Content

What is the Current Antimicrobial Textile Market Size and Volume?

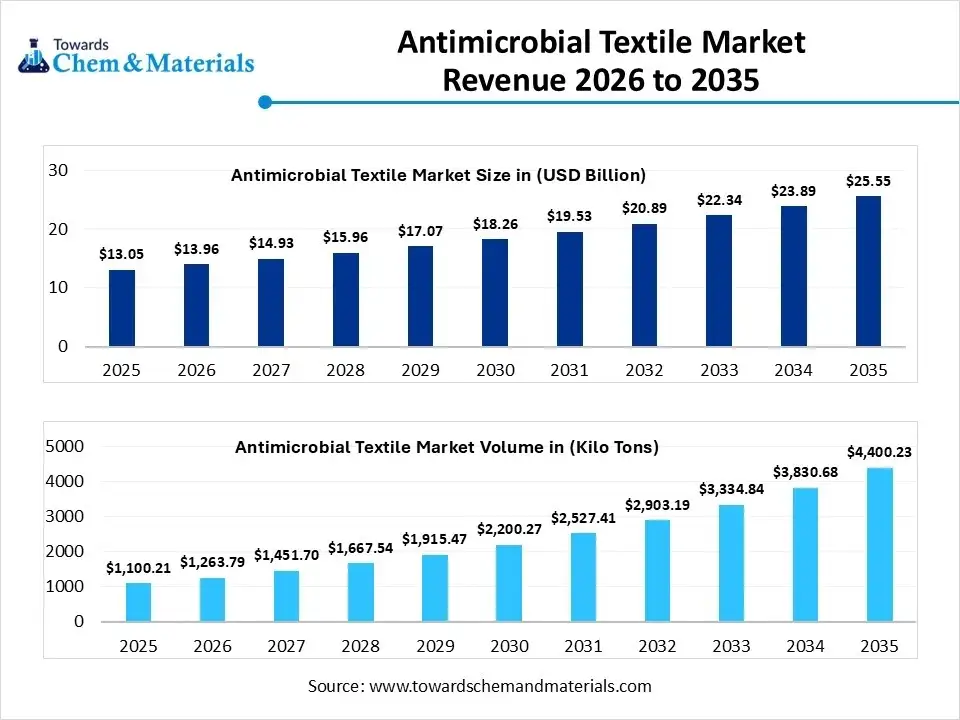

The global antimicrobial textile market size was estimated at USD 13.05 billion in 2025 and is expected to increase from USD 13.96 billion in 2026 to USD 25.55 billion by 2035, growing at a CAGR of 6.95% from 2026 to 2035. In terms of volume, the market is projected to grow from 1100.21 kilo tons in 2025 to 4400.23 kilo tons by 2035. growing at a CAGR of 14.87% from 2026 to 2035. North America dominated the antimicrobial textile market with the largest volume share of 35% in 2025.The market is driven by health and hygiene concerns supported by stringent environmental regulations with a focus on sustainability practices.

Market Highlights

- The North America dominated the antimicrobial textile market with the largest volume share of 35% in 2025.

- The antimicrobial textile market in Asia Pacific is expected to grow at a substantial CAGR of 18.26% from 2026 to 2035.

- The Europe antimicrobial textile market segment accounted for the major volume share of 23.01% in 2025.

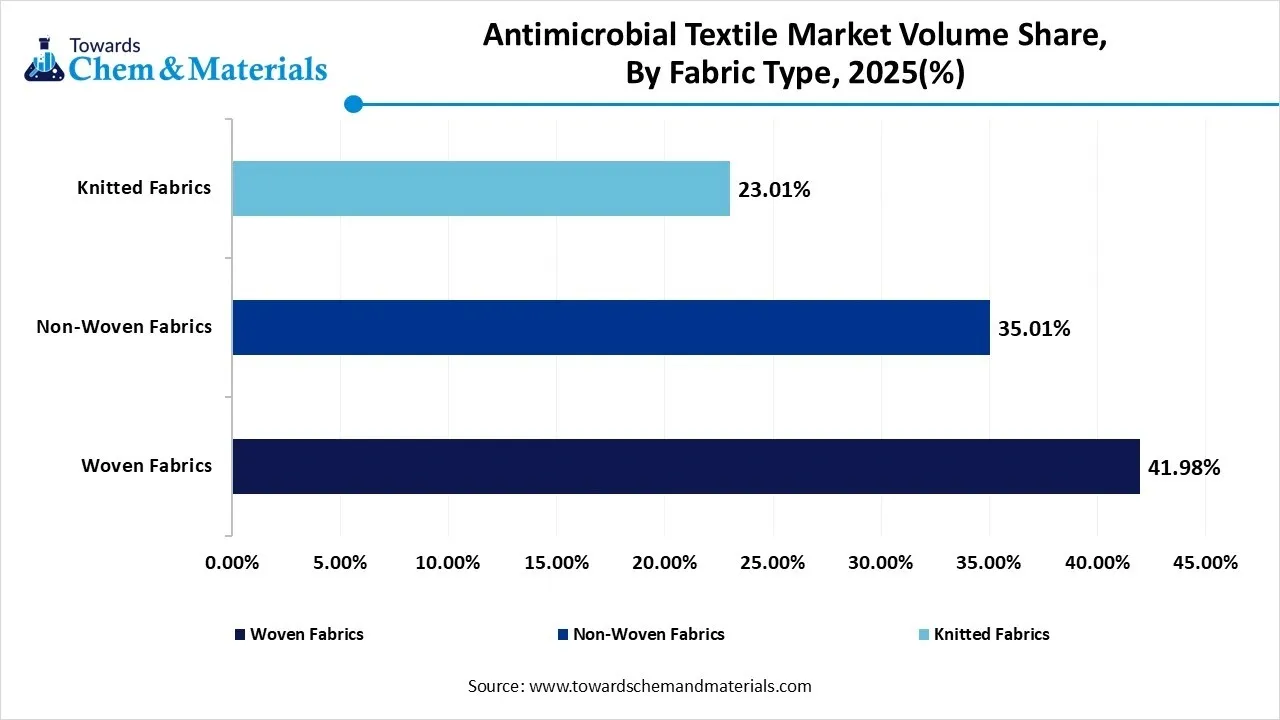

- By fabric type, the woven fabrics segment dominated the market and accounted for the largest volume share of 41.98% in 2025.

- By fabric type, the non-woven fabrics segment is expected to grow at the fastest CAGR of 19.99% from 2026 to 2035 in terms of volume.

- By active agent, the metal & metallic salts segment led the market with the largest revenue volume share of 61% in 2025.

- By fiber type, the cotton segment dominated the market and accounted for the largest volume share of 37% in 2025.

- By application, the medical textiles segment led the market with the largest revenue volume share of 46% in 2025.

Market Overview

The antimicrobial textile market is driven by global awareness of health and the need for infection control in several applications. These textiles inhibit microorganism growth by holding the largest share in the medical sector, to reduce hospital-acquired infections. The rising consumer demand is driving continuous innovation for more effective, durable and environmentally friendly treatments.

The adoption of hygiene-oriented products, including in sportswear for odor control and home furnishing for enhanced hygiene, increases disposable income and technological advancement in finishes in response to environmental impact, driving a sustainable transition for long-term growth

Antimicrobial Textile Market Trends

- Shift Towards Sustainability: The transition from synthetic to more sustainable and natural alternatives like plant extracts and bio-based silver nanoparticles due to toxicity and environmental concerns is pushing the market towards green chemistry.

- Stringent Environmental regulations: This trend shapes the market, with a focus on standardized efficiency testing and transparent labelling, reinforcing the market towards certified and safer chemical formulations.

- Expansion of Applications: The medical and home wellness is the utmost trend, but beyond this application, the surging demand in public transportation and shared mobility contributes to maintaining cleaner environments, accelerating market expansion.

- Focus on Recyclable Masterbatch Systems: The market player aimed at recyclable masterbatch systems to make final textiles easier to recycle in closed-loop systems for expanding the global consumer base.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 13.96 Billion / 1263.79 Kilo Tons |

| Revenue Forecast in 2035 | USD 25.55 Billion / 4400.23 Kilo Tons |

| Growth Rate | CAGR 6.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | North America |

| Segment Covered | By Active Agent, By Fiber Type, By Application, By Fabric Type, By Region |

| Key companies profiled | DuPont de Nemours, Inc., BASF SE, Indorama Ventures Public Company Limited, Toyobo Co., Ltd., Unitika Ltd., Trevira GmbH, Thai Acrylic Fibre Co. Ltd. (Aditya Birla Group), Herculite Products Inc., Microban International, Ltd., Sanitized AG, PurThread Technologies, Inc., HeiQ Materials AG, Sciessent LLC, Vestagen Protective Technologies, Inc., Milliken & Company |

Key Technological Shifts in the Antimicrobial Textile Market

The technological shift is driving towards the development of smart fabrics and advanced fabrication and finishing techniques to enhance chemical efficiency and product longevity. The AI-driven systems ensure novel antibiotic identification, while machine learning tools predict antimicrobial efficacy and durability for nanomaterials of nano-textiles. AI enables smart textiles integrate sensors to monitor infection in real time healthcare systems.

Trade Analysis of Antimicrobial Textile Market: Import & Export Statistics

- Vietnam imported 60 shipments of antimicrobial textiles.

- Pakistan imported 28 shipments of antimicrobial textiles.

- Peru imported 10 shipments of antimicrobial textiles.

- From May 2024 to April 2025, the world imported 42 shipments of antimicrobial textiles.

Antimicrobial Textile Market Value Chain Analysis

- Raw Material Production: The initial stage of producing base fibers like cotton, polyester, and antimicrobial active agents, including synthetic organic compounds and bio-based solutions.

- Key Players: BASF SE, Ty, Lonza Group AG, Microban International Ltd., Sanitized AG, Sciessent LLC, HeiQ Materials AG, Indorama Ventures Public Company Limited.

- Yarn Spinning and Fabric Production: The fibers are spun into yarns and then knitted into fabrics. This stage involves integrating antimicrobial properties by using pre-treated fibres.

- Key Players: Milliken & Company, Trevira GmbH, Herculite Products Inc., PurThread Technologies Inc., Life Threads LLC, Vestagen Protective Technologies Inc.

- Dyeing and Finishing: The fabric endures dyeing, cleaning by using techniques like pad-dry-cure, exhaust, and plasma treatments, and finishing by using quality control to ensure efficiency.

- Key Players: Sanitized AG, Microban International, DuPont

- Distribution to end user: The final product reaches end-users through distributors, wholesalers, retail stores, and specialized institutional sales channels in diversified applications like the medical sectors, defense, home textiles, and industrial use.

- Key Players: Mitsui & Co. (distribution partner for PurThread in Japan)

Country-Wise Regulations of Antimicrobial Textile

| Country | Regulations | Key Focus |

| United States | EPA (Environmental Protection Agency), FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act), FDA (Food and Drug Administration) | The key focus of regulatory agents is on pesticides and product making health & medical claims. |

| India | Bureau of Indian Standards (BIS) | BIS certification for specified medical textiles to ensure safety and quality. |

| European Union | BPR (Biocidal Products Regulation, REACH European Chemicals Agency (ECHA) |

The key focus on stricter labelling requirements to ensure safety for health and the environment. |

| China | Ministry of Industry and Information Technology (MIIT) | Standards for specific product types that focus on limiting functional finishing agents and specific national standards for quality control |

Segmental Insights

Active Agent Insights

Why the Metal & Metallic Salts Segment Dominates the Antimicrobial Textile Market?

The metal & metallic salts segment dominated the market with a 61% share in 2025 because it offers reliable, long-lasting protection by integrating inorganic agents like silver, copper, and zinc directly into fibers through ionizing processes, ensuring durability through heavy laundering. Nanotechnology has enhanced this segment, as metal nanoparticles increase surface area for rapid ion release, providing potent biocidal effects at lower chemical concentrations, preferred choice for premium sportswear focused on hygiene and odor control.

The bio-based agents segment is the fastest-growing in the market during the forecast period, driven by the transition to sustainable and low-toxicity alternatives by replacing traditional synthetic chemicals. The market rising regulatory pressure and higher consumer demand for biodegradable products fosters innovation and advancement in encapsulation techniques by improving durability and water-fastness of bio-based agents. Additionally, segment expansion is supported by skin-friendly materials in babywear and medical apparel, driving the growth.

Fiber Type Insights

How did the Cotton Segment hold the Largest Share in the Antimicrobial Textile Market?

The cotton segment held the largest revenue share of 37% in the market in 2025 due to its natural fiber and moisture-wicking properties, which support bacterial growth and odor development. Its cellular structure bonds well with various antimicrobial agents without compromising breathability and comfort, making it vital for medical textiles, hospital bedding, and intimate apparel, where hygiene and freshness are critical consumer needs.

The polyester segment is experiencing the fastest growth in the market during the forecast period because it serves as a key material in the activewear and athleisure trend for its quick-drying properties. Its melt-incorporation process embeds antimicrobial agents directly during fiber extrusion, ensuring garments stay fresh and hygienic. Polyester durability and cost-effectiveness make it preferable for medical scrubs, performance gear, and automotive interiors.

Application Insights

Which Application Dominated the Antimicrobial Textile Market?

The medical textiles segment dominated the market with a 46% share in 2025. It is vital for safety, preventing healthcare-associated infections. They are essential in clinical environments, such as surgical gowns, drapes, and hospital linens, which serve as the prime defence against healthcare-associated infections and the spread of multidrug-resistant pathogens. The segment is driven by meeting strict health regulations and supporting reusable textiles that endure sterilization, emphasizing patient safety and infection control.

The apparel segment is anticipated to grow fastest in the market during the forecast period. Driven by the athleisure trend and consumer hygiene focus. Antimicrobial agents provide permanent freshness in sportswear, appealing to eco-conscious shoppers by extending garment life and reducing wash cycles. By combining skin-safe silver-ion and bio-based technologies, apparel brands have shifted from medical to lifestyle markets, offering antimicrobial protection.

Fabric Insights

How did the Woven Fabrics Segment hold the Largest Share in the Antimicrobial Textile Market?

The woven fabrics segment volume was valued at 461.87 kilo tons in 2025 and is projected to reach 1657.57 kilo tons by 2035, expanding at a CAGR of 15.26% during the forecast period from 2025 to 2035. The woven fabrics segment held the largest revenue share of 42% in the market in 2025, due to its structural stability and integrity, essential for high-performance practices like surgical gowns, drapes, and hospital linens that tolerate sterilization and industrial laundering without lowering efficiency. Its dense yarn interlacing offers a uniform surface that improves antimicrobial bonding and creates durable pathogen barriers. Wovens are versatile for home, and protective workwear ensures long-lasting hygiene.

The non-woven fabrics segment volume was valued at 385.18 kilo tons in 2025 and is projected to reach 1985.38 kilo tons by 2035, expanding at a CAGR of 19.99% during the forecast period from 2025 to 2035. Driven by the transition to disposable healthcare and personal hygiene products. The key driver is the ease of integrating antimicrobials during web-bonding, which ensures uniform, cost-effective protection for single-use items. Non-wovens provide a lightweight and absorbent substrate, meet urgent infection-control needs by combining with high-volume manufacture and high biocidal efficiency, making them a dynamic segment for immediate hygiene safety.

Antimicrobial Textile Market Volume and Share, By Fabric Type, 2025-2035

| By Fabric Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Woven Fabrics | 41.98% | 461.87 | 1657.57 | 15.26% | 37.67% |

| Non-Woven Fabrics | 35.01% | 385.18 | 1985.38 | 19.99% | 45.12% |

| Knitted Fabrics | 23.01% | 253.16 | 757.28 | 12.95% | 17.21% |

Regional Insights

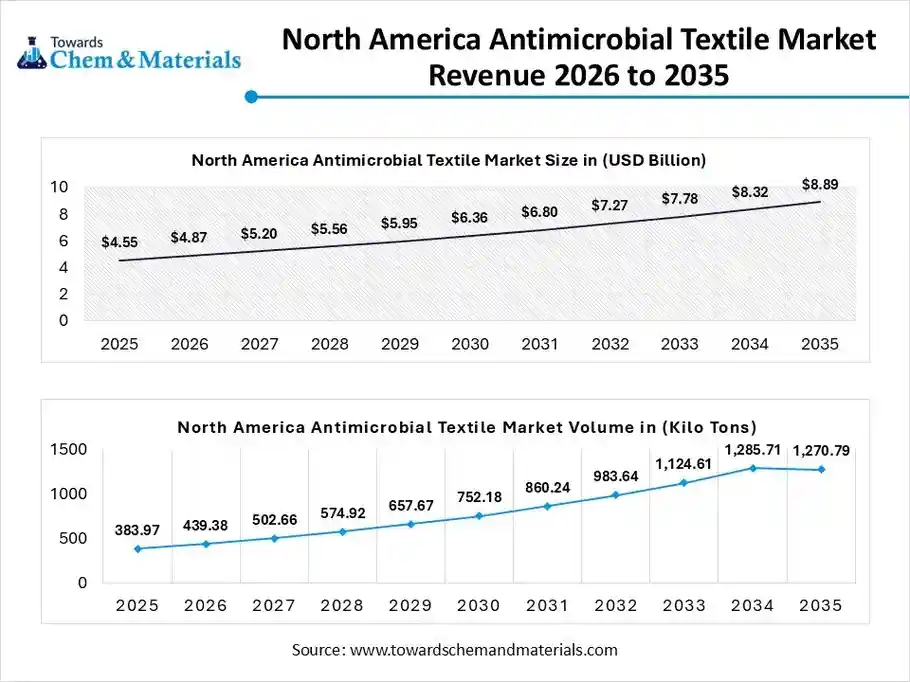

The North America antimicrobial textile market size was valued at USD 4.55 billion in 2025 and is expected to be worth around USD 8.89 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.93% over the forecast period from 2026 to 2035.

The North America antimicrobial textile volume was estimated at 383.97 kilo tons in 2025 and is projected to reach 1,270.79 kilo tons by 2035, growing at a CAGR of 12.70% from 2026 to 2035.North America dominated the market with a 35% share in 2025 driven by its innovation into a sophisticated healthcare system, strict regulatory standards, and a wellness-focused consumer base. The industry shift towards the growth of advanced nanotechnology and sustainable bio-based agents. By prioritizing durability and safety, pushing the region for use of biocidal textiles in clinical settings to prevent healthcare-associated infections and in activewear and athleisure markets for odor management and skin hygiene, ensuring the region as global hub for antimicrobial textile implementation and commercialization.

U.S. Antimicrobial Textile Market Trends

U.S maintain its leadership due to its advanced healthcare infrastructure and high demand for infection control textiles, which fosters innovation and a high consumption rate. The market players focus on eco-friendly antimicrobial coatings and specialized textiles in various applications that accelerated their leadership.

Asia Pacific Antimicrobial Textile Market Trends

The Asia Pacific antimicrobial textile volume was estimated at 341.62 kilo tons in 2025 and is projected to reach 1545.80 kilo tons by 2035, growing at a CAGR of 18.26% from 2026 to 2035, driven by rapid economic growth, industrialization, and a shift in manufacturing. The region's growth is supported by a growing healthcare sector adopting antimicrobial linens, gowns, and masks to meet hygiene and disease control standards. Additionally, the region is an emerging global textile hub with countries adopting new technologies to meet domestic demand and export orders. This expansion is driven by rising living standards, heightened health awareness, and government investments in public health.

China Antimicrobial Textile Market Trends

China dominates the Asia Pacific antimicrobial textile market, driven by its vast manufacturing base and implementation of textile technologies, including raw material processing, finishing facilities and increasing concern in health and disposable income, driving the domestic demand in healthcare and hygiene.

Antimicrobial Textile Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 34.90% | 383.97 | 1270.79 | 14.22% | 28.88% |

| Europe | 23.01% | 253.16 | 1109.30 | 17.84% | 25.21% |

| Asia Pacific | 31.05% | 341.62 | 1545.80 | 18.26% | 35.13% |

| South America | 5.03% | 55.34 | 244.21 | 17.93% | 5.55% |

| Middle East & Africa | 6.01% | 66.12 | 230.13 | 14.86% | 5.23% |

Recent Developments

- In January 2026, Archroma and HeiQ signed a global co-marketing agreement that focuses on groundbreaking antimicrobial and anti-odor technology, especially in the textile industry, to meet consumer demand for sustainability and hygiene.(Source: www.archroma.com)

- In November 2025, Dupont developed Tyvek® APX, which was launched at the A+A trade fair. This material is a breakthrough in personal protective equipment (PPE) which focus on worker safety and offering breathability driven by corporate responsibility and safety regulations.(Source: www.chemanalyst.com)

Top Market Players and Their Offerings

- DuPont de Nemours, Inc.: The global player specializes in designing textile fiber and surfaces with long-lasting protection, with a surge for innovation, offering product hygiene and longevity.

- BASF SE: Major player for shaping the market by leveraging advanced and sustainable technologies with widespread application in sportswear, home textiles focus on next-generation antimicrobial treatment.

- Indorama Ventures Public Company Limited

- Toyobo Co., Ltd.

- Unitika Ltd.

- Trevira GmbH

- Thai Acrylic Fibre Co. Ltd. (Aditya Birla Group)

- Herculite Products Inc.

- Microban International, Ltd.

- Sanitized AG

- PurThread Technologies, Inc.

- HeiQ Materials AG

- Sciessent LLC

- Vestagen Protective Technologies, Inc.

- Milliken & Company

Segment Covered in The Report

By Active Agent

- Metal & Metallic Salts

- Silver

- Copper

- Zinc

- Synthetic Organic Compounds

- QAC

- PHMB

- Triclosan

- Bio-based Agents

- Chitosan

- Plant Extracts

- Others

By Fiber Type

- Cotton

- Polyester

- Polyamide

- Others (Wool, Silk, Blends)

By Application

- Medical Textiles

- Gowns

- Masks

- Bedding

- Apparel

- Activewear

- Intimates

- Workwear

- Home Textiles

- Curtains

- Towels

- Carpets

- Commercial & Industrial Textiles

By Fabric Type

- Woven Fabrics

- Non-woven Fabrics

- Knitted Fabrics

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa