Content

What is the Current Flat Glass Coatings Market Size and Share?

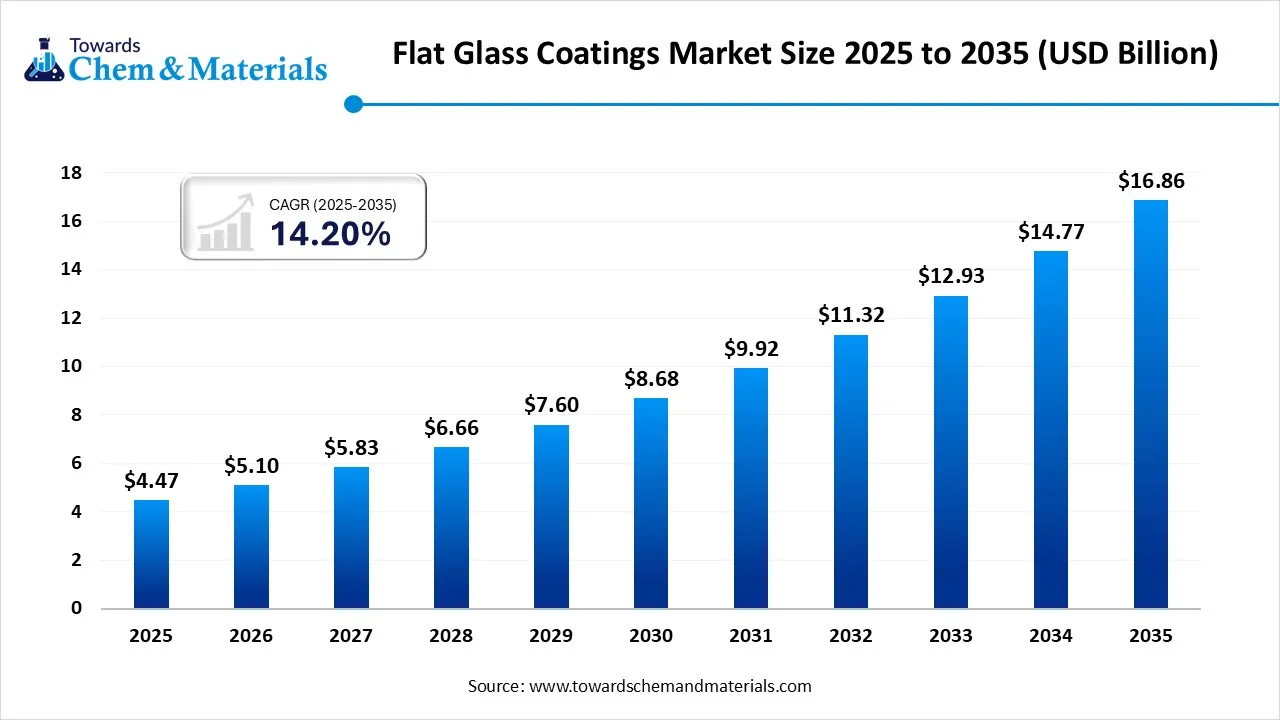

The global flat glass coatings market size was USD 4.47 billion in 2025 and is predicted to increase from USD 5.10 billion in 2026 and is expected to be worth around USD 16.86 billion by 2035, growing at a CAGR of 14.20% from 2026 to 2035. Asia Pacific dominated the flat glass coatings market with the largest revenue share of 60.23% in 2025.The expansion of the automotive industry and modern technological advancement.

Flat Glass Coatings Market Key Takeaways

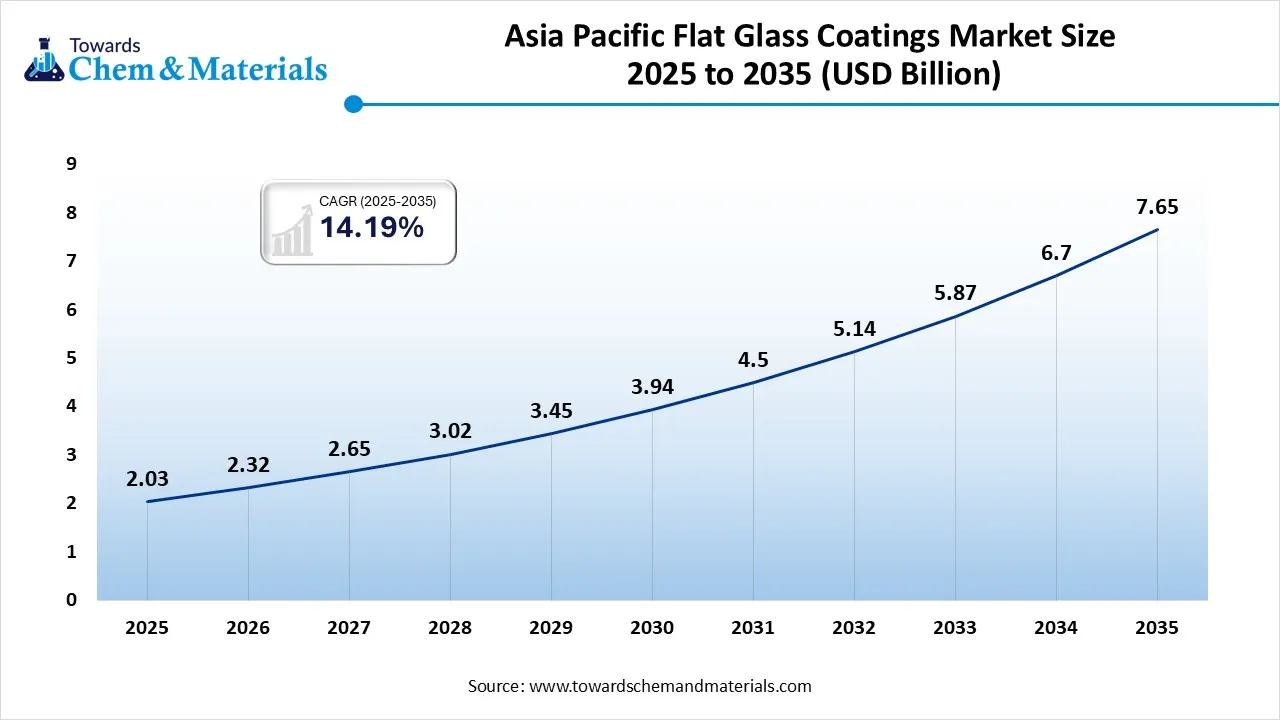

- The Asia Pacific region commanded the highest share of around 60.23% of the flat glass coatings market in 2025 and is expected to witness a significant growth rate over the forecast period.

- The North America flat glass coatings market is expected to register the fastest growth throughout the forecast period.

- By resin type, the acrylic segment dominated the market and accounted for the largest volume share of 44.11% in 2025.

- By technology, the water-based segment led the market with the largest revenue volume share of 56.05% in 2025.

- By application, the mirror segment dominated the market and accounted for the largest volume share of 46.03% in 2025.

Flat Glass Coatings Market Overview

The flat glass coatings market has witnessed steady growth in the recent period. Factors such as modern infrastructure development and continuously enhancing glass coating technologies are majorly contributing to the growth of the market in recent years. As industries are actively choosing efficient and durable materials, flat glass coating has gained a large market share in the current period. Moreover, the government's sustainability initiatives and demand for energy-efficient building are likely to provide a heavy consumer base during the projected period as architecture developers are seen using flat glass coatings to reduce indoor heat application and enhance thermal insulation at the same time. Also, the expansion of the electronics sectors can create profitable opportunities for flat glass coating in the coming years.

The transformation of the automotive industry is driving market growth in the current scenario. The manufacturers are actively seeking innovative vehicle designs that require different types of coated glasses nowadays. Sections such as panoramic sunroofs, windshields, and aesthetic passenger experience initiatives with flat glass coating have left their exceptional mark in recent years. By offering benefits such as standard UV protection, improved thermal insulation, and glare reduction, flat class coatings can gain substantial flat glass coatings market traction during the projected period.

-

For instance, Hyundai Motor Group introduced metal coating heated glass technology. This technology produces heat while blocking solar heat energy, which can cut off winter inconvenience. The aim behind the technology is to provide comfort and convenience to the consumers in winter weather.

Flat Glass Coatings Market Trends

- Increased sustainability initiatives have been driving the industry's growth in recent years. The trend towards energy-efficient building developments is actively leading the sale of flat glass coating nowadays. Having Low Emissivity makes flat glass coating an ideal option for this movement in the current scenario.

- The increasing dependency on solar energy is spearheading the flat glass market growth nowadays. Manufacturers are actively focusing on the development of solar panels that improve light transmission while reducing reflective losses. Thus, solar panel producers are heavily using the anti-reflective and hydrophobic flat glass coating in the current period.

- The rapid technological advancement in the chemical combination of coating has led to industry growth in recent years. Innovations such as nanotechnology and others have played a major role in making stronger and durable coatings in the past period. Also, these advancements can increase the lifespan of glass in the coming years with modern development integrations.

Flat Glass Coatings Market Report Scope

| Report Attributes | Details |

| Market Size In 2026 | USD 5.10 Billion |

| Expected Size in 2035 | USD 16.86 Billion |

| Growth Rate | CAGR of 14.20% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2025-2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin, By Technical, By Application, By Region |

| Key Companies Profile | Arkema, Inc.,Fenzi Spa,Ferro Corp.,Hesse Gmbh & Co. KG,The Sherwin-Williams Company,Vitro S.A.B. De C.V.,Nippon Paint Holdings Co., Ltd.,Bee Cool Glass CoatingsYantai Jialong Nano Industry Co., Ltd.,NanoTech Coatings,3M,Gulbrandsen,Unelko Corporation,Apogee Enterprises, Inc.,PPG Industries Inc. |

Flat Glass Coatings Market Opportunity

Coated for the Future: Smart Infrastructure Drives Demand for Advanced Glass Solutions

The sudden surge in smart glass in modern infrastructure development projects is expected to create significant opportunities for flat glass coating manufacturers in the coming years. Moreover, the manufacturers are actively focusing on the creation of glass that reduces glare and temperature inside buildings by using types of glass coating in recent years. Thus, with the formation of suitable coating for this smart glass initiative, the glass coating manufacturers can gain major market attraction during the forecast period. Furthermore, government initiatives such as smart city development and green building development are likely to contribute to the growth of the flat glass coatings market in the future.

Flat Glass Coatings Market Challenge

Capital-Intensive Technologies Limit Broader Market Penetration

The high cost of coating materials and technology is anticipated to limit the market expansion in the coming years. Furthermore, materials such as titanium dioxide, silver, and metal oxide can be expensive than other coating materials, which also need proper combinations and technology. Thus, these expensive technologies can create some business barriers for the newcomers during the forecast period. also, this technology requires high-tech machinery and a skilled workforce that can hamper flat glass coatings market growth in the coming years.

Value Chain Analysis

Research & Development (R&D)

- This involves developing chemical formulations that enhance functional properties like anti-reflection, UV protection, hydrophobicity, and Low-E performance.

- Key Players: Arkema Group, PPG Industries, AkzoNobel N.V., Fenzi Group, Nano-Care Deutschland, and BASF SE.

Raw Material Sourcing and Processing

- This involves sourcing raw components, including inorganic chemicals, metal oxides, specialized resins, and solvents.

- Key Players: Arkema, BASF, and Prince International.

Coating Manufacturing and Application

- This involves high-tech methods such as Chemical Vapor Deposition, magnetron sputtering andsol-gel methods, often applied directly onto the float line facilities.

- Key Players: Fenzi Group, Arkema S.A., Ferro Corporation, PPG Industries, Guardian Glass, and Vitro Architectural Glass.

Glass Fabrication and Processing

- This involves cutting, tempering, or insulating the glass for specific end-use sectors like automotive windscreens, architectural facades, and solar panels.

- Key Players: Saint-Gobain, AGC Inc., NSG Group, Fuyao Group, and Cardinal Glass Industries.

Distribution and End-User Application:

- This involves the finished, coated, and processed glass is distributed to final customers, including construction firms, automotive OEMs (original equipment manufacturers), and solar panel installers.

- Key Players: Tesla and Volvo.

Flat Glass Coatings Market Segmental Insights

By Resin Insights

The acrylic segment held the dominating share of the flat glass coatings market in 2025. Having superior durability and weather resistance led the segment growth in the current period. Acrylic coating is used as a cost-effective coating in many industries nowadays. Moreover, properties such as superior adhesion and excellent transparency have been majorly contributing to the segment growth in recent years. According to these properties, the demand for acrylic coating from construction and development is seen to have increased these days. Furthermore, solar and window manufacturers are also heavily demanding acrylic coating as it cannot turn yellow over time, which is ideal for solar panels and windows.

The polyurethane (PU) segment is expected to experience significant market growth in the future. These coatings gained significant market attention due to their resistance to abrasion, chemical, and weather conditions in the current period. Moreover, having tougher and flexible protective layer can help the segment to gain major market share in the coming years. the increasing demand for greenhouses and outdoor architectural glass is likely to drive the PU segment growth during the forecast period as PU can prevent these glasses from degradation with extending its lifespan for more years.

By Technology Insights

The water-based segment led the flat glass coatings market in 2024. Increasing initiatives towards sustainable practices leading the segment growth in the current period. Water-based technology has strong performance characteristics with an eco-friendly nature, which has gained market attraction in recent years. Industries such as solar, automotive, and construction are gaining major market share in water-based coatings sales nowadays, as several governments are implementing sustainability initiatives globally. Moreover, water-based coatings are lower in cost compared to advanced coating technologies, which makes them an ideal choice for the manufacturers seeking an efficient yet sustainable solution in the current .

The nano-based segment is expected to grow at the fastest rate during the forecast period. Having self-cleaning capabilities and continuous technology advancements is anticipated to lead to segment expansion in the coming years. By enhancing glass surfaces with ultra-thin layers, nano-based coating can gain significant market attraction in the future. Innovative moves such as hydrophobic layering can help nano based coating to gain substantial consumer based in the coming period. Moreover, demand for smart glass technologies from industries such as construction and automotive is likely to drive the segment growth during the projected period.

By Application Insights

The mirror segment led the flat glass coatings market in 2024. Increased use in commercial, residential, and industrial sectors is majorly contributing to segment growth in recent years. The demand for functional and decorative mirrors is providing a huge consumer base to mirror manufacturers nowadays. The individuals are using these mirrors for architectural application in the current period. Moreover, the demand for aesthetic appeal in home decor has been driving market growth in recent years. Also, the increasing need for high-quality glasses in automotive sectors is leading the segment growth nowadays.

The automotive & transportation segment is expected to experience significant flat glass coatings market growth in the future. The ongoing evolution of vehicle designs and increased safety standards is expected to create lucrative opportunities for flat glass coating in the future. The manufacturers use flat glass not only for the windows, sunroof, and windshields but also in the infotainment and interior displays, as has been observed in the current period.

Flat Glass Coatings Market Regional Insights

The Asia Pacific flat glass coatings market size was valued at USD 2.03 billion in 2025 and is expected to be worth around USD 7.65 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 14.19% over the forecast period from 2026 to 2035.

Asia Pacific dominated the flat glass coatings market in 2025. The region maintained its leading position over the years. The dominance is driven by increasing urbanization, population growth, and substantial infrastructure development. Various countries are experiencing development activities in construction, automotive formulation, and electronic production. These demonstrative activities are a surge to fuel the demand for flat glass coating. Moreover, rapidly increasing foreign investment and the government initiative that supports smart cities, and the development of green buildings are contributing to the growth of the sector. The largely rising production of consumer electronics and home appliances helps to expand the market. The strong regional capabilities of manufacturing ensure continued growth in the future.

From Production to Export: China Shapes the Future of Flat Glass Coatings

China is the leading country in the Asia Pacific region for the flat glass coating market. The country is the largest manufacturer and exporter of flat glass globally, playing a crucial role in the growth of the flat glass coating market globally. China’s thriving construction, automotive, and solar energy sectors are driving consistent demand for coated flat glass. With the large transition towards sustainable infrastructure and renewable energy, the need for high-performance coated glass is rising. Continuous development and innovation with the strong domestic demand will help to maintain China's dominance in the flat glass coatings market.

North America is expected to witness significant growth in the market during the forecast period. The region is anticipating significant developments in flat glass coating technology. The rising demand towards energy efficiency and sustainable infrastructure. The region is actively incorporating glass coatings in sectors like construction, automotive, and solar energy application. Increasing promotion of low-emission building and clean energy technologies by government regulation recently in the region. These activities are accelerating market expansion while rapidly raising investment in areas like renewable energy, particularly solar power, and enhancing the demand for high-performance glass coating. Increasing awareness about the environment and standards of green building, which increases the need for innovative coating technology.

Smart Policies, Smarter Glass: United States Set for Strong Growth

The United States will play a pivotal role in driving North America’s flat glass coating market in the future. The rising focus on energy efficiency is driven by federal and state building costs. These are the major catalysts for enhancing the demand for coated glasses. The adoption of sustainable construction practices is likely to expand the market’s reach during the forecast period. The Inflation Reduction Act and multiple other policies with incentives encourage clean energy and green construction in the future of the United States.

How will Europe be considered a notable region in the Flat Glass Coatings Market?

Europe is a notably growing region in the global market, primarily due to its stringent energy efficiency regulations, a strong focus on sustainable building construction, and the expansion of its solar energy sector. EU directives, such as the Energy Performance of Buildings Directive, mandate high-performance glazing, making low-emissivity and solar control coatings a necessity rather than a luxury. There is a high demand for high-efficiency glass, particularly in solar panels, which has led to increased use of anti-reflective and conductive coatings, especially in countries like Spain, Germany, and Italy.

Germany Flat Glass Coatings Market Trends

Germany is a mature market within the region, serving as a hub for advanced coated glass. This is driven by strict environmental regulations and sustainability goals, particularly the nation’s objective to achieve carbon neutrality. As a result, there is a strong push for high-performance glazing in both residential and commercial sectors, especially low-emissivity and heat-reflective coatings. Key players operating in Germany include Saint-Gobain, Glas Trösch, Pilkington, and AGC.

Emergence of Latin America in the Flat Glass Coatings Market

Latin America is an emerging region in the global market, fueled by rapid urbanization, increasing demand for energy-efficient building materials, and a recovering automotive industry. Rising environmental awareness and the adoption of green building certifications in Brazil, Mexico, and Colombia are driving the demand for specialized, energy-efficient, low-emissivity coated glass to enhance thermal insulation and reduce cooling loads. Mexico, being the seventh-largest automobile manufacturer worldwide, significantly contributes to the demand for advanced coatings that provide UV resistance and thermal control.

Brazil Flat Glass Coatings Market Trends

Brazil plays a vital role in the global market, primarily due to its rapid urbanization and the need for energy-efficient materials in both the construction and automotive sectors. The architectural sector is particularly dominant, with a strong focus on tempered and insulated glass for buildings. Additionally, the automotive sector fuels the demand for specialized OEM coatings. Brazil benefits from a robust manufacturing base, including locally sourced materials like titanium dioxide, which supports a reliable supply chain.

How will the Middle East and Africa contribute to the Flat Glass Coatings Market?

The Middle East and Africa are key contributors to the global market, largely due to intense climate-related demands, massive infrastructure developments, and a swift shift toward sustainable building regulations. The hot, arid climate in the GCC countries creates significant demand for high-performance low-emissivity and solar control coatings, which help minimize solar heat gain and reduce high air-conditioning cooling loads. Moreover, the localization of automotive assembly plants in South Africa and Morocco increases the need for advanced laminated and tempered windshields for high-transmittance, anti-reflective solar coatings.

The UAE Flat Glass Coatings Market Trends

The UAE plays a significant role in the region, driven by rapid infrastructure projects and an increasing demand for energy-efficient solar control solutions. There is a high demand for specialized reflective coatings that manage heat, resist sand abrasion, and reduce cooling loads. The market is also heavily influenced by the rise of smart city projects and green building strategies. Key companies in the UAE include Emirates Float Glass LLC (EFG), Saint-Gobain, Guardian Industries, and Obeikan Glass.

Recent Developments In Flat Glass Coatings Market

Varrotec

- Launch: In 2024, Varrotec introduced its latest hot-end glass coating. This coating is mainly for pharmaceutical and small container glass manufacturers. The aim behind the production of coating is to minimize losses during the hot end coating process by ensuring sustainability and improvising efficacy.

SGD PHARMA

- Launch: In 2024, SGD Pharma launched the new production of TYPE I tubular vials with an innovative vial coating with Corinig’s VelocityR. The SGD pharma created a partnership with Corining for their expertise in glass coating technology. This latest vial reduces frictional resistance, which is created by glass-to-glass and glass-to-metal contact.

Guardian Glass and Webasto

- Collaboration: In 2024, Guardian Glass and Webasto made a collaboration for new coated glass solutions for panoramic sunroof. According to the agreement, Guardian can supply new coated glasses for Webasto’s panoramic sunroofs. These glasses have low reflectivity and low-E coating for the surface of the roof inside the car.

Flat Glass Coatings Market Key Companies List

- Arkema, Inc.

- Fenzi Spa

- Ferro Corp.

- Hesse Gmbh & Co. KG

- The Sherwin-Williams Company

- Vitro S.A.B. De C.V.

- Nippon Paint Holdings Co., Ltd.

- Bee Cool Glass Coatings

- Yantai Jialong Nano Industry Co., Ltd.

- NanoTech Coatings

- 3M

- Gulbrandsen

- Unelko Corporation

- Apogee Enterprises, Inc.

- PPG Industries Inc.

Segments Covered In The Report

By Resin

- PU

- Acrylic

- Epoxy

- Others

By Technology

- Solvent-based

- Water-based

- Nano-based

By Application

- Solar Power

- Mirror

- Architectural

- Automotive & Transportation

- Other

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait