Content

Sodium Carbonate Market Size and Share 2034

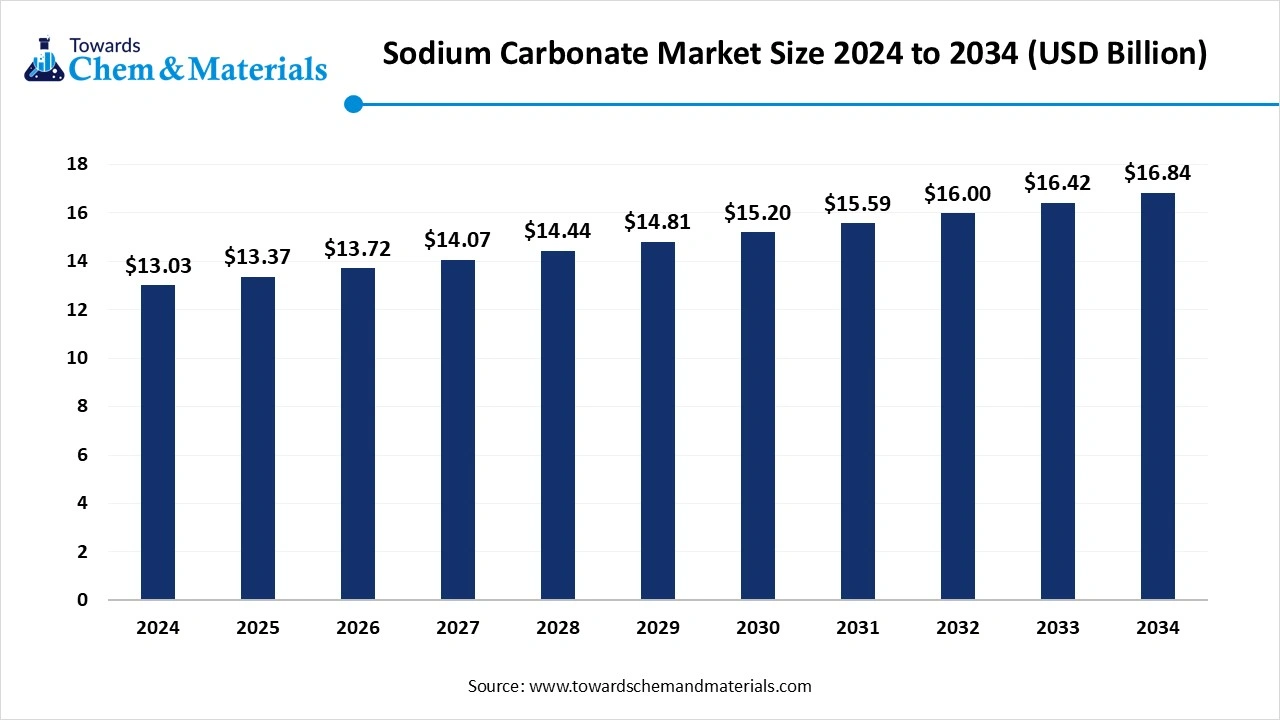

The global sodium carbonate market size was valued at USD 13.03 billion in 2024 and is expected to hit around USD 16.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.60% over the forecast period 2025 to 2034. The increasing need for glass products and the sudden shift to sustainability have accelerated the market potential in recent years.

Sodium Carbonate Market Key Takeaways

- By region, Asia Pacific dominated the sodium carbonate market in 2024, akin to the rapid expansion of end-use industries.

- By region, North America anticipated to experience the fastest growth rate during the forecast period, owing to its well-developed manufacturing sector.

- By type, the natural segment held the dominating share of the market in 2024 its cost-effectiveness and environmental benefits over synthetic variants.

- By type, the synthetic segment is expected to experience significant market growth in the future, due to rising global demand and limitations in natural trona

- By end use, the glass manufacturing segment dominated the market with the largest share in 2024, owing to the widespread application of soda ash in producing various types of glass, especially containers and flat glass.

- By end use, the chemical manufacturing segment is expected to grow at the fastest rate in the market during the forecast period due to the expanding need for chemicals such as sodium silicates, detergents, and bicarbonates

- By application, the detergents segment held the dominating share of the sodium carbonate market in 2024, owing to its widespread use in household and industrial cleaning products.

- By application, the water treatment segment is expected to experience significant market growth in the future, owing to increasing industrial wastewater generation.

- By purity grade, the technical grade segment dominated the market with the largest share in 2024 due to its vast industrial applicability.

- By purity grade, the food grade segment is expected to grow at the fastest rate in the market during the forecast period due to rising consumer preference for processed and packaged foods.

From Building to Windshield: Glass Demands Powers Market Expansion

The sodium carbonate market is witnessing significant growth owing to its wide-scale applications across industries such as glass, detergents, chemicals, and water treatment. Moreover, the global manufacturing base is increasingly adopting sodium carbonate as an important raw material, especially in the glass-making segment, where demand is expanding rapidly in the current period.

With evolving industrial trends, companies are reshaping their supply chains to meet growing demand efficiently. Moreover, rapid infrastructure development is further accelerating the need for sodium carbonate. As a result, global manufacturers are expanding their production lines while adapting to regional consumption patterns and logistics needs in the current industry environment.

The rising demand for glass products in the construction and automotive sectors is driving the sodium carbonate market in the current period. As the construction industry is increasingly deploying glass in modern infrastructure, akin to aesthetic and energy-efficient advantages.

Furthermore, the automotive producers are also accelerating the use of specialty glass for windshields and lightweight components, which gained significant market share recently. This rising consumption is pushing the need for high-purity sodium carbonate in large volumes, as glass producers seeking for consistency and scalability in the current period. Moreover, manufacturers are expanding their capacities and adopting clean processing technologies with eco-regulatory frameworks and sustainable production goals in recent years, as per observation.

Sodium Carbonate Market Trends

- The glass industry has been witnessing increased demand for sodium carbonate in recent times, primarily due to its essential role in lowering the melting point of silica, which is spearheading the sodium carbonate market in the current period. Also, the construction and automotive sectors are further expanding the glass consumption globally, as per industry observation.

- Water treatment facilities are increasingly dependent on sodium carbonate for pH regulation and softening purposes is driving the market growth in recent years. With rising concerns over water pollution, both municipal and industrial sectors are increasing treatment capacities.

- Sodium carbonate continues to hold a dominant position in the formulation of household and industrial cleaning products in the current period. The growing urban population and hygiene awareness have led to an increasing need for detergent production in recent years.

Sodium Carbonate Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 13.27 Billion |

| Expected Size in 2034 | USD 16.84 Billion |

| Growth Rate | CAGR of 2.60% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By End Use, By Application, By Purity Grade, By Region |

| Key Companies Profiled | Solvay,Soda Sanayi,Tosoh,Tata Chemicals,Ciner Resources,PCC,BASF,OCI,TNK, Tronox,ICL,Occidental Petroleum,Searles Valley Minerals,Cristal |

Sodium Carbonate Market Opportunity

From Emission to Innovation: A Sustainable Growth Path Ahead

As industries focus on reducing carbon emissions, manufacturers in the sodium carbonate market have a unique opportunity to develop eco-friendly alternatives in the coming years. Also, this sudden shift towards sustainable production methods follows the increasing demand for greener products in specific sectors such as chemicals, detergents, and glass manufacturing. Also, the investment research and development programs can create massive opportunities by innovating greater products while giving a first-mover advantage to the manufacturers during the forecast period.

Sodium Carbonate Market Challenge

From Cost to Carbon: Dual Threats to Industry Advancement

High production cost is expected to hamper the industry's growth during the projected period. Also, it can limit the profitability of producers in the future. Moreover, the complex manufacturing process, along with raw material expenses, leads to increased operational costs, making it harder for smaller manufacturers in the coming years, while reducing market growth. Moreover, the ongoing sustainability shift is likely to create some growth barriers for the sodium carbonate market in the future.

Sodium Carbonate Market Regional Insights

Asia Pacific dominated the sodium carbonate market in 2024, owing to the robust expansion of end-use industries such as glass, detergents, chemicals, and textiles in the region. Moreover, countries across the region are rapidly increasing production capacities to meet the accelerating domestic demand, while also maintaining the global supply chains in the current period. Furthermore, the rising urbanization with increasing population and industrial output is increasing the need for sodium carbonate in the region nowadays. Also, favorable government policies have further expanded industry potential in the region in recent years.

Efficiency and Infrastructure Push China to the Forefront

China has maintained its dominance in the Asia Pacific region for the past period. Also, China is considered the global production and export powerhouse in the current period. With heavy soda ash reserves, China leads the industry growth by having low-cost manufacturing backed by advanced infrastructure nowadays. Moreover, producers in China are seen as integrating automation and sustainable technologies to enhance efficiency and reduce environmental impact in the region. Strategic government initiatives are further improving its position, making it the

North America is expected to grow at the fastest pace in the sodium carbonate market during the coming period, akin to its well-established industrial base and the continuous expansion of sectors like glass manufacturing, detergents, and water treatment. The region is experiencing robust demand for sodium carbonate due to increasing environmental regulations that promote eco-friendly products and cleaner processes in the current period. Moreover, technological integration in mining and refining processes is enhancing production efficiency, which is anticipated to drive the growth of the market. Furthermore, producers can also receive the benefits of having a strong logistics infrastructure and robust supply chains in the region.

United States Sodium Carbonate Industry Rises on Natural Advantage and Green Innovation

The industry growth of United States is mainly attributed to its vast natural soda ash reserves, which significantly reduce production costs and ensure a consistent supply chain in the country The country’s increasing shift towards innovation and investment in green technologies allows United states manufacturers to lead in sustainable practices and global exports in future as per observation. Furthermore, strategic trade policies and long-standing industrial expertise are expected to create beneficial opportunities for the sodium carbonate manufacturers in the coming years.

- Product Export - For instance, in 2025, the United States exported sodium carbonate with 15,499 shipments, which is huge across the world.

Sodium Carbonate Market Segmental Insights

Type Insights

The natural segment held the dominating share of the sodium carbonate market in 2024 its cost-effectiveness and environmental benefits over synthetic variants. The wide availability of naturally occurring trona reserves, especially in regions such as the United States, has allowed manufacturers to produce soda ash through a more energy-efficient and low-emission process. Industries such as glass, detergents, and chemicals have shifted towards this naturally mined product as part of their sustainability practices targets. This sudden shift is contributing to the growth of the segment while reducing carbon footprints, creating a strong consumer base favoring naturally sourced sodium carbonate in the current period.

The synthetic segment is expected to experience significant sodium carbonate market growth in the future, due to rising global demand and limitations in natural trona reserves outside specific regions in the current period. Rapid industrialization in several countries, such as Asia-Pacific and the Middle East, is fueling the need for a consistent supply of synthetic where synthetic sodium carbonate can offer production flexibility in the coming years. As technology advances, manufacturers are seen in adopting efficient synthetic processes, while reducing environmental impacts, which is likely to create significant opportunities for the coming years.

End Use Insights

The glass manufacturing segment dominated the market with the largest share in 2024, owing to the widespread application of soda ash in producing various types of glass, especially containers and flat glass. With rapid urbanization and infrastructure development globally, the demand for glass in construction and automotive industries has surged in the current period. Moreover, the packaging sector, particularly food and beverages, is heavily dependent on glass containers, driving consistent usage in recent years. Manufacturers are seen in increasing production to meet this rising

The chemical manufacturing segment expects the significant growth in the sodium carbonate market during the forecast period due to the expanding need for chemicals such as sodium silicates, detergents, and bicarbonates. Industries are actively expanding operations to meet rising consumer and industrial demands, especially in cleaning agents and water treatment applications in the current period, which is expected to drive segment growth in the coming years. Moreover, as sustainability pressures increase, chemical producers are shifting toward eco-friendly production methods, where soda ash plays an ideal role.

Application Insights

The detergents segment held the dominating share of the sodium carbonate market in 2024, owing to its widespread use in household and industrial cleaning products. Over recent years, manufacturers have consistently expanded their detergent portfolios to meet growing hygiene awareness and demand for efficient cleaning solutions. Sodium carbonate, being an effective water softener and stain remover, has become an ideal component in detergent formulations. Moreover, the rise in urbanization and lifestyle changes has encouraged higher detergent consumption, especially in developing economies, as per observations.

The water treatment segment is expected to experience significant market growth in the future, owing to increasing industrial wastewater generation, with stricter environmental regulations encouraging individuals to adopt advanced water purification solutions. Moreover, sodium carbonate plays an ideal role in pH regulation and softening processes, making it preferred for efficient treatment systems, which is anticipated to drive the demand in the future. Furthermore, the rising concerns over freshwater pollution and government investments in public water infrastructure are contributing to the segment's growth in the current period.

Purity Grade Insights

The technical grade segment dominated the sodium carbonate market with the largest share in 2024 due to its vast industrial applicability across glass manufacturing, detergents, and chemical processing. The rising demand for technical-grade sodium carbonate in producing flat glass, especially for the construction and automotive industries, is driving the segment growth. Moreover, key players are increasing operations to meet surging global demand by integrating cost-efficient and high-output production models in the current period.

The food grade segment is expected to grow at the fastest rate in the market during the forecast period due to rising consumer preference for processed and packaged foods, where sodium carbonate plays a critical role as a food additive, acidity regulator, and leavening agent. With changing dietary patterns and the global shift toward convenience food, manufacturers are upgrading production capacities while ensuring regulatory compliance and safety standards in the current period. Moreover, the increasing demand for clean-label and multi-functional ingredients is encouraging food

Recent Developments in Sodium Carbonate Market

Akums

- Product Launch: In June 2024, Akums introduced its latest production of anti-reflux antacid tablet, which includes sodium alginate and potassium bicarbonate. Also, this tablet is chewable.

Tata Chemicals

- Investment: In November 2024, Tata Chemicals plans to invest 60 million euros in the development of a pharmaceutical-grade sodium bicarbonate plant in the United Kingdom. Also, this plant can produce 1,80,000 tons of sodium bicarbonate per year as per the company's claims. Also, this plant is expected to start in 2025, with the first production batch expected to be received in 2027.

GHCL

- Authorizations Received: In December 2024, the GHCL received authorization for its soda ash plant in India. Also, the company has secured environmental clearance for this plant establishment from the government, as per company claimed. Moreover, the project will be held in Kutch, Gujarat.

Sodium Carbonate Market Top Companies list

- Solvay

- Soda Sanayi

- Tosoh

- Tata Chemicals

- Ciner Resources

- PCC

- BASF

- OCI

- TNK

- Tronox

- ICL

- Occidental Petroleum

- Searles Valley Minerals

- Cristal

Segment Covered in the Report

By Type

- Natural

- Synthetic

By End Use

- Glass Manufacturing

- Chemical Manufacturing

- Pharmaceuticals

- Pulp and Paper

By Application

- Detergents

- Water Treatment

- Textile Manufacturing

- Food Processing

By Purity Grade

- Technical Grade

- Food Grade

- Pharmaceutical Grade

- Ultra-High Purity Grade

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait