Content

Marble Market Size and Growth 2025 to 2034

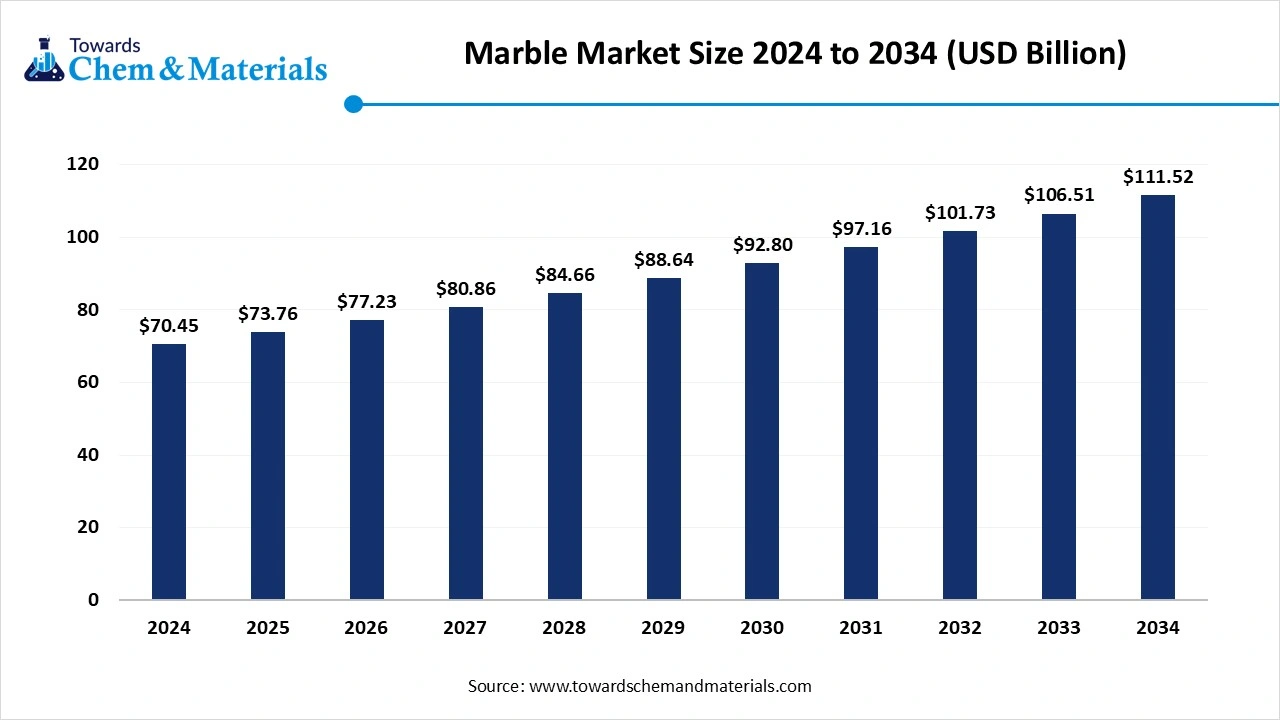

The global marble market size was valued at USD 70.45 billion in 2024 and is estimated to reach around USD 111.52 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.70% during the forecast period 2025 to 2034. The surge in the construction of commercial and residential buildings across the globe is the key factor driving market growth. Also, the growing demand for natural stone in decoration and construction coupled with innovations in quarrying technology can fuel market growth further.

Key Takeaways

- By region, Asia Pacific is a dominated global marble market with the largest share in 2024. The dominance of the region can be attributed to the growing trend of home remodeling and renovation initiatives in the developing countries of the region.

- By region, Europe is expected to grow at a significant CAGR over the forecast period. The growth of the area can be credited to high-end restoration and architectural projects.

- By product, the tiles or slabs segment dominated the market in 2024. The dominance of the segment can be attributed to the cost-effective and durable nature of tiles and slabs as compared to other materials.

- By product, the blocks segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising use of blocks in construction and in the carving and arts industries.

- By application, the building and construction segment held the largest marble market share in 2024. The dominance of the segment can be linked to the aesthetic appeal, durability, and versatility of marble as a building material.

- By application, the marble furniture segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the durability, aesthetic appeal, and versatility of marble furniture in different applications.

Rise in the Construction of Building Expanding Market Growth

The market encompasses the trade and distribution of marble, a kind of rock that is mainly composed of calcium carbonate (CaCO3). It also involves the digging, processing, and sale of these products for different applications, such as decoration, construction, and art. Marble's inherent durability and beauty make it a popular choice for high-end and luxury interior design projects. The increasing awareness regarding sustainable building materials promotes the use of marble, especially when sourced carefully.

What Are the Key Trends Influencing the Marble Market?

- The increasing focus on sustainability in the construction sector is substantially impacting material choices and also emerging as a more preferred choice. More architects and builders are emphasizing sustainable practices, and natural materials like marble are gaining traction because of their durability and eco-friendly nature.

- The product's higher shelf life is also a key trend impacting market growth positively. Structures and buildings built from marble tend to need less maintenance and have higher longevity as compared to those built with less durable materials. This factor lessens the need for frequent replacements and also decreases overall waste.

- There is also a growing demand for durable and aesthetic construction materials that substantially boost market expansion, especially in the real estate and infrastructure sector. Marble, known for its strength and beauty, fulfills this need, which makes it a popular choice in high-end commercial and residential developments.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 73.76 Billion |

| Market Size by 2034 | USD 111.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.70% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North Ameica |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Antolini Luigi & C SpA, BC Marble Products Ltd, Levantina y Asociados de Minerales, S.A., Fox Marble, Kangli stone group, Best Cheer Stone, Kingstone Mining Holdings Ltd., China Kingstone Mining Holdings Ltd., Daltile, HELLENIC GRANITE Co., Topalidis SA, Santucci Group Srl |

How is the Government Supporting the Marble Market?

The Indian government supports the market through policies such as imposing strict import duties to safeguard domestic producers and optimizing infrastructure development through strategic initiatives such as the "Smart Cities Mission" and "Housing for All" to offer infrastructure financing through the PM Gati Shakti Master Plan. The government of India has also raised import duties on travertine and marble blocks, increasing them up to four times from 10% to 40% to safeguard local manufacturers.

The US government promotes the market through a combination of construction initiatives, trade policies, and technological advancements. Government initiatives supporting eco-friendly building practices like green building certifications, also impact positively the demand for marble and other stones. Import duties on marble are less, ranging from 0% to 5%.

Market Opportunity

Surge in Luxury Real Estate Projects

Expanding infrastructure and luxury real estate are projected to create significant opportunities in the market. Marble is constantly being utilized as a design element in major architectural projects like government buildings, museums, and cultural centers. Furthermore, countries like India, China, and the UAE have substantially invested in large-scale projects that require high-quality marble, boosting marble market growth soon.

- In February 2025, European developer Mr. Eight Development unveiled its first building project in the UAE called Villa del DIVOS on the Dubai Islands. This is the first-ever development on the island. The development is the first project of MR Eight; each residence is created with interior finishes and features marble and stone surfaces.(Source: meconstructionnews )

Market Challenge

Fluctuating Costs and Resource Challenges

Marble is a natural resource typically found in limited locations in a specific region, and the availability and quality of these deposits can fluctuate. The energy-requiring processes need digging, transportation, and processing which can lead to fluctuating manufacturing costs. However, economic and political instability in major marble-manufacturing regions can disrupt the whole supply chain operations, hindering market growth further.

Regional Insights

Asia Pacific dominated the marble market in 2024. The dominance of the region can be attributed to the growing trend of home remodeling and renovation initiatives in the developing countries of the region. In addition, India and China are major producers and consumers of marbles in the world. A surge in the middle class and growing disposable incomes is fueling demand for luxury interior materials such as marble in commercial and residential spaces.

- In January 2025, Emaar India introduce its current luxury residential project,' Urban Ascent' at Sector 112, Gurugram. The location is at the center of Gurugram and Delhi, providing convenient access to strong social and physical infrastructure.(Source: Constructionworld)

Marble Market in China

In the Asia Pacific, China led the market owing to rapid urbanization, massive infrastructure development, and government-led construction activities. Also, China's increasing middle class has facilitated a shift towards luxury home décor, where marble is considered a status symbol, hence impacting positive market growth in the country.

Europe is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the high-end restoration and architectural projects, especially in historic and heritage buildings. Furthermore, European consumers are increasingly prioritizing aesthetics and quality, which makes marble a crucial material in luxury building projects. The strong presence of established artisans and producers in the region further promotes market expansion.

Marble Market in Germany

In Europe, Germany dominated the market in 2024, due to the surge in construction activities, shift in consumer trends, and the increase in luxury interior design in the country. Growing consumer inclination towards premium finishes in bathrooms and kitchens further supports market growth. The German market is especially known for its precision in construction and engineering.

Who is the Top Marble Exporting Country In 2024?

| Country | Marble - USD |

| Aruba | 16,726 |

| Australia | 2,640 |

| Austria | 8,437 |

| Bahamas | 235,398 |

| Bermuda | 32,025 |

Segmental Insights

Product Insights

Which Product Segment Dominated the Marble Market in 2024?

The tiles or slabs segment dominated the market in 2024. The dominance of the segment can be attributed to the cost-effective and durable nature of tiles and slabs as compared to other materials. Tiles are more affordable than slabs, which makes them a budget-friendly option. Additionally, marble can be utilized in different applications such as bathrooms, kitchens, flooring, and accent walls. Marble kitchen slabs are convenient for both commercial and residential kitchens.

- In June 2025, Walnut Building Solutions unveiled Zeoclean, the latest collection of stone & tile cleaners specially created by top experts in India. Through years of R&D, the company has designed different products depending on nearly 25 years of experience in chemical, construction, and materials.(Source: ahmedabadmirror)

The blocks segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising use of blocks in construction and in the carving & arts industries. Blocks allow for efficient quarrying, precise customization, and simpler logistics, which makes them a popular choice for commercial and residential projects. Moreover, marble's long lifespan and renewable nature contribute to its adoption in sustainable construction.

Application Insights

Why Did the Building And Construction Segment Dominated The Marble Market In 2024?

The building and construction segment held the largest market share in 2024. The dominance of the segment can be linked to the aesthetic appeal, durability, and versatility of marble as a building material. Also, marble is commonly used in construction for wall cladding, facades, flooring, and ornamental features. The growing trend of luxury living along with the preference for natural materials in construction further propels the segment's expansion.

The marble furniture segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the durability, aesthetic appeal, and versatility of marble furniture in different applications like countertops, tabletops, and decorative pieces for commercial and residential spaces. Furthermore, the availability of marble in numerous patterns and colors allows for customization specific to various design preferences.

Recent Developments

Putzmeister Group

- Announcement: In February 2025, The German company Putzmeister Group announced the expansion in concrete pumping to raise its investment in industrial-grade 3D printing solutions for the construction sector. With the introduction of its latest brand INSTATIQ, the company is also taking a key step towards making 3D concrete printing accessible to the global market.(Source: voxelmatters )

HSVP

- Announcement: In November 2024, the HSVP announced the plan to shift its latest construction metro depot from Sector 33 to Sector 34 in Gurugram. The Haryana Shahari Vikas Pradhikaran's (HSVP) chief administrator said. (Source: hindustantimes)

Top Companies List

- Antolini Luigi & C SpA

- BC Marble Products Ltd

- Levantina y Asociados de Minerales, S.A.

- Fox Marble

- Kangli stone group

- Best Cheer Stone

- Kingstone Mining Holdings Ltd.

- China Kingstone Mining Holdings Ltd.

- Daltile

- HELLENIC GRANITE Co.

- Topalidis SA

- Santucci Group Srl

Segments Covered

By Product

- Tiles or Slabs

- Blocks

- Others

By Application

- Building and Construction

- Statues and Monuments

- Furniture

- Other Applications

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait