Content

What is the Current PAN-based Carbon Fiber Market Size and Volume?

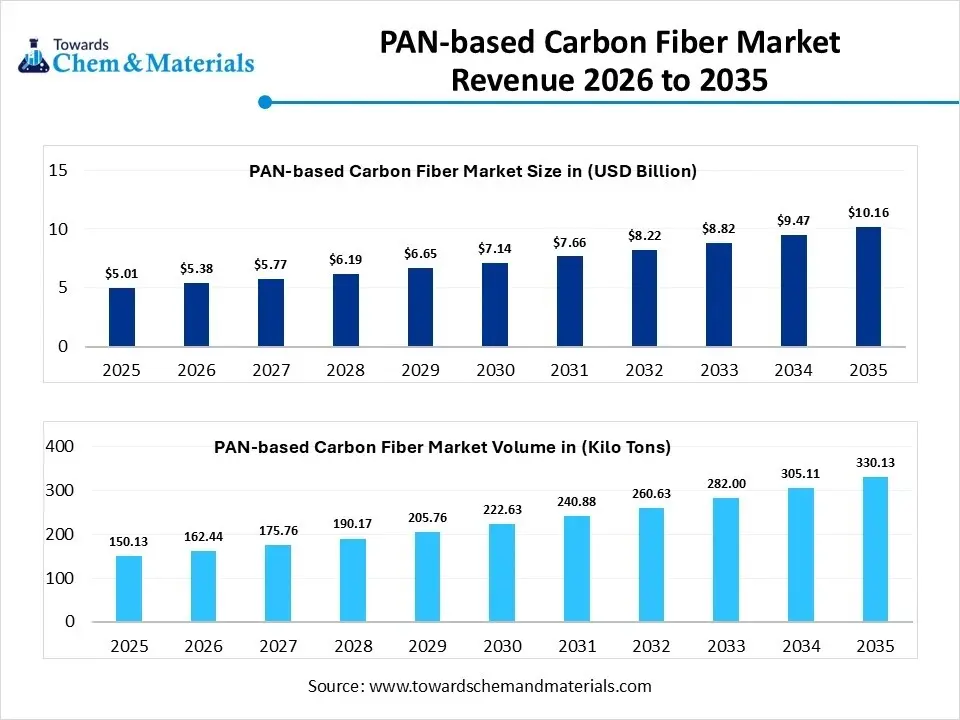

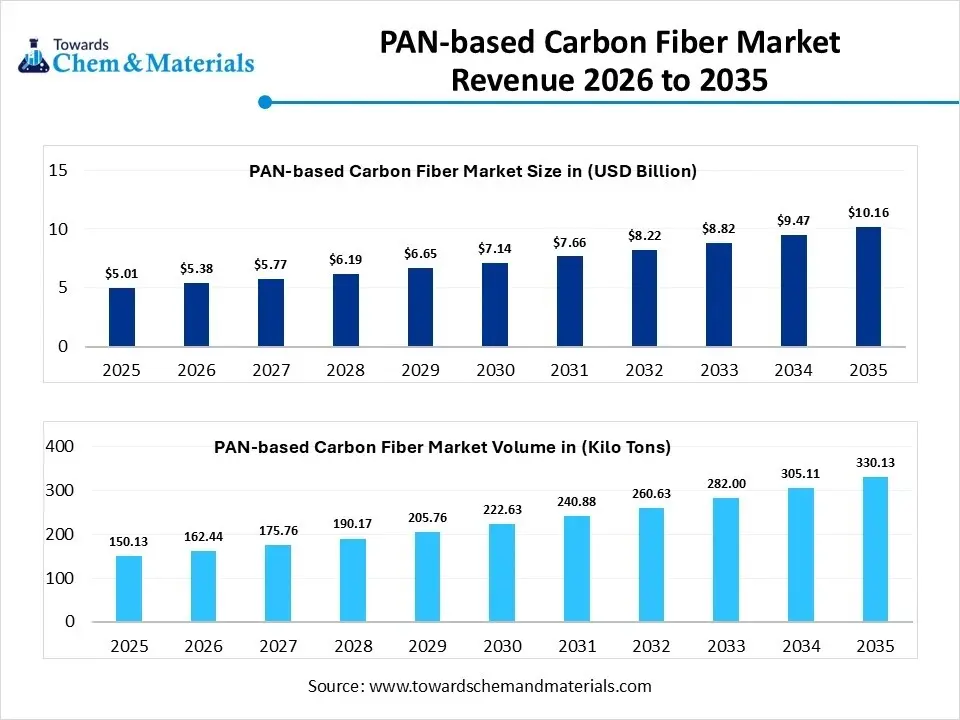

The global pan-based carbon fiber market size was estimated at USD 5.01 billion in 2025 and is expected to increase from USD 5.38 billion in 2026 to USD 10.16 billion by 2035, growing at a CAGR of 7.33% from 2026 to 2035. In terms of volume, the market is projected to grow from 150.13 kilo tons in 2025 to 330.13 kilo tons by 2035. growing at a CAGR of 8.20% from 2026 to 2035. Asia Pacific dominated the pan-based carbon fiber market with the largest volume share of 46% in 2025.The growth of the market is driven by demand for lightweight, high-strength materials in aerospace, automotive.

The global pan-based carbon fiber market covers the manufacturing and supply of carbon fibers produced from polyacrylonitrile (PAN) precursor. PAN-based carbon fibers are widely used in high-strength-to-weight and stiffness-critical applications across aerospace, wind energy, automotive, industrial, and sporting goods sectors. Market growth is driven by increasing demand for lightweight aircraft structures, rising adoption of carbon fiber in wind turbine blades, automotive lightweighting, particularly for electric vehicles, and expanding industrial applications requiring corrosion resistance and fatigue durability.

Key Takeaways

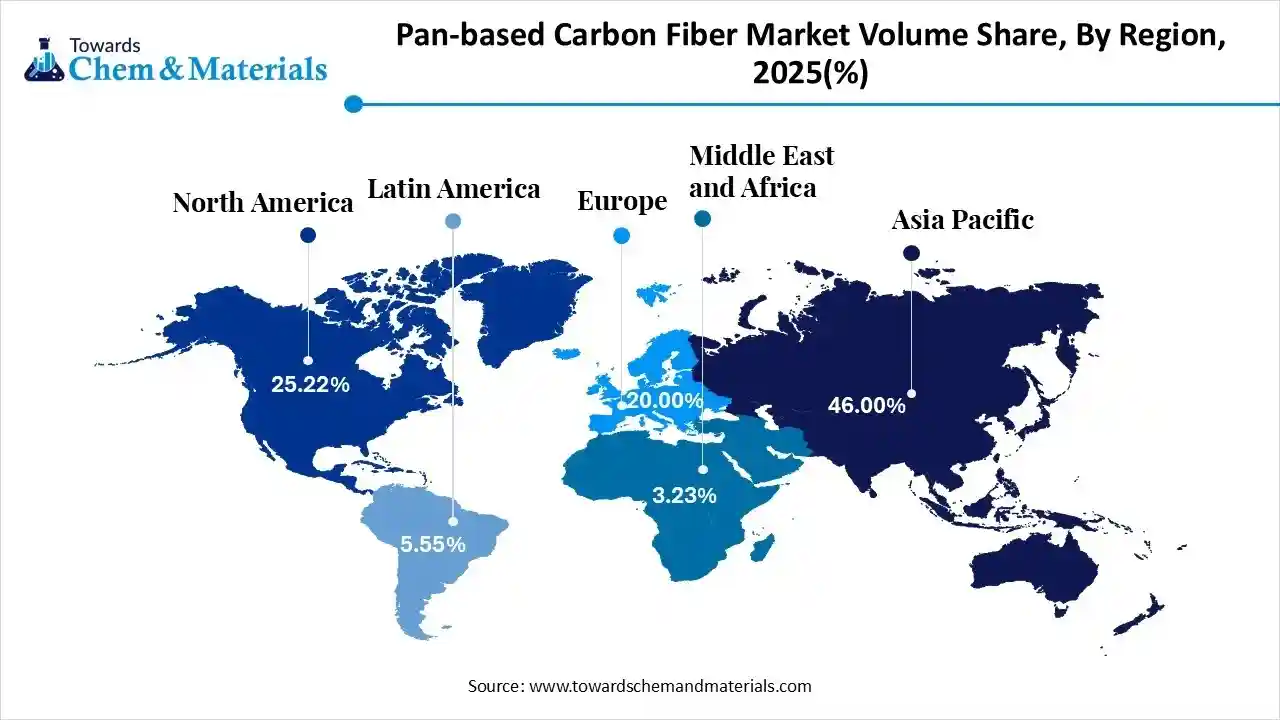

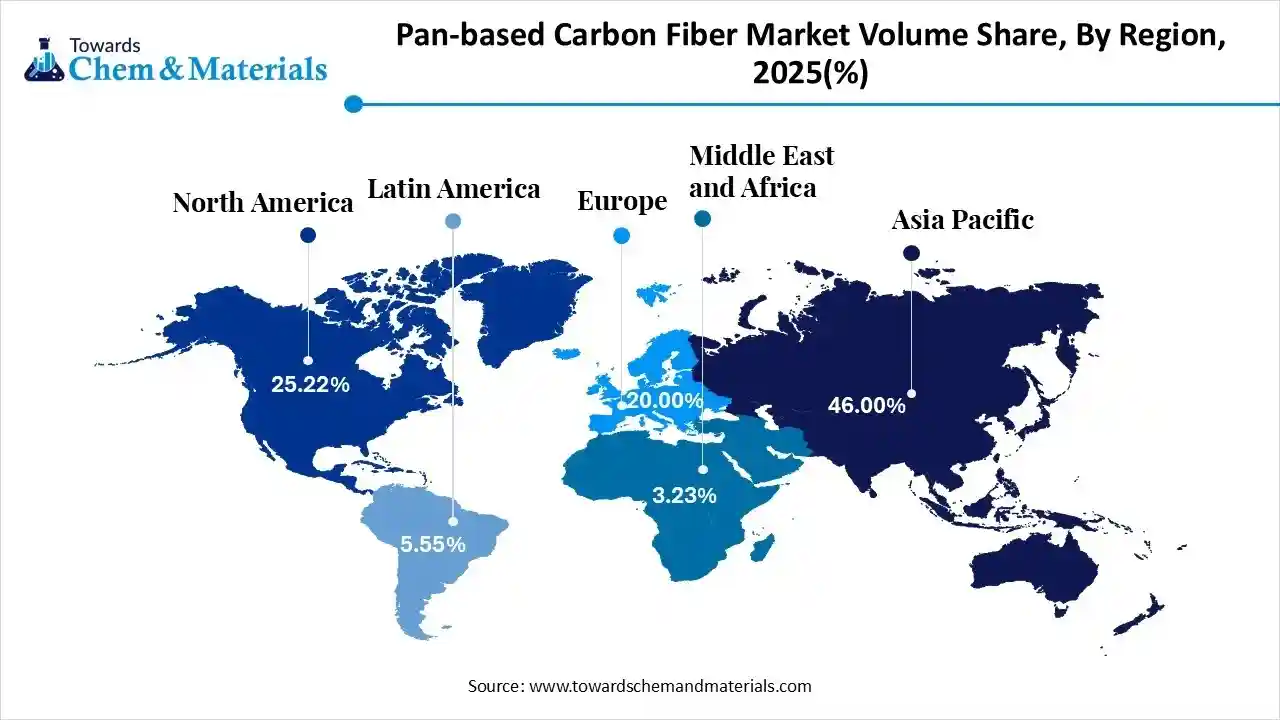

- The Asia Pacific dominated the global pan-based carbon fiber market with the largest volume share of 46% in 2025.

- The pan-based carbon fiber market in North America is expected to grow at a substantial CAGR of 8.35% from 2026 to 2035.

- The Europe pan-based carbon fiber market segment accounted for the major volume share of 20.13% in 2025.

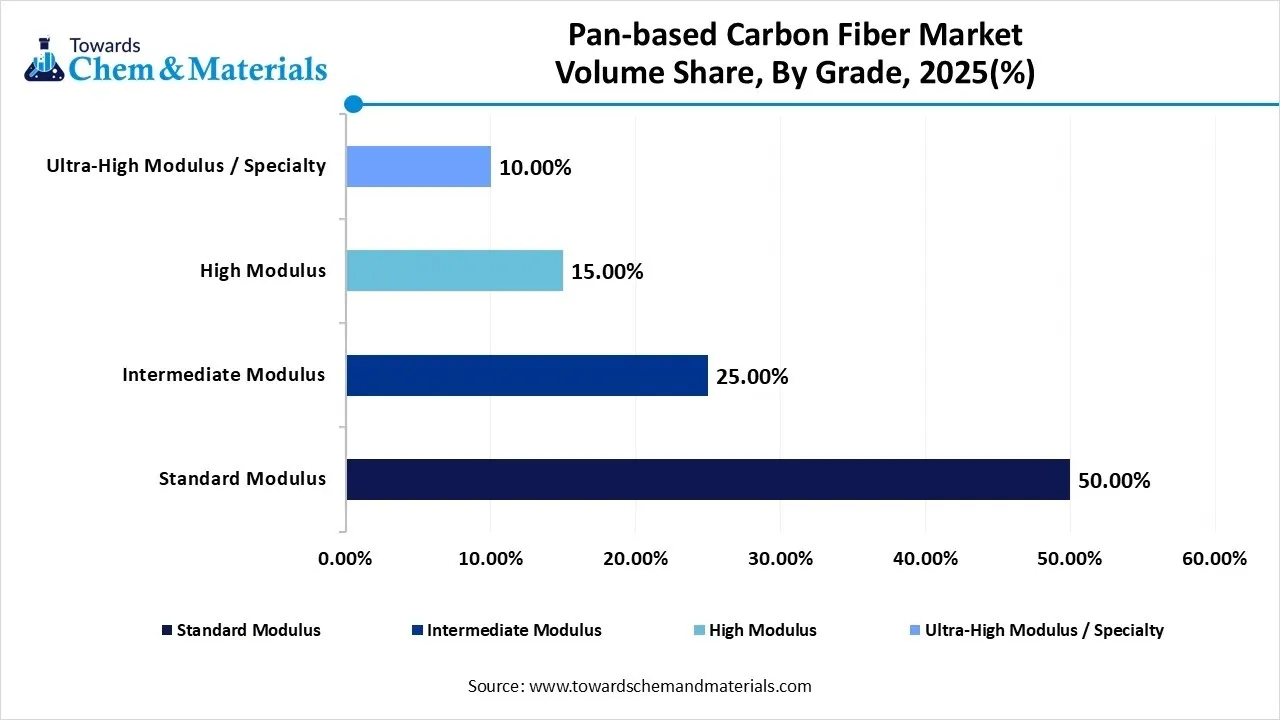

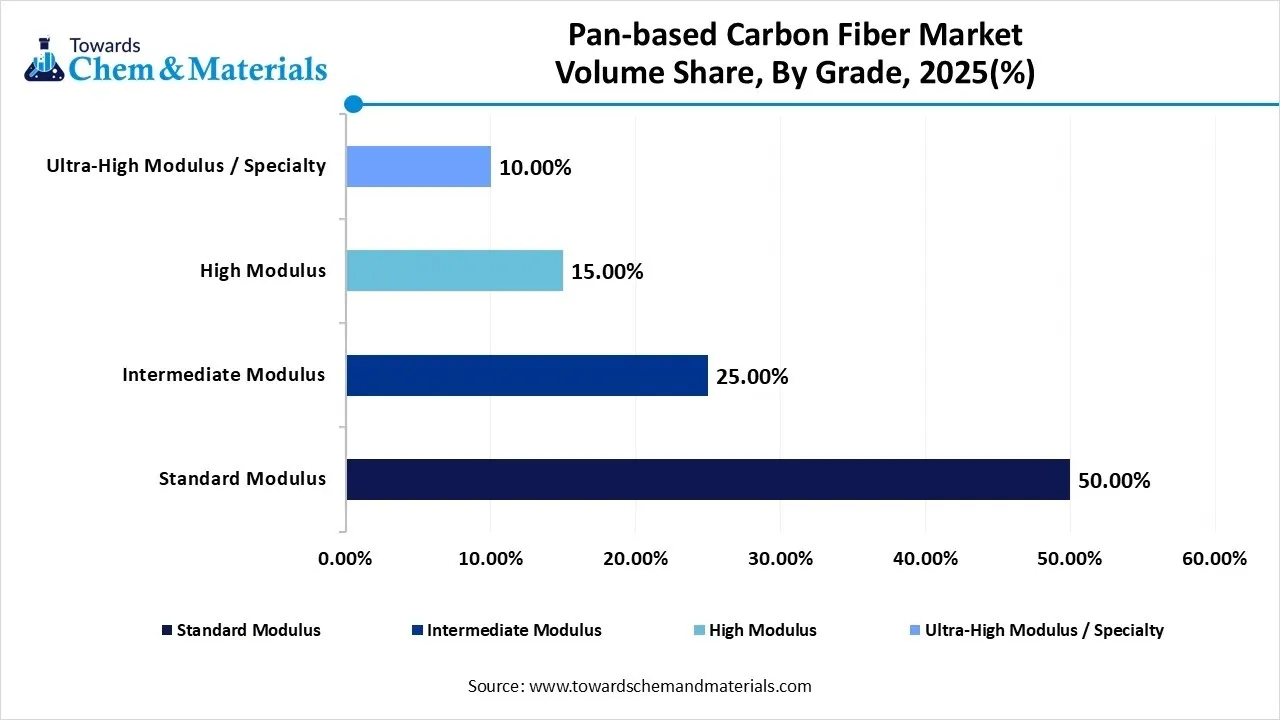

- By grade, the standard modulus segment dominated the market and accounted for the largest volume share of 50% in 2025.

- By grade, the high modulus segment is expected to grow at the fastest CAGR of 11.53% from 2026 to 2035 in terms of volume.

- By tow size, the 6k–12k segment led the market with the largest revenue volume share of 50% in 2025.

- By end user, the aerospace & defense segment dominated the market and accounted for the largest volume share of 35% in 2025.

- By end user industry, the automotive & transportation segment led the market with the largest revenue volume share of 24% in 2025.

What Is The Significance Of The PAN-Based Carbon Fiber Market?

The significance of the PAN-based carbon fiber market lies in its role as a crucial high-performance material, enabling lightweighting and enhanced efficiency in aerospace, automotive, and wind energy sectors by offering superior strength, stiffness, and durability for fuel savings and increased power generation, driving innovation in industries seeking advanced material solutions for performance and sustainability.

PAN-Based Carbon Fiber Market Growth Trends:

- Lightweighting: Essential for improving fuel efficiency in aircraft and vehicles, and extending EV battery range.

- Energy Efficiency: Lighter, stronger wind turbine blades capture more energy.

- Technological Advancements: Improved manufacturing processes and cost reductions enhance the adoption of these solutions.

- Sustainability Initiatives: Drive demand for efficient materials, but also push for greener production methods.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 5.38 Billion / 162.44 Kilo Tons |

| Revenue Forecast in 2035 | USD 10.16 Billion / 330.13 Kilo Tons |

| Growth Rate | CAGR 7.33% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Tow Size, By End-User Industry, By Application, By Regions |

| Key companies profiled | Toray Industries, Inc. (Japan), Mitsubishi Chemical Group (Japan), Zoltek, Taekwang Industrial Co., Ltd. (South Korea),Aksa Akrilik Kimya Sanayii A.S. (Turkey), Teijin Limited, Hexcel Corporation, SGL Carbon SE, Formosa Plastics Corporation, Hyosung Advanced Materials, Zhongfu Shenying Carbon Fiber Co., Ltd., Jilin Chemical Fiber Group,Toho Tenax (Teijin Group) |

Key Technological Shifts In The PAN-Based Carbon Fiber Market:

Key technological shifts in the PAN-based carbon fiber market focus on automation & AI for cost reduction, sustainable practices (recycling, bio-precursors), advanced process optimization (spinning, carbonization, surface treatment) to improve quality, and integration with 3D printing, all driven by demand from aerospace, automotive (EVs), and wind energy for lighter, stronger, more efficient materials.

Trade Analysis Of PAN-Based Carbon Fiber Market: Import & Export Statistics

- According to global export data, from June 2024 to May 2025 (TTM), the world exported 24,728 shipments of Carbon Fiber. These shipments were made by 3,231 exporters to 3,873 buyers, showing a 2% increase compared to the previous twelve months.

- The majority of these exports go to Vietnam, Ukraine, and the United States.

- The top three exporting countries are China, Japan, and Vietnam, with China leading at 21,251 shipments, followed by Japan with 10,875 shipments, and Vietnam with 9,701 shipments.

- Additionally, during the same period, World exported 5,098 shipments of Carbon Fiber to India by 569 exporters to 400 buyers in India. The main destinations continue to be Vietnam, Ukraine, and the United States, with China's exports also prominent.

PAN-Based Carbon Fiber Market Value Chain Analysis

- Precursor & Fiber Manufacturing: PAN-based carbon fiber is produced through processes such as polyacrylonitrile (PAN) precursor polymerization, fiber spinning, stabilization, carbonization, surface treatment, and sizing to achieve high tensile strength and modulus for advanced composite applications.

- Key players: Toray Industries Inc., Teijin Limited, Hexcel Corporation, Mitsubishi Chemical Group.

- Quality Testing and Certification: PAN-based carbon fiber requires certifications ensuring mechanical performance, fiber consistency, safety, and aerospace or industrial compliance. Key certifications include ISO quality standards, ASTM composite material testing, aerospace certifications, and material qualification standards.

- Key players: ISO (International Organization for Standardization), ASTM International, NADCAP, UL Solutions

- Distribution to Industrial Users:PAN-based carbon fiber is supplied to aerospace and defense manufacturers, automotive OEMs, wind energy blade producers, sporting goods manufacturers, and industrial composite fabricators.

- Key players: Toray Industries Inc., Hexcel Corporation, Teijin Limited.

PAN-Based Carbon Fiber Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA (Environmental Protection Agency) OSHA (Occupational Safety and Health Administration) DOT (Department of Transportation) Environment and Climate Change Canada (ECCC) |

Clean Air Act (CAA), VOCs, particulate emissions Clean Water Act (CWA) NPDES permits TSCA (Toxic Substances Control Act) OSHA 29 CFR (Hazard Communication, PSM) Canada CEPA (Canadian Environmental Protection Act) |

Emissions from fiber production & oxidation/graphitization furnaces Chemical safety & inventory (PAN precursors, solvents) Worker health & exposure limits Transportation of hazardous chemicals |

Carbon fiber production involves acrylonitrile and other hazardous intermediates — EPA and OSHA controls emissions and worker exposure; Canada’s CEPA and provincial rules enforce similar environmental/health safeguards. |

| European Union | European Commission European Chemicals Agency (ECHA) National Environment & Workplace Safety Agencies |

REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) |

Chemical registration & hazard classification Emission & effluent limits Workplace safety & labeling BAT (Best Available Techniques) for production facilities |

REACH requires registration and safety data for acrylonitrile and other monomers/solvents; IED/BREF documents affect emission limits from furnaces and precursor handling. |

| Asia Pacific | China MEE (Ministry of Ecology & Environment) SAMR/SAC Japan METI/MOE South Korea MoE India MoEFCC/CPCB |

China MEE Order No.12 (New Chemical Substance Registration) Air/Water Pollution Control Laws Japan CSCL & PRTR Korea K-REACH & Waste Control Act |

New chemical registration Environmental compliance Hazard communication Worker protection |

China and Korea increasingly require REACH-like registration of PAN and derivative chemicals; India’s evolving chemical rules will impact PAN precursor compliance. Japan’s PRTR mandates pollutant reporting. |

Segmental Insights

Grade Insights

Which Grade Type Segment Dominated The PAN-Based Carbon Fiber Market?

The standard modulus segment volume was valued at 75.07 kilo tons in 2025 and is projected to reach 145.52 kilo tons by 2035, expanding at a CAGR of 7.63% during the forecast period from 2025 to 2035. The standard modulus segment dominated the market, accounting for approximately 50% share in 2025. Standard modulus PAN-based carbon fibers dominate volume consumption due to their balanced mechanical performance, cost efficiency, and ease of processing. These fibers are widely used in industrial applications where a high strength-to-weight ratio is required without the premium cost of advanced grades. Growing lightweighting initiatives continue to support demand.

The high modulus segment volume was valued at 22.52 kilo tons in 2025 and is expected to surpass around 60.12 kilo tons by 2035, and it is anticipated to expand to 11.53% of CAGR during 2026 to 2035. High modulus PAN-based carbon fibers are engineered for superior stiffness and dimensional stability, making them critical in aerospace, defense, and high-performance sporting applications. Demand is rising with increasing aircraft production and advanced defense material requirements.

Pan-based Carbon Fiber Market Volume and Share, By Grade, 2025-2035

| By Grade | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Standard Modulus | 50.00% | 75.07 | 145.52 | 7.63% | 44.08% |

| Intermediate Modulus | 25.00% | 37.53 | 89.83 | 10.18% | 27.21% |

| High Modulus | 15.00% | 22.52 | 60.12 | 11.53% | 18.21% |

| Ultra-High Modulus / Specialty | 10.00% | 15.01 | 34.66 | 9.74% | 10.50% |

Tow Size Insights

How Did The 6k-12k Segment Dominate The PAN-Based Carbon Fiber Market?

The 6k–12k segment dominated the market, accounting for approximately 50% share in 2025. Carbon fibers in the 6K–12K tow size range offer a balance between mechanical strength and processing flexibility, making them suitable for aerospace components, pressure vessels, and premium automotive applications. These two sizes enable precise fiber placement and improved surface finish, supporting their adoption in high-performance structural components.

The >12k segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Tow sizes above 12K are primarily used in cost-sensitive, high-volume applications such as wind turbine blades, infrastructure reinforcement, and automotive mass production. These fibers reduce material costs while maintaining acceptable strength levels, making them ideal for large composite structures where weight reduction and scalability are key priorities.

End-User Insights

Which End-User Segment Dominated The PAN-Based Carbon Fiber Market?

The aerospace & defense segment dominated the market, accounting for approximately 35% share in 2025. The aerospace and defense sector is a major consumer of PAN-based carbon fibers due to strict weight reduction, fuel efficiency, and structural integrity requirements. Carbon fibers are extensively used in aircraft fuselages, wings, missiles, and unmanned systems. Increasing defense budgets and next-generation aircraft programs are driving sustained demand.

The automotive & wind energy segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Automotive and wind energy industries increasingly adopt PAN-based carbon fibers to improve energy efficiency and structural performance. In automotive manufacturing, lightweight carbon composites support emission reduction goals, while in wind energy, long and lightweight turbine blades enhance power generation efficiency, boosting large-tow fiber consumption.

Application Insights

How did the Structural Components Segment dominate the PAN-Based Carbon Fiber Market?

The structural components segment dominated the market, accounting for approximately 45% share in 2025. Structural components represent a core application area for PAN-based carbon fiber, particularly in aerospace, automotive, and construction sectors. These fibers enhance load-bearing capacity while significantly reducing overall weight. Their high fatigue resistance and corrosion protection properties make them ideal for long-life structural applications across demanding environments.

The wind turbine blades segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. PAN-based carbon fibers are increasingly used in wind turbine blades to enable longer blade designs with reduced weight and improved stiffness. This allows higher energy capture and improved turbine efficiency. Growing investments in renewable energy infrastructure and offshore wind projects are accelerating demand for carbon fiber-reinforced blades.

Regional Insights

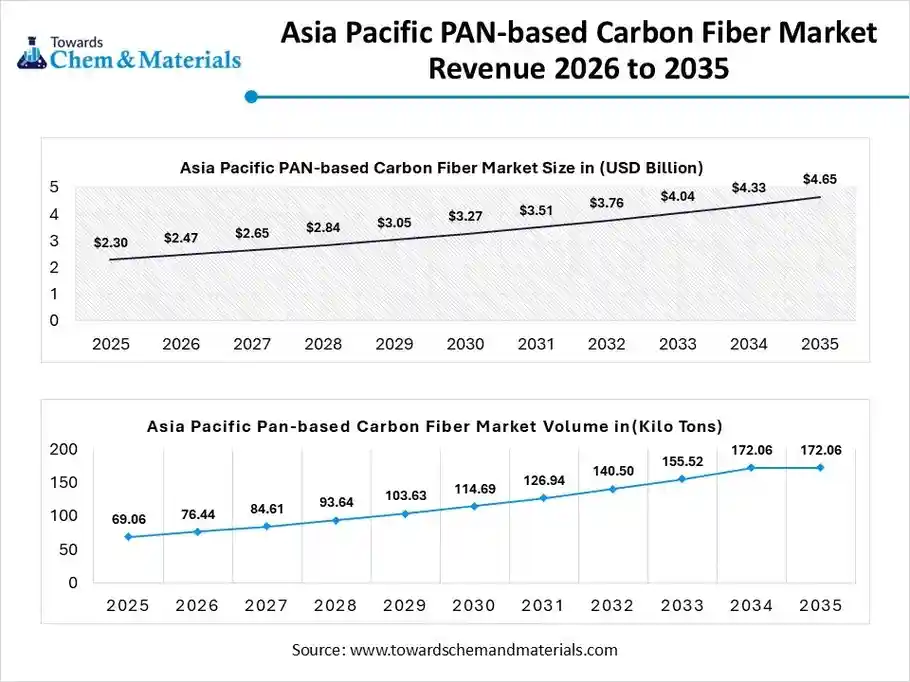

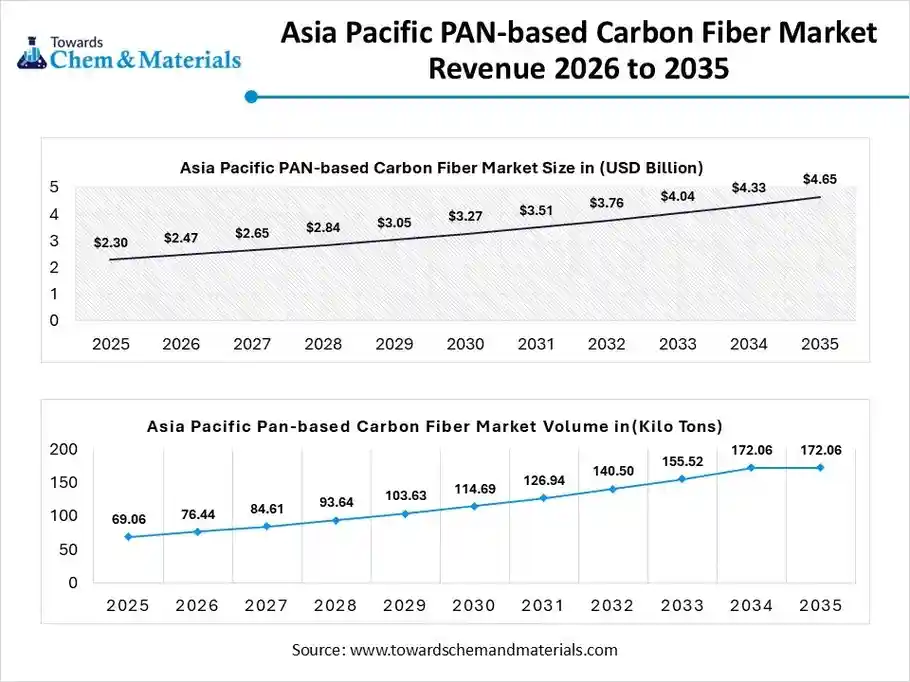

The Asia Pacific pan-based carbon fiber market size was valued at USD 2.30 billion in 2025 and is expected to be worth around USD 4.65 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.29% over the forecast period from 2026 to 2035.

The Asia Pacific pan-based carbon fiber market volume was estimated at 82.75 kilo tons in 2025 and is projected to reach 192.23 kilo tons by 2035, growing at a CAGR of 9.82% from 2026 to 2035.Asia Pacific dominated the market with a share of approximately 46% in 2025. The growth is driven due to strong manufacturing capabilities, expanding aerospace programs, and rapid growth in wind energy, automotive lightweighting, and defense applications. The region benefits from integrated precursor supply chains, cost-efficient production, and rising government investments in advanced materials. Growing demand for high-strength, lightweight composites across renewable energy, pressure vessels, and mobility sectors continues to support market expansion.

China: PAN-Based Carbon Fiber Market Growth Trends

China is the largest producer and consumer of PAN-based carbon fiber in the Asia Pacific, supported by aggressive capacity expansion and state-backed investments in domestic carbon fiber self-sufficiency. The country’s strong demand for wind turbine blades, aerospace structures, hydrogen storage tanks, and electric vehicles drives consumption. Continuous improvements in PAN precursor quality and domestic technology development are reducing reliance on imports.

North America: PAN-Based Carbon Fiber Market Strong Demand From Industries

The North America pan-based carbon fiber market volume was estimated at 20.97 kilo tons in 2025 and is projected to reach 43.18 kilo tons by 2035, growing at a CAGR of 8.35% from 2026 to 2035. North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. North America represents a mature and technology-driven PAN-based carbon fiber market, supported by strong demand from industries. The region benefits from advanced R&D ecosystems, established aerospace OEMs, and long-term supply contracts. Increasing use of carbon fiber in electric vehicles, urban air mobility, and hydrogen infrastructure further strengthens regional demand.

United States: PAN-Based Carbon Fiber Market Growth Trends

The U.S. leads the North American market, driven by high consumption in aerospace, defense, and space applications, where PAN-based carbon fiber is preferred for its superior mechanical properties. Government defense spending, commercial aviation recovery, and investments in lightweight automotive components fuel demand. The presence of major carbon fiber producers and strong innovation in PAN precursor technologies enhances domestic market competitiveness.

Europe PAN-Based Carbon Fiber Market Growth Is Driven By Manufacturing Base

The Europe pan-based carbon fiber market volume was estimated at 30.22 kilo tons in 2025 and is projected to reach 63.81 kilo tons by 2035, growing at a CAGR of 8.66% from 2026 to 2035. Europe’s PAN-based carbon fiber market is driven by sustainability-focused manufacturing, stringent emission regulations, and strong adoption in automotive lightweighting and renewable energy applications. The region emphasizes recycling technologies, energy-efficient production, and high-performance composites. Demand from wind energy, aerospace structures, and rail transportation supports steady market growth across Western and Central Europe.

Germany: PAN-Based Carbon Fiber Market Growth Trends

Germany is a key European market due to its advanced automotive, aerospace, and industrial engineering sectors. PAN-based carbon fiber is increasingly used in electric vehicle structures, high-performance components, and industrial automation equipment. Strong collaboration between research institutions and manufacturers accelerates material innovation, while government support for lightweight and sustainable mobility boosts long-term demand.

South America: PAN-Based Carbon Fiber Market Growth Is Driven By Industrial Applications

The South America pan-based carbon fiber market volume was estimated at 8.33 kilo tons in 2025 and is projected to reach 16.94 kilo tons by 2035, growing at a CAGR of 8.20% from 2026 to 2035. South America represents an emerging PAN-based carbon fiber market, supported by gradual adoption in wind energy, infrastructure reinforcement, and industrial applications. While production capacity remains limited, increasing renewable energy projects and demand for lightweight materials are creating new opportunities. Imports dominate supply, but regional investments in advanced composites are slowly strengthening market presence.

Brazil: PAN-Based Carbon Fiber Market Growth Trends

Brazil leads the South American market due to its expanding wind energy sector and growing use of carbon fiber composites in pressure vessels and industrial equipment. PAN-based carbon fiber demand is supported by renewable energy installations and infrastructure modernization. Although local manufacturing is limited, rising imports and technology partnerships are enhancing market development.

Global Pan-based Carbon Fiber Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 25.22% | 37.86 | 67.61 | 6.65% | 20.48% |

| Europe | 20.00% | 30.03 | 63.81 | 8.74% | 19.33% |

| Asia Pacific | 46.00% | 69.06 | 172.06 | 10.68% | 52.12% |

| South America | 5.55% | 8.33 | 16.37 | 7.80% | 4.96% |

| Middle East & Africa | 3.23% | 4.85 | 10.27 | 8.69% | 3.11% |

Middle East & Africa: PAN-Based Carbon Fiber Market Government Support

The Middle East & Africa pan-based carbon fiber market volume was estimated at 7.85 kilo tons in 2025 and is projected to reach 13.96 kilo tons by 2035, growing at a CAGR of 6.61% from 2026 to 2035. The Middle East & Africa market is driven by investments in aerospace, defense, oil & gas, and emerging hydrogen storage applications. PAN-based carbon fiber demand is growing as governments diversify economies and invest in advanced materials. Although adoption is still at an early stage, large-scale infrastructure and energy projects provide long-term growth potential.

Saudi Arabia: PAN-Based Carbon Fiber Market Growth Trends

Saudi Arabia is an emerging market supported by defense modernization, aerospace investments, and hydrogen economy initiatives. PAN-based carbon fiber is increasingly used in high-pressure tanks, industrial composites, and advanced mobility projects. Strategic investments under Vision 2030 and partnerships with global material suppliers are expected to accelerate domestic demand and technology adoption.

Recent Developments

- In November 2025, Carbon Fiber Recycling, LLC (CFR) launched a new line of sustainable, precision-milled recycled carbon fiber. This reduces CO2 emissions by over 99% compared to virgin fiber. The company operates North America's first fully integrated, continuous-flow recycling plant and provides fiber for applications such as automotive lightweighting and 3D printing.(Source: www.pr.com)

- In December 2025, China launched a major production base in Datong to mass-produce T1000-grade carbon fiber, a high-strength material critical for aerospace and high-end manufacturing.(Source:www.jeccomposites.com)

- In November 2025, 8 Clockwise and CarboMat partnered to scale sustainable carbon fibers and battery materials, targeting a greener supply chain. These moves signal a 2026 industry shift toward combining extreme material performance with sustainable production methods.(Source: www.businesswire.com)

Top players in the PAN-Based Carbon Fiber Market & Their Offerings:

- Toray Industries, Inc. (Japan): Toray is the global leader in PAN-based carbon fiber and precursor materials, producing high-performance TORAYCA® carbon fibers used extensively in aerospace, automotive, wind energy, and industrial applications. The company operates multiple global production facilities and continues to expand capacity to meet rising demand across sectors.

- Mitsubishi Chemical Group (Japan): Mitsubishi Chemical (through Mitsubishi Rayon) offers premium PAN-based carbon fibers under brands like DIALEAD™, targeting ultra-high modulus and high-strength applications. These materials are widely adopted in aerospace composites, sports equipment, and industrial components.

- Zoltek: Zoltek (part of Toray) focuses on cost-competitive PAN carbon fibers, especially for wind energy, automotive, and infrastructure composites. Its Panex® fiber products serve high-volume commercial applications.

- Taekwang Industrial Co., Ltd. (South Korea): Taekwang manufactures PAN precursor and carbon fiber products used in aerospace, automotive, and industrial markets. Its materials emphasize high mechanical properties and consistent quality.

- Aksa Akrilik Kimya Sanayii A.S. (Turkey): Aksa produces PAN precursors and carbon fiber materials, serving both textile and technical markets. Its joint ventures and capacity expansions support diversified global demand, particularly in Europe and Asia.

- Teijin Limited

- Hexcel Corporation

- SGL Carbon SE

- Formosa Plastics Corporation

- Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Jilin Chemical Fiber Group

- Toho Tenax (Teijin Group)

Segments Covered

By Grade

- Standard Modulus

- Intermediate Modulus

- High Modulus

- Ultra-High Modulus / Specialty

By Tow Size

- <6k

- 6k–12k

- >12k

By End-User Industry

- Aerospace & Defense

- Wind Energy

- Automotive & Transportation

- Industrial

- Sporting Goods & Consumer

- Others

By Application

- Structural Components

- Wind Turbine Blades

- Interior & Secondary Parts

- Pressure Vessels & Cylinders

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa