Content

Sealing Tapes Market Size and Forecast 2025 to 2034

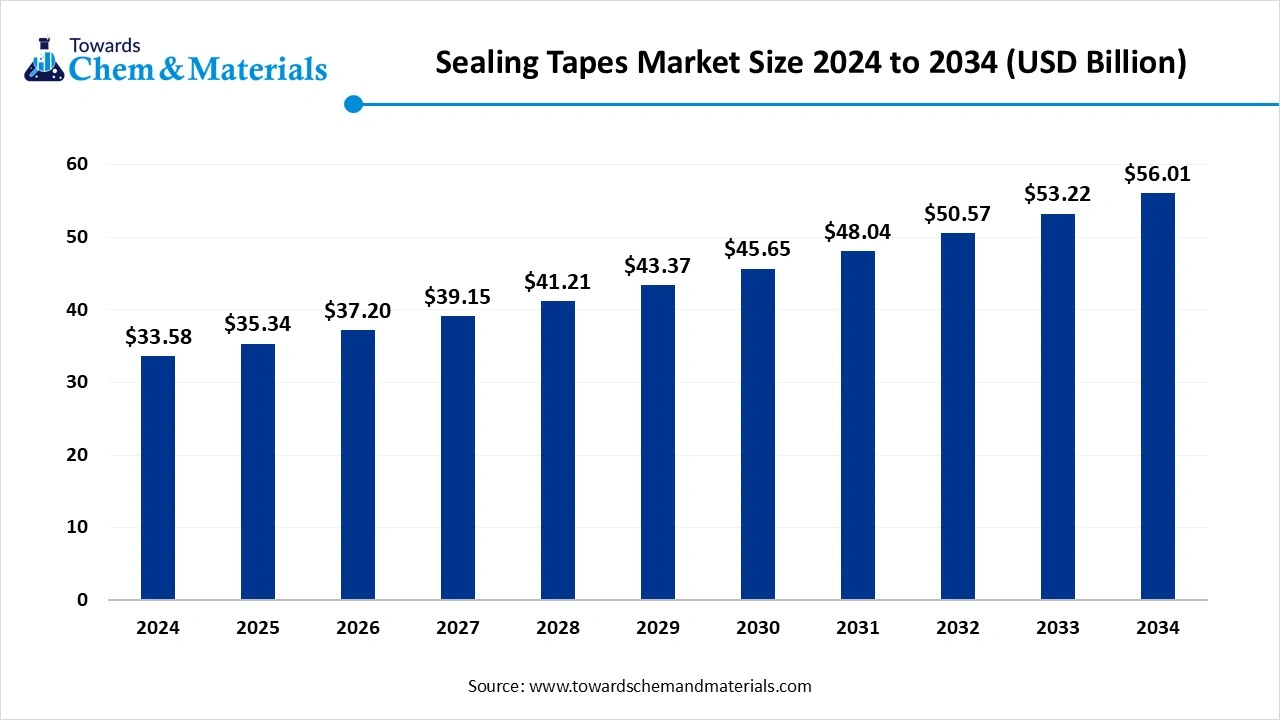

The global sealing tapes market size was valued at USD 33.58 billion in 2024. The market is projected to grow from USD 35.34 billion in 2025 to USD 56.01 billion by 2034, exhibiting a CAGR of 5.25% during the forecast period. The growing construction sector, increasing utilization in healthcare, and the rise of e-commerce drive the growth of the market.

Key Takeaways

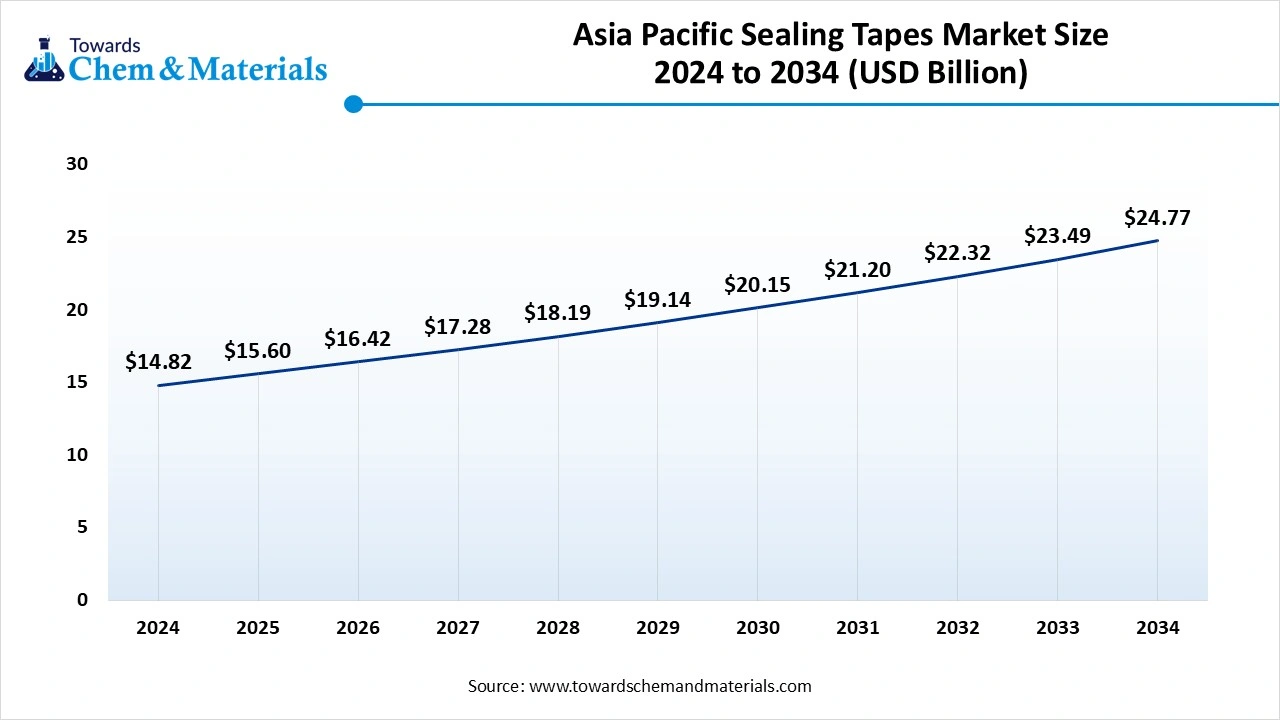

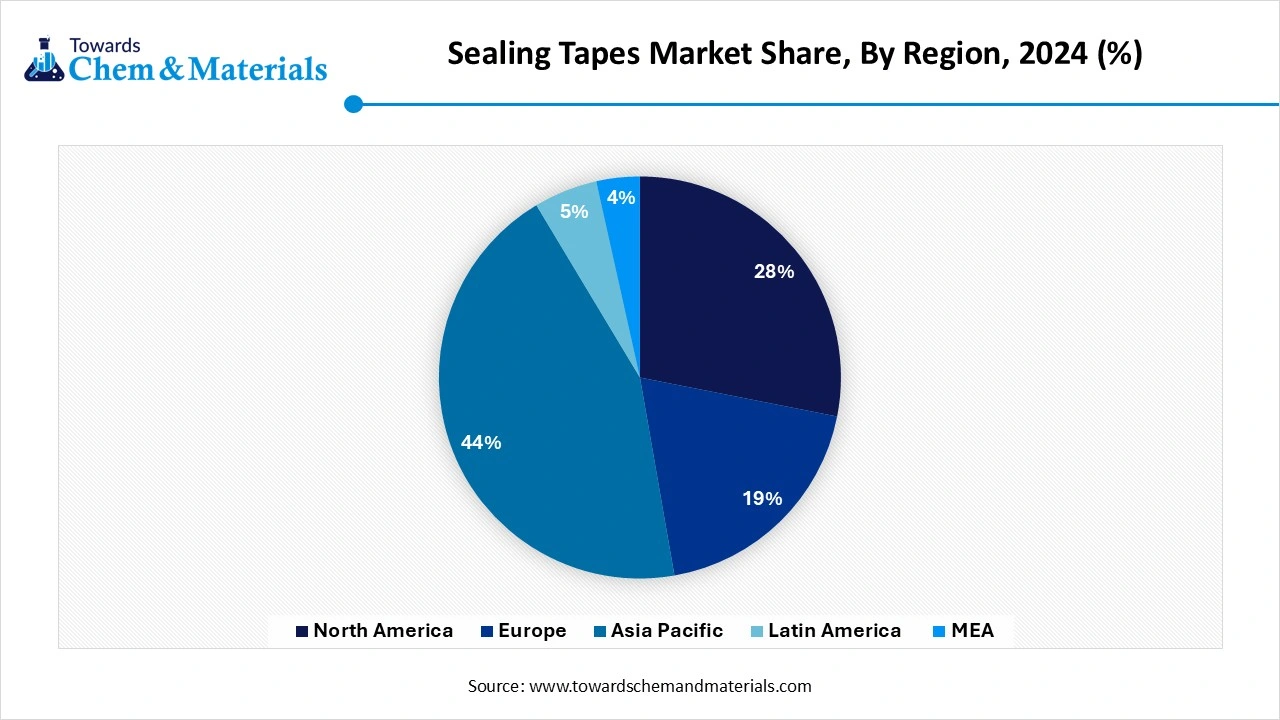

- By region, Asia Pacific dominated the global sealing tapes market and accounted for the revenue share of about 44.14% in 2024. due to the growing expansion of various end-user industries.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the increasing various construction activities.

- By material type, the plastic-based segment dominated the market in 2024 due to the growing demand from the e-commerce sector.

- By material type, the foil-based segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand from automotive applications.

- By adhesive type, the acrylic segment led the market in 2024 due to the strong focus on sustainability.

- By adhesive type, the silicone-based segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing manufacturing in the automotive and aerospace industries.

- By backing material, the BOPP segment dominated the market in 2024 due to the increasing demand for reliable packaging.

- By backing material, the foam segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand from the construction sector.

- By application, the packaging segment held the largest revenue share of the market in 2024 due to the rapid growth in online shopping.

- By application, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of electric and hybrid vehicles.

- By end-use industry, the e-commerce segment dominated the sealing tapes market in 2024 due to the rapid growth in online ordering of various consumer goods.

- By end-use industry, the healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing chronic wounds and surgical procedures.

- By product type, the single-sided sealing tape segment held the largest revenue share of the market in 2024, due to the increasing demand from various healthcare applications.

- By product type, the foam tapes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand from the electronics sector.

Sealing Tapes: A Power Behind Modern Industry and Manufacturing

Sealing Tapes refer to adhesive tapes designed for creating a dustproof, waterproof, and airtight barrier by sealing seams, gaps, and joints. They are used for sealing cartons, packages, and other products to maintain integrity, secure closure, and protection from contaminants during the storage or transportation process. Sealing tapes prevent leaks, secure items, and protect against UV rays, dust, & moisture. The rapid growth in the e-commerce sector and the expansion of logistics increase demand for sealing tapes. The growing demand for sealing tapes in healthcare, like surgical procedures, medical device assembly, and wound care, helps the market growth. The increasing demand from industries like packaging, automotive, plumbing, construction, and electronics contributes to the sealing tapes market growth.

- India exported 73 shipments of carton sealing tape.(Source: www.volza.com )

- India exported 10,106 shipments of BOPP tapes.(Source: www.volza.com )

- Vietnam exported 46,653 shipments of the foam tape.(Source: www.volza.com )

- The United States exported 408 shipments of duct sealing tapes.(Source: www.volza.com)

The Growing Construction and Infrastructure Development

The rapid urbanization and rising demand for residential, commercial, and infrastructure development increase demand for sealing tapes for various applications. Sealing tapes are used in areas like doors, roofing, and windows for creating waterproof & airtight seals in construction buildings. The growing focus on infrastructure development increases demand for sealing tapes in various infrastructure components, pipelines, and tunnels.

The growing focus on fire safety and energy efficiency in construction increases demand for sealing tapes. The rapid growth in renovation and new construction is fueling demand for sealing tapes for various applications. The increasing focus on eco-friendly construction applications is driving demand for sealing tapes. The construction applications, like sealing joints, thermal insulation, electrical insulation, vibration damping, and many more, increase demand for sealing tapes. The growing construction and infrastructure development is a key driver for the growth of the sealing tapes market.

Market Trends

- The Rapid Growth in Online Shopping: The growing rate of online shopping increases the demand for sealing tapes for flexible packaging and shipping products securely.

- The Growing Demand from the Healthcare Industry: The growing demand for various medical products like surgical, medical devices, and wound care products increases the demand for sealing tapes. The rise in surgical procedures and home healthcare fuel demand for sealing tapes.

- The Increasing Demand for Protective Accessories and Apparel: The growing demand for protective accessories and clothing in industries like chemical protection, medical, and military increases demand for seam sealing tapes for ensuring the wearer’s protection & safety.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 35.34 Billion |

| Market Size by 2034 | USD 56.01 Billion |

| Growth rate from 2024 to 2025 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Adhesive Type, By Backing Material, By Application, By End-Use Industry, By Product Type, By Region |

| Key Companies Profiled | 3M Company, Nitto Denko Corporation, tesa SE (Beiersdorf AG), Intertape Polymer Group Inc., Avery Dennison Corporation, Shurtape Technologies LLC, Scapa Group Ltd., Henkel AG & Co. KGaA, Berry Global Inc., Saint-Gobain Performance Plastics, H.B. Fuller Company, LINTEC Corporation, Lohmann GmbH & Co. KG, Rogers Corporation, Jonson Tapes Limited, Ajit Industries Private Limited, Vibac GroupPPM Industries S.p.A, Advance Tapes International, Teraoka Seisakusho Co., Ltd. |

Market Opportunity

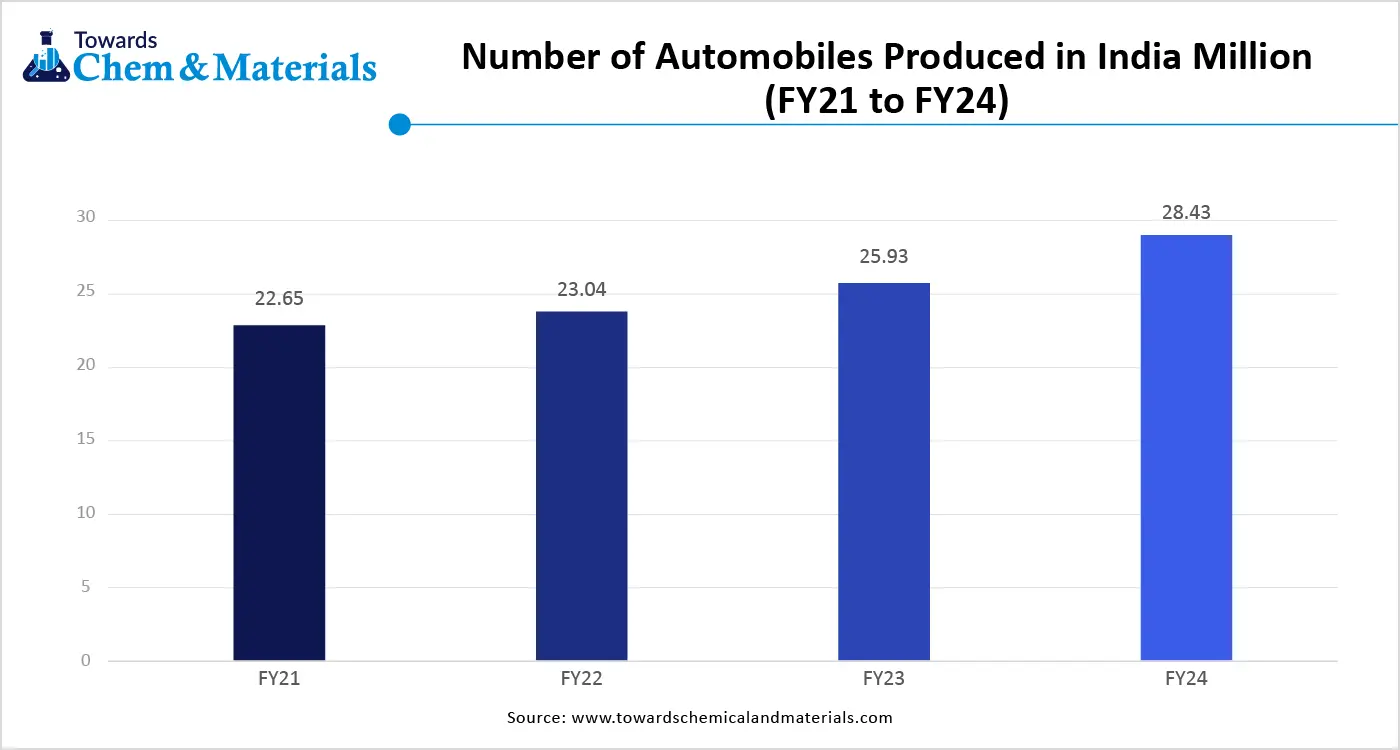

The Growing Automotive Industry Surges Demand for Sealing Tapes

The growing automotive industry and increasing production of vehicles fuel demand for sealing tapes for various applications. The growing focus on improving vehicle performance and fuel efficiency increases demand for lightweight materials like sealing tapes. Thy enhances passenger comfort & driving experience by reducing noise and dampening vibrations of vehicles.

The growing adoption & production of hybrid and electric vehicles increases demand for sealing tapes for powertrain components and battery packs. The growing focus on aesthetic improvements of vehicles has fueled demand for sealing tapes to enhance the look. The growing automotive manufacturing, like bonding exterior parts, wire harnessing, and interior mounting, increases demand for sealing tapes. The growing automotive industry creates an opportunity for the growth of the sealing tapes market.

Market Challenge

High Initial Cost Restrains Expansion of Sealing Tapes Market

Despite several advantages of the sealing tapes in various industries, the high initial cost restricts the market growth. Factors like the need for specialized machinery, complex manufacturing processes, and fluctuating raw material prices are responsible for the high initial cost. The requirement of specialized materials and complex formulations of raw materials like adhesives, acrylic foams, and UV-curable resins increases the initial cost.

The need for advanced machinery and focus on strict quality control fuels the initial cost. The complex manufacturing process requires skilled labor, which increases the cost. The fluctuations in the raw materials like resins, petrochemical derivatives, and various chemicals used lead to higher costs. The high initial investment in infrastructure for the production of sealing tapes increases the cost. The high initial cost hampers the growth of the market.

Regional Insights

Why did Asia Pacific Dominate the Sealing Tapes Market?

The Asia Pacific sealing tapes market is expected to increase from USD 15.60 billion in 2025 to USD 24.77 billion by 2034, growing at a CAGR of 5.27% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the sealing tapes market in 2024. The growing manufacturing in various industries like electronics, automotive, and construction increases the demand for sealing tapes. The growing focus on eco-friendly and sustainable packaging solutions helps in the market growth. The easily available raw materials and low labor cost increase the production of the sealing tapes. The growing expansion of the end-use industries like automotive, construction, and electronics in regions leads to higher demand for sealing tapes. The rise of the e-commerce sector in countries like India and China drives the overall growth of the market.

China Sealing Tapes Market Trends

China is a major contributor to the market. The rise in e-commerce increases demand for sealing tapes for packaging applications. The readily available raw materials and low labor cost increase the production of the sealing tapes. The growing strong government support for domestic manufacturing through initiatives like Made in China increases the production of sealing tapes. The well-established manufacturing in sectors like automotive and electronics supports the overall growth of the market.

- China exported 194 shipments of carton sealing tape.(Source: www.volza.com)

- China exported 26,177 shipments of BOPP tapes. (Source: www.volza.com)

- China exported 348 shipments of duct sealing tapes.(Source: www.volza.com)

Why is the Middle East & Africa the Fastest Growing in the Sealing Tapes Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing construction of the transportation infrastructure, new roads, and bridges increases demand for sealing tapes. The growing investment in infrastructure development and real estate helps in the market growth. The growing industrialization in the region increases demand for the sealing tapes. The growing focus on improving supply chain efficiency and logistics leads to higher demand for sealing tapes. The rapid growth in the e-commerce sector in the region drives the overall growth of the market.

What are the Growth Factors for the Sealing Tapes Market in South Africa?

South Africa is growing in the market. The growing advancements in the automotive industry and the rising production of vehicles increase demand for sealing tapes. The growing investment in infrastructure projects like non-residential and residential construction helps in the market growth. The growing food & beverage industry increases demand for sealing tapes for packaging. The growing packaging industry and the rise of e-commerce support the overall growth of the market.

Segmental Insights

Material Type Insights

Why Plastic-Based Segment Dominates the Sealing Tapes Market?

The plastic-based segment led the market in 2024. The rise of e-commerce and the growing demand for packaging increases the demand for plastic-based tapes. The increasing demand from key industries like electronics, construction, and automotive helps the overall growth of the market. The BOPP is growing in the plastic-based sealing tapes market. BOPP tapes are cost-effective and have high durability & tensile strength. It is used on various surfaces and sustains in varying temperatures & moisture. They are user-friendly and have good initial adhesion. The growing demand from various sectors like e-commerce, manufacturing, packaging, retail, and logistics drives the market growth.

The foil-based segment is the fastest-growing in the market during the forecast period. The growing demand from construction for seams, sealing ductwork, and joints helps in the market growth. Foil-based tapes provide excellent moisture & heat resistance and offer energy efficiency. The aluminium foil is widely used in various applications. Foil-based materials withstand various environmental conditions and are widely used in HVAC systems. The growing automotive industry is fueling demand for foil tapes for heat shielding and wire & cable wrapping. The growing demand from various industries like aerospace, electronics, and packaging supports the overall growth of the market.

Adhesive Type Insights

How Acrylic Segment Dominates Sealing Tapes Market?

The acrylic segment dominated the sealing tapes market in 2024. The strong bonding capabilities with various materials like plastic, ceramic, wood, metal, and glass increase demand for acrylic adhesives. The water-based acrylics demand is growing in various industries. The growing focus on sustainability and eco-friendliness increases demand for water-based acrylics, helping in the market growth. The growing packaging and construction industry increases demand for water-based acrylics. The rising expansion of industries like healthcare, automotive, e-commerce, and electronics drives the overall market growth.

The silicon-based segment is experiencing the fastest growth in the market during the forecast period. The growing demand for high-performance materials in various sectors increases the demand for silicon-based sealing tapes. The growing production in the aerospace & automotive industries helps the market growth. Silicon-based tapes provide excellent electrical insulation, sustain high temperatures, and are highly UV resistant. The growing focus on eco-friendly and sustainable solutions increases demand for silicon-based tapes. The increasing demand from various industries like aerospace, electronics, construction, automotive, electrical, and medical drives the overall growth of the market.

Backing Material Insights

How BOPP Held the Largest Share of the Sealing Tapes Market?

The BOPP segment held the largest revenue share of the sealing tapes market in 2024. The rapid growth in the e-commerce sector increases demand for BOPP for secure shipping. The growing expansion of the manufacturing sector increases demand for packaging, helping in the market growth. BOPP provides excellent clarity and is moisture-resistant. BOPP ensures the integrity of the seal and is a cost-effective packaging solution. The growing consumer spending on packaged goods increases demand for reliable packaging, driving the overall growth of the market.

The foam segment is the fastest growing in the market during the forecast period. The growing demand from the construction industry for applications like insulation, sealing, and weatherproofing increases demand for the foam material.

Foam tapes offer excellent insulators and provide durable & strong bonds on a wide range of surfaces like composites, metals, and plastics. They are highly resistant to temperature fluctuations, moisture, and UV rays. The growing demand for sealing, sound damping, and vibration reduction in vehicle production increases demand for foam material-based tapes. The growing demand from consumer electronics and e-commerce packaging supports the growth of the market.

Application Insights

Why did the Packaging Segment Dominate the Sealing Tapes Market?

The packaging segment dominated the sealing tapes market in 2024. The growing trend of online shopping increases demand for packaging tapes like sealing tapes. They ensure the security and integrity of packaging during shipping. Polypropylene tapes are widely used in packaging applications due to their strong adhesive properties, high tensile strength, and moisture resistance. The growing demand for automated and manual sealing helps the market growth. The increasing demand from the logistics, pharmaceutical, industrial, and manufacturing sectors drives the overall growth of the market.

The automotive segment is the fastest growing in the market during the forecast period. The growing vehicle production increases demand for the sealing tapes for automotive applications. The increasing focus on improving fuel efficiency and minimizing vehicle weight, fuel demand for sealing tapes is helping in the market growth. The automotive applications, like cable management, masking during painting, wire harnessing, and interior mounting, increase demand for the sealing tapes. The growing expansion of hybrid and electric vehicles supports the overall growth of the market.

End-Use Insights

Which End-Use Industry Held the Largest Share of the Sealing Tapes Market in 2024?

The e-commerce segment held the largest revenue share of the sealing tapes market in 2024. The growing trend for online shopping increases the demand for sealing tapes. The strong focus on efficient and fast delivery in e-commerce helps in the market growth. The availability of return shipments increases demand for the sealing tapes. The growing online shopping of various products, like large household items and small electronics, is driving the overall growth of the market.

The healthcare segment is experiencing the fastest growth in the market during the forecast period. The increasing prevalence of injuries and chronic wounds increases demand for sealing tapes. The growing surgical procedures, like medical devices, dressings, and incisions, fuel demand for sealing tapes, helping the overall growth of the market. The aging population and growing prevalence of chronic diseases increase demand for sealing tapes for healthcare applications. The growing focus on home healthcare services and medical device assembly supports the market growth.

Product Type Insights

Why did Single-Sided Sealing Tapes Dominate the Sealing Tapes Market?

The single-sided sealing tapes segment dominated the sealing tapes market in 2024. The growing focus on energy-efficient and sustainable construction practices increases demand for single-sided sealing tapes. The increasing demand for insulation and component assembly in the electronics sector helps in the market growth. The healthcare applications, like surgical procedures, medical device assembly, and wound care, increase demand for the single-sided tapes. The rise in e-commerce increases demand for effective packaging solutions, driving the market growth.

The foam tapes segment is the fastest growing in the market during the forecast period. The growing demand automotive industry increases demand for foam tapes for applications like vibration absorption, sealing, and sound dampening. The growing demand for various electronics devices like TVs, laptops, smartphones, and computers fuels demand for foam tapes for applications like protecting components, mounting, and cushioning. Foam tapes maintain the desired temperature and offer reliable bonding capabilities. Foam tapes consist of vibration & shock absorption. The growing focus on sustainability and growth in the construction and automotive industries drives the market growth.

Recent Developments

- In January 2024, Intertape Polymer Group launched carton sealing tape, 170e. The new tape is designed with 30% recycled film and is pressure sensitive, water-based, & acrylic carton sealing tape. It lowers the carbon footprint and is suitable for automated & manual applications. (Source: fastenerandfixing.com)

- In July 2023, Flex Seal launched a high-performance duct tape. The duct tape consists of reinforced, tough backing and has super-wide sizing. It is available in 7.5 wide rolls and 4.6 wide rolls. The features include UV, water & weather resistant, and bonds with PVC, metal, and glass, & many more.(Source: www.torque-expo.com)

Top Companies List

- 3M Company

- Nitto Denko Corporation

- tesa SE (Beiersdorf AG)

- Intertape Polymer Group Inc.

- Avery Dennison Corporation

- Shurtape Technologies LLC

- Scapa Group Ltd.

- Henkel AG & Co. KGaA

- Berry Global Inc.

- Saint-Gobain Performance Plastics

- H.B. Fuller Company

- LINTEC Corporation

- Lohmann GmbH & Co. KG

- Rogers Corporation

- Jonson Tapes Limited

- Ajit Industries Private Limited

- Vibac GroupPPM Industries S.p.A

- Advance Tapes International

- Teraoka Seisakusho Co., Ltd.

Segments Covered

By Material Type

- Plastic-based

- Polypropylene (BOPP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Paper-based

- Foil-based

- Aluminum Foil

- Cloth-based

- Woven Fabric

- Non-woven Fabric

By Adhesive Type

- Acrylic

- Water-based Acrylic

- Solvent-based Acrylic

- Rubber-based

- Natural Rubber

- Synthetic Rubber (Hot Melt)

- Silicone-based

By Backing Material

- BOPP

- PET

- PVC

- Foam

- Kraft Paper

- Aluminum Foil

- Cloth/Fabric

By Application

- Packaging

- Carton Sealing

- Parcel Sealing

- E-commerce Packaging

- Electrical & Electronics

- Insulation

- EMI Shielding

- Building & Construction

- HVAC Sealing

- Vapor Barrier

- Window/Door Sealing

- Automotive

- Interior Sealing

- Wire Harnessing

- Healthcare

- Sterile Packaging

- Aerospace & Defense

- Others

- Sports Equipment

- Appliance Assembly

By End-Use Industry

- Food & Beverage

- Consumer Goods

- E-commerce

- Logistics & Transportation

- Construction

- Automotive

- Electronics

- Healthcare

- Aerospace

By Product Type

- Single-sided Sealing Tape

- Double-sided Sealing Tape

- Transfer Tapes

- Foam Tapes

- Filament Tapes

- Butyl Tapes

- Masking Tapes

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait