Content

Steviol Glycoside Market Size and Growth 2025 to 2034

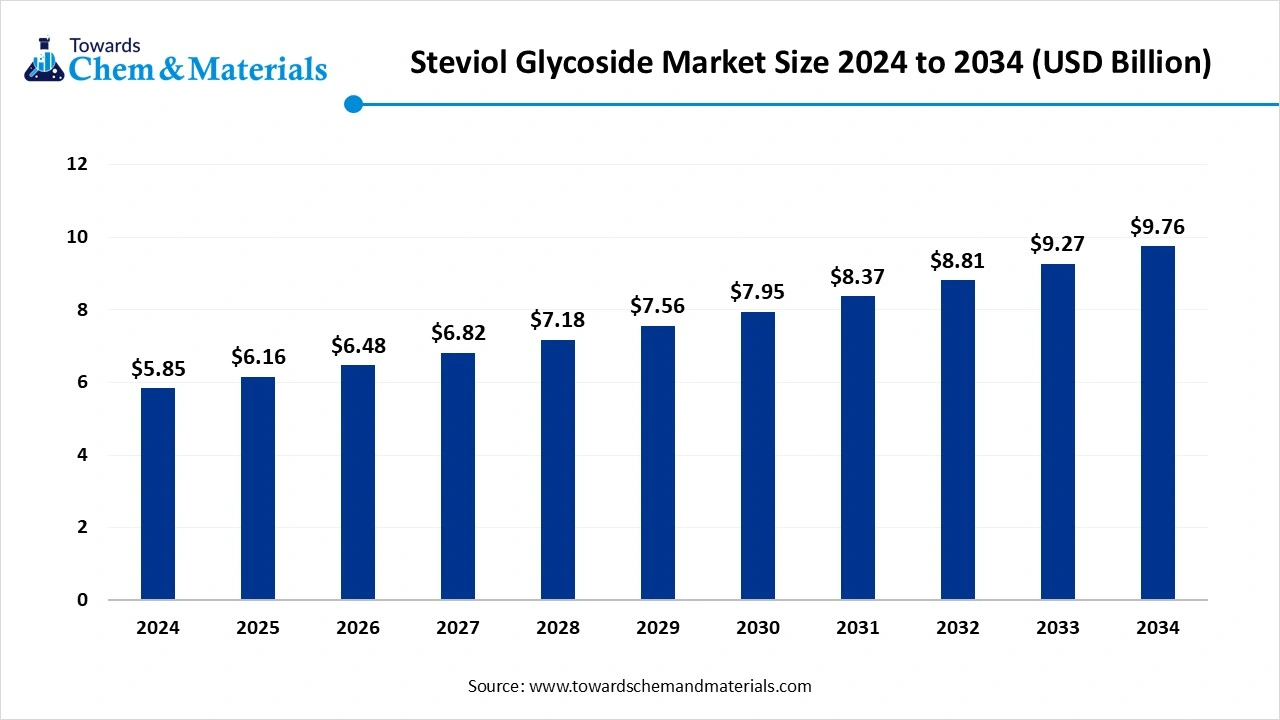

The global steviol glycoside market size accounted for USD 6.16 billion in 2025 and is forecasted to hit around USD 9.76 billion by 2034, representing a CAGR of 5.25% from 2025 to 2034. The growth of the market is driven by the growing consumer awareness of the health and wellness trends and the rise in the use of natural sugars as an alternative, which increases the demand and growth of the market.

Steviol glycosides are a group of naturally occurring, intensely sweet compounds found in the leaves of the Stevia rebaudiana plant. They're widely used as a low-calorie sugar substitute in foods and drinks. Steviol glycosides are extracted from stevia leaves and are significantly sweeter than sugar - some are 150-300 times sweeter than sucrose. Since the body doesn't metabolize them for energy, they're considered low-calorie sweeteners.

As a natural alternative to artificial sweeteners, they're derived from a plant source. Steviol glycosides are used in many food and beverage products, including drinks, desserts, yogurt, and candy. Regulatory bodies like the FDA recognize them as generally safe (GRAS) and have established an acceptable daily intake (ADI). There are several types of steviol glycosides, with stevioside and rebaudioside A being the most common. Some studies suggest potential health benefits, such as helping with diabetes and inflammation.

Key Takeaways

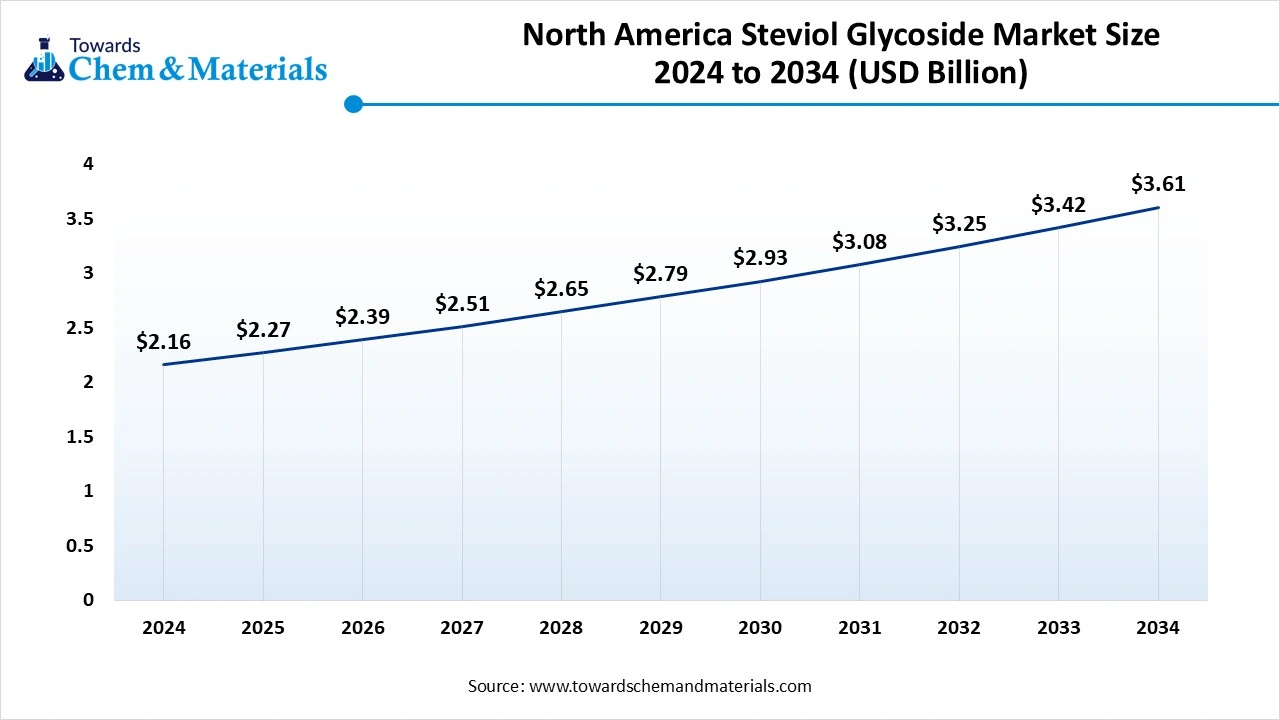

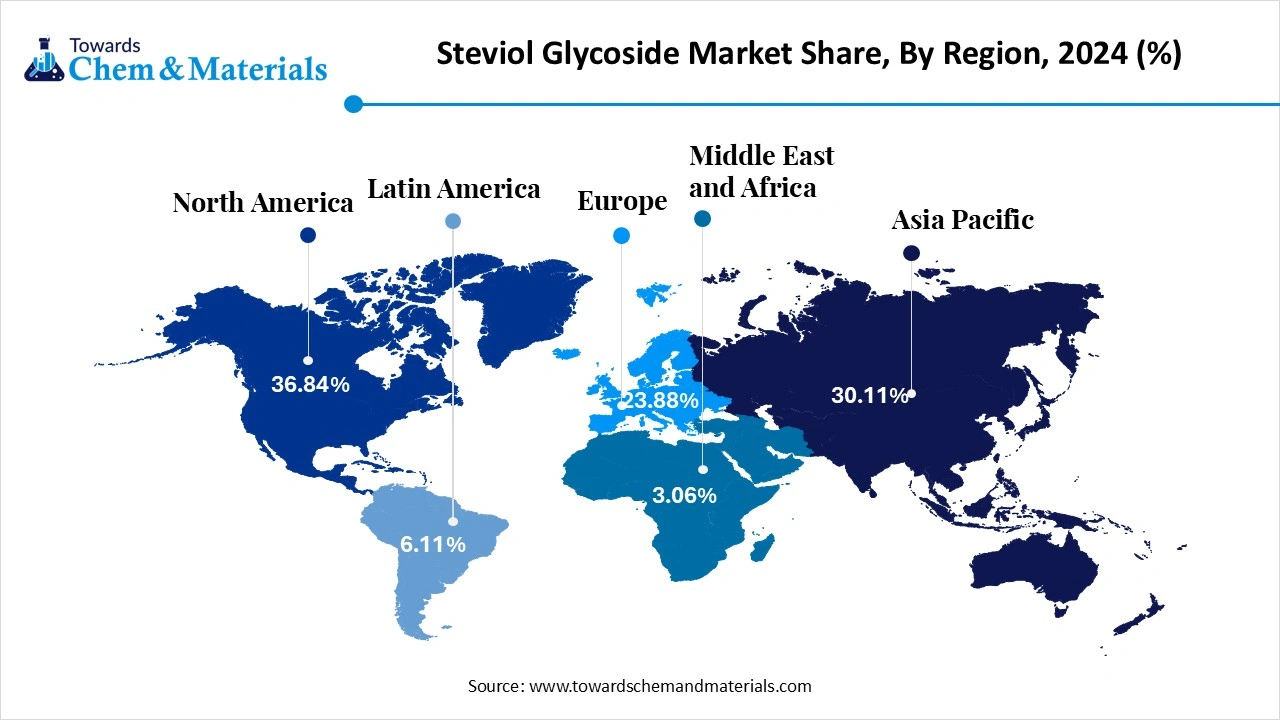

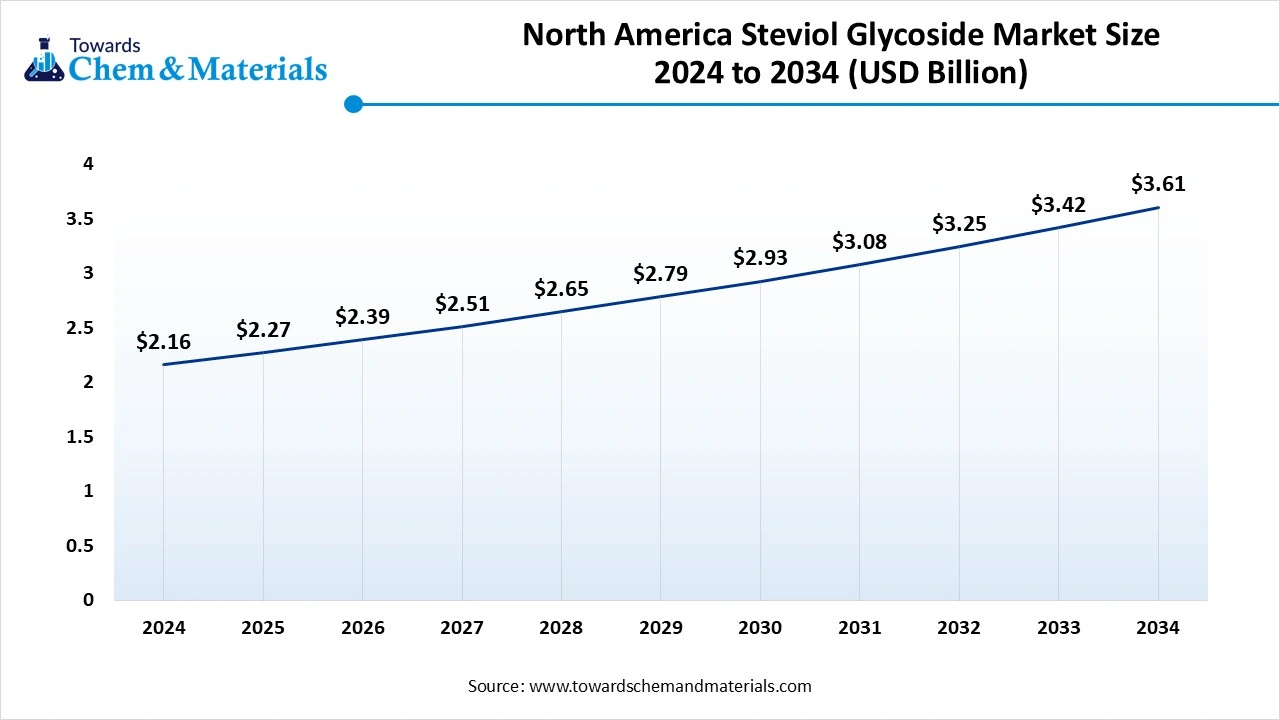

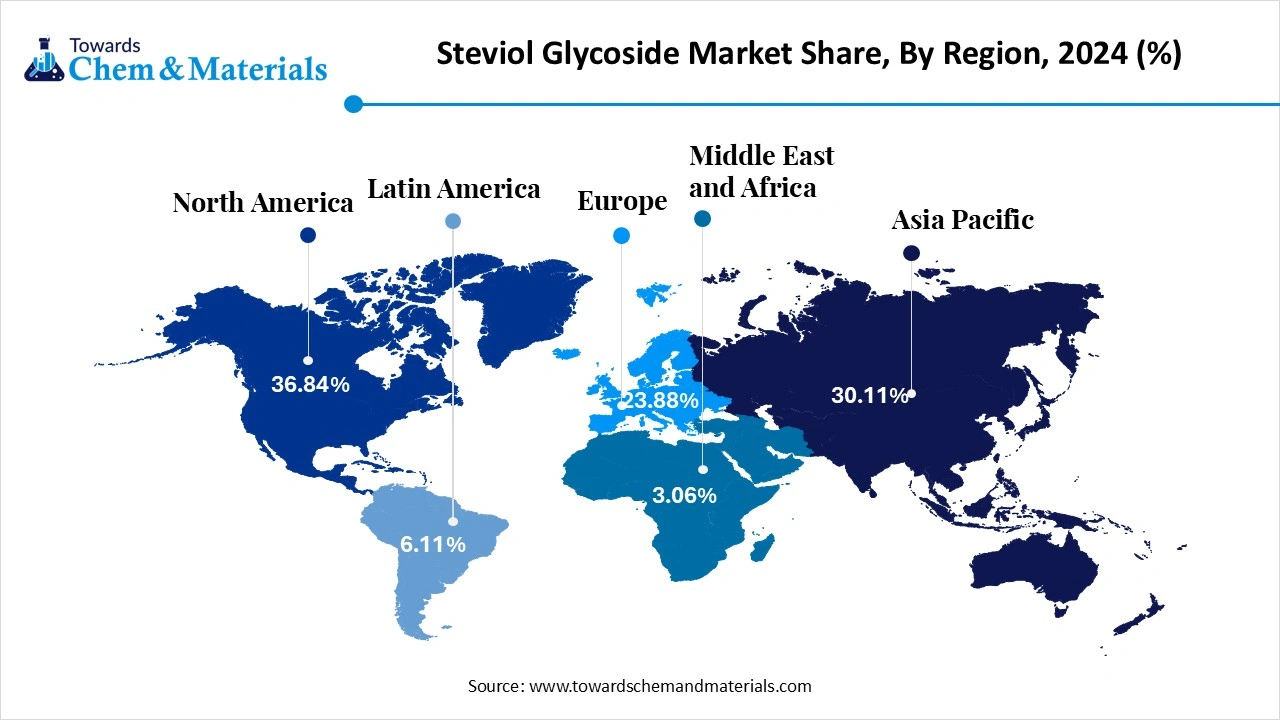

- North America steviol glycoside market dominated the global landscape with a revenue share of 36.84% in 2024.. The growth driven by the increasing consumer demand and awareness about health and wellness.

- The Asia Pacific is expected to have significant growth in the market in the forecast period. The rising health awareness and rapid urbanization drive the growth of the market.

- The Europe’s steviol glycoside market is expected to grow at a CAGR of 5.25% during the forecast period.

- By product, the stevioside segment led the market and accounted for the largest revenue share of 42.52% in 2024.The growing demand for zero-calorie sweeteners drives the growth of the market.

- By product, the rebaudioside A segment is expected to grow in the forecast period. Demand for clean label drives the growth of the market.

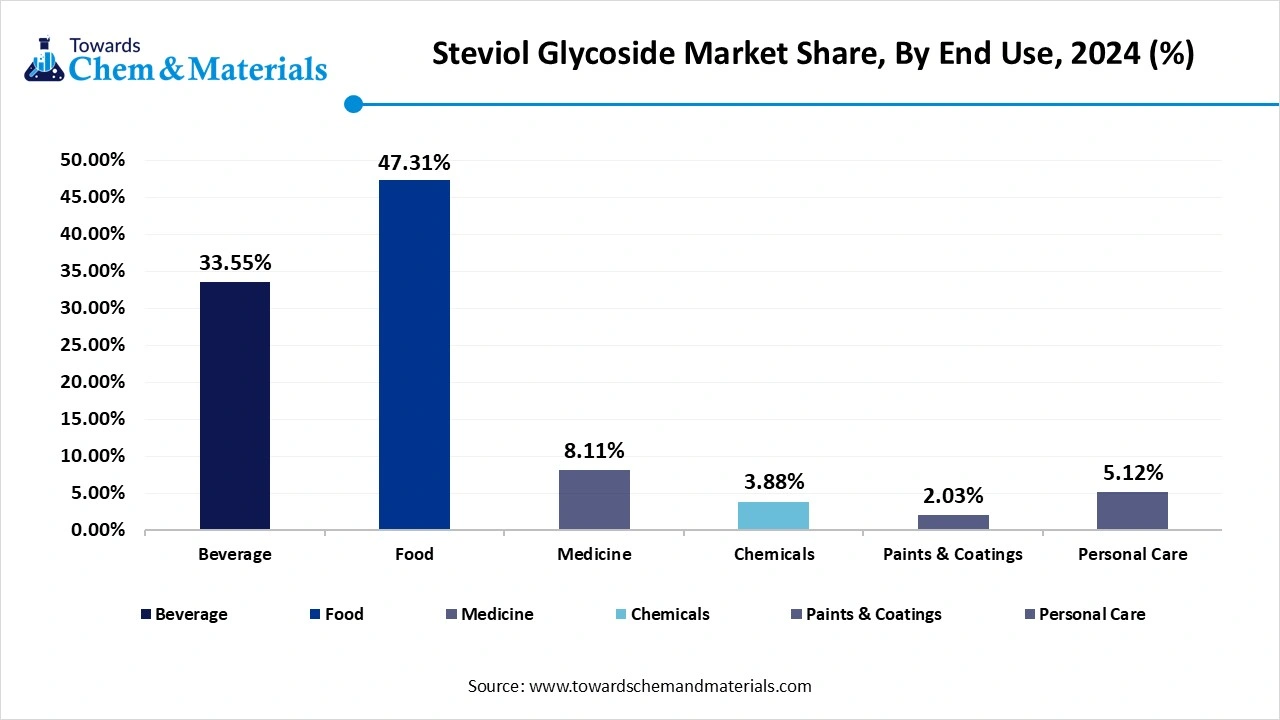

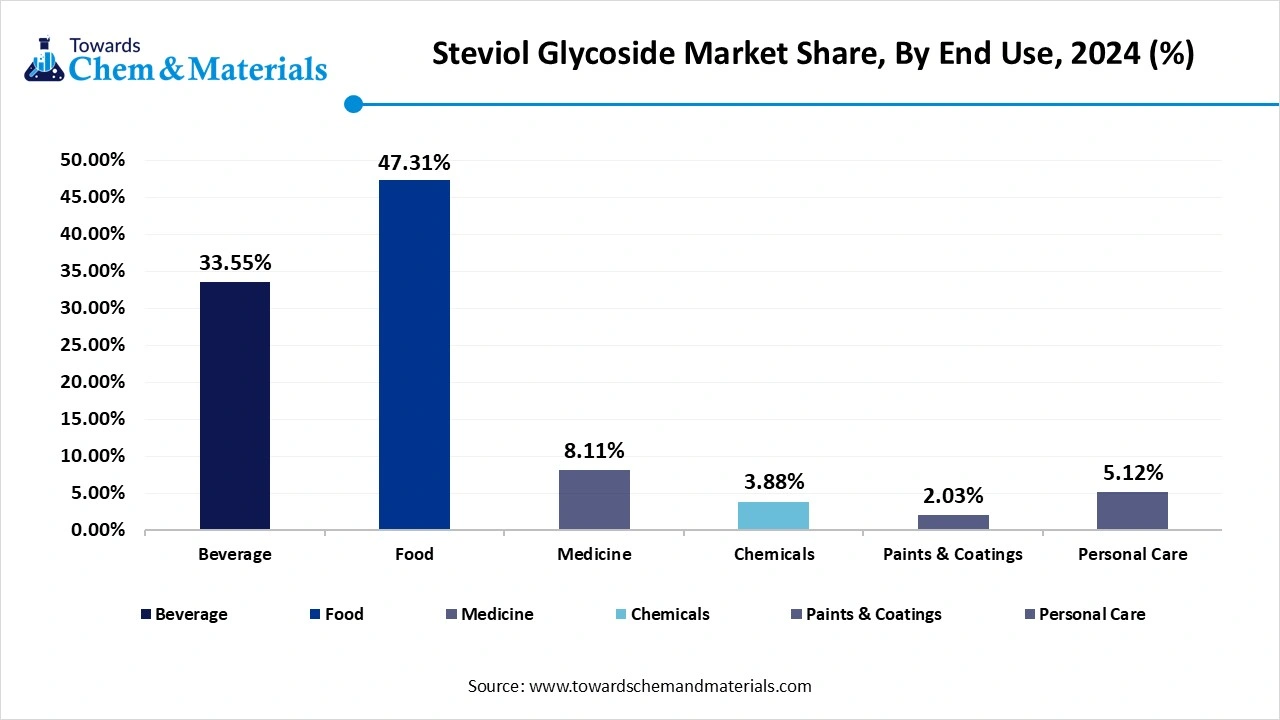

- By end use, the food segment dominated the market with a revenue share of 47.31% in 2024. The growing industry and use of natural substitutes drive the growth of the market.

- By end use, the beverage segment accounted for the market revenue share of 33.55% in 2024 and is projected to grow rapidly during the forecast period. Growing consumers of beverages and demand for low-calorie beverages drive the growth.

What Are the Key Growth Drivers Responsible for the Growth of the Steviol Glycoside Market?

The growth of the market is driven by the increasing health consciousness among the growing population and the growing demand for natural sweeteners over artificial ones. The demand for plant-based steviol drives the growth. Growing cases of diabetes and heart disease in the regions increase demand for the natural sugars or zero-calorie sweeteners, demand rises the demand. The growth is also driven by the growing food and beverages industry, which demands flavor enhancers and ingredients for various products, like bakery and confectionery, which demand natural sweeteners with increasing innovation in products, which drives the growth of the market. The growth is also driven by the technological advancements in processing and extraction for cost-effectiveness, which makes them more attractive to the manufacturers, driving the growth of the market and helping in the expansion of the market.

Market Trends

- The growing consumer demand for natural sweeteners, with changing preferences and lifestyle changes, drives the growth of the market.

- The growing health and wellness trends and rising awareness of the consumption of plant-based sweeteners and low-calorie sweeteners fuel the growth.

- The growing applications of steviol glycosides in various industries, like the food and beverages industry and the pharmaceutical industry, boost the growth of the market.

- The growing demand for clean-label and organic products by consumers boosts the demand for natural sweeteners, and boosts the market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.16 Billion |

| Expected Size by 2034 | USD 9.76 Billiion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By End Use, By Region |

| Key Companies Profiled | PureCircle (a part of Ingredion), Cargill, Incorporated, Tate & Lyle, ADM (Archer Daniels Midland), GLG Life Tech Corp., HOWTIAN, Evolva Holding SA, Stevia First Corp., Sunwin Stevia International Inc, Kerry Group plc., FUJIFILM Wako Pure Chemical Corporation, GLSTEVIA, MORITA KAGAKU KOGYO CO., LTD., Zydus Wellness.com, Whole Earth Brands, Daepyung Co., Ltd. |

Market Opportunity

What Are the Key Growth Opportunities Responsible for the Growth of the Steviol Glycoside Market?

The key growth opportunity responsible for the growth of the market is the growing trend of a shift in preferences of the consumer for the option of natural sweeteners and growing awareness of consumers over health and wellness trends, which fuels the growth of the market due to increasing demand for their benefits. The growing prevalence of diabetes and obesity in the growing population is another driving factor that increases the demand for the market and helps in the expansion of the steviol glycoside market.

Market Challenge

The High Production Cost and Extraction Costs of The Product Are a Challenge That Hinders the Growth of The Market.

The extraction process of steviol glycosides from stevia leaves is a very complex and expensive process, which leads to and contributes to a higher final cost of the product, which affects the profitability margin, affecting and limiting the growth of the market and adoption by the consumers. The high product cost affects the adoption of the plant-based sweeteners and use of cheaper alternatives like conventional sugar, which is also a challenge and hinders the growth of the market.

Regional Insights

How Did North America Dominate the Steviol Glycoside Market In 2024?

The North America steviol glycoside market is expected to increase from USD 2.27 billion in 2025 to USD 3.61 billion by 2034, growing at a CAGR of 5.27% throughout the forecast period from 2025 to 2034. North America dominated the steviol glycoside market in 2024. The growth of the market is driven by the growing consumer awareness about health and wellness in the region due to the growing prevalence of chronic diseases like diabetes and cardiac diseases, which demand for plan-based and low-calorie sweeteners, which increases the demand for the market in the region. The growing food and beverages industry in the region demands healthy beverages from consumers, driving the growth of the market. The growing and increasing demand for label transparency and increasing health-conscious consumers in the region fuels the growth and expansion of the market in the region.

The U.S. Market Has Seen Growth Due To Technical and Product Innovation.

The growth of the market in the U.S. is driven by product innovation, as food and beverage companies are developing their products with innovative methods, including steviol glycosides, to meet the consumer demand for healthier alternatives to align with the growing need of the consumers for the reduction in the use of sugar which drives the growth of the market and also helps and supports expansion of the market.

- The United States shipped out 42 Steviol Glycosides shipments from October 2023 to September 2024 (TTM). These exports were handled by 22 United States exporters to 20 buyers, showing a growth rate of 14% over the previous 12 months.(Source: volza.com)

- Globally China, Malaysia, and the United States are the top three exporters of Steviol Glycosides. China is the global leader in Steviol Glycosides exports with 2485 shipments, followed closely by Malaysia with 1284 shipments, and the United States in third place with 121 shipments.(Source: volza.com)

Asia Pacific Has Seen a Steady Growth, Driven by The Rapid Adoption of Healthy Alternatives.

Asia Pacific is expected to have significant growth in the Steviol Glycoside market in the forecast period. Th growth of the market is driven by the growing and rapid urbanization and growing health and wellness trends in the region, which demand for the plant-based sugars by the healthcare and health-conscious consumers driven by the growing diabetic population and government initiatives promoting reduces and no sugar intake and findings for the development of plant-based sugar alternatives which drives the growth and expansion of the market in the region.

India Has Seen Significant Growth in The Market, Driven by Growing Demand from Industries.

The growth of the market in India has seen steady growth, the growth is driven by the growing demand from industries like food and beverages and pharmaceuticals due to demand for low-calorie and sugar-free products, which drives the growth of the market. The growth is also supported by the innovation in technology in the country and demand for cost-effectiveness and enhanced quality products due to growing health awareness, which boosts the growth of the market and supports the expansion of the market in the country.

- The World shipped out 1,423 Steviol Glycosides shipments from October 2023 to September 2024 (TTM). These exports were handled by 197 United States exporters to 288 buyers, with the growth rate of 40% over the previous 12 months.(Source: volza.com)

Segmental Insights

Product Insights

Which Product Segment Dominated the Steviol Glycoside Market In 2024?

The stevioside segment dominated the steviol glycoside market in 2024. They are the natural glycosides which are found in the stevia plant and are in rising demand due to their intense sweetness offered by the product, which makes it a popular choice for a non-caloric sweetener, increasing the demand for the market. The growth is also driven by the demand and its application in the food and beverage industries as a sugar substitute which drives the demand. The key properties that increase the demand are its sweetness, natural origin, use as a sugar substitute, and its potential health benefits for potential effects on blood glycose levels and insulin resistance, which drives the growth of the market.

The rebaudioside A segment expects significant growth in the steviol glycoside market during the forecast period. It is a natural and non-caloric sweetener that is derived from the stevia plant. It is the most stable steviol glycoside, which is found in stevia and is used as a sugar substitute in the food and beverages industry, which drives the growth of the market. The growth of the market is also driven by the potential health benefits offered by the product, like stimulating insulin secretion from pancreatic beta-cells and having GLP-1 release effects on enteroendocrine cells, which drives the growth and expansion of the market.

End Use Insights

How did the Food Segment dominate the Steviol Glycoside Market in 2024?

The food segment dominated the steviol glycoside market in 2024. The growth of the market is driven by the benefits offered by the product, like low calorie and high sweetness, although being a natural sweetener extracted from plants, which increases the demand. Common applications of the stevia include fruit and milk drinks, yogurts, confectioneries, desserts, and other products as well, which increases the demand from the industry. The stability offered by the steviol glycoside is a major factor for food processing, which requires high temperatures for processing, driving the demand for the product, which fuels the growth of the market and boosts the expansion of the market.

The beverage segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing demand from consumers and manufacturers due to growing preferences of the consumers for sugar-free, low-calorie, and plant-based drinks, which are a healthy alternative to carbonated sugary drinks, driving the demand and growth of the market. The product is in increasing demand due to the benefits offered, like low calorie content, potential health benefits, versatile applications, and natural origin, which increases the demand for the market and helps in the expansion of the market with varied applications.

Recent Developments

- In December 2024, Belvoir Farm, an UK’s soft drink brand will introduce two new products: Non-Alcoholic Raspberry Margarita and No Added Sugar Blackcurrant and Apple Cordial. The brand's No Added Sugar range, launched earlier this year, now features the new apple and blackcurrant flavor. (Source: foodbev.com)

- August 2024 saw the launch of SoPure Dorado, an unrefined golden stevia extract from Howtian, a global wholesale ingredient provider. This sweetener is plant-based, minimally processed, and calorie-free. According to the company, it's designed for food and beverage consumers who prefer products that are as close to their natural state as possible. The innovation comes as the sweetener market evolves, with more consumers seeking ways to cut back on sugar.(Source: fooddive.com)

Top Companies List

- PureCircle (a part of Ingredion)

- Cargill, Incorporated

- Tate & Lyle

- ADM (Archer Daniels Midland)

- GLG Life Tech Corp.

- HOWTIAN

- Evolva Holding SA

- Stevia First Corp.

- Sunwin Stevia International Inc

- Kerry Group plc.

- FUJIFILM Wako Pure Chemical Corporation

- GLSTEVIA

- MORITA KAGAKU KOGYO CO., LTD.

- Zydus Wellness.com

- Whole Earth Brands

- Daepyung Co., Ltd.

Segments Covered

By Product

- Stevioside

- Rebaudioside A

- Rebaudioside C

- Dulcoside A

- Others

By End Use

- Beverage

- Food

- Medicine

- Chemicals

- Paints & Coatings

- Personal Care

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait