating active ingredient market.

The Rapid Urbanization, Industrialization, and Infrastructural Development In The Region Drive The Growth of the Market

Asia Pacific is anticipated to grow significantly in the wood preservative chemical and coating active ingredient market in the forecasted period. The Asia-Pacific region is the fastest-growing market for wood preservatives, chemicals, and coating active ingredients, driven by rapid urbanization, industrialization, and infrastructure development. Rising construction activities, increasing disposable incomes, and expanding real estate sectors are fueling demand for treated wood products.

The region's growing awareness of the need for durable and long-lasting construction materials also supports market growth. Environmental concerns are encouraging a gradual shift toward eco-friendly preservatives. Countries in the region are investing heavily in residential, commercial, and public projects, creating strong opportunities for wood preservation solutions. Overall, Asia-Pacific offers a highly dynamic and promising market environment.

The top three exporters of Wood preservatives are Russia, China, and India. Russia leads the world in Wood Preservative exports with 34,347 shipments, followed by China with 3,036 shipments, and India taking the third spot with 1,015 shipments.

The Growing Urbanization And Government Initiatives, and Growing Demand For Durable Wood Products Drive The Growth of the Market.

In India, rapid urbanization, infrastructure projects, and industrial growth are driving significant demand for wood preservatives. As construction booms, treated wood is increasingly preferred for residential and commercial applications. Growing urbanization and government initiatives promoting affordable housing boost the need for durable, treated wood products, particularly for outdoor structures.

The focus on advanced preservation technologies, with a strong demand for eco-friendly solutions, drives the growth. India's focus on prioritizing sustainability, with increased use of certified and treated wood in both residential and commercial sectors, is seeing growth due to high demand for wood preservation in its expanding construction markets.

The size of the Indian chemical industry in 2022 was 220 billion USD and is expected to reach 1 trillion USD in 2040, which contributes to around 7% of India's GDP and 2.8-3% of the total global chemical Industry.

Wood Preservative Chemical and Coating Active Ingredient Market Segmental Insights

Application Insights

The furniture segment dominated the wood preservative chemical and coating active ingredient market in 2024. The furniture segment plays a significant role in the wood preservatives market, as treated wood is essential for ensuring the longevity and durability of wooden furniture. Wood preservatives in this segment protect furniture from termites, fungal decay, and environmental damage, extending its lifespan and preserving its appearance. As sustainability and eco-friendly products gain popularity, there is an increasing demand for non-toxic, environmentally safe wood preservatives in the furniture industry.

The decking segment expects significant growth in the market during the forecast period. The decking segment is a key application for wood preservatives, as decks are exposed to harsh outdoor conditions, including moisture, UV rays, and temperature fluctuations, which can lead to rapid deterioration of untreated wood. As consumers demand more sustainable and eco-friendly options, there is a growing trend toward using biodegradable and non-toxic preservatives in decking materials.

Formulation Insights

The water-based segment dominated the market in 2024. Water-based wood preservatives are increasingly popular due to their lower environmental impact, ease of application, and reduced toxicity compared to other formulations. Their fast-drying nature and minimal odour make them a preferred choice for homeowners and professionals alike, contributing to their growing adoption. Additionally, the shift toward sustainable products and eco-friendly construction is further driving demand for water-based preservatives in the wood treatment market.

The solvent-based segment expects significant growth in the wood preservative chemical and coating active ingredient market during the forecast period. Solvent-based wood preservatives are known for their excellent performance in providing long-lasting protection.

These preservatives use organic solvents to dissolve active ingredients, allowing them to penetrate deeper into the wood and offer superior durability. Solvent-based treatments are often preferred for high-performance applications, where wood is exposed to harsh environmental conditions. They provide stronger resistance to water, extreme weather, and wear, making them ideal for application, which increases the demand and drives the market.

Active Ingredients Insights

The copper compounds segment dominated the wood preservative chemical and coating active ingredient market in 2024. Copper-based compounds are one of the most widely used categories of wood preservatives due to their effectiveness in preventing decay, insect infestation, and fungal growth. These compounds are commonly used in outdoor applications, as they offer superior resistance to moisture, UV damage, and insects.

Copper-based preservatives are particularly popular due to their effectiveness in maintaining wood integrity under challenging environmental conditions, and their use continues to grow in eco-conscious markets due to their relatively low environmental impact compared to other chemical treatments.

The organic biocides segment expects significant growth in the wood preservative chemical and coating active ingredient market during the forecast period. Organic biocides in wood preservation are becoming increasingly popular due to their ability to provide effective protection. These preservatives often contain active ingredients derived from natural sources.

Organic biocides are particularly appealing in residential, commercial, and furniture applications, as they offer a safer, non-toxic alternative to more hazardous substances. With regulatory pressures increasing for environmentally responsible solutions, the use of organic biocides in wood preservatives is expected to continue to rise, especially in markets focused on green building and sustainability.

End Use Insights

The residential segment dominated the wood preservative chemical and coating active ingredient market in 2024. The market is driven by the need for durable, long-lasting wood in homes and outdoor areas. Wood preservatives are essential in protecting wooden structures. In residential applications, water-based preservatives are often preferred due to their ease of use, minimal odour, and eco-friendly properties.

Organic biocides are also gaining popularity as safer, non-toxic alternatives. The regulations concerning the use of hazardous chemicals are pushing the residential market toward more environmentally friendly preservative options, which helps in the expansion of the market.

The commercial segment expects significant growth in the wood preservative chemical and coating active ingredient market during the forecast period. The commercial segment of the wood preservatives market is driven by the need for durable wood used in high-traffic areas.

Wood preservatives are critical in ensuring the longevity and structural integrity of wooden elements, which are exposed to harsh environmental conditions, wear, and tear. With increasing demand for eco-friendly materials, the commercial sector is also shifting towards more sustainable and non-toxic wood treatments, aligning with green building standards and regulations in many regions, which drives the market.

Wood Preservative Chemical and Coating Active Ingredient Market Recent Developments

Arxada

- Innovation: In April 2025, Arxada, a global leader in specialty chemicals and innovative solutions, launched NUGEN HLD-CD, a groundbreaking healthcare disinfectant. This innovative solution rapidly disinfects medical devices in just five minutes, effectively eliminating even the most resilient microorganisms that can withstand harsh conditions.

T2EARTH

- Launch: In April 2025, T2EARTH unveiled OnWood Plywood, a cutting-edge, eco-friendly fire-retardant treated wood that offers strength, Class A fire retardancy, and sustainability. Free from toxic chemicals, OnWood provides builders and developers with a healthier, high-performance, and affordable solution for fire-prone environments. When paired with OnWood Dimensional Lumber, T2EARTH is helping meet the growing demand for eco-friendly, fire-resistant "hardened homes" in today’s market.

WOODSAFE WPG

- Launch: In June 2024, WOODSAFE WPG is a premium product designed to meet the EU Construction Products Regulation CPR 305/2011 requirements. It boasts several key features, including being 100% free of substances requiring labeling, having approved emission values, being pH neutral, and possessing non-hygroscopic properties. Upon launch, the WPG™ product has been environmentally assessed and approved under all relevant assessment schemes.

Wood Preservative Chemical and Coating Active Ingredient Market Top Companies List

- RPM International

- Troy Corporation

- Emerald Performance Materials

- Ecolab

- Fuchs Petrolub

- ADAMA Agricultural Solutions

- Becker Acroma

- Arkema

- BASF

- Clariant

- DuPont

- Koppers

- Sherwin-Williams

- Lonza

- Westlake Chemical

Segments Covered in the Report

By Application

- Decking

- Furniture

- Plywood

- Timber

- Fencing

By Formulation

- Water-Based

- Solvent Based

- Oil-Based

By Active Ingredient

- Copper Compounds

- Boric Acid

- Organic Biocides

- Synthetic Pyrethroids

By End Use

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait